King Trump & the MAGA Mind Virus: Delusions of Economic Grandeur & "Trade Deficit" Tariffs to Rebuild U.S. Manufacturing

Trump imposes "trade deficit" tariffs... woke right MAGA communists are loving it.

Trump has essentially become “King of the U.S.” and everyone in the Republican party is afraid to call him out on his bullshit.

Humans are social animals with a clear “social rank” — and Trump currently ranks highest (he’s President of the United States!).

Go against Trump? You’ll feel the wrath from: Trump, Russian bots on X, hordes of populist morons, and many smart sycophants who pledge allegiance to Trump on a daily basis.

This is why Trump’s Liberation Day tariffs were rolled out by Scott Bessent in April 2025 with basically zero internal opposition or friction. My guess is that Bessent thought the tariffs were a retarded idea, but had to go along with them because it was Trump’s “pet idea.”

If he doesn’t? Say goodbye to being U.S. Treasury Secretary and social backlash from MAGA’s that you’ll carry with you to your grave. You also risk having someone replace you who might be dumber and fuck up the economy more than you would (so you just go with the flow and give it your best shot.)

FWIW, I don’t think Trump is a dumb person. In fact, I think Trump is much smarter than many think (in various domains) and is intellectually curious… plus bold and not afraid to brainstorm ideas or ask questions that may be perceived as stupid (e.g. Why don’t we just drop a nuke on the hurricanes?) Trump is not “low IQ” but he is significantly off-the-mark on many key issues; and these can have harsh consequences.

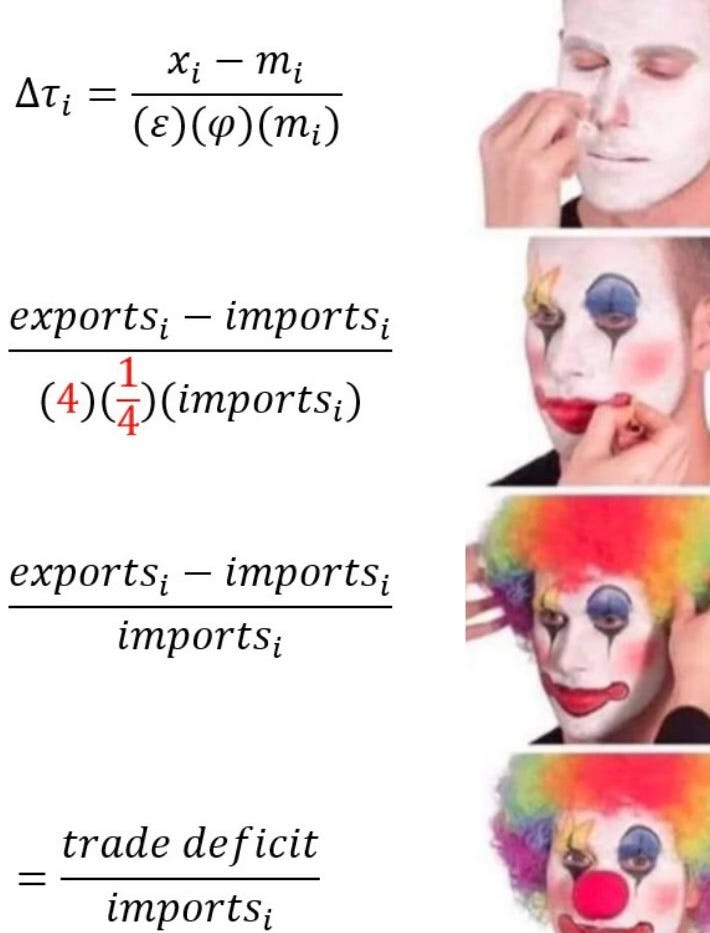

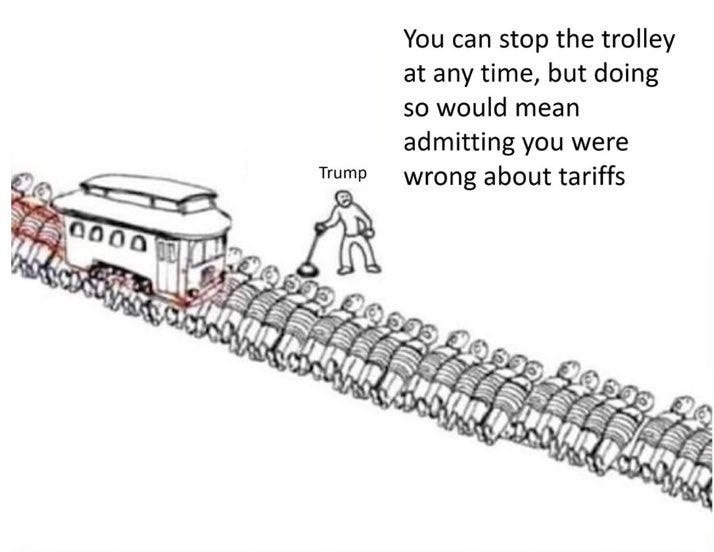

However, a major issue is that when Trump: (1) gets a batshit insane idea in his head that becomes his “pet idea” (e.g. tariffs to target “trade deficits” rather than fix “trade terms”) AND (2) thinks he has special insight that nobody else does (i.e. tariffs will MAGA) — he digs in and goes full steam ahead.

In Trump 1.0 (2017-2021) Trump had people around him that were willing to take an honest stand against some of his “pet ideas.” These people were like… nah Trump this won’t work how you think. And of course some would get shitcanned and take the hit of being labeled “deep state” or whatever.

And his supporters would be like: See! Trump can’t get anything done because he still needs to drain the swamp! (The “swamp” is just code for people who stand up to Trump for whatever reason… sometimes it’s justified, other times it may be a personal vendetta. I’m not implying nobody Trump fired was bad.)

What about this time around in Trump 2.0 (2025-2029)? Trump was off to a solid start. Axing woke ideology, cracking down on illegal immigration, announcing DOGE to cut irresponsible government spending, etc. — all favorable developments.

Some shakiness with unnecessary crypto projects (e.g. Trump, Melania, etc.) — but this didn’t bother me. Seemed unpresidential, but whatever. Then bailing on Ukraine and thinking you can trust Putin? Not understanding that it’s probably America First to continue helping Ukraine (downstream effects/gains of neutralizing Russia).

