Trump's 2018 Tariffs vs. Economists' Doomsday Predictions: A Retroactive Analysis

Trump's tariffs caused economists' brains to self-combust in 2018...

Many people place great trust in economists’ forecasts and the “consensus conventional wisdom,” but this trust is not always warranted.

These experts can sometimes be overly ideological—some might even say “woke”—and neglect the complex, real-world factors that can offset their gloomy predictions.

The pre-COVID performance of the U.S. economy under President Trump’s tariffs offers a prime illustration: numerous economists warned of imminent disaster, yet their forecasts failed to materialize.

Trump 2018 Tariffs vs. Economists: The Reality

Below is a pre-COVID comparison of what many economists predicted about Trump’s major tariffs (including the specific tariff details) versus what actually happened in terms of jobs, GDP, and overall economic performance through early 2020.

You’ll see how the dire forecasts turned out to be wrong in the short run—along with the underlying logic behind those economist predictions.

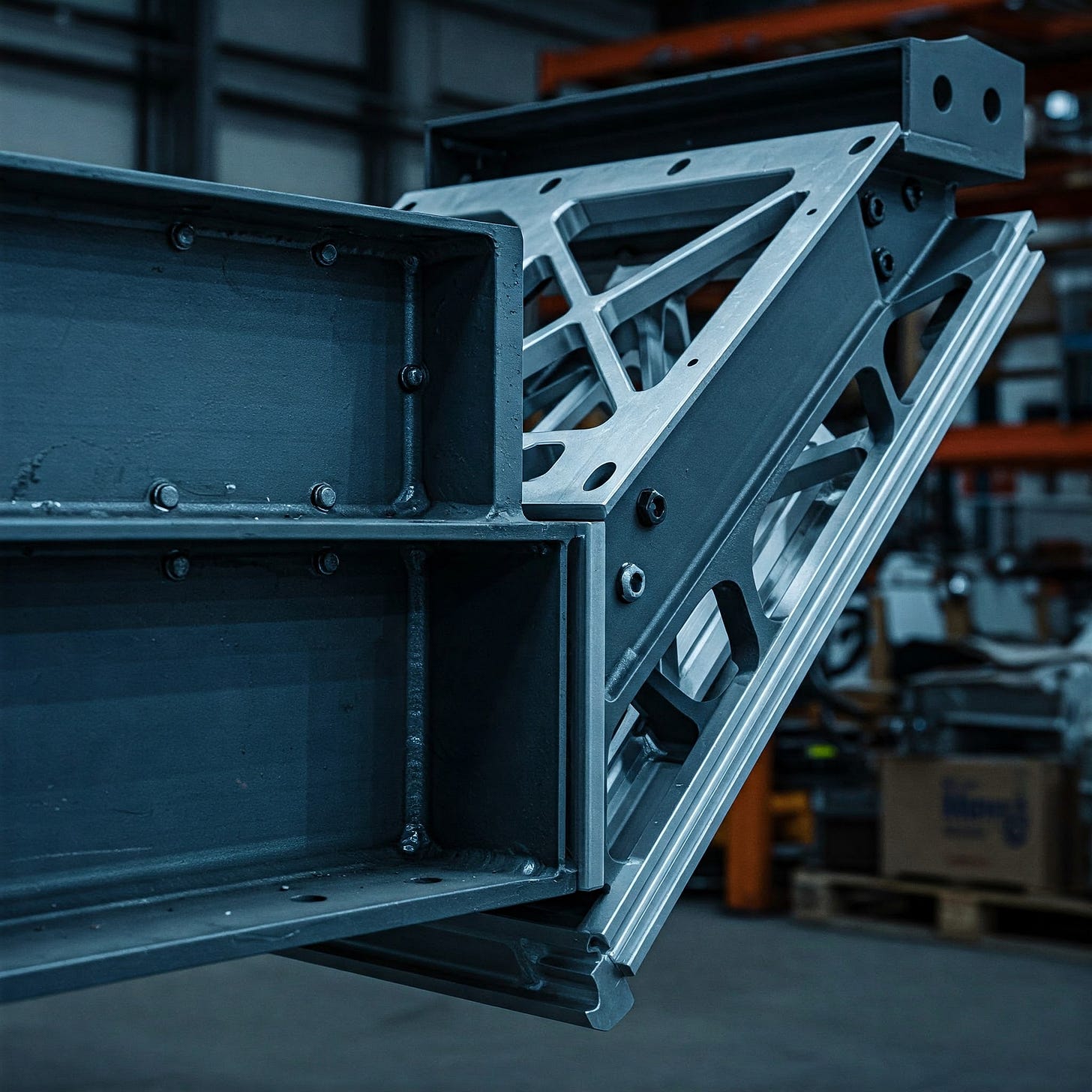

1. Steel & Aluminum Tariffs

(Imposed March 2018 via Section 232)

Actual Tariff Details

Tariff Rates: 25% on steel imports and 10% on aluminum imports.

