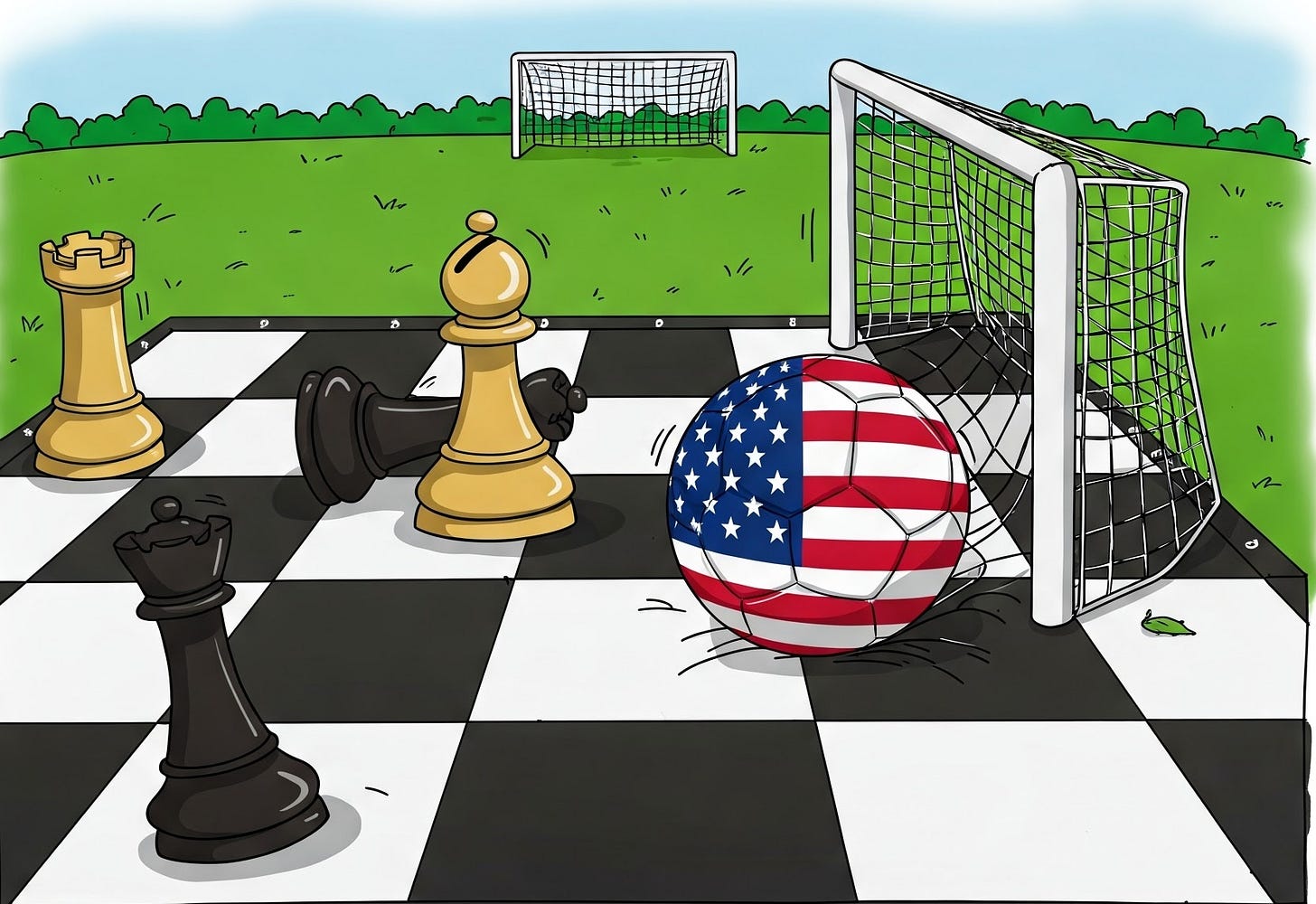

Trump's 90 Day Tariff Pause: 3D Chess (Art of the Deal) or Own Goal via Market Chaos & China Pressure?

Trump, Bessent, Lutnick, et al. got slap chopped and capitulated... (thankfully)

The MAGA Mind Virus hosts suddenly shifted from: (1) “Tariffs are amazing because they’ll bring back manufacturing jobs!” to (2) “Art of the Deal baby!” (with the most recent 90-day tariff pause)… they are being mentally whiplashed by their cult leader (DJT).

First tariffs are good. Now a tariff pause is good? Guys like Anthony Pompliano (Pomp) were suggesting Trump’s trade deficit tariffs (i.e. Liberation Day tariffs) were the best thing for the U.S. (Read: Trump Tariff Trade Formula Analysis)

Then suddenly they were praising Trump for pausing the tariffs (can’t make this stuff up). If you wanted tariffs, why are you happy about the pause?

Will we shift back to “Tariffs are amazing!” sometime soon? Who knows with these dolts. You could take their collective brains, shove them up an ants ass, and they’d roll around like a BB in a boxcar.

The real question to ask when they say “Art of the Deal” is: What fucking deal? The reality? No deal. (In their minds: You have TDS for not being in a cult, probably.)

