Trump's Tariffs (April 2025): "Liberation Day" Genius or Economic Insanity?

I'm not convinced that Trump's "Liberation Day" tariffs are 4D chess... or the optimal "America First" strategy.

In the past I’ve written about how “economists” and left-wingers (Democrats) freaked out over nothing in 2018 when Trump imposed tariffs on China… the “experts” said tariffs bad, Trump a moron, etc. and they were clearly inaccurate.

Something very few left-wingers will admit is that not only did Biden continue Trump’s tariffs, he actually doubled-down on them in certain sectors (increasing Chinese tariffs). The response from Dems? *Crickets* because “their guy” (the good guy) imposed tariffs… and because the economy was good. (Biden Kept Most of Trump’s Tariffs).

(Sidebar: There is plenty of research that highlights partisan brain-rot regarding the economy… as soon as a Republican candidate becomes president, most Republicans immediately rate the economy as “better” or justify things that “it will get better” because he’s fixing things; the Democrats do the same thing when a Democrat wins.)

Something I’ll give Joe Biden credit for (or his administration) is turning around the U.S. economy post-COVID. Republicans pointed out correctly that he achieved this with massive money printing… but it worked. The U.S. had a better economy than EVERY OTHER MAJOR COUNTRY post-COVID thanks to his policies.

You may not have liked the inflation or whatever, but it was FAR WORSE ELSEWHERE. If you think you had it bad in the U.S., you don’t realize how much worse other countries had it. Could Biden have done better with less artificial growth (i.e. pseudo-growth via bullshit jobs & gov $ printing)? Definitely.

Related: King Trump & the MAGA Mind Virus: Trade Deficit Tariffs & Delusions of Economic Grandeur

What did I strongly dislike about Biden’s admin?

Illegal immigration to an extreme: He was basically holding illegals hands, helping them walk across cross the border, giving them free welfare/housing, skipping background checks, accelerating citizenship acquisition (illegals become legal quickly), and prioritizing them over actual Americans (nonwhite DEI > white citizens). Nonetheless, this policy likely did help the economy (even with hordes of low IQ, low skill general laborers).

Woke & DEI politics: Anti-merit, anti-White, anti-Asian, anti-male, Black advantages, nonwhite advantages, etc. This permeated throughout the entire U.S. and became nauseating for normal Americans of all racial groups.

Illogical policies: Everything Biden did in the name of woke made the economy less efficient and degraded society — creating significant tension as a result of a war on competence/skill.

Zero debt plan: The Biden admin seemed to have zero plan to address the U.S. debt and interest payments on the debt. You know how you procrastinate and try to “not think about” something until last minute? This is what Democrats were doing with the debt and interest on it… “We’ll do it eventually” (yet numbers continue getting bigger).

That said, if you were an investor, the economy was blazing. Even if a lot of this was pseudo-growth, all you had to do to benefit was throw money in the market. A conservative play was just throw a % of your money in the S&P and “chill” (the status quo strategy)… it generally works.

Many working class Republicans don’t actually do this… I kept reading from populist Republicans about how “savers” are getting crushed due to the inflation.

Then they started advocating for “ending the fed” (yet these same idiots don’t realize that “ending the fed” would allow Dems to be even more fiscally irresponsible if they attained power).

I haven’t seen any legitimately smart arguments for “ending the Fed” from any Republican… there are some smart arguments, but none have been presented.

Anyways, prior to Trump’s inauguration, many were ultra-bullish on the economy and thought he would unleash “animal spirits” in terms of M&A, free markets, lower taxes, lower regulations, etc. All good things. Why? His economy kicked ass from 2017-2021.

A subset were skeptical… Biden admin had booming growth, a lot of “overheating” (stocks bubbled up), etc. I listened to a convo with some guys at Goldman Sachs and many noted that the economy would likely contract and growth would slow going forward 5-10 years due to the current overheating.

I didn’t necessarily agree because much of this is contingent on actual policy… We did know that a “majority” for one party (Republican: Prez, House, Senate) is typically bad for the economy… but many thought “this time may be different.” I also thought this time could be different.

Why? Cut more regulations, eliminate woke DEI bullshit, promote meritocracy, cut taxes, accelerate AI/robotics, etc. I also thought that Trump may be able to negotiate fairer trade terms (perhaps using tariffs strategically as leverage), increase the ratio of skilled-to-unskilled immigration, stop the asylum/refugee bullshit, etc. — these would all be good things.

But when there’s a stalemate or mix of Republicans and Dems nothing gets done, but the economy is typically better usually because neither side can pass any batshit insane or economically-disastrous policies (checks/balances).

Trump tariffs (April 2025)

For some reason Trump got the idea in his brain that the U.S. needs tariffs to stay dominant going forward. He was relatively vague regarding his rationale… so people (including myself) speculated.

Initially I thought that Trump would use tariffs as a strategic negotiating mechanism to ensure fairer trade terms and/or to stop exploitation of U.S. (e.g. U.S. subsidizing other countries’ socialism & advancement indirectly).

Related: Trump’s Initial 2025 “America First” Tariffs: EU, Mexico, Canada, China

His actual rationale? He certainly wants to stop exploitation of the U.S. and improve trade terms (this is smart). But for whatever reason, he has it in his head that he also needs to “correct trade deficits.”

Many run-of-the-mill right-wingers don’t understand the difference between: (1) negotiating even trade terms & supporting freer markets (smart) vs. (2) “correcting trade deficits” or “imbalances” (borderline retarded).

If you’re trading with some country and importing a bunch of say coffee beans or T-shirts or widgets cheaply — yet they can’t afford to buy many U.S. products… you may have “even trade terms” (e.g. zero tariffs) but there will be a “trade deficit” because the country selling these has no reason to buy U.S. products and/or can’t afford them.

A prime example is Cambodia. Cambodia exports low-cost T-shirts and footwear to the U.S. produced with really cheap labor. These flood the U.S. market and consumers like the deals they’re getting.

Cambodia buys almost nothing from the U.S. for various reasons (most can’t afford U.S. products if they wanted them). In this case, the U.S. is getting a great deal because we’re getting cheap stuff from Cambodia at the expense of Cambodians.

Now you might say… “well companies should move their business to the U.S. instead” to “give Americans jobs.” The problem? You’ll never get workers that cheap in U.S. so this is an impossible scenario. American consumers wouldn’t buy these products if they were higher cost (even if “made in U.S.A.”).

And even countries who are tariffed hard will still be able to undercut U.S. wages. Hypothetically let’s say Cambodia T-shirts typically sell for $0.50 and they’re tariffed at 50%… that’s a $0.75/shirt. Do you think an American company is competing here? No.

Moreover, do you really want to bring textile factories to the U.S.? If others are willing to grind away making good T-shirts for $2/hour — why TF wouldn’t you just accept the arbitrage opportunity?

Smart to do so. But people will be out of jobs? So what. Most would rather get welfare than have a job in a textile mill (where now they have to work and the products cost more for similar quality).

But because Cambodia exports ~$8.5 billion per year (~10% of Cambodia’s GDP) but only imports ~$0.3 billion from the U.S. per year… Trump slaps on a 49% tariff.

You might say, well doesn’t Cambodia have leverage over U.S. with these industries? Not really. Plenty of competitors. U.S. could easily crush Cambodia if it wanted and/or turn elsewhere for this type of trade… the beauty is you go with the best deal and it’s a win-win.

Trump alleges the “people voted for this.” No they didn’t. Most voted for Trump — not his personal “pet idea” of tariffs. This was a policy Trump pushed, but people didn’t vote for this… he won on other issues, not “tariffs.”

Since Trump has an ego the size of Mt. Rushmore… he likely legitimately thinks most people wanted this to “correct deficits” (even though it was mostly just him).

Many didn’t even think Trump would implement tariffs → then when he did they thought well it’s just a negotiating tactic to get fairer trade terms → and then when he showed that tariffs are mostly because of the “deficits” or “imbalances” they are now trying to justify it (Olympic-level mental gymnastics). Every move Trump makes? 10D chess bro… just give it time you’ll see.

What about Scott Bessent? (U.S. Treasury Secretary)

I like Scott and think he was an excellent selection for U.S. Treasury Secretary.

The problem is I think Trump basically said “we need to do these tariffs” and Scott had to weave them into his gameplan (he likely didn’t want to, but he’s not going to challenge Trump).

Scott Bessent likely “supports” Trumps tariffs because:

It was the ONLY WAY to get his job as U.S. Treasury Secretary

Remains the ONLY WAY to keep his job as U.S. Treasury Secretary

And to be fair… Scott Bessent trying to implement these tariffs precisely how Trump desires is not an easy thing to do. Others in his position would likely do a worse job — especially since they cannot challenge Trump on his logic.

