Trump Insider Trading? SPY 0DTE & QQQ Options Bets Before April 9 Tariff Pause & Truth Social Posts

Insiders clearly weren't a panican... because they had inside info.

Insider trading with Trump as president? No way. Cue the whatabouts: What about Pelosi? What about Hunter Biden? What about Hillary? What about George Soros?

I’m not writing about Pelosi, Biden, Hillary, or Soros today… This is about clues that indicate insider trading that likely occurred on April 9, 2025 under Trump.

“No way. I don’t believe you. Trump LITERALLY told you “this is a great time to buy” on Truth Social earlier this morning! All you had to do was listen to Trump. It’s your fault for being a Panican.” — Art Ufthadil (3D Chess Grandmaster)

It is true that Trump posted on Truth Social mid-morning April 9th: “this is a great time to buy.” (Screenshotted and posted above.)

Some took him literally and the intra-day Truth Social Trump post trade worked out… but most were highly skeptical. Trump always says it’s a great time to buy. Markets were down and sentiment was extreme fear.

~4 hours later? Trump posted again on Truth Social that he’d authorized a 90 day tariff pause (on his “reciprocal tariffs” i.e. mentally disabled “trade deficit” tariffs).

Don’t tell me you were actually a Panican though. As long as you weren’t a Panican (weak and stupid person) you could’ve made a lot of money. Trump tried to help you with the subliminal post in the AM — a man of the people.

As an aside: Trump wanted to go through with the batshit tariffs but Bessent was like uhh you’ll nuke both the U.S. and global economy simultaneously… not good. And Trump was like maybe we should pause them for 90 days while I bask in my recent senior golf tourney win, eh? So Trump’s 90-day tariff pause ensued (still 10% for most countries & worse for China). 24/7 The Apprentice reality show.

This was good news. As I’ve mentioned, I am not necessarily against tariffs when used strategically to negotiate or to incentivize specific sectors that are critical to U.S. national security — but Trump’s tariff plans were brazenly stupid (Musk, Dimon, Griffin, et al. were sounding the alarm bells).

Anyways someone (or an entity), suspected to have had insider information, loaded TF up prior to Trump’s posts on Truth Social and made out like one of those guys you’d see on an episode of the show American Greed.

How do we know they had insider information? We don’t know for sure. Take out your gavel and judge for yourself. There’s a chance they weren’t insider trading but hedging a massive short position.

What do we know? Someone went balls deep in $SPY (S&P500) $QQQ, $TQQQ, etc. minutes before Trump’s posts… millions were wagered that the market would blast off like a SpaceX Starship rocket. Suspicious, eh?

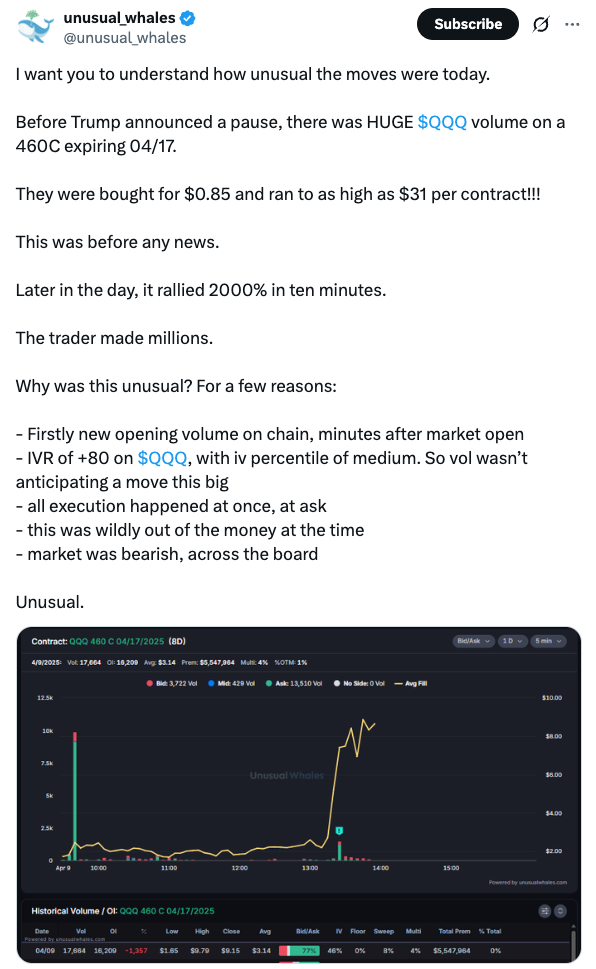

And predictably the market boomed in response to Trump’s “90-day tariff pause” post. An options sleuth on X (@unusual_whales) — which offers an options flow service to retail traders — noticed these uncanny market movements and reported on the egregiousness of what they’d observed prior to Trump’s post… leading to the obvious deduction: insider trading.