ZERO PUSHBACK. RADIO SILENT. Then the Republicans passed a major spending bill that will far outpace any (likely transient) cuts that DOGE purports. Alright… whatever. Now? “Liberation Day.” Markets are tanking and Fox News removes the Dow ticker from their broadcast as a result.

Elon Musk had been posting Milton Friedman clips on X/Twitter (Milton Friedman is a smart guy with good economic philosophy/strategy)… but now with Trump tariffs?

I think Elon knows they are retarded but: (1) they might help Tesla (TSLA) and/or (2) he can’t speak out against them because it would damage his relationship with Trump and hinder his ability to do any kind of good. (I believe Musk is trying to do good with DOGE… even if the results have been questionable at best thus far.)

Related: The Elon Theory: Why Musk Embraced Trump Propaganda

Why nobody will challenge Trump on his tariffs…

This goes for his staff AND right-wing political figures… look what happened when Thomas Massie opposed the recent government funding bill that King Trump wanted passed.

Trump vowed to lead the charge to unseat Massie of Kentucky. It’s even more extreme when Trump can fire you from your job on a whim (he can fire Bessent and Lutnick on a whim).

This all creates an environment where even massively problematic ideas from King Trump go unchallenged… leading to a cycle of self-reinforcing compliance and zero internal critique.

Basically you go against Trump and he unleashes the MAGA pitbulls in your direction.

1.) Fear of Social & Political Backlash

The most obvious reason to avoid clashing with Trump is simple self-preservation. Individuals who publicly disagree with Trump face severe and immediate consequences: being branded as traitors, “RINOs,” or members of the “deep state.”

This stigma is virtually permanent, ending political careers and damaging personal reputations. Trump's mastery of social media amplifies these repercussions, making the backlash swift, intense, and lasting.

Everywhere you go for the rest of your life, right-winger populist trolls follow you around and harass you for defying Trump.

2.) Trump’s Dominant Social Rank

Humans instinctively defer to authority figures and those perceived as socially dominant. Trump, as President, occupies the highest rung on the American social ladder.

Advisors and party members subconsciously hesitate to contradict him openly, preferring to remain aligned with the figure they perceive as the ultimate leader.

This dynamic creates an inherent bias toward obedience and conformity.

3.) Strategic Self-Preservation & “Lesser Evil” Rationale

Many in Trump’s administration genuinely believe they're the most capable individuals for their roles.

They rationalize supporting questionable ideas by thinking, “If I don't implement this policy, Trump will replace me with someone less competent who will cause even greater harm.”

Thus, even privately skeptical officials feel compelled to execute Trump’s initiatives to mitigate potential damage.

4.) Intentional Alignment & Cultivation of “Yes” Men

Trump deliberately assembled an administration and advisory circle filled exclusively with loyalists who never challenge his core ideas or strategies.

Learning from his first administration, he eliminated voices of dissent, surrounding himself instead with individuals who reinforce his viewpoints.

This approach creates an echo chamber where bad ideas from Trump become self-reinforcing, making genuine critique impossible.

5.) Direct Personal or Financial Benefit

Certain powerful stakeholders—business leaders, advisors, political allies—stand to benefit personally from Trump’s policies, no matter their overall merit.

They understand these policies may not benefit the nation broadly, yet their personal incentives (financial gains, political favor, or influence) override broader ethical or strategic considerations, ensuring their continued public support.

6.) Perceived Opportunity to Achieve Larger Goals

Some administration members genuinely want to achieve beneficial goals for the U.S. under Trump’s presidency, even if it means tolerating or supporting his flawed policies along the way.

They calculate that challenging Trump on specific pet ideas (e.g., tariffs) risks jeopardizing their ability to influence more significant long-term initiatives. Therefore, they choose strategic silence or compliance.

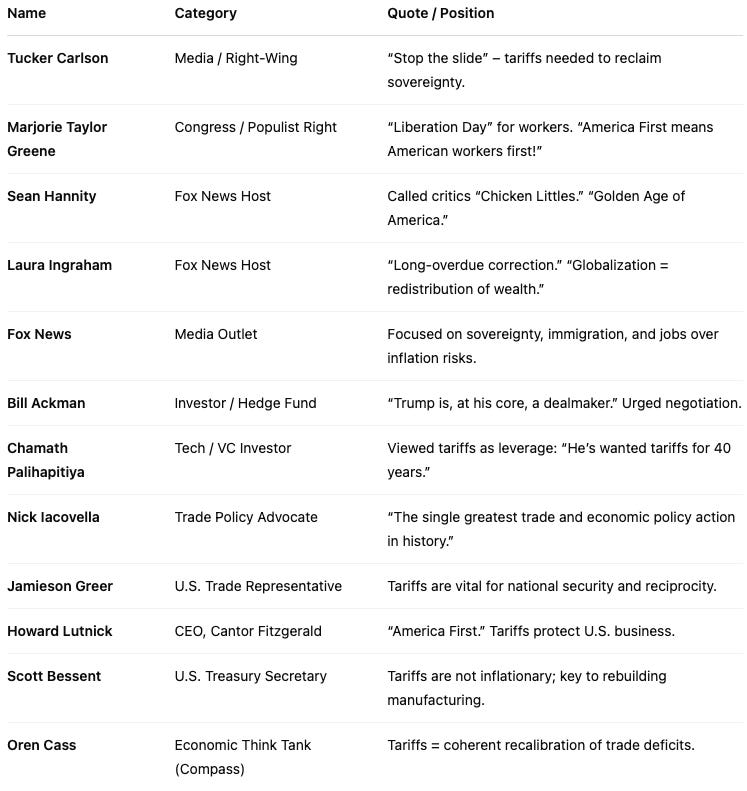

Trump “Liberation Day” Tariffs: Supportive Reactions

The defenders of Trump’s tariffs are hilarious. Many have been asked to make specific bets on these tariffs or DOGE yet most will not actually put some “skin in the game” (likely because they really are unsure what to think — which is fine — but hyping these tariffs with no strong logic is stupid).

A simple way to tell if someone is honest is have them show proof of their large wager that DOGE (Department of Government Efficiency) will truly “cut” the % of spending that was claimed. If they genuinely believe this, they should have no issue placing a massive bet on Polymarket with proof.