Bessent may internally think “Trump’s logic doesn’t make too much sense in the big picture” or more bluntly “damn Trump’s tariff ideas are retarded” — but he’s gotta go with what the top dog wants or risk getting axed and labeled “deep state” conspiring against Trump.

Bessent’s essentially trying to optimize the economy in spite of Trump’s insane demands/desires — likely based on an illogical/misguided interpretation of history and deficits/imbalances.

What about Howard Lutnick?

Just watch this guy on finance shows sometime (e.g. CNBC). He’s in the media nearly every day as a borderline blowhard propagandist trying to promote the idea that tariffs will revolutionize the U.S., they’re amazing, etc.

And Trump will say “Howard is a great guy” or “very high IQ guy” or whatever. I do like the fact that the Trump administration is fully aligned in their ambitions, but there should be open discussion/debate about the most likely implications/effects of these policies.

Just look at Howard hyping up “Trump Gold Cards” to an absurd degree (claiming sales of these things exceeded everyone’s wildest imaginations)… someone needs to fact check this with critical analysis… and when the numbers come out evaluate for manipulation of data/presentation.

Trump’s likely logic…

Trump knows it’s his final term (ends 2028) and wants to go out with a bang doing what’s best for America long-term (I applaud this philosophy).

He’s bought into the idea that he needs to leave a lasting impression and legacy as “one of the greatest” or perhaps “the greatest” president of all time.

Trump wants to be remembered for things like: “eliminating inflation,” “re-shoring U.S. jobs & manufacturing,” and making America greater than it’s ever been.

He thinks that with a combination of DOGE (Dept. of Gov Efficiency) and targeting “trade imbalances” with tariffs — he can achieve this.

He’s also stopped focusing on the stock market because he genuinely thinks that there will be massive long-term gains after these short-term corrections, stagflation, or even a recession.

He views this as eliminating bullshit/slack from the market — letting businesses reset to their true/real values (not artificially boosted pseudo-values).

Unfortunately, I don’t think Trump realizes that his tariff strategy could actually be short-term sacrifice (corrections or a recession) for long-term loss… just because the stock markets drop now doesn’t guarantee that the future will be bright.

I also don’t think he’s thought about things like…

Latency: The time it takes to negotiate fairer trade agreements, AI/robotics, reshore/build up manufacturing in the U.S. is time lost that could’ve been better spent accelerating. The longer this drags out, the more of an inefficiency it creates and the more damage it inflicts in terms of innovation and true growth relative to time.

Other countries’ reactions: The U.S. has most of the leverage, but other countries may be willing to inflict pain on the U.S. (even if it hurts them more) knowing that it increases chances of Democrats winning in 2026 and/or 2028 — and restoring the former agreements. The U.S. may get rerouted out of certain trade deals and new trading blocs may form.

2026 Midterms & 2028 Prez: The implications of Trump’s tariffs and economic policy on 2026 midterm elections and the 2028 presidential election could be substantial. Republicans get voted out because they botched the economy due to one man’s ego. Things then revert back to what they had been and all Trump’s work is undone. The economy is an important issue and people aren’t patient… and under Trump there’s no logic behind being patient as he doesn’t have a plan. (Short-term pain for long-term…

gainpain. Just because you are suffering now doesn’t mean you won’t be suffering in the future.)Reversion to former policy: If the Dems win majority House/Senate in 2026 and/or Presidency in 2028… they overturn most of Trump’s tariffs such that they’ll have all been for nothing. Trump is assuming people will stay on board with his tariff idea here (even though it’s his personal pet idea not backed by anything other than his own logic). Imagine Trump’s reaction to Dems: (1) winning because of his tariffs AND THEN (2) undoing all of them.

AI/robotics: Premature tariffs slow everything down including innovation. The goal should’ve been to accelerate AI/robotics until they reach a point that the robots can do all the manufacturing… then once the cost-efficiency is low, you reshore everything because you hold all the cards. We are far from this point and Trump’s tariffs make this harder to achieve more efficiently.

Dramatically reducing immigration: Logically incompatible with the idea that we need to bring back manufacturing jobs. If you want more manufacturing you should be welcoming as many low-skilled laborers as possible or you literally won’t be able to fill all the jobs at these manufacturing plants.

Someone recently made a comment that they don’t think the Trump admin is compromised by Russia or China, but that if the Trump admin were hypothetically compromised by Russia or China — actions thus far (cutting ties, giving allies zero idea what you want in trade deals, trying to “correct imbalances”, etc.) would probably be consistent with what we’re observing.

No matter what Trump does, hardcore Trump supporters will say things like genius (with zero understanding of what was done) or “1000D chess” etc. (Most of these people aren’t very bright but are prime examples of the Dunning-Kruger effect.)

Once again, people are afraid of going against Trump because he’s the highest social rank in the U.S. — so they fall in line. If they don’t? They’ll get called a RINO (oh no! imagine how bad it would feel to be called this by a Russian bot on X!)… but this is how people are thinking (they don’t want to go against the grain).

The best analogy for the Trump tariffs logic of “correcting the deficits” that I could come up with:

Imagine you have an elite-caliber pro-sports team (e.g. NBA team) with a blatantly bad coaching strategy/gameplan. Let’s say the coach is some NBA legend (a lot of cachet/clout), but his logic is retarded. The team “goes along with the plan” because the coach is a legend! (You’ve gotta “buy in” even if you think the strategy is retarded… give it a chance.) The team’s performance is downright weak… but nobody wants to blame the coach because “he’s a legend!” After consistent underperformance for 2 seasons, the coach is axed and a new coach with logic enters the equation — and the team wins the NBA Championship.

I’d love to think that Trump is being guided by some 10,000 IQ Palantir algorithm recommending that he portray himself as a deranged tariff lunatic as part of strategy… which inevitably hits other countries hard and leads to a sustained U.S. advantage long-term… but sadly I don’t think this is the case.

What do I think could happen? Things could turn out far better than the doomers think. How? It’s just possible that things simply work out better than people think (some short term pain for eliminating the bubbles/bullshit from the market) and Trump achieves success in reshoring critical industries and decreasing dependence on globalist trade.

Nobody “knows for sure” what the outcomes will be… because we don’t know if Trump is even committed to these tariffs long-term. It’s possible that Trump decides to do some “mega negotiation” wherein he revokes the tariffs after fairer terms are achieved (perhaps realizing that fully reshoring manufacturing is stupid) — and the economy spikes back to bullish.

That said, things will likely be worse than the Trump populists/sycophants think. Most of these people have bought in with zero logic other than it is something that Trump wants. If they had an actual strategy (e.g. we’re scaling up robotics — it might make some sense).

But they don’t have an actual strategy. And if you tell me “robotics” is their strategy… then explain why Trump declined to automate the ports. And explain why most people think he’s bringing back more human American jobs. Moreover, robotics isn’t advanced enough to scale like this in the U.S. — and Trump won’t subsidize this market to give it a spark.

We should remember that the U.S. is still the “biggest dog on the block” and other countries need to access the U.S. market. Those who are heavily reliant on the U.S. for trade will experience major pain… but the U.S. will also experience a lot of pain if Trump commits to his personal pet tariff plan.

So thinking we’ll know the full implications of these tariffs short-term and long-term is wrong… it’s too complex.

I should note that the White House recently published an article on April 2, 2025: “Tariffs Work — and President Trump’s First Term Proves It.” Yet this article is completely misleading because the tariffs implemented in Trump 1.0 were very different from the tariffs Trump just implemented on “Liberation Day.”

All his first term proved was that you could hit China with tariffs and the U.S. economy could weather the transient turbulence and maintain strength. These tariffs were strategic/surgical (aimed at counteracting China’s blatant massive theft of American IP).

His first term proved that a specific type of tariff can be used without massive backlash… yet he did NOT impose “universal tariffs” on all countries in which the U.S. has a “trade deficit.”

It also proved that mainstream economists are frequently incorrect (which makes sense when you analyze most of their rebuttals using pure logic)… I wrote about this: Economists’ Doomsday Predictions vs. Reality: 2018 Trump Tariffs.

Keep in mind that a “trade deficit” simply means the U.S. imports more products from a country than it sells to them — it is orthogonal to trade terms. A country may have completely equal trade terms with the U.S. but if the U.S. buys more than it sells to them… it has a “trade deficit.” (In Trump’s mind this is somehow bad.)

You probably have a trade deficit with your local grocery store. Should your family start their own grocery store or become subsistence farmers to avoid the deficit? Lol. Many somehow have their wires crossed thinking that “trade deficit” = uneven trade terms = “national deficit” (these are 3 distinct things).

Are the tariffs already working? Well Trump got Israel and Vietnam to eliminate tariffs on U.S. goods (this should be the goal). This is a good thing, but acting like this is a major win is laughable. How so? The U.S. barely sells anything to Vietnam… so getting “even trade terms” has very little impact.

