Trump Tariff Dividend Checks: 2026 Midterm Odds (Feb 2026)

Will Trump roll out tariff dividend checks before the 2026 midterms?

Trump has repeatedly floated a “tariff dividend / tariff rebate” idea, including a $2,000 payment framed as funded by tariff revenue.

The White House said in November 2025 he’s “committed” to a $2,000 check and staff are exploring “how to go about making the plan a reality.”

But details and timing remain unclear. Trump has recently been noncommittal when asked to “promise” checks, even while claiming he could do it.

And critically, new household checks at scale generally require Congress — the IRS can’t just invent a new nationwide payment program without statutory authority.

Realistic Path: Tax Credits vs. Checks

If something gets paid out before the midterms, the most plausible vehicle is a tax credit with advance refunds — stimulus-check mechanics run through the IRS.

The cleanest template already exists: Sen. Josh Hawley’s American Worker Rebate Act of 2025 (S.2475), which would:

Create a refundable tax credit tied to “qualifying tariff proceeds” (duties imposed after Jan. 20, 2025).

Set the applicable amount as the greater of $600 or a formula based on tariff proceeds per eligible person/child.

Phase out starting at $75K single / $112.5K HOH / $150K joint—the same structure as COVID-era payments.

Authorize advance refunds with a hard deadline of Dec. 31, 2026, implicitly aiming to get money out the door before it matters politically.

This also matches what Treasury Secretary Bessent suggested early on: the “dividend” might be structured as tax cuts rather than literal checks.

Trump Would Frame It as “Tariff Checks”

The political logic is straightforward:

Sell tariffs as a benefit. The pitch: tariffs raise money → voters get cash back → tariffs are “working for you.” The dividend pitch arrived right after GOP losses tied to cost-of-living discontent.

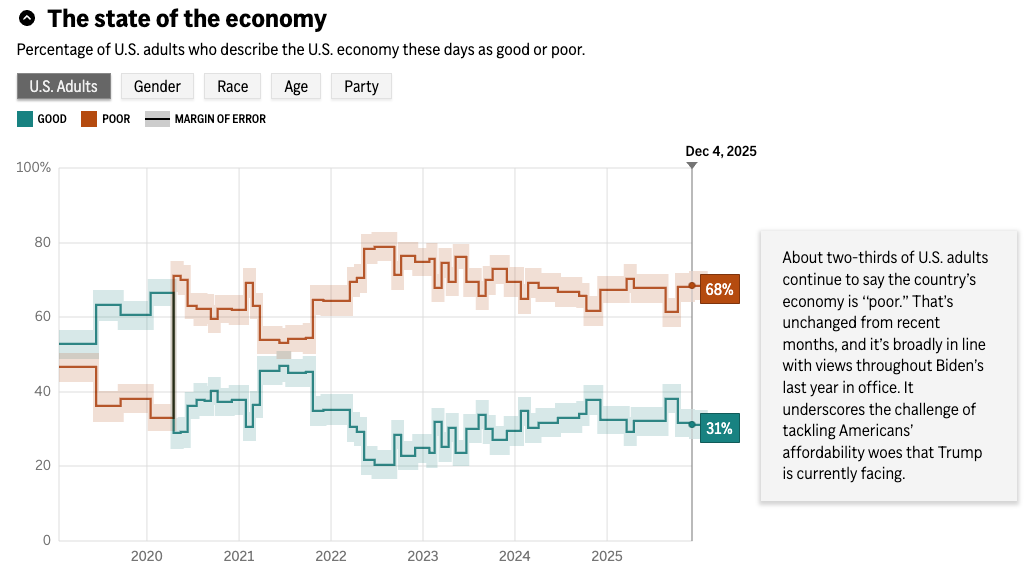

Counter the affordability narrative. The midterm environment is already being framed around “pocketbook issues”.

Logically this is stupid given that purchasing power for 1 hour of work is higher than ever historically but is drowned out by narratives being pushed in the mainstream media and on social media (fixation on inflation with zero acknowledgment of wage/investment growth).

Perception = reality and vibecession is the perception.

Many people don’t invest: More than you think have zero long-term investments. As a result? They lose out on the gains and are envious of those who invested.

Many want to spend immediately (money in / money out… easy come / easy go)

Dopamine spike + lower impulse control: TikTok “shorts” brainrot, genetic shifts in demographics, etc. Not surprising that many just want to gamble on some YOLOs (if they didn’t spend immediately) and DraftKings lottos.

Mainstream media: Constantly harps on “inflation” and how awful everyone has life today. It’s how they attract and “lock in” listeners. Just keep complaining about how life is unaffordable in the U.S. Remember you have no agency to move or change your situation.