But other countries want to negotiate! No shit… They’ve wanted to negotiate from the jump because halting international trade is straight up moronic. They don’t even know what Trump wants because he hasn’t made it clear.

Foreign countries wanting to negotiate and work out deals to eliminate “trade deficit” tariffs isn’t some magical insight or a testament to Trump’s enlightened “dealmaking ability.”

Trump is mostly massaging his ego. With every high-profile foreign leader’s call he receives and/or meeting he gets to discuss tariffs, he gets an ego boost.

Trump is the head honcho and the foreign leaders are peasants who should get down on their knees and beg. Please MAGA King Trump! Only you can save us! LMAO.

If Trump undoes an idiotic move, he also gets an ego boost from his tribe of cult members who will praise him for his “genius.” It’s egos all the way down with Trump.

So what’s the truth about the most recent 90-day tariff pause?

The Trump administration’s tariff cartel of Ron Vara (not to be confused with Ron Burgundy), Bessent, Lutnick, Miran announced a “strategic pause” to allow space for negotiations and stabilization of markets following significant market volatility and concerns from investors and business leaders.

The recent 90-day pause on tariffs applies to the braindead “trade deficit” liberation day tariffs (marketed as “reciprocal tariffs” above 10% for countries that haven’t retaliated against U.S. tariffs.

However, a baseline 10% tariff remains in place for most imports — and higher tariffs on specific sectors like steel, aluminum, and automobiles are still in effect.

So tariffs are still in effect… just not to the absurd extent they would’ve been with Liberation Day calculations.

Tariffs on Chinese imports were increased to 125% due to China’s retaliatory measures and “lack of respect” for the U.S.

Tariff increases on China under Trump 2.0 have gone: 10% → 20% → 54% → 104% → 125% (present).

Why were tariffs really paused on April 9, 2025?

Were tariffs paused as part of a strategic high IQ Lee Sedol Move 78 against AlphaGo? Or were they actually paused because Bessent realized he was about to get taken out to the woodshed? I’m siding with the latter.

If you analyze the entire econ cartel assembled by Team Trump (other than Bessent) they are fully on board with tariffs of all types (including trade-deficit tariffs) — and their rhetoric up to April 9th was consistent with this.

Rumor has it that they planned to go through with all tariffs until billionaires like Ken Griffin spoke out, Elon Musk called Ron Vara a “moron,” and CEOs like Jamie Dimon went on Fox Business to discuss why the tariffs would be disastrous for the U.S. economy and global economy — causing lasting economic damage.

The marketing from Team Trump was it’s time for “Main Street” not “Wall Street.” (This is braindead BTW. If Wall Street is doing well, Main Street is doing well. These are not inseparable entities. If markets and Wall Street are performing poorly, businesses shut down and it arguably hits the median “Main Street” Americans far more severely.)

Reality: Bessent capitulated due to pressure → Media spin: “Art of the Deal”

Anyone being intellectually honest (i.e. good faith) here can see that this was not some “Art of the Deal” genius.

Trump et al. crashed the market with their idiotic tariff announcements… then called off most tariffs and the market “boomed.”

Will you give them credit now! Look at the market all “green!”

If you set fire to the market, then put out the fire that you lit, should you get credit for saving the day?

By the way… the markets are still down. It is true that they dropped 10% then increased 10%. Some don’t understand math here… If you drop 10% from 100 to 90, then increase 10% you are at 99 (still lower than where you started); volatility decay in action.

I’ve seen all sorts of mental gymnastics from the MAGA crowd. One of the most ridiculous went something like: China intentionally released COVID from a lab to punish Trump in his first term and Trump knows this so he’s hitting China harder than ever with tariffs.

Many saw China devaluing the Yuan (Chinese currency) and assumed this meant U.S. and Trump were winning or dominating the “trade war” (this is a gross misinterpretation of what was happening).

China made Trump look a bit foolish… this was equivalent to an own goal in soccer — and then claiming it was part of your strategy.

What exactly happened with Trump Tariffs?

I’ll explain precisely what happened with Trump’s tariffs in the most concise way possible (using some emojis).

💣 1. Bond Market Rebellion

10-year Treasury yields spiked to 4.362%, signaling inflation fears and eroding investor confidence.

U.S. debt servicing costs surged (1% = ~$340B/year), threatening fiscal stability.

Corporate bond markets froze, choking off business investment.

Translation: The bond market warned: “Back off or we crash your economy.”

🌪️ 2. China Calls Trump’s Bluff

84% retaliatory tariffs on U.S. goods.

Yuan devaluation made Chinese exports cheaper, neutralizing U.S. tariffs.

Market flooding and backdoor exports crushed U.S. manufacturers.

China threatened to dump U.S. Treasuries, adding to bond stress.

Translation: China was ready for a war of attrition—Trump wasn’t.

🔥 3. U.S. Inflation & Recession Risk

Tariffs acted like a massive tax on Americans (125% on China, 25–40% on allies).

Supply chains buckled, and consumer prices were set to spike 15–40% on essentials.