(They hamster-wheel themselves into whatever “the current right wing thing” demands. They are no different than the woke left. Whatever Trump wants? The-current-thing *LOADING IN BRAIN*)

If I had to describe tariff-supporting demographics:

Non-investors: Want to see those who invested money and/or are wealthy suffer because they are too dumb to invest. A form of schadenfreude.

Billionaires: With plenty of cash on hand. Loving the fact that they can buy up all cheap assets while the middle investor class gets gutted.

Economically illiterate: They simply don’t understand logic. I’ve heard some reasonable arguments for these tariffs… but from most people? Nope.

MAGA mind virus (“woke” right): Embraces right-wing populism or whatever Trump does no matter what. He’s a genius 24/7.

Some AI guys affiliated with Elon: They want to rationalize the tariffs because they’re aligned with the tech right and/or Elon. Can’t criticize Trump’s policy decisions if you’re friends with Elon or work at xAI.

Fox News: Pundits on Fox. They love Trump. It’s basically Trump news.

Notable Supporters of Trump’s 2025 Tariffs (April 4, 2025)

Tucker Carlson (Media / Right-Wing): Called tariffs necessary to “stop the slide” and reclaim national sovereignty.

Marjorie Taylor Greene (Congress / Populist Right): Declared April 2nd “Liberation Day” for American workers. “America First means American workers first!”

Sean Hannity (Fox News Host): Called critics “Chicken Littles.” Framed tariffs as the start of the “Golden Age of America.”

Laura Ingraham (Fox News Host): Called tariffs a “long-overdue correction.” “Globalization is the redistribution of American wealth.”

Fox News (Media Outlet): Coverage emphasized sovereignty, jobs, and immigration over inflation or market risks.

Bill Ackman (Investor / Hedge Fund): Advised foreign leaders to negotiate. “Trump is, at his core, a dealmaker.”

Chamath Palihapitiya (Tech / VC Investor): Framed tariffs as strategic leverage. “He’s wanted tariffs for 40 years.”

Nick Iacovella (Trade Policy Advocate): Called it “the single greatest trade and economic policy action in history.”

Jamieson Greer (U.S. Trade Representative): Framed tariffs as urgent for national security and reciprocal trade.

Howard Lutnick (U.S. Secretary of Commerce): Praised tariffs as aligned with “America First.” Called them key to protecting U.S. business interests.

Scott Bessent (U.S. Treasury Secretary): Argued tariffs are not inflationary. Key to restoring U.S. manufacturing.

Oren Cass (Economic Think Tank – American Compass): Described tariffs as a coherent recalibration tied to trade deficits and national strategy.

DOGE + Trump Tariffs = MAGA’s “Critical Trade Theory”?

A recent post on X from a prominent investor and all-around high-IQ guy who I’ll leave unnamed claims that the: (1) combination of DOGE cuts & (2) Trump tariffs will Make America Great Again and position the U.S. for long-term dominance.

Let’s analyze this logic for a sec.

A.) DOGE Cuts

Lower inflation (-): Allegedly as a result of spending cuts.

Higher unemployment (+): Because gov employees were fired.

B.) Trump Tariffs

Higher inflation (+): As a result of prioritizing American-made products.

Lower unemployment (-): More people will work for American companies.

What’s true here?

DOGE has already fired ~20-30k federal workers with more firings to come.

Broad tariffs (according to a 2022 CPA trade model) could create ~10 million U.S. jobs by boosting domestic manufacturing.

The idea is that the Trump administration can use the combination of DOGE cuts and tariffs to control economic levers like interest rates, while new tariff revenues (e.g. 46% on Vietnam) could fund tax cuts.

Why Trump’s DOGE Cuts & Tariffs Won’t "Make America Great Again"

The idea that Elon’s DOGE with Trump’s Tariffs will “MAGA” is pure stupidity. DOGE is a great concept, but has been blatantly dishonest thus far (even if they are trying to do legitimately good work).

1. Tariffs Increase Inflation, Hurting American Consumers

Tariffs intended to protect American manufacturing inevitably drive up prices.

Higher Consumer Costs: A 25% tariff on autos alone could raise U.S. vehicle prices by over 11%. Similarly, the 46% tariff on imports from Vietnam inflates costs for consumer goods like apparel and electronics.

Retaliation from Trading Partners: History shows trade partners respond to tariffs with their own penalties. Retaliation shrinks export markets, damaging sectors like agriculture and tech, which depend heavily on international sales.

Reduced Purchasing Power: Rising inflation reduces consumer purchasing power, erodes savings, and disproportionately harms middle- and lower-income families.

2. Republicans are Simultaneously Increasing Spending

Despite DOGE cuts, Senate Republicans have introduced a budget proposal that significantly increases spending.

Tax Cuts: The plan extends the 2017 tax cuts and adds further reductions, eliminating taxes on tips and Social Security retirement benefits, costing approximately $1.5 trillion over ten years.

Additional Spending: The proposal allows for up to $500 billion in new spending over ten years, including $175 billion for border security. It lacks detailed spending cuts, leaving difficult decisions to future debates.

Debt Ceiling Increase: The plan also proposes raising the federal debt ceiling by $5 trillion, deferring borrowing debates until after the 2026 midterm elections. Nonpartisan analyses predict this plan could add about $5.8 trillion to the national debt over the next decade, undermining claims of fiscal responsibility.

3. Alienating Allies & Damaging International Relations

Trump’s aggressive tariff policies alienate key allies and trade partners.

Strained Diplomacy: High tariffs, such as the 46% tariff on imports from Vietnam, damage U.S. diplomatic relationships at a critical time when strategic alliances are essential to counterbalance China's global influence.

Loss of Global Influence: Alienating allies weakens America's position in international negotiations and diminishes its ability to lead on global issues such as trade agreements, security alliances, and climate cooperation.

4. Americans May Not Want the Jobs Trump’s Tariffs Promise

The Trump strategy relies on tariffs to drive manufacturing back to U.S. shores, assuming American workers will readily fill millions of manual labor jobs created.

Labor Shortages: U.S. unemployment was already at historically low levels (4.2% in late 2024). Mass immigration cuts and deportations exacerbate shortages, meaning fewer available workers for these proposed factory jobs.