Social media: Markets the illusion that everyone is a billionaire flying private jets and needs $100M to be satisfied with life. Anything less and you’re a failure.

Psychological entitlement: Increased over time for a variety of reasons (social media is a big perception). Lack of skin in the game, insane welfare standards, etc.

Welfare standards keep rising: More handouts / can never reverse or “put the cat back in the bag.”

Zoomers and “Up Only” markets: That’s all they know, so any stagnation or pullback = psychic pain.

This cocktail is how we end up with investors like Michael Green succumbing to the mind virus and/or chasing populist clout — and implying $140k is the new poverty line.

All roads likely lead to socialism in the U.S.

The question is mostly about the pace. Ideally we slow the transition so we don’t overwhelm the system before AI/robotics have a chance to diffuse.

If you want the best chance of America staying a first-world economy, you should hope that Republicans keep winning… otherwise it’s open borders, less law enforcement, more transfers from your taxes to illegals that are “growing GDP” (but not really when you subtract all offsets).

As Elon articulated: AI/robotics needs to work. If it doesn’t work, we’re fucked. Likely debt bomb, stagnation, etc.

Another point I’ll keep making: Rolling out UBI prematurely = braindead. The U.S. already has proto-UBI with generous handouts/welfare for poor people.

UBI should not be widely promoted until absolutely necessary.

It should be something the gov discusses privately.

And if eventually a time comes when growth from AI/robotics is high and there’s mass job displacement — we can efficiently adapt and roll out stimmy checks like we did during COVID followed by a permanent UBI program (we can likely just tweak the current system a bit).

We should not prematurely warp the cognitive-psychological patterns of Americans by making them think they’ll be displaced by AI tomorrow and that we need UBI immediately. Social unrest from a mob demanding UBI before practical/feasible and actually giving into that mob would be a grave mistake.

Branding precedent. The administration has already used symbolic direct-payment branding (the “Warrior Dividend”), even amid disputes over funding sources.

The Biggest Obstacles

1. The Math Is Ugly

A $2,000-per-person plan runs into the hundreds of billions. CRFB estimates ~$600B per round if designed like COVID-era Economic Impact Payments. Multiple analyses (FactCheck, Axios) note that tariff revenue is far smaller than the cost of a broad $2K dividend, especially if the administration also claims it will reduce deficits with the same money.

There’s also the “net burden” problem: The Tax Policy Center estimates that tariff policies could impose a substantial average burden in 2026, blunting the political benefit of any rebate.

2. Congressional Politics Inside the GOP

There’s Senate Republican resistance to prioritizing checks over deficit reduction.

A revised CBO forecast further complicates the “we can afford it” narrative.

3. Legal Risk: The Revenue Stream Itself Is Under Threat

The Supreme Court is reviewing whether IEEPA authorizes the tariffs at the center of the revenue story. Lower courts have already found parts of the tariff regime unlawful, with tariffs temporarily left in place pending review.

If the Court ultimately rules against the administration, refund obligations are a real risk — making it politically and fiscally harder for lawmakers to commit money that could later be needed for refunds.

Forecast 1: Will Tariff Checks Actually Go Out Before the 2026 Midterms?

Assuming “before the midterms” means by Election Day, November 3, 2026.

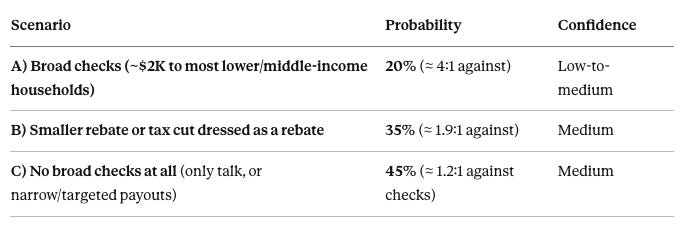

A) Broad checks (~$2K to most lower/middle-income households): 20% (≈ 4:1 against).

Confidence: Low-to-medium.

The White House has said he wants it, but Trump remains noncommittal on timing. A classic sign of a promise being used as leverage rather than a locked plan.

The cost/revenue gap is substantial, and the Supreme Court risk makes “counting the money before it’s legally secure” harder.

B) Smaller rebate or tax cut dressed as a rebate: 35% (≈ 1.9:1 against).

Confidence: Medium.

A scaled-down design is more financeable and more likely to unify Republicans. Hawley’s bill shows a workable mechanism with an explicit window through Dec. 31, 2026.

This is the path of least resistance, but it still requires Congress.

C) No broad checks at all: 45% (≈ 1.2:1 against checks).