The tariffs have been highly effective in causing a major stock market correction.

Related: U.S. Tariffs: Pros & Cons — Strategic Leverage vs. Inflation (A Nuanced Analysis)

I.) Tariffs Can Be Good (If Used Strategically)

I have long argued that tariffs can serve as a useful negotiation and defensive instrument, provided they are deployed surgically rather than blanketed across entire swaths of international trade.

From my perspective, the distinction lies in targeting specific countries or specific industries whenever there is clear evidence of:

IP Theft: For instance, nations that systematically force American companies to surrender patents or replicate proprietary designs with no compensation.

Forced Tech Transfer: Situations where local regulations mandate foreign (U.S.) companies to partner with a domestic entity and hand over cutting-edge technology as a prerequisite for market access.

Unfair Tax or Regulatory Discrepancies: Subtle manipulations like hidden subsidies or tax structures that effectively shut out U.S. exporters from competing on an equal footing.

Targeted tariffs have historically compelled certain regimes to alter their policies or at least come to the bargaining table.

The reason is straightforward: the U.S. market is extremely valuable. Denying or threatening to restrict access to that market—via a specific tariff—can force foreign officials to re-evaluate any exploitative practices.

Pairing Tariffs with a DBCF to Combat VAT

Tariffs are especially useful when coupled with a Destination-Based Cash Flow Tax (DBCF)… yet U.S. hasn’t implemented this (they should though).

Many countries use something akin to a Value-Added Tax (VAT), effectively taxing American exports while rebating domestic producers.

That tilts the playing field against U.S. firms, even if nominal “tariffs” are nominally low. By imposing a DBCF, the U.S. can neutralize or mirror foreign VAT rates—meaning:

American Exports to those countries no longer face hidden barriers or partial double taxation.

Foreign Imports become subject to a comparable tax if they want to sell in the U.S., aligning the net burden more fairly.

In that scenario, any additional tariff on top of the DBCF gets hyper-focused on actual misconduct—like currency manipulation or IP theft—rather than punishing countries for having smaller markets or lower purchasing power.

Case-by-Case vs. Deficit-Focused

Focusing on “trade deficits” for tariff strategy isn’t smart. Tariffs should be levied on a case-by-case basis.

By “case-by-case,” I mean a thorough investigation and actual evidence of wrongdoing (e.g. IP theft, failing to meet NATO contributions, uneven terms, etc.).

When the U.S. singles out those who truly deserve it (like a country with sky-high barriers against American goods) tariffs are economically justified.

I view “deficit-focused” tariffs (imposed simply because there’s a trade imbalance) as inherently flawed.

If the trade flows are “even” in terms of formal barriers, but the other country just happens to be poor or specialized in cheap textiles, then the resulting deficit isn’t proof of exploitation.

Slapping punitive tariffs in that context can be self-defeating, raising prices for American consumers while yielding no leverage for a fairer deal.

A carefully designed, surgical approach—coupled with robust data on tax structures and real trade barriers—produces far better outcomes than a scattershot push to “correct” every deficit under the sun.

A country like China that systematically dumps steel or siphons American technology clearly warrants a tougher stance, whereas a small, low-income exporter of T-shirts does not.

Why This Matters Now…

The difference between strategic, targeted tariffs and a broad attempt to balance every trade deficit is massive.

As I watch Trump & the U.S. government roll out massive, near-universal tariffs, I can’t help but think we’re losing sight of what really justifies restricting imports.

The best justification for tariffs is tit-for-tat strategy (mirror-like treatment), not a spreadsheet that says we import more trinkets from Country X than we export to them. A one-size-fits-all approach seems stupid.

II.) Trump’s 2025 “Deficit-Focused” Tariffs & Key Admin Figures

When Donald Trump unveiled this new round of tariffs—what he called “Liberation Day”—I initially assumed they would be similar to 2018’s measures: narrowly aimed at countries genuinely exploiting the United States.

Back then, the Trump administration selectively targeted sectors (like steel, aluminum, or tech-related industries) where unfair practices such as IP theft or forced technology transfers were suspected.