Markets tanked. Recession odds soared. Voters, farmers, and businesses revolted.

Translation: The tariffs were nuking Trump’s economy—and his re-election platform.

📉 4. Internal & External Pressure

Bessent, Musk, Dimon, and Griffin privately (and publicly) warned: you’re blowing up the system.

Insiders like Bessent pushed Trump to pivot, fearing total financial instability.

Allies threatened retaliation, further isolating the U.S.

Translation: Even Trump’s allies begged him to stop before it was too late.

🎭 5. Political Optics > Policy Integrity

Instead of admitting failure, the team spun the pause as “strategic leverage” and a “smart deal move.”

They marketed it as a win, while quietly trying to contain the damage.

Translation: They tripped over their own policy, helped themselves up, and claimed victory.

Explaining the positive reactions to Trump’s 90-day tariff pause…

I understand a variety of positive reactions to the Trump tariff pause (even from smart people). I’ll explain them.

Art of the deal, genius move, predictable (High IQs): You may think the tariffs were retarded but you gotta ride for your guy… you’re on “Team Trump”. (A subset of these guys likely got away with insider trading as I’ll explain in another post… so that subset actually loved it.) But yeah most of the high IQs know his tariffs are stupid if they’re being honest, but you’d never pry it out of them unless you injected a truth serum.

Psychological persuasion: I suspect guys like Bill Ackman are in this camp. You give Trump massive props for putting a 90-day pause on his moronic tariffs… not because you think he did something great — but because you need to feed his ego and make him think he did the right thing. It’s a psychological reinforcement mechanism (reward for making a good move in hopes that it stays that way.)

Thankful Trump didn’t nuke the markets: Even if you hate Trump you at have some hope that people can get through to the guy within the next 90 days to prevent him from nuking the entire U.S. market for no reason other than he wants to pistol-whip the global economy around with his ego.

Art of the deal, genius move, predictable (low IQs): These people are genuinely convinced that Trump masterminded the entire series of events and that he now has China by the balls. All hail King Trump!

Anyways… if you want the full set of details… do some reading below. Everything is broken down.

I.) Background: From “Liberation Day” Tariffs to a Sudden Pause (April 9th)

In early April 2025, the Trump administration announced a sweeping trade policy overhaul branded as “Liberation Day” tariffs — a comprehensive and aggressive reciprocal tariff scheme targeting virtually all U.S. trading partners.

Tariff rates were set to spike to levels not seen in a century, with many countries facing double- or even triple-digit import duties.

Some allied nations were held to a 10% baseline, while many others—particularly in Asia and China — were slapped with punitive tariffs exceeding 25%, in some cases reaching as high as 40–45%.

The tariffs officially took effect at midnight on April 8–9, 2025, unleashing financial turmoil and igniting diplomatic tensions.

Yet, in a stunning reversal less than 24 hours later, President Trump announced a 90-day pause on additional tariff increases for most countries. Simultaneously, he raised tariffs on China even further—from 104% to 125%.

This abrupt pivot raised pressing questions: Was the pause a strategic negotiating maneuver or a forced retreat in the face of global backlash?

II.) Market Turmoil Triggered by Tariffs

The initial market reaction to the Liberation Day tariffs was one of chaos, panic, and historic volatility.

Global stock markets plunged, with trillions in value erased in the days surrounding the implementation.

U.S. bond prices fell sharply, pushing yields to multi-year highs as investors feared rising inflation, foreign sell-offs of Treasuries, and a looming recession.

Corporate bond spreads widened significantly due to concerns over soaring input costs and collapsing profit margins.

The U.S. dollar weakened, reflecting global uncertainty and speculation that the Federal Reserve might loosen monetary policy to cushion the blow.

Taiwan’s stock index dropped precipitously ahead of its slated 32% U.S. tariff, while U.S. indices entered correction territory as markets priced in worst-case scenarios for earnings and growth.

Relief Rally on April 9

When Trump’s 90-day tariff pause was announced on April 9, the markets rebounded violently in what appeared to be a desperate sigh of relief:

The S&P 500 jumped +9.5%, its largest one-day gain in years.

The Dow Jones surged +6.3% (over 2,300 points).

The Nasdaq skyrocketed nearly +10%, posting one of its biggest rallies ever.

Asia-Pacific markets rallied, with Taiwan’s index opening +9% the next day.

Bond markets also reversed course:

Treasury prices rose, pushing yields down from their peak.

The U.S. dollar regained strength as immediate recession fears subsided.

A Strategic Pause – or Circuit Breaker?

The whipsaw market reaction—panic on implementation, euphoria on pause—suggests the 90-day suspension may not have been a calculated “chess move,” but rather a desperate circuit-breaker to prevent a financial crisis.

3 in 4 Americans expected price increases as the tariffs took effect.

Companies scrambled to manage surcharges and reroute supply chains.

Consumers began stockpiling essentials, anticipating inflationary shocks.

Confidence metrics were on the verge of collapse, signaling a broader economic downturn.

The 90-day suspension instantly calmed these fears, underscoring just how economically destabilizing the initial tariff wave had become.