Confidence: Medium.

The default outcome when fiscal math doesn’t work cleanly, Congress is divided, and the tariff base is legally uncertain.

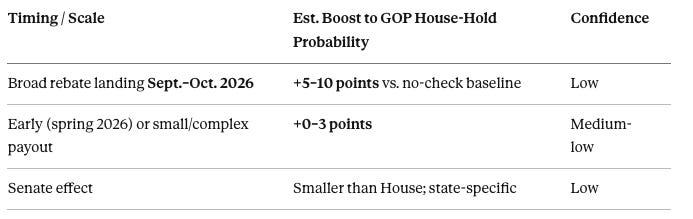

Forecast 2: If Checks Happen, Do They Help Republicans Hold Congress?

Baseline Environment

House control is razor-thin: 218 Republicans / 214 Democrats / 3 vacancies.

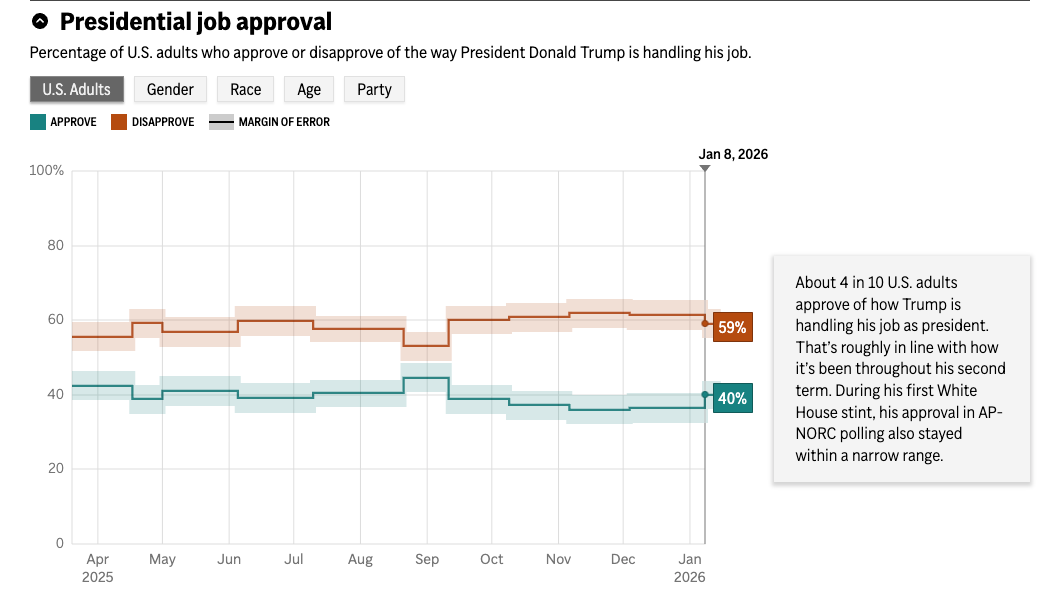

The president’s party historically faces midterm headwinds (an average loss of 26 House seats since 1932, and Trump’s approval sat at ~40% in January 2026.

With that margin, even a small national swing flips the House.

Net Effect: Modest Help, Not a Cure

Direct payments can temporarily improve perceptions of “government is helping” and blunt affordability messaging. But two major offsets limit the upside:

Tariffs themselves raise prices. Opponents will argue the check is just giving back money households already paid through higher costs, potentially diluting gratitude and fueling cynicism.

Attack lines write themselves. “Unfunded giveaway,” “election-year gimmick,” and if tariff authority gets struck down, “promised money that evaporated” becomes a liability.

Quantified Election Impact (Approximate)

Rebate landing Sept. to Oct. 2026: Estimated +5–10 points boost vs. no-check baseline. Confidence: Low. Lots of unknowns and highly timing-sensitive.

Early (Spring 2026) or small/complex payout: Effect likely fades or gets drowned out, roughly +0–3 points improvement. Confidence: Medium-low.

Senate: effects are more state-specific; expect a smaller net benefit than in the House unless checks are highly salient in a few swing states. Confidence: Low.

Bottom line: Checks would probably help Republicans at the margin but are unlikely to override the combination of midterm fundamentals, Trump’s approval trajectory, and the broader cost-of-living environment.

The “Tell” Indicators

If you’re tracking whether checks are actually coming, these are the high-signal moves:

A White House–backed bill text: Or reconciliation instructions that mirrors the Hawley refundable-credit structure.

Treasury/IRS operational language: Implementation timelines and payment rails.

Supreme Court ruling clarity: On the tariff authority question, which would remove the biggest single uncertainty.