The Wall Street Journal further documented this in an article: “Trades Before Trump Tariff Post Draw Scrutiny”.

Note: It is important to be a bit skeptical of “@unusual_whales” at times. Why? They want to give the impression that if you use their options service, you’ll be able to identify insider movements before the crowd — enabling you to copy-trade and enrich yourself.

In some of these cases it’s unclear if what we’re seeing is legitimate “insider trading” vs. run-of-the-mill hedging activity being framed as insider trading as a psychological marketing tactic (i.e. you need to buy our services — we profited heavily here, you could’ve too but you missed out).

I’ll err on the side that the unusual whales account is being more truthful than not… as they’ve accurately identified insider trading plenty of times in the past among government officials. Seems like they’re mostly doing a good public service.

It isn’t just them who suspected “insider trading” on April 9th though.

Here they highlight the egregiousness of the moves that were made on April 9, 2025 for $QQQ. They allege that the timings of these moves were so optimal that insider trading via Trump’s cronies or MAGA cronies’ cronies is the most probable explanation.

More Potential Insider Trading: Apple & Nvidia Insider Trading Alarm After Trump’s Tariff Flip (April 2025)

I.) Timeline of Events & Suspicious Trades (April 9, 2025)

On April 9, 2025, a series of highly unusual call option trades on QQQ, TQQQ, and SPY coincided with 2 social media posts from former President Donald Trump.

These posts — a morning Truth Social post suggesting Americans “buy” and an afternoon announcement of a 90-day tariff pause — helped spark a dramatic stock market rally.

The abrupt timing of the option purchases, just minutes before Trump’s market-moving statements, raised immediate suspicions of insider trading.

Observers noted the extraordinary size of the trades, far-out-of-the-money strikes, and exceptionally short time frames—suggesting that the buyer(s) had foreknowledge of the forthcoming announcements.

Based on the available information, this appears to be one of the most conspicuous examples of potential insider trading in recent memory.

Pre-April 9 Context: In early April 2025, escalating tariff announcements from President Trump’s administration had pummeled the stock market for three straight days. By April 9, fear of a recession was in the air (even The Guardian issued a public warning that morning). Investor sentiment was broadly bearish, and volatility was elevated. Yet unknown trader(s) were about to make extremely contrarian bets.

9:30 AM ET – Market Opens Gloomy: Stocks opened lower on April 9 amid the tariff fallout. No positive news was public at the time, and implied volatility was high – the Nasdaq-100 (QQQ) had an Implied Volatility (IV) Rank ~82 that morning, reflecting that options were expensive and the market was braced for further downside. Under such conditions, buying large amounts of call options (bullish bets) was not a typical strategy.

~9:35 AM ET – Huge $QQQ Call Purchase: Just minutes after the opening bell, an enormous one-time purchase of Invesco QQQ (QQQ) call options was observed. Specifically, a block of $QQQ $460 strike calls expiring April 17 was bought for roughly $0.85 per contract (i.e. $85 per contract, since each option covers 100 shares). This trade was executed “all at once” and at the ask price, indicating aggressive buying. Importantly, this volume was entirely new (open interest in that strike jumped, marked by a “green arrow” on flow trackers). In other words, someone opened a brand-new, large bullish position on the tech-heavy Nasdaq while everyone else was fearful. One market watcher later noted that “The QQQ 460C [Apr 17] in the early 10AM Eastern was a big give away.” It was a glaring signal in hindsight that something was up.

~9:37 AM ET – Trump’s First Post (“Great Time to Buy”): Late in the morning, President Trump took to Truth Social to urge calm in the markets. In a post, he told Americans to “BE COOL” and insisted “Everything is going to work out well. The USA will be bigger and better than ever before!” This message – effectively telling investors not to panic, and implicitly that it was a great time to buy – came after the mysterious QQQ call buy. In fact, the timing is chilling: traders had loaded up on bullish bets just minutes before Trump publicly hinted that the market would be okay. Unusual Whales, a service that tracks unusual options activity, observed that “before Trump posted ‘buy’ on Truth Social, traders opened $QQQ, $TQQQ, and $SPY calls.” In other words, the call-buying frenzy preceded Trump’s optimistic post, suggesting those traders already knew a market-friendly statement was coming.