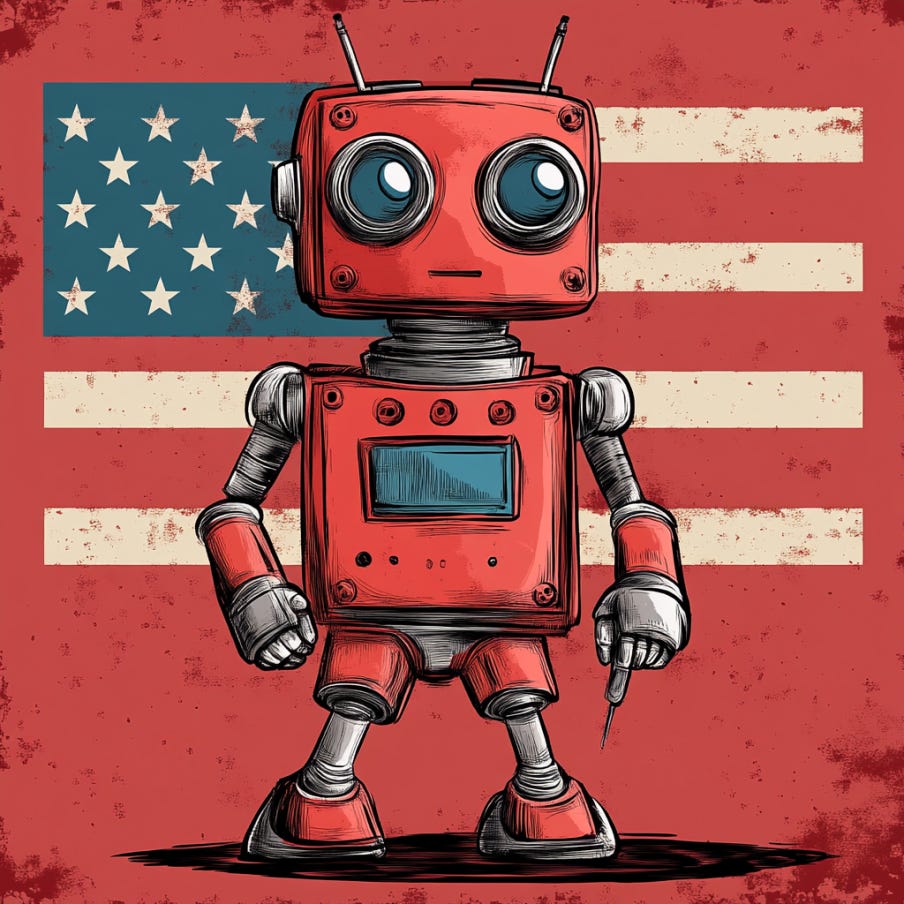

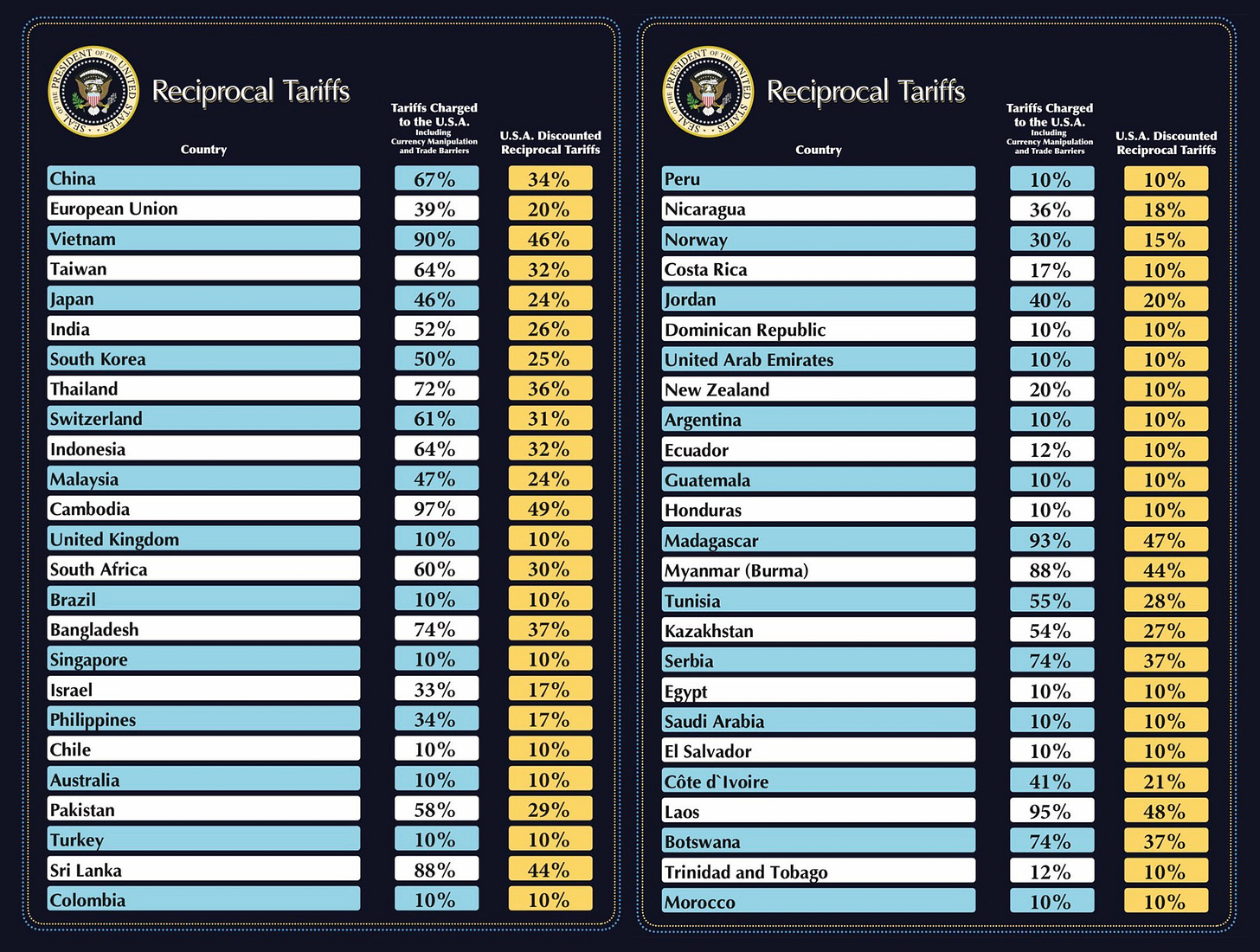

This time, however, the White House rolled out a formula hitting virtually every country running a trade surplus with the U.S., from affluent industrial nations like Germany to low-income exporters like Cambodia.

Trump officials keep referring to these tariffs as “reciprocal,” but they’re not. Calling them reciprocal is blatant propaganda. This is not reciprocity — it’s mostly just a deficit-driven tariff.

The New Tariff Formula: More than “Reciprocal” (Trade Deficits)

Public Rhetoric: Trump and his advisers claim these are “reciprocal tariffs,” implying they merely match whatever duties or barriers other countries apply to American goods.

Reality Under the Hood: They’re using a calculation roughly described as:

If a country sells the U.S. far more than it buys, it automatically faces a hefty tariff.

There’s a 10% floor so that even if the deficit ratio is small, the country still gets hit with at least a 10% rate.

Why It’s Not Actually Reciprocity:

A truly “reciprocal” tariff would mean, for instance, matching a 10% duty on U.S. goods with a 10% duty on their goods.

Here, we’re penalizing countries simply because our trade deficit with them is large, regardless of whether they impose actual high barriers against the U.S.

Consider Cambodia: it charges almost nothing on U.S. imports, but because Americans buy $8.5 billion in cheap textiles and Cambodians can only afford about $0.3 billion in American products, that yields an $8.2B deficit.

The formula lumps them with a ~48% tariff, purely from that math—not from any real “Cambodian tariff” on us.

The Rationale & Scale

Trump’s public statements often frame any trade deficit as an automatic sign of losing. He or his aides will say that foreign nations use “America’s dime” to prop up their industries and that the U.S. has every right to balance the ledger.

Ignoring Capital Flows or Comparative Advantage: This perspective overlooks nuances such as countries with smaller GDPs or consumer bases, or those specialized in ultra-cheap labor. They might run a surplus by exporting, say, T-shirts or footwear—hardly a threat to “high-tech American jobs.”

A Vast Rollout: This new formula dwarfs the narrower tariffs from 2018. It slaps double-digit (sometimes triple-digit) duties on nearly everyone with a surplus, from Cambodia to Germany and even longtime allies that keep near-zero tariffs on U.S. goods.

Hence, major trade partners get entangled even if they are relatively open markets. If they happen to buy fewer American goods—for reasons like local consumer preferences or smaller incomes—they suddenly face 20%, 30%, 40% or higher tariffs.

Scott Bessent (Treasury Secretary): Upholding the Plan

I’ve always viewed Scott Bessent as a sharp mind who likely wanted a more surgical approach—akin to forging a Destination-Based Cash Flow Tax (DBCF) or targeted measures similar to the 2018 round. Yet this new plan lumps all deficits into one basket:

Bessent’s Public Posture: He often says things like “cheap imports aren’t the American dream,” warning countries that they must remove their own barriers or face “reciprocal” tariffs.

Why He’s Stuck: I suspect he sees flaws in a universal deficit-based approach but can’t openly defy Trump without risking his position. That means he’s obliged to defend something he might privately question, just to maintain leverage in other economic areas.

Howard Lutnick (Commerce Secretary): Full-Throttle Cheerleading

If Bessent is the reluctant face of the new policy, Lutnick is its loudest champion. Every day on business networks, he extols how these tariffs will “revolutionize” onshore manufacturing.

Constant Media Blitz: Lutnick frames the deficits themselves as the root evil. He promotes the idea that imposing massive duties is the only path to American greatness.

Overlooking the Details: There’s little talk of how many deficits might be harmless or reflect normal market preferences, or how advanced robotics could be a bigger solution. He appears convinced that high tariffs alone can catapult U.S. manufacturing forward.

Trump’s Endgame: Fixing “Imbalances” at All Costs

Trump’s personal conviction seems to hinge on a brute-force notion that if the U.S. runs a deficit, it must be “fixed,” no matter if it’s with a major trading partner like Japan or a small garment exporter like Cambodia.

He refers to it as restoring American industry, but seldom addresses:

Poor Nations: Countries that can’t buy American goods in large volumes, or whose real contribution to global trade is low-cost textiles. Are they truly exploiting the U.S.?

Shifting Global Tastes: Sometimes people overseas just prefer their local alternatives or, conversely, we prefer cheaper foreign goods that we’re no longer set up to produce.

Low Threat Sectors: Certain low-value industries pose no competitive danger to America’s tech-driven economy, yet they’re being hammered as if they’re a menace.

All these nuances fade in a worldview where every trade imbalance equals losing. And so the tariffs march forward, punishing any surplus in an unprecedented sweep.

Why the “Deficit-Fixation” is Troubling…

At the end of the day, it’s a stark departure from how I initially imagined a second Trump tariff wave.

Not True Reciprocity: Despite official language, we’re not matching each country’s existing tariff rates; we’re punishing them for numerical deficits.

Ignores Varying Economic Structures: Some nations simply lack the consumer base to buy loads of American goods. Their surpluses may not result from protectionism at all.

Collateral Damage: Allies, low-income states, and other potential partners get the same harsh treatment as nations that genuinely erect giant barriers.

Potential Self-Harm: By raising costs for American importers, we risk inflation, strained supply chains, and retaliation that might hurt U.S. exports—without addressing root issues like IP theft, forced tech transfers, or real tariffs on U.S. goods.

Back in 2018, there was at least a semblance of using tariffs as leverage to correct exploitation of U.S. IP by China rather than automatically hammering everything that shows up on a deficit spreadsheet.

This new formula reveals a policy guided by “trade deficit” numbers — rather than trade terms. It just isn’t smart.

III.) Waiting for AI/Robotics Is Smarter Than Going All-In on Tariffs Right Now…

One of my biggest critiques of the current “tariff everyone” onslaught is that it’s premature (if you actually wanted to use this strategically to give the U.S. an advantage).

A far smarter strategy would be to hone in on advanced automation first… then consider large-scale reshoring or broader tariffs. (You might argue well then humans will be without jobs… but if China goes all-in on automation and U.S. doesn’t — we’re toast either way.)

A.) Capitalizing on AI/Robotics Leadership

Right now, the U.S. sits on the cusp of a major leap in artificial intelligence and robotics, but we aren’t yet at the point where robots can produce all of our clothing, electronics, or other consumer goods at a globally competitive cost.

We’re heading there—companies like Tesla, Amazon, and a host of robotics startups have made huge strides, yet it’ll likely take another 5 to 10 years before we see truly mass-scale, cost-effective automation on factory floors.

If we accelerate robotics R&D: By throwing resources behind advanced automation, we can reduce labor costs and skill mismatches, effectively neutralizing the advantage of super-cheap labor overseas.

Once AI & robotics dominate: Slapping tariffs on countries that rely on sweatshop-level wages becomes strategically impactful. We could reshore a significant chunk of production without saddling American consumers with massive price hikes, because our robots handle the labor input cheaply and efficiently.

B.) Accepting Minor Deficits in the Short Term

It makes practical sense to allow moderate trade deficits while we focus on building out AI/robotics.