While the administration continued framing the move as part of a broader strategy, market behavior painted a different picture: this was an emergency measure to prevent systemic damage.

III.) China Retaliation: Fighting Fire with Fire

China did not back down in the face of Trump’s aggressive tariff barrage. Instead, it retaliated forcefully and swiftly.

Within hours of the U.S. tariffs taking effect, Beijing imposed its own set of sweeping tariffs, matching Trump’s escalation with an 84% import duty on American goods.

This tit-for-tat move sent an unmistakable message:

China was prepared for a prolonged, all-out trade war.

Chinese officials condemned the U.S. tariffs as “tariff blackmail” and declared their readiness for a “war of attrition”—a drawn-out economic conflict they believed China’s system could withstand better than America’s.

Strategic Devaluation & Economic Fortification

To soften the blow from incoming tariffs, China allowed the yuan to weaken, dropping it to multi-year lows between ¥7.3–7.5 per U.S. dollar.

This devaluation helped offset U.S. tariffs by making Chinese exports more competitive globally.

Simultaneously, Beijing enacted a multi-pronged domestic stabilization plan:

State-owned banks were directed to loosen credit conditions.

Fiscal stimulus packages were prepped to support domestic demand.

Exporters were encouraged to reroute products to alternative global markets.

Supply chains were restructured internally to absorb shocks and find new partners.

Playing the Long Game: Treasury Threats & Market Flooding

China also signaled its willingness to leverage its financial clout.

As the largest holder of U.S. Treasury bonds, Beijing hinted at potential bond sell-offs, contributing to the spike in U.S. yields during the tariff storm.

Additionally, Chinese firms reportedly began engaging in “market flooding”—dumping excess inventory worldwide at deep discounts to maintain cash flow.

This had several consequences:

Global deflationary pressure increased, impacting inflation targets elsewhere.

U.S. exporters were undercut in third markets.

Some of these cheap goods found indirect routes into the U.S., reducing the effectiveness of the tariffs and pressuring American manufacturers.

Global Messaging & Diplomatic Counteroffensive

On the diplomatic front, China seized the narrative:

State media and officials cast the U.S. as a reckless trade aggressor.

China positioned itself as the defender of global free trade.

Beijing rallied regional allies, pushing forward multilateral trade agreements and accelerating integration with neighbors.

The message to the world:

China would not yield to coercion.

Trump’s Tactical Retreat: “90 Day Pause”

Beijing’s aggressive and coordinated response appeared to catch the Trump administration off guard.

In response…

The U.S. announced a 90-day pause on new tariffs for most countries.

Tariffs on China, however, were increased from 104% to 125%, signaling a focused campaign to isolate Beijing economically.

This lopsided approach—10% baseline for allies vs. 125% for China—was designed to maximize pressure on China while temporarily easing global backlash.

But it also betrayed a deeper reality: The administration may have underestimated China’s resilience and was forced to recalibrate quickly to avoid a cascading economic crisis.

IV.) Inside the U.S. White House: Advisors Divided & Policy Ad-Libbing

The sudden escalation of tariffs, followed by the equally abrupt 90-day pause, exposed deep rifts within the Trump administration and a striking lack of a unified trade strategy.

Peter Navarro, the administration’s staunchly protectionist trade advisor, was the principal architect behind the Liberation Day tariffs.

His message was uncompromising:

The tariff blitz was “not a negotiation” and the U.S. “would not back down.”

Navarro advocated full-speed escalation, regardless of market fallout. He viewed the tariffs as a permanent restructuring of global trade relationships—brute force over diplomacy.

In stark contrast, Stephen Miran, the newly appointed Chair of the Council of Economic Advisers, signaled a very different tone.

On the eve of implementation, Miran publicly invited U.S. allies to offer trade concessions, implying that the White House was open to negotiated deals as a path out of the tariff net.

Miran emphasized the importance of services trade, suggesting the tariff pressure was also aimed at correcting manufacturing imbalances. (Related: Trump Tariffs & MAGA Manufacturing Myths)

His comments implied that the tariffs were tactical leverage rather than an end in themselves—directly contradicting Navarro’s hardline stance.

He acknowledged the internal contradictions, stating:

“Everybody’s got an opinion, and that’s fine.”

Translation: The White House was winging it.

The Weekend Pivot: From Escalation to Pause

Behind the scenes, other voices helped drive the dramatic course correction.

Scott Bessent, Trump’s Treasury Secretary, grew alarmed at the financial carnage unfolding.

Over the weekend before the pause, Bessent met with Trump at Mar-a-Lago and urged a shift toward negotiation.

When the pause was announced, Bessent became its chief defender and spin-doctor, insisting the move was not a retreat but a deliberate strategic maneuver.

According to Bessent:

The pause was a “calculated tactic” by Trump to reward cooperative partners.

The tariff shock had “exposed China as the aggressor”, framing them as the global antagonist.

Trump had “goaded China into a bad position”, proving they were the destabilizing force.

In his telling, the plan was always to blanket the world with tariffs, provoke overreaction from adversaries like China, and then offer a reprieve to the “good actors.”