Mid-Day Rally: Trump’s morning pep-talk post had some effect in stabilizing the markets. By mid-day, rumors swirled that the White House might soften its stance on tariffs. Other traders, seeing the unusual call option activity (and perhaps suspecting something), started “following these opening calls” – i.e. piling into bullish positions in hopes of a rebound. Net call premiums surged as more traders bet on a reversal, even as net put premiums (bearish bets) sank. Still, nothing concrete had been announced yet.

~1:15 PM ET – Large 0DTE $SPY Call Bet Right Before Big News: In the early afternoon, minutes before a major White House announcement, another highly unusual trade hit the tape. An unknown trader aggressively bought a large batch of same-day expiring call options on the S&P 500 ETF (SPY) – specifically $SPY $509 strike calls expiring that day (0-DTE calls). All of this volume came “RIGHT BEFORE THE NEWS” and was again entirely opening volume. These calls were extremely cheap initially (far out-of-the-money with only hours until expiration), but someone appeared to know they wouldn’t be cheap for long. Observers noted this looked like an enormous “lotto ticket” bet – possibly millions of dollars in premium was spent in these few minutes on SPY 0DTE calls. Such a large, last-moment bet on a market surge is virtually unheard of unless one had advance knowledge of an imminent bullish catalyst.

1:18 PM ET – Trump’s Tariff “Pause” Bombshell: At ~1:18 PM, President Trump shocked the markets by announcing on Truth Social (and via a concurrent post on X) a 90-day “PAUSE” on his global tariff scheme. After days of escalating trade war rhetoric, this was a complete about-face. In his post, Trump explained that over 75 countries had called to negotiate, so he was suspending the new tariffs for three months – a dramatic de-escalation. This policy reversal news was highly market-friendly and entirely unexpected by the public (just hours earlier Trump had seemed to double-down on tariffs, per his own aides).

Immediate Market Reaction: The effect on stocks was explosive. The previously gloomy market roared to life on Trump’s tariff pause news. The S&P 500 and Nasdaq ripped higher within minutes. SPY (S&P 500 ETF) spiked from the ~$493 range to over $535 in the afternoon – a +7.8% intraday swing that is almost unheard of for such a broad index. QQQ (Nasdaq-100 ETF) likewise rocketed upward (tech stocks, which had been beaten down by tariff fears, led the rally). As one outlet put it, “the stock market soared immediately after his announcement”.

II.) Trade Outcomes: Position Sizes & Profits

Morning $QQQ Call Trade (Apr 17 $460C): The trader(s) who bought the QQQ $460 calls for ~$0.85 saw an almost unbelievable payoff. Once Trump’s news hit and tech stocks soared, those calls skyrocketed in value. In fact, they went from about $0.85 to as high as ~$31.00 at peak – a gain of over 3,500%. To put that in perspective: each contract that cost $85 in the morning was worth $3,100 in the afternoon. We don’t know the exact number of contracts, but the volume was described as “massive.” If it was, say, 10,000 contracts (a reasonable estimate given the size of the move), that position cost about $850,000 to enter – and at $31 it would be worth $31,000,000. Even a more conservative size of 5,000 contracts would have turned ~$425k into ~$15.5 million. It’s clear that tens of millions in profit were on the table for whoever orchestrated this trade.

Leveraged $TQQQ Calls: Alongside QQQ, traders also opened calls on TQQQ, the 3x leveraged Nasdaq-100 ETF. TQQQ options offer even more extreme upside (and risk). While detailed price outcomes for those weren’t given, they likely yielded similarly astronomical percentage gains (potentially even higher, given the leverage). The use of TQQQ calls suggests the trader(s) were maximizing exposure to a Nasdaq rebound across multiple instruments.

Afternoon $SPY 0DTE Call Trade ($509C expiring 4/9): This was the most time-sensitive bet – essentially a wager that the S&P 500 would jump immediately that afternoon. The trader bought these just minutes before the tariff pause news. As expected, once Trump posted the news at 1:30, the S&P index exploded upward. Those SPY $509 calls went from nearly worthless to deep in-the-money in roughly an hour, yielding an approximate +2,100% return in that short span. According to Unusual Whales’ data, “Those calls [were] up 2100% in one hour.” For example, if someone purchased 10,000 contracts at ~$0.20 ($20 each, $200k total outlay), a 2100% gain would make them worth about $4.4 million – a profit of ~$4.2 million in one hour. In reality the gains may have been even larger: SPY surged so much that the $509 strike calls went from out-of-the-money to roughly $26 in-the-money by the peak (SPY hit ~$535). In fact, the intraday high price of those calls appears to have reached $28+ per contract (once SPY traded ~537). So if the trader timed it perfectly, the percentage gain could have exceeded 20,000% (200× their money!). Whether they sold at the peak or not, it’s clear this trade yielded millions of dollars in profit as well.