Effective Date: Announced in March 2018 and took effect on March 23, 2018.

Scope and Exemptions: Initially, these tariffs applied globally. Over time, certain countries (e.g., Canada, Mexico, South Korea, Brazil, Argentina, Australia) received exemptions or were subject to quota agreements rather than tariffs.

Economists’ Common Predictions

Immediate Job Losses in Manufacturing

Many economists and business groups warned that higher input costs for steel/aluminum would cripple downstream manufacturers (e.g., auto, machinery, appliances).

Forecasts ranged from tens of thousands to hundreds of thousands of lost jobs.

Broad Price Inflation

Tariffs on metals were expected to raise prices for steel- and aluminum-heavy products (cars, canned goods, construction projects).

These higher costs, economists said, could slow consumer spending and push inflation above the Fed’s comfort zone.

What Actually Happened? (Through Early 2020)

Manufacturing Jobs Increased

From March 2018 (when tariffs began) to February 2020 (just before COVID disruptions), U.S. manufacturing added roughly 225,000 jobs (BLS data). This contradicts forecasts of immediate manufacturing decline.

Some sub-sectors (e.g., certain farm-equipment manufacturers) did struggle, but the overall sector continued growing.

Minimal Consumer Price Impact

Car prices and appliances did go up somewhat, but not at the rate feared. For instance, auto prices rose slower than overall CPI in 2019.

Core inflation stayed near the Fed’s 2% target, showing no tariff-driven price spike across the board.

Net Effect on the Economy

GDP Growth Stayed Solid

U.S. GDP grew 2.9% in 2018 and 2.3% in 2019, continuing the post-2009 expansion rather than stalling due to steel/aluminum tariffs.

Economists’ Accuracy: Widely Overestimated

Economists predicted large-scale immediate damage to downstream manufacturing and consumer prices. Instead, pre-COVID data showed continued manufacturing job gains and tame inflation.

2. Washing Machines & Solar Panels

(Safeguard Tariffs, January 2018 via Section 201)

Actual Tariff Details

Washing Machines:

20% tariff on the first 1.2 million units imported each year, then 50% on all additional units above that threshold.

Solar Panels:

A 30% tariff on imported solar cells/modules, gradually declining over four years (falling 5 percentage points each year).

Economists’ Common Predictions

Skyrocketing Washer Prices → Sharp Drop in Sales

Early forecasts warned of a 20%–30% price hike for washers, which would hit consumers hard and reduce sales volume.

Solar Industry Decline

The Solar Energy Industries Association (SEIA) and some economists warned of a potential 23,000+ lost solar jobs, predicting a large slowdown in U.S. solar installations.

What Actually Happened (Through Early 2020)

Washer Prices Did Rise…But Sales Held Up

Prices jumped by an estimated 12%–15% in the first year—higher than historical norms.

However, retailers like Lowe’s and Home Depot still reported continued growth in appliance sales through 2018 and 2019.

Solar Still Grew

Despite the initial 30% tariff, U.S. solar capacity continued to expand each year.

By early 2020, total solar employment remained above 240,000—near its pre-tariff peak—rather than plummeting.

Net Effect on the Economy

Consumer Spending Remained Strong

Overall retail sales rose in both 2018 and 2019, supported by low unemployment and rising wages.

Higher washer prices didn’t derail broader household consumption.

Economists’ Accuracy: Overstated

Dire forecasts of large-scale demand collapse (washers) and job losses (solar) did not materialize before COVID. The economy absorbed these tariffs fairly smoothly.

3. Tariffs on Chinese Goods

(Section 301 “Trade War,” Starting Mid-2018)

Actual Tariff Details

Initial Rounds (2018):

Tariffs on $50 billion worth of Chinese imports at a 25% rate (two separate $25 billion lists).

Expanded Round (Late 2018):

$200 billion of Chinese imports at a 10% rate, later raised to 25%.

Further Threats (2019):

Additional tariffs on $300 billion in Chinese goods at rates between 10% and 15% (some took effect, some were negotiated down).

China responded with retaliatory tariffs on U.S. products, especially agricultural goods (soybeans, pork, etc.).

Economists’ Common Predictions

“Trade War” Recession

Many high-profile analysts predicted the U.S.-China trade war—covering hundreds of billions in imports—would trigger a sharp downturn or even a recession by 2019 or 2020.

Severe Farm Crisis

Retaliatory tariffs on agriculture were expected to devastate U.S. farmers, with widespread bankruptcies and major ripple effects in rural economies.

What Actually Happened (Through Early 2020)

No Recession Materialized

The economy expanded at 2.9% in 2018 and 2.3% in 2019.

Unemployment fell to 3.5% by late 2019, a 50-year low.

Farm Sector Hurt, But Not Collapsed

Some farmers faced lower commodity prices and lost export markets, but the Trump administration gave $28+ billion in aid (2018–2019) to cushion the blow.

Agriculture is about 1% of U.S. GDP, so localized pain did not spiral into a national crisis.