Spinning the Reversal

However, the optics of Bessent’s narrative—delivered after the markets nearly imploded—suggest an attempt to save face rather than describe a pre-planned strategy.

Statements like:

“This was [Trump’s] strategy all along”

Felt aimed at placating Trump’s ego and reassuring his political base that there had been no retreat—only a “tactical pivot.”

Reports indicated that Bessent, along with other pragmatists, had spent the weekend in damage-control mode, convincing Trump to walk back the global tariff blitz and crafting a narrative to make the reversal look intentional.

As I’ve mentioned in my King Trump & the MAGA Mind Virus: Delusions of Economic Grandeur piece, I suspect Bessent did NOT want “trade deficit” tariffs in the first place… but I explain why I think he went along with them.

Lutnick, Markets, Quiet Concessions

Howard Lutnick, U.S. Secretary of Commerce under Trump, also allegedly played a critical role.

As head of a major bond dealer, Lutnick sounded the alarm on soaring yields, warning that a bond market rebellion could:

Jeopardize corporate credit conditions

Undermine Trump’s booming economy narrative

While Lutnick made no public statements, insiders reported his clear influence in the turnaround, particularly with regard to investor sentiment and Treasury market stability.

Even Navarro, the loudest hawk, went quiet. When the pause was announced, he made no public objections, a sign he too had been overruled—or at least sidelined for the moment.

A Policy Patched Together on the Fly

In the end, the internal dynamic was one of urgent recalibration.

Bessent, Miran, and business allies scrambled to avert disaster.

Trump was persuaded to pull back globally, while keeping the heat on China.

Hardliners like Navarro were muzzled, at least temporarily.

The result was a frantically improvised compromise:

Freeze most tariffs. Isolate China. Blitz the media with: “This was the plan!”

V.) Backlash from Business Leaders & Allies: Possible Pressure on Trump

Even before the administration announced the 90-day pause, major stakeholders and prominent Trump allies were openly rebelling against the sweeping tariff escalation—likely influencing the abrupt policy reversal.

Elon Musk, typically an occasional Trump supporter, publicly broke ranks.

Furious over soaring costs at Tesla caused by the tariffs, Musk launched scathing critiques of Trump’s trade policies, notably branding trade advisor Peter Navarro as:

“Dumber than a sack of bricks” and a “moron.”

Musk vigorously advocated for zero tariffs globally, warning Trump’s levies were causing “market chaos” and threatening American manufacturing competitiveness.

Such blunt criticism from an influential innovator represented a clear red flag for the administration.

Likewise, Jamie Dimon, CEO of JPMorgan Chase—known for measured public commentary—was unusually direct. He warned publicly:

A tariff-induced recession was the likely outcome.

Trump’s tariffs would “spike inflation” and “slow down growth.”

America risked “abdicating its leadership role” by pursuing isolationist trade policies.

Dimon strongly advised the administration to “fix these tariff issues sooner rather than later”, emphasizing that continued escalation would lead to severe economic harm.

Perhaps most cutting was the criticism from Ken Griffin, billionaire CEO of Citadel and influential Republican donor. Griffin slammed the new tariffs as:

A “huge policy mistake”, akin to one of the largest tax hikes in U.S. history.

Hurting middle-class families disproportionately, vividly illustrating the tariffs’ real-world impacts:

“It’s not right to take [a family making $50,000] and say it’s gonna cost 20, 30, 40% more for your groceries, toaster, new car…”

Griffin further implied the tariffs were a symptom of national decline, calling them actions a country takes in its “death throes”—a scathing critique indicating self-destructive policy.

Collectively, voices like Musk, Dimon, and Griffin—prominent figures influential within Trump’s circle—rang loud alarm bells that the tariffs were rapidly backfiring.

Sector-Wide Resistance & International Pushback

The backlash extended beyond individual figures; entire sectors and international allies quickly pushed back:

U.S. auto industry groups and Michigan business leaders condemned Trump’s ongoing 25% tariffs on imported automobiles and parts, calling them disastrous for supply chains and car prices.

The European Union prepared counter-tariffs on iconic American exports (though initially held back on products like bourbon, signaling willingness for negotiation).

Japan & Vietnam swiftly moved toward dialogue: Vietnam explicitly welcomed the pause as “breathing room” and immediately agreed to negotiate a new bilateral trade agreement.

Taiwan’s president pledged to pursue a “zero-tariff” deal with the U.S., notably refraining from retaliation, hoping to curry favor and avoid further punitive measures.

These diplomatic moves partially supported the White House’s claim that the tariff pause could yield favorable concessions.

However, these conciliatory gestures were likely encouraged or prearranged through frantic behind-the-scenes diplomacy by officials like Stephen Miran and Scott Bessent, who urgently sought to manage fallout from the administration’s initial aggressive moves.

Behind-the-Scenes Pressure & Market Panic

There is strong reason to believe that direct, high-pressure interventions occurred behind closed doors:

Multiple insider reports hinted at a deluge of phone calls to the White House as stock markets spiraled downward.