Mismatch of Skills & Desires: Many U.S. workers have shifted toward service-oriented, higher-paying, or less physically demanding jobs. Simply opening factories doesn’t guarantee workers will flood in, particularly younger generations uninterested in repetitive, manual labor.

Demographic Challenges: An aging workforce and slowing population growth limit the potential labor supply. Without adequate immigration, there’s simply no large pool of workers waiting to take manufacturing roles.

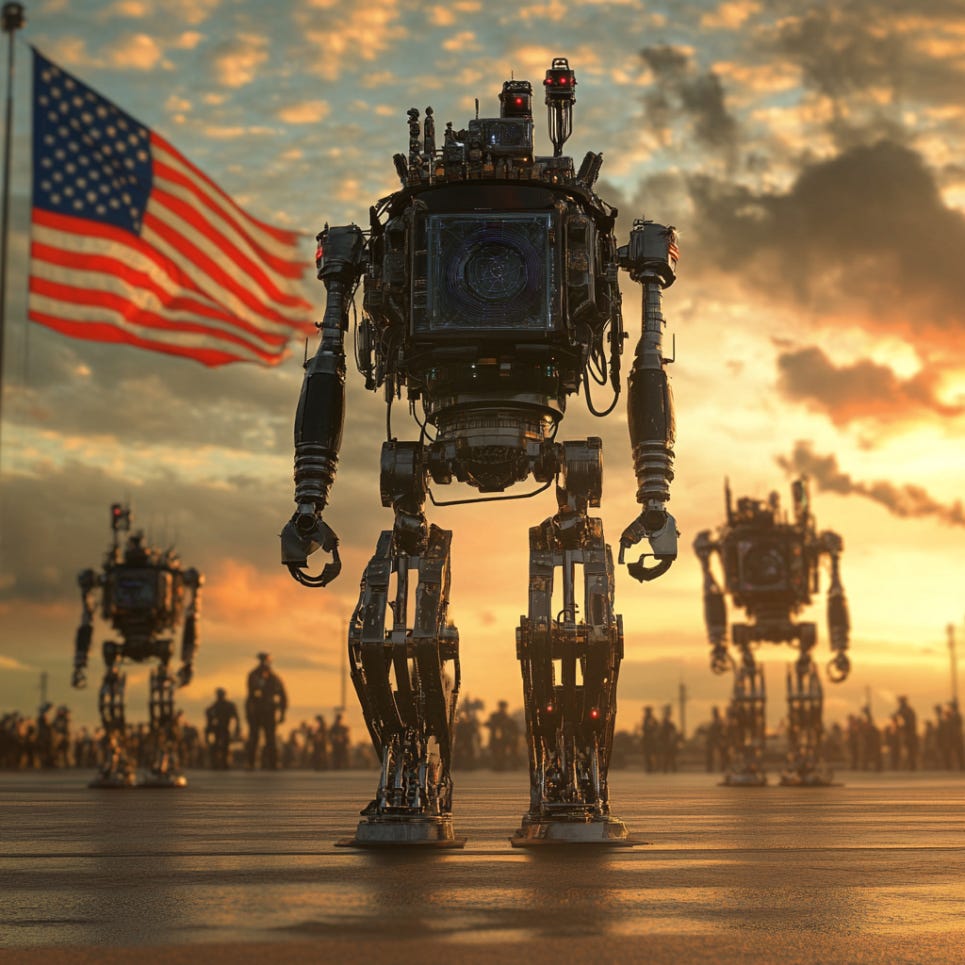

5. China’s 100% Robot Factories will Outcompete Human-Driven U.S. Manufacturing

Trump’s plan emphasizes human labor over automation, ignoring China’s rapid shift toward robotics.

China’s Robotics Advantage: China installed over half of the world’s industrial robots in 2022 alone, dramatically lowering manufacturing costs, increasing productivity, and rapidly scaling output.

U.S. Cost Disadvantage: Human-based factories are significantly more expensive and less efficient. U.S. labor averages $31/hour versus robotic factories operating at a fraction of that long-term cost. Tariffs won’t bridge that cost gap.

Lagging Innovation: Prioritizing manual labor over automation risks leaving the U.S. decades behind in technology and innovation. This strategic error positions China as the global manufacturing leader for decades.

6. DOGE Cuts Are Smaller & Less Reliable than Claimed

The administration touts massive DOGE cuts (allegedly totaling $140 billion), but evidence suggests these numbers are inflated.

Inconsistent Data: DOGE initially claimed $55 billion in early 2025, yet verified savings amounted to just $16.5 billion. The pattern of exaggeration raises doubts about the accuracy of the $140 billion figure.

Mistakes and Reinstatements: 20% of health agency layoffs were acknowledged as mistakes, with those employees rehired. This signals rushed, ineffective cuts rather than strategic efficiency gains.

Small Scale: Even at their most generous estimate, DOGE cuts represent less than 2% of annual federal spending ($6.75 trillion). When new spending increases (e.g., infrastructure and defense) are considered, DOGE’s net effect becomes negligible.

7. Political Instability & Short-Termism

The strategy's success relies on sustained public support, but Americans typically lack patience for significant economic disruption:

Risk of Policy Reversal: If tariffs trigger a recession or sustained inflation, voters may reject Republicans in upcoming elections (2026 or 2028), forcing policy reversals and further economic instability.

Short-Term Thinking: Economic policies requiring substantial patience and widespread disruption rarely survive multiple election cycles, undermining the long-term potential for success.

Long-Term Not Guaranteed: The short-term economic pain inflicted by tariffs and spending cuts does not guarantee any long-term gain under Trump’s approach, further questioning the strategy's viability.

Trump's strategy, with inflated DOGE cuts, reliance on unpopular manual labor jobs, inflation-driving tariffs, and neglect of automation and structural investments, ultimately weakens America’s economic standing rather than strengthening it. Do you want more people making T-shirts and shoes for $30/hour when a robot in China will be doing it for $0.10/hour? All while decoupling from strategic allies? Makes zero sense.

Short-term pain for long-term… pain?

For some reason people have this idea in their heads that “short-term pain” always equals “long-term gains.”

In some cases short-term pain is merely a sign of longer-term pain… and potentially never-ending pain.

If Trump actually had a clear strategy that people could analyze… then maybe I’d agree with his moves here and say Yeah short-term pain for long-term gain makes logical sense based on what he’s doing.