If a country like Cambodia is sending us inexpensive T-shirts, so what? In the short term, that actually frees up American capital and labor to pursue higher-value industries such as software, automation, and pharmaceuticals.

Consumers benefit: Low-cost imports keep inflation in check. The public can spend on more advanced goods or services, potentially fueling sectors where the U.S. truly excels.

We can out-innovate: By not forcing every thread of cloth to be made domestically at high cost, we can channel that energy into the R&D pipeline—some of which is directly tied to building the next wave of AI or manufacturing automation.

C.) The Risk of Premature Onshoring

Trump’s broad tariffs effectively compel companies to consider relocating manufacturing back to the U.S.—but we aren’t fully ready to handle that at competitive costs, unless we want to import cheap labor (contradicting Trump’s immigration crackdown) or pay significantly more for goods (which hits consumers). Either way, we end up losing momentum in critical tech fields:

Innovation gets sidelined: Corporations facing sudden tariffs may scramble to rearrange supply chains, tie up capital in short-term fixes, and slash spending on R&D.

Supply chain chaos: Rebuilding entire factory ecosystems stateside is no trivial task. Without robust robotics in place, it’s all that more expensive and slower.

Opportunity cost: Every dollar forced into less-efficient domestic production is a dollar not poured into AI labs or advanced robotics companies that could deliver a real competitive edge five years down the road.

D.) The Immigration Paradox

To re-shore labor-intensive industries right away, we’d either need:

A flood of cheap laborers willing to work under tough conditions, or

Automation tech advanced enough to handle most of it.

Trump’s administration, though, has tightened immigration drastically, making Option 1 practically impossible if you want the volume of workers a new wave of factories would require.

If we’re not letting in large numbers of low-skilled labor, then it’s all the more crucial to wait until robotics can fill the gap.

E.) Long-Term Advantage: When to Strike

If we bide our time, invest heavily in AI and robotics, and gradually become the world’s undisputed leader in factory automation, we’ll be holding all the cards:

Onshoring becomes painless: American-made goods could match or beat low-wage competitors on cost, all while giving U.S. workers more specialized roles (operating or maintaining automated systems).

Tariffs become a real leverage tool: If countries still impose unfair practices, we can threaten or implement tariffs knowing we can replace any foreign production more smoothly.

True strategic security: From a national-security standpoint, having advanced domestic production capabilities—powered by automation—means we’re not reliant on authoritarian regimes or fragile supply chains in geopolitically shaky regions.

In contrast, the current blanket approach is basically throwing a blunt hammer at a complex global market. It might lead to short-term illusions of reshoring, but lacking the robot revolution we actually need, it risks inflating costs for everyone while also draining resources that should be fueling our next big technological leap.

IV.) Reactions to Trump’s Tariffs (2025)

I’ve seen a broad spectrum of opinions on these new tariffs, from unbridled enthusiasm to sharp denunciation. I’m not directly rebutting or debating them here… just presenting the different viewpoints.

A.) Pro-Tariff Reactions

These accounts support Trump’s “liberation day” deficit-focused tariffs, often emphasizing protectionism, job creation, or national self-reliance.

@DOGEai (Pro-Trump "America First" Bot)

Stance: Celebrates reciprocal tariffs as a shield against foreign exploitation.

Label: Oversimplified

Details: Likely prioritizes patriotic rhetoric over economic nuance, framing tariffs as a defense against "freeloading" nations. This view may overlook complexities like higher consumer costs or trade retaliation.

Peter Navarro (Trump’s Economic Advisor)

Stance: Calls tariffs "tax cuts," suggesting they boost domestic industry and revenue.

Label: Likely Misleading

Details: Navarro’s argument hinges on tariffs fostering U.S. jobs and generating funds, but the "tax cuts" label is contentious—economists note tariffs typically act as consumer taxes, not reductions.

Anthony Pompliano ("Pomp")

Stance: Strongly supports tariffs for protecting jobs and generating revenue, likening them to "passive income" from imports.

Label: Strongly Supportive

Details: Known for his Substack posts, Pompliano likely uses historical data to argue tariffs strengthen manufacturing, though critics might counter that this ignores global supply chain risks.

IB (@Indian_Bronson)

Stance: Advocates tariffs to rebuild U.S. manufacturing and achieve self-reliance.

Label: Pro-Tariff

Details: Focuses on long-term national security and economic independence, possibly downplaying short-term disruptions to trade and prices.

Note: Of course the “All-In Podcast” crew minus Jason are in favor of these tariffs (predictable because they are deliberately uncritical of anything Trump/Musk now).

B.) Anti-Tariff Reactions

These accounts oppose the “liberation day” deficit-focused tariffs, highlighting economic harm, inefficiency, or flawed reasoning.

James Surowiecki (@JamesSurowiecki)

Stance: Criticizes the tariff formula as flawed (focusing on deficits).

Label: Strongly Opposed

Details: Surowiecki argues that trade deficits aren’t inherently negative and that the formula misrepresents economic realities.

Noah Smith (@noahpinion)

Stance: Labels tariffs "self-destructive," comparing them to the Smoot-Hawley disaster.

Label: Highly Critical

Details: An economist and writer, Smith warns of retaliation and export losses, viewing tariffs as ideologically driven rather than practical.

Ramit Sethi (@ramit)

Stance: Highlights hypocrisy among tariff supporters who once decried inflation.

Label: Strongly Opposed

Details: A personal finance expert, Sethi focuses on consumer impacts, noting tariffs raise prices—contradicting earlier anti-inflation rhetoric.

Jeremy Kauffman (@jeremykauffman)

Stance: Rejects deficit-based tariffs as "nonsensical," though open to targeted ones.

Label: Clearly Against

Details: A libertarian voice, he argues deficits stem from broader factors, not trade policies alone.

Spencer Hakimian (@SpencerHakimian)

Stance: Calls deficit obsession "dumb," linking tariffs to inflation and market confusion.

Label: Strongly Opposed

Details: Likely views tariffs as shortsighted, prioritizing economic growth over deficit fixation.

Sheel Mohnot (@pitdesi)

Stance: Quotes Reagan to argue tariffs spark trade wars and job losses.

Label: Strongly Opposed

Details: A venture capitalist, Mohnot champions free trade principles, viewing tariffs as regressive.

Nate Silver (@NateSilver538)

Stance: Mocks the White House’s tariff logic as akin to a "dumb academic paper."

Label: Strongly Opposed

Details: A data analyst, Silver likely sees the policy as poorly reasoned and empirically weak.

Adam Cochran (@AdamScochran)

Stance: Dismisses tariff-driven market crashes as a debt refinance strategy.

Label: Strongly Opposed

Details: A crypto analyst, he argues the numbers don’t support such conspiracy theories, focusing on economic feasibility.

C.) Nuanced & Mixed Accounts

These accounts offer balanced views, recognizing both pros and cons of tariffs.

Balaji (@balajis)

Stance: Warns tariffs disrupt supply chains and that the U.S. can’t revert to past manufacturing models quickly.

Label: Logical / Cautionary

Details: A tech thinker, Balaji emphasizes global trade’s complexity and the impracticality of rapid reindustrialization.

Oren Cass (@oren_cass)

Stance: Explains tariffs as a coherent response to trade imbalances, despite economists’ skepticism.

Label: Nuanced

Details: A policy thinker, Cass sees tariffs as addressing real issues, though he acknowledges implementation challenges and critiques.

John Caple (@BigJohn043)

Stance: Views tariffs as taxes with revenue potential and production benefits, but notes consumer price hikes.

Label: Nuanced

Details: His tweets suggest a practical lens—tariffs can work strategically, but exchange rates and supplier responses complicate their impact.

Ray Dalio

Stance: Analyzes tariffs comprehensively, noting they raise revenue, reduce global efficiencies, are stagflationary, protect domestic firms, are vital in conflict, and address imbalances, with further effects from responses.

Label: Nuanced

Details: A hedge fund titan, Dalio provides a holistic view: tariffs have clear benefits (e.g., revenue, protection) but also risks (e.g., stagflation, trade wars). His analysis stresses context and second-order consequences like monetary policy shifts.

Yishan (@Yishan)

Stance: Warns the U.S. lacks capacity for tariff-driven reindustrialization.

Label: Critical

Details: A tech entrepreneur, he highlights infrastructure and workforce gaps that hinder rapid domestic production shifts.

Nick Timiraos (@NickTimiraos)

Stance: Sees tariffs as a Fed dilemma, raising prices while slowing growth.

Label: Analytical / Neutral

Details: A Wall Street Journal reporter, he focuses on monetary policy challenges rather than a firm stance.

Brian Chau (@psychosort)

Stance: Fears economic pain like inflation or market crashes from tariffs.