Prominent supporters, donors, and business allies likely contacted Trump or senior aides, urgently expressing panic and demanding immediate relief.

Trump’s sudden policy reversal—announced on a Wednesday afternoon after consecutive days of severe market declines—strongly suggests these pleas, alongside relentless negative media coverage, heavily influenced the decision.

Indeed, media narratives quickly became harshly critical, describing:

“Market chaos” triggered by Trump’s tariffs.

“Trump’s tariff folly” risking voter backlash and job losses.

Potential consumer pain from skyrocketing prices, undermining Trump’s political base.

Facing potential economic and political disaster—and increasingly hostile public and business opinion—Trump’s administration effectively hit the emergency brake, announcing the 90-day tariff pause to prevent further damage.

VI.) Messaging the Pivot: “Strategic Pause” vs. Climb-Down

Once the administration decided to pause most tariff hikes, the White House rapidly pivoted to messaging the reversal as a deliberate act of strength and strategic brilliance, rather than an admission of retreat.

President Trump immediately took to Truth Social, emphasizing:

“No one creates leverage like President Trump.”

Trump portrayed the 90-day pause as a calculated and generous move, giving allies a window to negotiate more favorable trade agreements:

“I have authorized a 90-day PAUSE, and a substantially lowered Reciprocal Tariff of 10% during this period—except on China.”

He positioned this temporary reprieve as rewarding nations willing to “make great deals,” while simultaneously highlighting the 125% tariff on China as proof he remained tough on America’s primary adversary.

Dual Messaging: Reward Allies, Punish China

The White House’s carefully calibrated narrative focused on distinguishing allies from adversaries. Trump’s surrogates, especially within conservative media circles (talk radio, cable news, and MAGA-friendly platforms), aggressively reinforced this dual strategy:

Allies who cooperated would benefit from reduced tariffs and favorable bilateral negotiations, showcasing Trump’s iconic “Art of the Deal” style.

China, portrayed as the villain, was left isolated, punished by even higher tariffs, and spotlighted as the true aggressor.

Treasury Secretary Scott Bessent reinforced this narrative explicitly, declaring:

“Do not retaliate, and you will be rewarded.”

Bessent emphasized that Trump’s pressure tactics were already effective, claiming neighboring nations like Vietnam and Taiwan had swiftly come to the negotiating table.

These examples were repeatedly highlighted as evidence that Trump’s brinkmanship was working—yielding concrete, pro-American results.

Selling the Pivot to Trump’s Base: The “3D Chess” Narrative

To the broader political base, the White House carefully packaged the pivot as a clear victory and validation of Trump’s strategic genius.

Supporters were told that the tariff escalation was just the first phase of Trump’s broader strategy:

Phase 1: Shock the world, proving Trump’s willingness to risk a full-blown trade war.

Phase 2: Utilize the generated leverage to secure superior trade deals.

Conservative commentators likened Trump’s moves to historical examples of strategic brinkmanship:

Reagan’s “trust but verify” policy with the Soviets.

Nixon’s “madman theory”, suggesting Trump had intentionally exaggerated threats to scare opponents into concessions.

MAGA influencers praised Trump for “outmaneuvering globalists”, arguing that Europe, Asia, and the Americas would rush to negotiate “America-first” agreements during the 90-day pause.

This reinforced a “3D chess” narrative: Trump’s aggressive tariffs were simply the opening gambit in a larger, meticulously planned strategy, incomprehensible to “hysterical” markets and media.

Maintaining the Optics of Victory

Every official statement was carefully crafted to avoid any suggestion of weakness. The administration repeatedly insisted that the tariff pause was possible:

“Because we’ve achieved our initial objectives faster than expected” (a claim not substantiated publicly).

And that it would “keep the pressure on China where it needs to be.”

These talking points were essential to prevent Trump’s political base from perceiving the pause as a retreat or failure, thereby preserving the critical tough-guy image central to Trump’s political brand.

Internally, advisors like Bessent likely used this framing to rationalize the pivot directly to Trump himself—assuring him he was still outsmarting Chinese leader Xi Jinping, maintaining Trump’s ego, and allowing him to claim victory rather than defeat.

VII.) Strategy or Blunder? Critical Analysis

Was the 90-day tariff pause a strategic masterstroke or a clumsy retreat rebranded as victory?

Analyzing from first principles – i.e. looking at intentions, execution, and outcomes – it leans heavily toward the latter: A self-inflicted crisis that the administration is now spinning as calculated.

Several key points support this conclusion:

Lack of Initial Coherence: If the pause were truly planned “3D chess,” one would expect internal consistency and forethought. Instead, we saw open contradictions – Navarro insisting on no negotiations. The policy appeared to lurch from maximalist (tariff everyone, no exceptions) to moderated (deal-making welcomed) in a matter of days, reflecting improvisation. A genuinely strategic rollout would have set clear backchannels or criteria for exemptions before markets panicked. Instead, the White House let the worst-case fears fester, then abruptly reversed course – a sign they reacted to events rather than controlled them.