Trump's current economic team with Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick — has ambitious goals but highly-questionable strategies.

Trump’s Economic Strategy (April 2025 Overview)

Trump’s plan, outlined in April 2025, includes:

Broad Tariffs: 10% baseline tariffs on all imports (from April 5). Higher tariffs on major trade-deficit countries, notably 54% on China and 25% on certain Canadian/Mexican imports (from April 9).

Deep Tax Cuts: Permanently extend the 2017 tax cuts (adding $4.5 trillion to deficits). Remove taxes on tips, overtime pay, and Social Security benefits. Introduce tax deductions for auto loan interest on American-made vehicles.

Budget and Infrastructure Cuts: Significant reductions in Biden-era infrastructure spending. Potential clawbacks on tech subsidies (notably CHIPS Act funding).

Bessent’s Shinzo-Abe-Inspired “3-3-3” Strategy

Scott Bessent (Treasury nominee) proposes a “333 strategy,” inspired the economic model utilized by Shinzo Abe (former Prime Minister of Japan).

GDP Growth: 3% annually. (Risk: Tariffs driving inflation; labor shortages due to reduced immigration)

Budget Deficit: Reduce to 3% of GDP. (Risk: Massive $4.5 trillion tax cuts undermine deficit reduction)

Oil Production: Increase by 3M barrels/day. (Risk: May not ensure long-term prosperity without broader economic investments)

While Bessent presents a clear numeric strategy, many economists question its feasibility. Many call it unrealistic, predicting outcomes more like “2% growth, 6% deficit” instead.

Lutnick’s Tariff-Focused Trade Gameplan

Howard Lutnick, Commerce Secretary, has centered his economic strategy around tariffs, emphasizing protecting American manufacturing:

Implementing high tariffs, particularly targeting China, Canada, and Mexico.

Aggressively renegotiating trade agreements.

Prioritizing immediate trade protectionism over long-term competitiveness.

But tariffs inherently drive inflation higher, hurting consumers and stoking uncertainty. Allies within Trump’s circle even blame Lutnick for recent market turmoil, hinting that internal confidence in this strategy might be shaky.

Powell’s Opposition & Economic Uncertainty

Jerome Powell (Fed Chair) remains concerned about inflation risks and has resisted lowering interest rates despite pressure implied by Trump’s team:

Powell is maintaining rates at 4.25%–4.5%, explicitly citing tariff-induced inflation.

Trump’s strategy of stimulating growth via lower long-term rates (Bessent) clashes directly with Powell’s cautious approach.

Persistent tension suggests economic policy is misaligned—risking instability or stagflation rather than sustainable growth.

Where’s the Evidence of a Real Long-Term Strategy?

Trump’s rhetoric emphasizes “long-term gain,” yet his actions often prioritize short-term politics over sustainable economic growth:

Automation Failures: Trump recently capitulated to dockworker unions, rejecting crucial port automation that would enhance competitiveness—illustrating a preference for short-term political peace over clear long-term economic benefit.

Immigration Contradiction: He plans massive reshoring of manufacturing, yet simultaneously reduces immigration, worsening labor shortages.

Tech Subsidies Cut: His intent to repeal the CHIPS Act funding directly undermines U.S. tech competitiveness precisely when investment is critical.

These contradictions cast doubt on the viability of Trump's long-term vision.

Long-term Gains Far from Guaranteed

Trump’s strategy may indeed lead to short-term pain, but the long-term outlook is cloudy at best. Without a coherent economic framework that resolves internal contradictions—between tariff-driven inflation, reduced immigration, unrealistic growth targets, and Federal Reserve tensions—the promise of long-term gains remains speculative and uncertain.

Instead of assured prosperity, Trump’s current path may lock the U.S. into a cycle of persistent inflation, labor shortages, and diminished global competitiveness—trading today's short-term pain for tomorrow’s prolonged economic struggles.

Trump secretly is switching to advanced AI, robotics, automation theory… Really?

If he does switch to robotics he certainly didn’t plan this… it will have been a pivot. And there’s evidence to support my perspective.

Some defenders of Trump’s tariffs claim that covertly, Trump is quietly shifting America toward advanced robotics, automation, and AI-driven manufacturing — implying that tariffs are just the first step toward high-tech industrialization.

Obviously I would love this to be true… but all evidence points in the opposite direction.

Consider the recent dockworker negotiations led by Trump’s administration.

In January I wrote about why the “U.S. Needs to Automate All Ports” and buyout the dockworkers (ILA).

And instead of pushing for port automation (a clear step toward efficiency, cost-reduction, and global competitiveness), Trump caved entirely to union leader Harold Daggett, granting the dockworkers nearly every demand.

Zero progress was made on automating port infrastructure.

Trump’s administration agreed explicitly to keep ports staffed by humans rather than invest in robotic systems.

This decision was not driven by economics or competitiveness, but rather by politics — specifically, Trump’s promise of delivering “good jobs” to American workers.

Prez Trump and VP J.D. Vance consistently emphasize their goal of creating millions of manual-labor jobs for Americans, explicitly promising jobs for human workers, not robots.

The messaging is crystal clear:

Humans, not machines, will fill these newly created manufacturing jobs.

Automation and robotics are rarely, if ever, mentioned positively by Trump or his administration, and often cast negatively as threats to employment.

Their speeches celebrate traditional labor-intensive industry—factories filled with workers rather than robotic automation centers.

There's ZERO credible evidence Trump intends a hidden pivot to automation or robotics… maybe he will do this and claim it was the plan all along (clearly it wasn’t).

If anything, his recent policy decisions (like the dockworker negotiations) and explicit public promises point decisively toward manual-labor manufacturing as his ideal—not advanced, automated factories.

This “secret automation” narrative is pure wishful thinking, contradicted entirely by Trump’s actual actions and stated goals.

Trump cutting all government subsidies for tech (important competitive industry)…

Trump’s “Liberation Day” tariffs are supposed to push American companies to bring manufacturing back home.

The logic: Raise tariffs, make foreign goods more expensive, and watch factories return to the U.S.

But there’s one major contradiction: Trump is simultaneously trying to eliminate the very subsidies needed to build that domestic capacity — especially in critical industries like semiconductors, robotics, AI, and advanced manufacturing.