Label: Pragmatic Warning

Details: Likely considers political consequences, suggesting tariffs could undermine their own supporters if economic fallout occurs.

Types of Reactions…

Pro-Tariff: Emphasize nationalist goals—protecting jobs, raising revenue, and reducing reliance on imports. Arguments range from oversimplified (@DOGEai) to data-driven (Pompliano), but may downplay downsides.

Anti-Tariff: Highlight economic harm—inflation, supply chain chaos, and flawed logic. Critics range from pragmatic (Chau) to ideological (Mohnot), often rooted in free trade or consumer-focused reasoning.

Nuanced: Acknowledge tariffs’ strategic potential but stress complexity and risks. Cass, Caple, and Dalio bridge the divide, offering detailed analyses over blanket endorsements or rejections.

V.) Likely Outcomes & Confidence Estimates

In trying to predict how these sweeping tariffs might play out, I acknowledge it’s a murky landscape.

Nonetheless, I’ve pieced together a rough timeline—short-, medium-, and long-term—along with my confidence level in each scenario.

These estimates reflect how I believe things could unfold given Trump’s fixation on deficits, the state of AI/robotics, and how other countries might respond.

A.) Short-Term (0–12 Months)

Moderate Inflation & Confusion

I’d give it a 70% chance that consumer prices for electronics, apparel, auto parts, and a range of imports climb by at least a few percentage points. Retailers and brands can’t fully absorb new tariffs, so they’ll pass on some costs to American buyers.

Stock markets are likely to see significant volatility as companies scramble to clarify their supply chains and pass on or absorb costs. Many investors hate uncertainty, so I expect a wave of knee-jerk negative reactions.

Partial Retaliation or Overcompliance

I’d put it at 50% that major trading partners like the EU or Japan retaliate with their own tariffs on American exports. Others, especially poorer nations that can’t risk losing access to the U.S. market, might instead rush to negotiate or comply.

If that latter group cedes ground and cuts their own barriers quickly, Trump will tout it as vindication—though it might yield only short-lived “wins.”

Federal Reserve Conundrum

As Nick Timiraos and others pointed out, tariffs complicate monetary policy.

The Fed might feel pressure to cut rates if the economy slows, but inflation from tariff-driven price hikes could curb their ability to do so aggressively.

This tug-of-war in policy is real and could make markets even more skittish.

B.) Medium-Term (1–3 Years)

Supply Chain Shifts, But in Messy Ways

Roughly 60% chance that companies engage in partial “China+1” or “low-cost-country + 1” diversification—not necessarily bringing everything to the U.S., but spreading factories among multiple nations to dodge certain tariffs.

Since the tariff formula is purely deficit-based, any new deficit that emerges could lead to fresh tariffs later. This cyclical chase might create an environment of constant flux.

No Fundamental Resolution on IP Theft or Real Barriers

80% likelihood that deficit-centric tariffs fail to solve the actual causes of unfair trade—IP theft, forced tech transfers, hidden state subsidies—because we’re punishing countries across the board, rather than targeting transgressors.

Some countries may reduce token tariffs on paper, but they’ll keep underlying non-tariff barriers if they can get away with it.

AI/Robotics R&D Continues, But Slowed

I’m 50% confident that large companies might siphon off capital from longer-term R&D to cover higher import costs or relocate factories. This detour saps the momentum that should be fueling advanced automation.

A few tech giants could still push forward, but the full-throttle approach we need might be undercut by the ripple effects of these tariffs.

Political Fallout

If inflation bites and growth stalls, I see a 60% chance this leads to a backlash in the 2026 midterms against Trump’s party.

Voters who initially cheered “America First” might sour when prices rise faster than wages.

C.) Long-Term (3–10 Years)

Advanced Robotics Finally Mature

Barring major disruptions, there’s a 70% chance that within a decade, we see robotics leap forward enough to seriously reduce labor-cost advantages held by developing countries.

If the U.S. invests heavily right now, it might emerge as the clear automation leader—unless we squander resources defending suboptimal supply chains.

Policy Reversal Risk

Another major consideration: if Democrats retake the presidency in 2028 or control of Congress in 2026, there’s a 50-50 possibility they roll back these tariffs, making current disruptions moot.

If that happens, the short-term chaos yields no lasting trade rebalancing—just a scuttled experiment.

Potential for Real Gains—If Done Right

If somehow Trump (or a successor) pairs advanced robotics with more surgical tariffs, the U.S. might genuinely reshore critical industries effectively. I’d assign a 40% probability that we see a positive outcome like this, assuming a pivot away from purely deficit-based metrics.

In that best-case scenario, we’d have major growth in domestic manufacturing at a robot-driven cost structure, minimal consumer price shocks, and a true crackdown on actual exploitative trade practices.

Recap of Estimated Outcomes…

Short-term inflation & confusion: ~70%

Mixed global response (retaliation vs. compliance): ~50%

Medium-term supply chain muddle: ~60%

No fix for deeper issues (IP theft, etc.): ~80%

Major AI leaps within 10 years: ~70%

Policy reversal if Dems retake power: ~50%

Successful synergy of AI & targeted tariffs: ~40%

My central concern is that the current broad-sweep tariffs could waste time and resources that might otherwise be invested in real competitiveness—especially advanced robotics that would genuinely transform the U.S. manufacturing landscape.

While there’s a nonzero chance Trump’s gambit forces other nations to drop barriers, the short-term pain and the risk of future reversals make this a high-stakes, high-uncertainty endeavor.

VI.) Historical & Geopolitical Context

Let’s step back and compare these new “correct-all-deficits” tariffs to past episodes in U.S. economic history and acknowledge the broader strategic contest America faces on the global stage.

A.) Comparisons to Past High-Tariff Eras

Smoot-Hawley Tariffs (1930)

Often cited as a catalyst for deepening the Great Depression, though historians debate the extent of its impact.

What’s undeniable is that global retaliation followed, shrinking overall trade and fueling a spiral of protectionism.

Trump’s 2025 tariffs, in raw scope, surpass Smoot-Hawley—though the global economy is infinitely more complex and interconnected now.

Gilded Age Protective Tariffs (Late 19th Century)

The U.S. maintained high tariffs, yet simultaneously benefited from abundant natural resources, massive immigration, and minimal competition from war-torn or colonized nations.

That combination powered American industrial ascendance, but attributing it solely to tariffs is simplistic. It was a different world, lacking today’s global supply chains and advanced technology competition.

Trump’s First-Term Tariffs (2018–2020)

In hindsight, those tariffs were moderate compared to this new wave, and some ended up being used as leverage to adjust trade terms with China, the EU, etc.

While they didn’t create an economic apocalypse, they also didn’t attempt to systematically balance deficits across the board. They were targeted, albeit somewhat scattershot at times.

B.) The U.S. vs. China Rivalry

Real Tech & AI Race

The real battleground is advanced AI & robotics dominance. If America invests heavily in robotics/automation, they have a chance of beating China… China is currently crushing the U.S. in manufacturing.

Deficit-based tariffs on everyone distracts from the more pressing need to preserve intellectual property and accelerate high-tech R&D.

Global Alliances & Supply Chains

Punishing allies (like Japan, South Korea, or Germany) with big tariffs for the mere “sin” of having a trade surplus may risk pushing them closer to China or forcing them to form alternate trade blocs.

In a scenario where we want strong coalitions against Beijing, alienating potential partners over numeric deficits could prove counterproductive.

C.) Security vs. Economic Efficiency

The ‘National Security’ Argument

Some supporters of across-the-board tariffs insist they bolster security by reducing reliance on foreign supply chains.

That rationale certainly holds if we’re talking about critical goods (semiconductors, defense components). But penalizing every deficit on items like T-shirts or sneakers stretches the security claim thin.

Collateral Damage

If every sector is shielded equally, the U.S. might end up protecting uncompetitive industries it doesn’t truly need, at the cost of higher consumer prices and less capital for crucial technologies.

Historically, successful industrial policies targeted emerging or strategically necessary areas, not shotgun blasts at all deficits.

D.) Potential for New Blocs or ‘Trade War’ Domino Effect

Retaliation or Bypassing the U.S.

Countries that feel singled out by high tariffs might seek out new trade agreements or regional blocs, reducing dependence on American consumers.

If major powers band together—like the EU forging deeper ties with Asia—our leverage erodes, especially if they share tech and capital among themselves.

The Russia/China Angle

Some have speculated (hyperbolically) that if an administration wanted to sow maximum economic disruption to weaken America, they might do something similar to these Trump tariffs.

While that’s conspiratorial, it highlights how a policy that alienates allies and confuses domestic industries could inadvertently serve rival geopolitical interests.

Lessons from the Past, Outlook for the Future

Lessons: High tariffs can deepen recessions if they prompt global retaliation, and they can preserve certain industries—but only if those industries eventually modernize.