Severity of Economic Pressure: The scale of financial stress leading up to the pause was extreme. The administration watched the Dow free-fall and credit markets flash red alarm signals. It’s implausible that this was intentionally engineered as a mere bluff; no savvy strategist would deliberately vaporize trillions in wealth in 48 hours just to prove a point, especially in a sensitive post-COVID economic recovery. More likely, the administration underestimated the market and geopolitical backlash, and when faced with the real prospect of a recession (as Dimon predicted), they hit the panic button. The timing of the pause – coming right as markets appeared on the verge of a meltdown – strongly indicates a forced retreat. Had it been a cool-headed strategy, Trump could have announced a conditional pause before tariffs took effect to avoid turmoil, or at least calibrated the rollout with exemptions upfront. He did not. The White House only pivoted after “the most intense episode of financial volatility since COVID” had already occurred. That looks more like crisis control than chess.

Diplomatic Chaos vs. Calculated Isolation: Strategically, one might argue the pause allowed the U.S. to isolate China while relieving pressure on allies – a divide-and-conquer tactic. There is some evidence this outcome is unfolding: countries like Vietnam, Taiwan, and possibly the EU signaled they’re willing to negotiate rather than retaliate. This could validate Trump’s approach if it was the plan all along. However, the way the scenario played out was incredibly damaging to U.S. credibility. Allies were infuriated at being lumped into sweeping tariffs in the first place (even if briefly). Trust in the U.S. as a stable partner was eroded – friendly nations felt they were one tweet away from economic harm. A number of them did prepare counter-tariffs and emergency measures (Canada, for example, was ready to impose 25% tariffs on U.S. goods in response). The short pause window may not fully repair that trust. In a carefully orchestrated strategy, the U.S. might have quietly coordinated with allies: e.g. warn them of the coming hardline on China and promise a quick exemption if they cooperate. There’s no indication such coordination happened; instead, allies were stunned and scrambling. So while Trump’s team now claims he “meant” to spare allies and isolate China, initially he tariffed them all without distinction. That suggests the intent was maximalist, and the carve-outs came later as damage control. In strategic terms, that’s closer to an own goal that you then try to undo.

Insider Narratives & Leaks: Reports that Bessent met Trump to urge a pivot and that business leaders “urged the president to reverse course” point to a reactive change. If it were “strategy all along,” one wouldn’t need a last-minute intervention by advisers; Trump would have planned the tariff pause timing from the start. The fact that Bessent and others are taking credit for influencing Trump behind closed doors undermines the notion that Trump conceived this 90-day pause as part of a master plan from the outset. Analogous historical behavior also casts doubt on the 3D chess idea – in Trump’s first term trade spats, he often escalated to the point of market distress, then cut partial deals or delayed measures (e.g. postponing some China tariffs in late 2019 when the stock market wobbled). Those instances were similarly spun as “great deals” or victories, but many analysts noted they merely avoided further pain that Trump’s own policy had caused. The current pause fits that pattern: a familiar “escalate, then trim back and declare win” cycle.

Results vs. Claims: The true test of strategy is whether it achieves objectives. It’s too early to judge all outcomes, but consider this: If Trump’s goal was to drastically reorder global trade in America’s favor, did the frantic 24-hour tariff barrage followed by a retreat achieve that? It did shock other countries and got some talking about concessions (a minor win). But it also likely caused lasting reputational damage and domestic economic cost. The administration now has 90 days to secure bilateral deals or concessions to save face. If we see only modest agreements (say, a few agricultural purchase promises or minor tariff reductions by allies), it will underscore that the whole episode was largely performative. Even in the best case, any deals secured in the 90-day window could likely have been negotiated without first nuking the global markets – just as trade deals have historically been struck through diplomacy rather than economic mutually assured destruction. In a worst case, if partners drag their feet, Trump will face a dilemma in July: either re-impose tariffs (risking another market shock in an election run-up) or extend the pause and look indecisive. Neither is ideal, meaning the initial strategy may have weakened his hand long-term.

On the other hand, it’s worth acknowledging the argument for strategy.

Trump’s defenders can point to immediate carrots-and-sticks outcomes: Taiwan pledging no retaliation and seeking zero tariffs, Vietnam and others entering talks, and China suddenly being relatively isolated as the only major economy under full tariffs.

By narrowing the fight to China, Trump has in effect created a quasi-coalition of countries that prefer to align with the U.S. rather than suffer in a broad trade war.

If, in theory, this leads to a string of bilateral wins (EU lowers auto barriers, Japan opens agriculture, etc.), one could retroactively call the chaos a form of “creative destruction” in trade policy.

Bessent’s claim that “the tariffs pushed neighbors to the negotiating table” might hold some water – fear is a motivator. Additionally, by goading China into extreme retaliation, the U.S. can now more easily justify continued hardline on Beijing without losing global support.

From a game theory perspective, Trump showed maximum irrational aggression (the “madman” tactic), then pulled back selectively, which in some negotiations can yield concessions from more rational players who want to avoid unpredictability. There is a sliver of strategic logic in that sequence.