Specifically, he’s targeting the $52.7 billion CHIPS Act, a program essential to reviving semiconductor production in America. Trump calls this funding a “horrible, horrible thing” and wants it repealed, redirecting money toward debt reduction.

But semiconductors and advanced automation are precisely the types of industries you need to subsidize if you want tariffs to succeed long-term. Without federal investment:

U.S. manufacturing can’t scale fast enough to replace tariffed imports.

Companies face higher costs without domestic alternatives, leading to inflation.

Competitiveness suffers compared to countries (like China, Korea, or Germany) that aggressively fund their tech sectors.

This combination creates short-term pain (higher prices, disrupted supply chains) without guaranteeing long-term gain (stronger manufacturing base, innovation, high-quality jobs).

If the goal is to genuinely make America more competitive and self-reliant, Trump’s current policy mix—heavy tariffs but deep subsidy cuts—is strategically incoherent.

Trump cutting total immigration…

Trump’s tariff strategy is aimed squarely at bringing manufacturing back to American soil, boosting domestic production, and increasing factory jobs.

But at the same time, he’s drastically cutting immigration and pursuing mass deportations—policies that directly shrink the labor force needed for rapid industrial expansion.

If the goal is to rebuild a robust American manufacturing sector, then scaling back immigration—especially of lower-skilled workers—makes little sense.

America already has historically low unemployment (around 4.2% as of late 2024), meaning there’s no vast reserve of domestic workers available to fill new manufacturing roles quickly.

Many native-born workers have shifted toward higher-skilled, higher-paying, and less physically demanding jobs, making them unlikely to rush into newly created factory positions.

Mass deportations and immigration restrictions exacerbate existing labor shortages in key industries such as manufacturing, construction, and agriculture—exactly the sectors Trump claims tariffs will boost.

Without adequate immigrant labor, factories encouraged by tariffs to reshore to the U.S. face serious staffing shortages, resulting in higher production costs, slower output, and weaker competitiveness against automated factories overseas.

Trump’s anti-immigration stance directly undercuts his stated goal of rapidly scaling up American manufacturing. If the intention is truly to rebuild domestic industry at scale, the U.S. would logically benefit from increased — not reduced — low-skilled immigration.

Protecting key domestic industries (i.e. the steel industry)

There was a recent play by Japanese Nippon Steel to buy “U.S. Steel” (an American steel company — not affiliated with the government).

The Nippon x U.S. Steel deal was highly favorable for the U.S. (would’ve increased jobs in the United States for Americans, expanded buildouts, increased sock value, and improved production efficiency).

The terms also required massive upfront investment in the U.S. and the company wanted the sale to go through… yet it was blocked by Biden and Trump would’ve blocked it as well.

Sure Nippon is Japanese-owned, but Japan is a strong ally of the U.S. If the U.S. needed steel in a war or for whatever reason(s), the U.S. could count on Japan.

We could simply buy more steel from Nippon and have them ramp up production… they’d have more infrastructure and newer infrastructure than now… more steel capacity from steel mills in the U.S. sounds good right?

What if Nippon didn’t help the U.S.? Just takeover the plants if it’s urgent. What is Japan gonna do about it? The plants are in the U.S. (And this is a highly farfetched scenario given that Japan is a strong ally… they’d likely help the U.S.)

Both Trump and Biden recognize that steel is an important domestic industry… but if this is the case they should be accelerating the hell out of steel production with subsidies. So… foreign acquisitions of U.S. steel companies blocked — yet no homegrown subsidies to incentivize steel production… makes sense eh? No.

Trump & Putin Parallels: Doubling Down on Dumb Ideas

Recently I had a thought that Putin is likely knee-deep in shit that he doesn’t want to be in, but he can’t back out now or looks weak… and things are looking optimistic for Putin with Trump at the helm of the U.S. (seems to want full isolationism).

Bessent likely recommended reciprocal tariffs… yet Trump et al. insisted on tariffs that target the “trade deficit.” So that’s what we have. The markets are reacting badly… and the markets are forward looking.

Most people have zero issue handling market pain if there’s a logical strategy to achieve long-term gains. But when it’s seemingly pure chaos (lack of a coherent strategy) like we have with Trump — it’s important to speak up. We don’t want the future of the U.S. torched by one man’s tariff fixation.

Because Trump is socially savvy, he has plenty of “outs” (to get out of his tariff debacle)… he could sign some deals and/or remove tariffs and market it as a win and his base would lap it up like some magical QAnon elixir (3D chess, 1-trillion IQ, “art-of-the-deal” strategy).

But if he seemingly doesn’t want any outs right now and may actually go through with his variant of “trade deficit” based tariffs because he thinks targeting deficits is smart. This could cause him to keep “doubling down” thinking he’s doing a great service to the future of America.

In his mind short-term pain guarantees long-term gain — but he doesn’t understand that it’s possible short-term pain leads to long-term pain (as there are no guarantees with a haphazard ChatGPT slop-inspired strategy).

No Internal Challenges: Both Trump and Putin initiated bold policies (Trump's massive deficit-based tariffs, Putin's Ukraine invasion) without meaningful internal debate or dissent.

Early Realization of Mistakes: Putin likely understood early that invading Ukraine was a strategic mistake. Trump might soon recognize his tariffs similarly harm the economy rather than strengthen it.

Pressure to “Double Down”: Admitting errors publicly risks humiliation and undermines authority. Both leaders, isolated by loyalist advisors, thus escalate their commitments instead of reconsidering.

Lack of Exit Strategy: Putin remains trapped in a costly war; Trump risks getting locked into damaging tariffs. Without internal accountability, both face increasing economic and political costs, driven by pride rather than strategic clarity.

Horseshoe Theory: Woke Left? Meet Your Twin Flame… The Woke Right

Likely a manifestation of dysgenic, idiocratic trends… IQ is declining in the U.S. And support for this type of protectionism is a symptom.

Many MAGA communists support tariffs to punish investors, Wall Street executives, and tech billionaires, driven by resentment and jealousy rather than sound economic strategy.

This mindset encapsulates the essence of "MAGA Communism.”

The Rise of MAGA Communism

Under MAGA Communism, populist anger replaces logical economic policy.

The woke left condemns capitalism as inherently exploitative, promoting state intervention and redistribution.