Present Reality: We have an economy anchored in advanced technology, finance, and services—blanket protection for low-level manufacturing may not align with our actual strengths.

Forward Path: I believe the ultimate success rests on whether we can carefully differentiate strategic goods from commodities and whether we prioritize building AI/robotics leadership over indulging in a simplistic “deficits = losing” mindset.

In short, history shows that while protectionism can sometimes boost domestic players, it often provokes retaliation and inefficiency.

The geopolitical landscape today is more competitive than ever, with nations eager to form new alliances if America refuses to trade on rational, strategic terms.

Unless we adapt and concentrate on the truly critical sectors, we risk repeating the errors of past high-tariff eras—only in a far more interlinked global marketplace.

VII.) Addressing Counterarguments

Throughout this debate on “tariffs as leverage” vs. “tariffs to fix deficits,” there are several recurring counterarguments. I want to lay them out succinctly, acknowledging their points without extensively refuting them in this section.

“We Must Stop Deficits Immediately or We’re Being Exploited”

Argument: Any trade deficit represents Americans sending money abroad while receiving relatively little in return, so balancing every deficit at once is urgent.

Counter-Note: This logic assumes all deficits come from exploitation or unfair practices, ignoring that many can reflect normal comparative advantage or low purchasing power in poorer nations.

“Tariffs Alone Will Prompt Rapid Job Reshoring”

Argument: If imported goods become more expensive, domestic factories will magically reappear, creating millions of manufacturing jobs.

Counter-Note: Large-scale onshoring typically requires cheap labor or advanced automation. With immigration crackdowns and AI/robotics still not fully mature, the pace of true reshoring may be slower than expected.

“Accepting Uneven Terms Is Weak”

Argument: Some claim that tolerating minor deficits, even with zero tariffs, amounts to letting other nations “walk all over us.”

Counter-Note: Sometimes, a deficit doesn’t stem from manipulative practices but from natural economic disparities or local income constraints. Tolerating modest imbalances can free us to focus resources on more high-value pursuits (like AI R&D).

“We Need to Bring Back All Manufacturing Now!”

Argument: The U.S. should quickly revive textile, shoe, or simple electronics plants to employ unskilled workers and curb import dependence.

Counter-Note: If the government simultaneously limits unskilled immigration, there may not be enough willing Americans to fill such labor-intensive roles. Also, cost-competitive domestic production often hinges on robust automation that isn’t fully ready.

“Tariffs Worked Wonders in Past Eras, So They’ll Work Now.”

Argument: Proponents cite the Gilded Age or post–World War II booms, attributing them heavily to tariffs.

Counter-Note: Those eras also featured unique advantages—vast resources, huge labor influx, minimal global competition. Modern supply chains and the AI/robotics race drastically change the dynamics of what tariffs can achieve. Additionally, many would argue that the tariffs of old didn’t actually help… such that the U.S. thrived in spite of the tariffs.

VIII.) Considering the “Golden Goose” of the U.S. Market & America’s Debt Problem

Having surveyed a wide array of reactions—ranging from Nick Timiraos’ Fed-focused warnings to Ray Dalio’s macro view—it’s clear that the U.S. tariffs do more than just punish trade partners: they function like a consumption tax at home.

Some suggest that since the United States is both: (1) burdened by massive debt and (2) home to the planet’s most desirable consumer market — tariffs could be a blunt but “efficient” way to raise revenue, protect key industries, and reduce reliance on foreign capital.

Yet these arguments raise the question:

Is an across-the-board, deficit-driven tariff truly the best we can do—or is there a more optimal plan to “put America first” without sacrificing the principles of a free market and low regulation?

A.) The U.S. Market as the “Golden Goose”

Leverage of American Consumers

By many accounts, the United States is the world’s biggest, wealthiest consumption zone. Access to it is so vital that foreign producers often accept less profitable terms just to stay in the game.

If we brandish that market, we do indeed have a powerful “stick” to enforce trade rules or demand concessions. That part is correct.

Why This Doesn’t Necessarily Require “Fixing Every Deficit”

We can exploit the goose’s golden eggs (i.e., everyone’s desire to sell to Americans) without imposing giant tariffs on every single country with a surplus.

A more precise approach can still wield the threat of losing U.S. market access, but tie it to verifiable unfair practices or refusal to open markets—not raw deficits.

B.) Addressing America’s Debt & Budget Deficit

Tariffs as a Tax

As Ray Dalio, John Caple, and others note, import duties generate revenue. Some fraction is effectively paid by foreign suppliers (via currency adjustments, supplier concessions), though another fraction inevitably passes to U.S. consumers in higher prices.

If we’re drowning in debt, it’s tempting to see tariffs as a “tax” that partly lands on foreigners, making it politically easier than raising income or capital-gains taxes.

Downsides of Relying on Blanket Tariffs for Revenue

Overly broad duties can stoke inflation, hamper free trade, and risk global retaliation, which itself can depress American exports and hamper growth.

If the Fed tightens rates to curb tariff-driven price hikes, that can slow the economy further, complicating the debt picture rather than solving it.

Alternative Approaches

Destination-Based Cash Flow Tax (DBCF): This could offset foreign VAT advantages and function somewhat like a consumption tax, but more systematically and fairly.

Reducing Government Bloat: If we truly want low taxes and low regulations, we also must rein in spending—something neither Democrats nor Republicans have managed effectively. No signs of this happening either with a new “spending bill” approved under Trump.

C.) The Fed, Interest on Debt, and “4D Chess” Myths

Nick Timiraos warns that the Fed faces conflicting goals if tariffs drive up prices while economic activity slows. Rate cuts help certain sectors, but you can’t cut too far if inflation is climbing.

Some Trump supporters claim he’s trying to “break the economy” short-term so the Fed drastically cuts interest rates, letting America refinance its debt at lower rates. But as many point out, the math doesn’t justify tanking the economy for minimal interest savings.

In reality, if we want to reduce the debt burden, we need either:

Higher growth (through real productivity and stable investment climate), OR

New revenue sources (like a carefully structured consumption tax or partial tariff) plus actual spending restraint.

D.) Oren Cass’s Perspective on Using Deficits as a “Proxy”

Oren Cass articulates the logic that trade deficits may serve as a rough stand-in for unfair practices. He acknowledges it’s not a perfect measure—some deficits come from other causes—but argues it’s still “practically useful.”

This approach, while simple, lumps legitimate comparative advantage together with shady trade barriers. It’s “coherent” in the sense that it imposes a uniform standard, but it can punish innocent deficits alongside genuinely exploitative ones.

IX.) American Reciprocity Act (2025): My Proposal

If I were to design a ruthlessly effective yet rational approach that puts America first—covering everything from underpayment for defense (NATO), pharmaceutical freeloading, IP theft, and VAT mismatches—I’d propose the following multi-pronged framework.

This plan would draw on the immense leverage the U.S. consumer market holds, while systematically tackling each source of “exploitation.”

Better plan: ASAP Protocol to Fix U.S. Debt & Accelerate GDP Growth

1.) Adopt a Robust Destination-Based Cash Flow Tax (DBCF)

Neutralize VAT Advantages

Any country imposing a 20% VAT effectively penalizes U.S. exports while rebating its own producers, even if nominal customs duties are zero.

A DBCF ensures foreign goods sold in the U.S. face a similar tax environment, offsetting that hidden advantage.

This “leveling tax” becomes the baseline: if a country has, say, a 15% VAT, we automatically levy something analogous, closing the gap.

Simplicity & Revenue

This DBCF doubles as a broad consumption-based revenue stream, funneling money into the U.S. treasury.

It’s less arbitrary than slapping random deficits with high tariffs. Instead, it systematically counters structural tax disparities.

No Blanket Punitive Tariffs—Yet

At this stage, the DBCF primarily evens out normal trade flows, letting truly free markets flourish where no direct exploitation is proven.

2.) Institute “Freeloader Surcharges” for Underpaid Defense & Security

Many countries depend on the U.S. for defense—NATO allies that spend well below the 2% GDP guideline, or partners in East Asia who rely on the U.S. Navy.

If they refuse to share these costs adequately, the U.S. can impose an additional Freeloader Surcharge.

Defense Cost Surcharge

Calculate each ally’s shortfall (e.g., the difference between 2% GDP and what they actually spend on defense).

Impose a tariff-like surcharge on that ally’s exports to the U.S. that recoups part of the cost Americans bear on their behalf.

Alternatively, let them pay a direct defense contribution or purchase U.S. defense equipment to waive/reduce the surcharge.

Signal Strength without Blanket Punishment

This specifically targets “defense freeloader” behavior, not normal goods trade.

Countries meeting the recommended spending or signing cost-sharing agreements are exempt.