However, the confidence level in the “masterstroke” interpretation is low. The overwhelming evidence from market behavior, insider testimony, and the hasty nature of the reversal points to an ad hoc retreat being spun as strategy.

My assessment is that this was 80% a massive own-goal, with perhaps a 20% veneer of strategy applied after the fact.

Trump’s team is effectively retconning a strategy onto what was largely a reaction to avoid a self-made catastrophe. The administration’s internal coherence also suffers – it’s clear different advisors had different playbooks, indicating the White House was winging it.

The credibility of their response is shaky; even as they claim victory, everyone saw the initial stumble.

Prominent Trump-friendly figures are indeed rationalizing the pivot to stay in the president’s good graces and preserve influence.

Scott Bessent’s effusive praise of Trump’s “leverage” and “strategy all along” is textbook ego appeasement.

It allows Trump to feel vindicated rather than humbled, which means Bessent and others keep their roles and can continue guiding policy (hopefully in a saner direction).

They know that if Trump felt he “lost” or was talked into a retreat, he might lash out or revert to hardline positions out of pride. By framing it as Trump’s brilliant move, they not only placate his ego but also maintain continuity – the policy can evolve without the president feeling undermined.

Elon Musk and Jamie Dimon, though critical, also walked a fine line: they couched some criticisms with hopes that Trump would change course, implicitly flattering him that he could still make the “right call.”

This suggests even critics moderated their tone to some extent to leave Trump an out. And indeed, once Trump did pause, some business leaders cautiously praised the move as “a good first step,” again feeding the narrative that Trump made a wise tactical decision (even if they had been screaming for days that the policy was a disaster).

Analogy: One might liken this to a general who charges ahead in battle, suffers huge losses, then calls a temporary ceasefire and claims it was the plan to lure the enemy in. The troops and onlookers know it’s a spin, but many play along to keep morale up and appease the leader. In the end, the 90-day tariff pause looks more like damage control than 4D chess. The administration is now essentially doing PR triage, rebranding an emergency reversal as a strategic pivot. As evidence, even Trump’s favorite metric – the stock market – “voted” on the credibility of the move: the gigantic relief rally was effectively Wall Street saying “thank goodness they backed off (for now)”, not “ah, a cunning plan unfolds.” Had investors believed it was all part of a plan, we likely wouldn’t have seen such fear and then such relief. The magnitude of those swings betrays how close to disaster the policy came before being walked back.

Conclusion: Trump’s 3D Chess or Own Goal?

All things considered, the 90-day tariff pause appears to be a massive own goal that the Trump administration is frantically repainting as a victory.

While there are elements of strategic opportunism in how they’re handling the pivot – isolating China and claiming credit for subsequent talks – these are largely ex post facto justifications.

The more straightforward story is that Trump’s tariff overreach backfired economically and politically, forcing a retreat.

The administration’s response, though now coordinated in messaging, lacks the ring of premeditation.

It is, in effect, a face-saving exercise: calling a timeout on a self-created trade war and dubbing it a masterstroke.

My confidence in this interpretation is reinforced by both data and behavior. Market indicators, stakeholder reactions, and leaks all point to a reactive posture by the White House.

The “3D chess” narrative is maintained chiefly through the loyalty of Trump’s inner circle and base, who are willing to rationalize almost any outcome as a win.

Indeed, many of Trump’s prominent supporters are dutifully spinning the tale that “this was his plan all along” – not necessarily because they believe it, but because saying otherwise would diminish their influence with Trump and clash with the image he cultivates.

In private, those same people likely breathe a sigh of relief that a disaster was averted and hope to steer policy more prudently in the coming months.

In summary, this move was far more a self-inflicted wound being hastily bandaged than a chess grandmaster’s gambit.

Trump’s team will continue to sell it as a win – and may even squeeze some minor victories from the aftermath – but the chaotic build-up and climb-down reveal an administration reacting to events, not orchestrating them.

As the saying goes, “success has many fathers, but failure is an orphan.” Here we see many rushing to father a “success” that was nearly a failure.

Barring a dramatic and unlikely comprehensive trade realignment favoring the U.S. in the next 90 days, history will likely record this episode not as brilliant statecraft, but as a cautionary tale of brinksmanship that blinked – with the blink being swiftly repackaged as a wink.

What could the U.S. do to fix their economic situation & reduce debt? One criticism from the right-wing is something along the lines of “What’s your plan then?!” Read my plan: The ASAP Protocol to fix the U.S. economy.

References:

Reuters: "Stocks slide again as US forges ahead with 104% tariffs on China | Reuters"

Reuters: "Taiwan says Trump tariff pause gives breathing room for more detailed talks"

Reuters: "China's deflationary pressures persist as trade gloom worsens | Reuters"

Reuters: "White House aide encourages countries to approach Trump with offers to cut tariffs | Reuters"

Quartz (qz.com): "Jamie Dimon says a recession is probably coming as tariffs take hold"

Forbes: "Billionaires—Including Elon Musk—Speak Out Against Trump's Tariffs"

Reuters: "Oil jumps 4% after Trump pauses tariffs on many countries, raises China levy | Reuters"