Simultaneously, the woke right romanticizes a bygone industrial age, advocating for nationalist economic policies and protectionism.

Both extremes reject market-driven innovation, efficiency, and global trade, instead favoring isolationist, command-and-control economics.

Both are low IQ… free market capitalism with elite human capital is what has advanced humanity the most, but they don’t care cuz feelings don’t care about your facts.

Shared Hostility Toward Economic Progress

The common enemy of both extremes is perceived elitism—Wall Street, globalization, and technological advancement.

Trump's tariffs epitomize this destructive unity, aiming to punish "the elites" while unintentionally damaging America’s real engines of innovation and prosperity.

Economic Consequences

Far from ushering in a new golden era, MAGA Communism from the woke right risks stalling economic progress by discouraging investment, hampering innovation, and diminishing America’s competitiveness internationally.

Tariffs, rather than creating manufacturing jobs, typically result in higher inflation, market uncertainty, and economic stagnation.

Intellectual Bankruptcy & the Horseshoe Theory

The ideological overlap between woke left and woke right demonstrates intellectual bankruptcy—both sides sacrifice nuanced, intelligent economic discussion for simplistic, emotionally charged rhetoric.

Their convergence validates Horseshoe Theory, revealing how extreme ends of the political spectrum can unite around shared grievances and flawed solutions.

Ultimately, MAGA Communism represents a troubling departure from rational economic policy, threatening America's sustained growth, innovation, and genuine prosperity.

Trump voter demographics… R’s Lose in 2026 and/or 2028?

Older white people. Portfolios? Tanked. Will they be happy? No. Real possibility of Republicans getting voted out. R’s might lose 2026 midterms and/or underperform and then get absolutely slap-chopped in the 2028 election.

I’ve already made the case that Democrats likely have an advantage in the future due to the aggregate racial composition & genetics of the U.S. — my theory could turn out to be inaccurate as a result of selection effects, but I suspect Dems will have at least a modest-to-moderate advantage in 2026 and 2028 based on racial voting patterns and population fluctuations.

Add in a bad economy? R’s are toast. The backbone: Boomers (older white voters) don’t want their retirement portfolios (401k’s) tanked because some guy has a tariff fixation without a cogent plan… and I don’t blame them. Boomers get a lot of unwarranted hate (mostly from low IQs).

Economic Stability Matters

401(k) & Retirement Dependence: Trump's base includes millions of retirees and near-retirees. They can't afford economic volatility or major downturns. A significant hit to the economy—triggered by reckless tariffs, trade wars, and isolationist policies—would quickly translate into anger and betrayal among these voters.

Consequences of Economic Mismanagement: For older voters, the economy isn't just important—it's existential. Trump won their support promising prosperity and security. If the tariffs cause inflation, stagnation, or a stock-market collapse, these voters won’t blame vague external factors—they'll blame Trump and the GOP directly.

Potential Electoral Fallout

2026 Midterm Disaster: Economic turmoil under Trump would place Republicans at serious risk of losing control in Congress. Older voters, traditionally reliable for Republicans, could easily swing against the GOP if they see their retirement savings evaporate.

2028 Presidential Election (Rise of Left Populism): Severe economic mismanagement under Trump could fracture the Republican coalition. Voters disillusioned by broken economic promises may reject the entire GOP establishment, opening a wide lane for a populist left-wing candidate like AOC (which would be a disaster in its own right).

For Republicans, there's fairly little margin for error. Economic mismanagement is potentially electoral suicide in 2026 & 2028. If Trump gambles recklessly with tariffs and loses, the GOP could pay a steep political price… tariffs? Reversed. Republicans? Done.

What if Biden implemented the exact same “Liberation Day” tariffs?

The right would be outraged. They’d be calling Biden mentally retarded and questioning what stage of dementia he’s currently in… And in my opinion, they’d be correct to do so.

But because Trump did it? So smart. Genius. “High IQ.” Bold move. You don’t understand what he’s cooking. Nothing but glazing.

And remember, Trump did all of this without dementia… so that makes it even worse. It’s an unforced error. But Trump has “tariff fixation syndrome” (TFS) so here we are.

The partisan brain-rot (perhaps “partisan mind virus”?) is evident. Strategic tariffs to force fairer trade terms were criticized in bad faith by the left & tariffs targeting “trade deficits” were followed by moronic cheerleading on the right.

If my side does it? It’s really good. If your side does it? It’s really bad.

Betting on Tariffs? U.S. Real GDP per Capita Growth Bet (Adjusted for Inflation)

If someone claims “tariffs will strengthen America” but refuses to make any measurable bet within a 5–10 year timeframe, they're basically saying:

“Trust me, the results will come... eventually… and only under perfect conditions… and only if nothing interrupts the plan… and only if we measure it a very specific way I’ll define later.”

Mental gymnastics… predictable.

Logic: Real GDP per capita (inflation-adjusted) directly measures whether average Americans become wealthier in a meaningful, inflation-controlled way. It captures genuine economic productivity and prosperity—precisely what tariffs aim to enhance by "making America stronger."

🎯 Bet Structure:

Baseline: Real GDP per capita at the end of 2024 (official U.S. government data—Bureau of Economic Analysis).

Target: Real GDP per capita growth rate significantly exceeds the previous pre-tariff period (e.g., 2010–2024 annual average of ~1.5–2%) during the 2025–2030 period.

📌 Example Simple Bet Statement:

"I bet Trump's tariffs, if maintained, will increase U.S. real GDP per capita growth to an average annual rate of at least 2.5% from 2025 to 2030, significantly higher than the approximately 1.5–2% annual rate observed from 2010–2024. If tariffs are reversed or significantly reduced, the bet is void."

Why ideal…

Not distorted by inflation or money-printing: Directly adjusted for inflation, it measures true economic prosperity.

Clearly quantifiable: Official BEA data is easily available and widely trusted.

Simple & intuitive: No need for complex calculations or metrics—just clear GDP per capita numbers.

This GDP per capita bet cuts through arguments about inflation, easy money, or "fake" stock market growth, providing a simple, objective, and unambiguous measure of genuine American economic strength.

All Trump has to do to actually “MAGA” & “KAG” (2025-2029)…

Trump really only has to do a few things right to MAGA/KAG 2025-2029… and it seems like he’s already on the wrong track.