3.) Tackle IP Theft, Forced Tech Transfer, Pharma Free-Riding

IP Theft Panel

Establish a specialized “IP & Tech Enforcement Commission” that calculates estimated damages from stolen patents, trade secrets, AI models, or forced JV rules.

If a country’s actions cost U.S. firms $X billion in lost IP value, that triggers proportionate tariffs or surcharges on exports from that country, labeled an “IP Restitution Fee.”

Pharma “Fair Share” Mandate

Many wealthy nations get cheaper drug prices by capping or negotiating them, effectively relying on American R&D funded by higher prices stateside.

Impose a Pharma Fairness Surcharge if a nation’s average brand-name drug cost is significantly below some internationally recognized baseline.

That surcharge remains until the country agrees to pay more reasonable prices or sign a cost-sharing arrangement with major American pharmaceutical innovators.

AI/Tech Alliance

Countries wanting tariff-free or DBCF-free arrangement on technology trade must sign a “No Forced Transfer” clause and adopt strong IP-protection laws.

Violators face immediate “IP Restitution Fees” plus restricted access to the U.S. software or cloud market.

Related: Exploitation of the U.S. by Allies: Trade, Pharma, Defense, IP (2025 Estimates)

4.) Selective “Offenders” Tariffs if Surcharges Inadequate

If certain nations still refuse to address:

Defense cost-sharing,

Ongoing IP theft or forced tech transfer,

Highly protectionist drug pricing or other freeloading measures,

Then we escalate to targeted tariffs on their critical exports.

The difference from a blanket deficit-based approach is:

Evidence-Based Trigger: The U.S. must detail: “You owe us $X in defense shortfall,” or “Your IP theft cost us $Y.” The tariff then matches that, not an arbitrary deficit ratio.

Path to Removal: If the nation addresses these specific demands—raising defense spending, signing IP protections, adjusting drug price rules—the extra duties drop, reestablishing normal trade.

5.) Maintain Low Taxes & Minimal Regulation Domestically

Use DBCF & Surcharges Revenue to Offset Income Taxes

Part of the plan is to reduce or cap personal/corporate taxes by channeling new revenues from the DBCF, freeloader surcharges, or IP restitution fees.

This keeps America business-friendly, fueling growth and furthering AI/robotics innovation.

Deregulate wherever Possible

If we lighten regulatory burdens on manufacturing and R&D, domestic firms can scale faster, making them more robust once we roll out targeted tariffs or re-shoring.

Freed from excessive red tape, entrepreneurs can channel resources into advanced robotics, eliminating the need for cheap labor imports.

6.) AI & Robotics Acceleration (Go H.A.M.)

Incentivize Robotics: Offer tax credits for adopting AI-driven factory automation, fast-tracking the day we can produce goods competitively at home.

Revisit Tariff Escalation: Once advanced robotics are widespread, we can more safely ramp up certain protective tariffs if we still face major exploiters. By then, cost differentials are smaller, meaning domestic production won’t spike consumer prices as severely.

7.) Monetary & Debt Strategy

Sustainable Debt Financing

Relying on surcharges and a DBCF can bring in new revenue. Use that to pay down existing interest obligations or reinvest in infrastructure.

Avoid forcing the Fed to cut rates artificially—focus on real growth via technology and global leverage, not short-term financial engineering.

Prudent Spending Cuts

This plan needs synergy: if we’re injecting new revenue, we should also cut wasteful programs, ensuring a net improvement to the debt trajectory.

No “End the Fed” Distractions

Keep the Fed as an independent entity managing inflation.

Don’t sabotage it with illusions of “killing interest rates.”

Instead, let stable growth and new revenues organically strengthen America’s credit standing.

Why This Plan is Smart…

Pinpointed Force: We harness the U.S. market’s “golden goose” status by punishing only genuine free-riders on defense and IP or pharma cheats.

Revenue for Debt: The combination of a DBCF, surcharges, and potential targeted tariffs can meaningfully raise funds without hammering every single American consumer good.

Preserves Free Market Where Possible: We keep normal trade flow with countries not engaged in blatant exploitation, sustaining low domestic taxes and letting genuine comparative advantage flourish.

No Overkill: Instead of forcing uniform 20–50% tariffs on all surpluses, we tie sanctions to quantifiable shortfalls or theft. This dissuades countries from underfunding defense or stealing IP if they want tariff-free access.

Encourages Allies to Cooperate: Allies get a clear message: pay your fair share in security, stop underpricing U.S. pharma, respect IP, or face a targeted penalty—no more free lunch.

Implementation & Political Feasibility

Possible Bipartisan Appeal

Republicans might back this for “America First” and low tax reasons.

Some Democrats might see fairness in forcing foreigners to pay more for their own security and IP usage, rather than overburdening U.S. taxpayers (I’m skeptical but who knows).

Gradual Rollout

Start with the DBCF to neutralize foreign VAT. Meanwhile, set up the IP/Defense/Pharma panels that measure and quantify shortfalls.

Roll out surcharges methodically, giving countries a chance to rectify policies.

Leverage Over Both Allies and Rivals

For rivals like China, the IP theft fees and forced-tech-transfer fines could be steep if negotiations fail.

For European allies underpaying NATO, a “defense offset” surcharge encourages them to meet the 2% GDP guideline.

My proposed plan wields America’s greatest asset (its consumer market) with surgical precision rather than a scattershot deficit-based hammer.

It addresses the “freeloading” dimension (defense, IP, pharma) and VAT mismatch through a DBCF. It preserves domestic free-market principles, low taxes, and fosters AI/robotics investment so that long-term onshoring is cost-efficient.

Most importantly, it raises revenue to tackle the U.S. debt and invests in growth rather than fueling inflation or antagonizing allies for no good reason.

Related: A Hypothetical America First Reciprocity Blueprint for Ending Exploitation (2025)

Final Take: Trump Tariffs (April 2025)

I remain convinced that tariffs can be smart when leveraged on a targeted, case-by-case basis against:

Exploitation of the U.S.: IP theft (tech/pharma), defense/military spending (NATO contributions), etc.

Uneven terms: Unequal trade terms (tariffs, taxes, etc.), regulations & money-grab fines against U.S. companies, etc.

VAT (value-added tax): On U.S. companies but not native companies. This is an indirect competitive advantage for non-U.S. companies.

The smartest strategy is surgical going-for-the-jugular tariffs on countries that are deliberately exploiting the U.S. and tell these countries EXACTLY WHAT THEY’RE DOING — so that they know how to remedy the problem.

If you want the EU, Canada, etc. to stop the VAT — tell them. If they can’t? Implement a flexible DBCF tax (destination-based cash flow tax) that auto-matches their VAT so that terms are even.

If you want to protect critical industries in the U.S. (e.g. tech, semiconductors, etc.) then focus on this in a smart way… this doesn’t involve tariffing T-shirts in Cambodia.

Trump’s new push to “correct trade imbalances” across the board strikes me as a recipe for broad disruption, muddled with the assumption that any deficit automatically equals exploitation.

Reshoring could eventually be beneficial—but only if U.S. manufacturing can leverage advanced AI/robotics, drastically reducing labor costs. Right now, many industries simply aren’t ready to bring large-scale production back onshore without either cheap labor (which contradicts immigration crackdowns) or skyrocketing consumer prices.

In the short run, I anticipate higher inflation, supply-chain complexities, and possible retaliation from key partners. The Federal Reserve, already juggling inflation and employment mandates, faces added pressure when tariff-driven price hikes meet economic slowdowns.

Long term, if the administration or a future government reverts to more strategic, data-based tariffs—especially if the U.S. doubles down on automation R&D—there’s a path to real gains. Cheap foreign labor won’t be so decisive if robots do most of the work here in America. Then, tariffs become a final lever to negotiate fair terms, not a bludgeon to fix “imbalances” that might be largely benign.

Ultimately, my hope is that we’ll pivot before lasting damage is done—either Trump modifies this approach upon seeing unintended consequences, or enough public, corporate, and political feedback pressures a policy adjustment.

If we keep channeling energy into advanced technologies rather than prematurely waging a universal tariff crusade, we could still emerge stronger, more independent, and better prepared for a shifting global economy.

If Trump does somehow modify his approach to be smarter (even terms rather than “correcting the deficits”) — his supporters will say “SEE!!! I KNEW THIS WAS WHAT HE WAS DOING!!! 100000D CHESS AS ALWAYS!” (And I’ll be happy for them and the U.S. — this is what I’m hoping for, but definitely will not claim to know what’s going on in Trump’s head.)

I’m not going to assume I know the downstream effects of this policy or what will actually happen in the future… it may turn out to be a fakeout like the 2018 tariffs… but most likely it will be a mix of good, bad, and recalibration — assuming these tariffs are permanent to the tune of reshoring industry in the U.S.