Net Effect on the Economy

Steady Job & Wage Growth

From mid-2018 to early 2020, the U.S. economy added 4+ million jobs overall, with wages growing above 3% annually by late 2019.

Economists’ Accuracy: Significantly Overestimated Recession Risk

Predictions of a near-term recession or major economic slowdown did not manifest pre-COVID.

While certain sectors had disruptions, the broader economy stayed strong through early 2020.

4. Threatened Tariffs on EU and Elsewhere

Actual Tariff/Threat Details

Steel & Aluminum Tariffs (see Section 232 above) also affected European producers, though some got exemptions/quotas.

Automotive Tariffs Threat: Trump threatened up to 25% tariffs on imported cars and auto parts from the EU and other regions.

Various Targeted Threats: Potential tariffs on French wine, European cheeses, aircraft subsidies disputes, etc.

Economists’ Common Predictions

Global Trade Contraction

Many warned of a “full-blown trade war” if the U.S. and EU kept escalating.

A large share of global exports could be affected, risking a broader global slowdown.

Massive Market Uncertainty

Auto tariffs in particular were cited as a huge threat to both European manufacturers and U.S. consumer spending.

What Actually Happened (Through Early 2020)

Limited Actual Imposition

Despite tough rhetoric, many proposed EU-focused tariffs never fully materialized or lasted briefly.

Ongoing negotiations and partial deals kept an all-out U.S.-EU tariff war at bay.

Strong Consumer & Business Confidence

Consumer confidence indices remained elevated throughout 2019.

The stock market hit new highs pre-COVID, reflecting continued business optimism.

Net Effect on the Economy

No Major U.S.-EU Trade Collapse

Transatlantic trade, though tense, continued without the severe disruptions many economists anticipated.

Economists’ Accuracy: Overblown (Immediate Global Implosion)

Pre-COVID, the predicted global trade crisis didn’t unfold on the scale forecasted.

Quantifying How Wrong the Economists Were: Key Metrics

Below are before vs. after tariffs snapshots from early 2018 (when the first big tariffs began) to early 2020 (just before the pandemic):

1. GDP Growth

Predictions: 0.5–1.0 percentage point annual drag (or more) if trade wars escalated.

Reality: 2018: +2.9% (up from 2.4% in 2017). 2019: +2.3% (slightly slower, but nowhere near recessionary).

2. Unemployment Rate

Predictions: Could rise back to 4.5%–5% by 2019 if trade wars hit manufacturing and exports hard.

Reality: End of 2019: 3.5% unemployment—a 50-year low.

3. Manufacturing Employment

Predictions: Net manufacturing job losses from higher input costs (steel/aluminum) and disrupted supply chains (China).

Reality: +225,000 manufacturing jobs (March 2018–Feb 2020).

4. Consumer Prices (CPI)

Predictions: Broad inflation spike (apparel, electronics, groceries) from tariffs on imports.

Reality: Headline inflation stayed around 1.5%–2.3% in 2018–2019—well within the Fed’s target range.

5. Recession Odds

Predictions: By mid-2019, many economists placed 35%–50% odds on a 2020 recession, citing trade conflicts.

Reality: Through early 2020, there was virtually no sign of a “tariff-induced” recession. COVID-19 then became the overwhelming external shock, unrelated to tariff predictions.

Why Economists’ Predictions Were Off: The Underlying Logic

Standard Free-Trade Models

Conventional economic theory says tariffs reduce efficiency, raise consumer prices, and risk retaliation—leading many economists to assume immediate, significant harm.

Ignoring Offsetting Policies

2017 Tax Cuts (corporate rate cut from 35% to 21%) and deregulation provided powerful counter-stimulus, boosting corporate profitability and consumer spending.

Low Interest Rates from the Fed also supported borrowing and investment.

Targeted Subsidies

$28+ billion in farm aid blunted the impact of China’s retaliatory tariffs. This stopped what might have become a broader farm crisis, containing the damage.

Supply Chain Adaptation

Companies pivoted to alternate suppliers (e.g., Vietnam, Mexico), mitigating the tariff shock from China.

Short-Term vs. Long-Term Horizon

Economists could potentially be correct about potential long-term inefficiencies or lost trade opportunities, but short-term data (2018–early 2020) showed no major economic downturn.

Final Verdict: How Wrong Were the Economists?

Short-Run Doomsday Predictions (large net job losses, sudden inflation, recession by 2019/2020) did not come to pass before COVID.

Quantitatively, key indicators (GDP, unemployment, manufacturing jobs, inflation) outperformed the negative forecasts.

Most economists significantly overestimated the immediate harm from Trump’s tariffs—often missing how tax cuts, deregulation, strong consumer demand, and government aid would offset or delay negative effects.

In sum, from early 2018 to early 2020, the U.S. economy maintained solid growth, record-low unemployment, and robust consumer spending—showing that pre-COVID “dire” tariff forecasts were indeed wrong in both magnitude and timing.