And if you think the backlash to “Biden’s inflation” was bad, just wait until 2026 midterms and the 2028 presidency.

Here is all I think Trump has to do to “win” (i.e. make people happy) for his 2.0 term… not even all of these things. Just some of them. It wasn’t that hard either.

I guess the good thing is that Trump can still course-correct and convince his base that it was a “win” and that is tariffs were “strategy” all along.

Crack down on illegal immigration: People were tired of illegals coming to the U.S. and exploiting the country. Going to grocery stores at certain times of the day in the U.S. suddenly seemed like you hopped in a portal to Mexico City… pre-Biden it looked like shopping in the U.S. (this is how crazy things got under Biden).

Restore meritocracy (eliminate woke/DEI): Trump is doing this… good.

Strategic government spending cuts: DOGE is trying to do this, but the cuts are small scale and will be ineffective for offsetting new spending bills. We need much bigger cuts.

Demand more from allies but don’t alienate: If you want the EU, Canada, UK, Mexico, Australia, etc. to chip in more for IP theft, pharma innovation, defense/NATO — tell them they need to step up. Make it clear to them why you are playing hardball and that you will not capitulate unless they pay up.

Even trade terms & DBCF tax: Impose reciprocal tariffs and implement a DBCF tax to counteract VATs from other countries. Make it clear that you want even trade terms (you’re not trying to “balance the trade deficit”).

Stick with Ukraine (weaken Russia): Do not try to cooperate with Putin. Just keep the status quo (funding Ukraine) going… it’s a tiny fraction of the defense budget and puts America first long-term when considering the second order effects. (Huge mistake by Trump thinking he could trust Putin.)

Address the debt & interest on debt: The right way to do this isn’t with “trade deficit” based tariffs. There are plenty of alternative strategies that would be far more effective.

Accelerate AI, robotics, automation: Use targeted or strategic government subsidies. Don’t want to cut things like The Chips Act. If you don’t accelerate? China’s robots will outperform your American humans. (Step 1? Failure. You should’ve eliminated the dockworkers union and automated the ports.)

Cut regulations & embrace crypto (stablecoins): Cut all regulations within reason. The U.S. should embrace stablecoins like USDC/USDT on the blockchain to ensure that USD remains a reserve currency.

Increase high-skilled immigration: This should be accelerated strategically and then stopped once robotics are ready to replace most human labor.

Operation warp speed robotics, AI, medical innovation: Operation warp speed on mRNA vaccines was great. Just operation warp speed the entire AI and robotics industry. (Much of his base aren’t smart, but Trump could convince them that it’s smart.)

Leverage soft power: Analyze the implications of the soft power that you currently have. Leverage strategically for an America First effect.

Birth rate plan: Counteract declining birth rates and dysgenic fertility. Incentivize U.S. births & embryo selection, increase America First AI/robots, invest heavily in aging reversal, etc. (No need for more births if you reverse aging of your existing populace and/or go all in on bots.)

Do I think Trump is a bad prez? It’s too early to tell. His first term was mostly fine minus the abortion bans and mishandling of COVID. His second term was off to a great start (many excellent executive orders)… but then it seems like he slipped and may have landed face first in a heaping pile of tariff shit.

Hopefully Trump course-corrects. Otherwise he is setting himself and the Republican party up for a hot L in the 2026 midterms & the 2028 presidential election.

If Trump botches the economy Dems will have an easy layup W. Even if he doesn’t botch the economy, Dems still have an advantage… they just need to run “normal people” (i.e. Bill Clinton & Barack Obama types) — and they have a good shot at winning.

Otherwise we will continue dealing with pure lunacy from the woke right (bRiNg BaCk mAnUfAcTuRiNg!!!) and the woke left (bow down to black people while wearing African garb and kiss their feet)… not sure if either side can get back to common sense. Would love a Mitt Romney type Republican on the right.

What will the effects of Trump’s trade deficit tariffs be? Nobody truly knows. We can speculate (obviously). Something like this has never been done before in this specific context.

There are some historical examples but these cannot be extrapolated to 2025 U.S. and global economies. For this reason, we must analyze the strategy and logic behind them… and it’s not looking good.

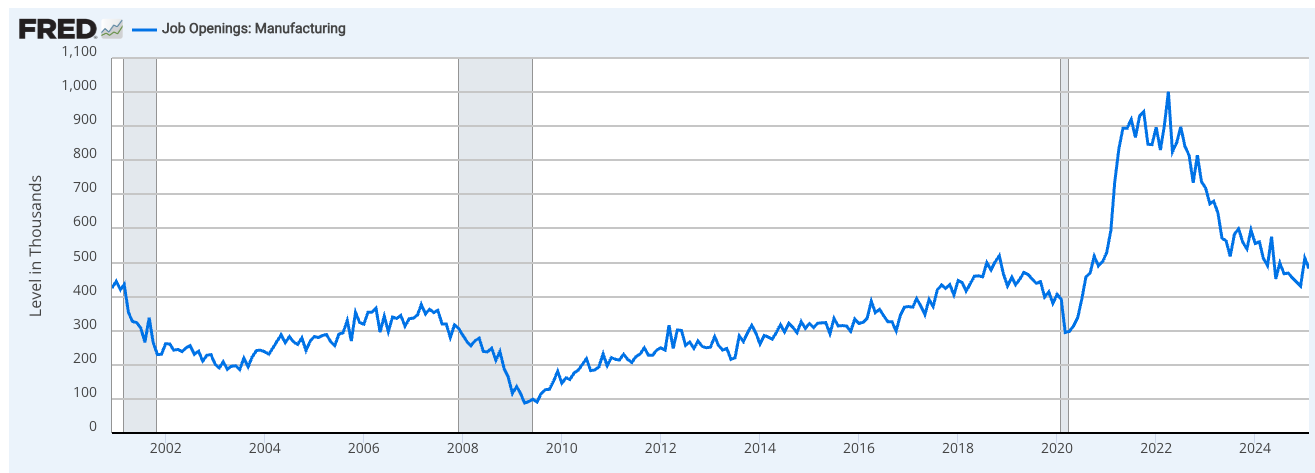

Oh and a final note… there are currently over ~500,000 manufacturing job openings throughout the U.S. — maybe we should fill those first before bringing more manufacturing to the U.S.?