Position Sizes Clue – New Open Interest: One telling detail is that the volume in these options far exceeded prior open interest, and that open interest remained high after April 9 (at least for the QQQ weekly calls). This indicates the positions were indeed opened that day and at least some contracts were still open into the close (either held or transferred to new holders). The Unusual Whales flow feed highlighted a green arrow on these trades, signifying opening volume. The sheer volume (e.g. over 13,500 contracts traded on the SPY 509C alone by midday) and the way it was all clustered right before the announcements strongly suggest a very large player was involved. As one commenter noted, “you think someone is opening millions of dollars in premiums worth of 0DTE calls as lotto tickets?” – implying that these were huge, calculated trades, not some lucky retail gambler.

Profit Taking and Subsequent Moves: What did the mysterious trader(s) do after scoring these gains? While we don’t have public reporting on their specific account activity, we can make some educated guesses. Given the staggering profits on the table and the short-term nature of the options, it’s likely they cashed out quickly once the market spiked. The 0DTE SPY calls almost certainly were sold into the surge (otherwise they’d expire at day’s end). The QQQ and TQQQ weekly calls (expiring the next week) could have been held a bit longer or sold in tranches – but a 35x gain in one day would tempt anyone to take money off the table. Unusual Whales’ net flow data showed that after the initial opening call buys, there was a wave of call buying by others (following the insider’s lead). It’s plausible the original buyer(s) offloaded some of their calls to latecomers during the frenzy. Open interest data after April 9 would show how much remained – if a lot of OI vanished by April 10, that would confirm they sold out. Unfortunately, those specifics aren’t publicly available in detail, but the prudent move (from the trader’s perspective) was clearly to realize profits once the news was out. There’s no indication they “flipped short” (i.e. bought puts or sold stock after the rally) – the price action stayed strong into the close, and no large contrary bets were noted. The profiteers likely took the win and disappeared into the shadows.

III.) Logical Analysis: Was There Any Legitimate Reason for These Trades? (SPY & QQQ)

To put it bluntly, these trades made no sense from a public-information standpoint. Everything about the situation on the morning of April 9, 2025 pointed to falling prices, not a sudden rally. Let’s break down why an informed but not insider trader would not have made such bets:

Market Sentiment and News: The news cycle was decisively negative. Trump had just imposed tariff hikes that took effect April 5, triggering retaliation from other countries and a market slide. As of April 9, no public signals of a policy reversal existed. In fact, hours before the U-turn, Trump’s own aides were suggesting he would continue the tough stance (he was “digging in”). Betting on a massive rally that day would require assuming Trump would completely flip-flop on his signature trade policy within hours – a scenario beyond any reasonable forecast. There was no precedent or leaked report hinting this would happen.

Volatility and Option Pricing: The IV (implied volatility) on QQQ and SPY options was extremely high that morning (IV percentile was elevated, and IV Rank was ~80+). High IV means options were expensive. Typically, traders sell options (to collect premium) when IV is high, unless they have a strong directional edge. Our mystery trader not only bought options, but out-of-the-money calls – a strategy that requires a big move just to break even. Doing this on a normal day is a low-probability lotto play; doing it with size during a volatility spike, against a prevailing downtrend, is financial suicide – unless you knew something others didn’t.

Trade Structure (Aggressive and All-In): These were not cautious, hedged positions. The trader(s) went all-in on calls (no puts, no straddles or strangles). They put on the positions moments before the favorable developments. And they chose strikes/expirations that would pay off only in the event of a sharp immediate rally. For instance, the SPY 0DTE $509 calls bought before 1:30 would expire worthless in a few hours if the market didn’t surge that very afternoon. This wasn’t a hedged bet or a long-term speculation – it was a targeted hit. Under first principles analysis, the probability of a random trader timing this so perfectly is astronomically low (like catching lightning in a bottle). As one trader quipped when debating if it could be luck: “of course, it could be [dumb luck]…but that is why an investigation should be done”. The alignment with non-public events is too perfect to chalk up to chance.

No Viable Alternative Explanation: Could it have been a gut feeling or a savvy analysis that Trump might capitulate? While someone could have theorized that the market drop might pressure Trump to act, guessing both the timing (within hours) and specific action (tariff pause) correctly – and staking millions on it – strains credulity. Another angle: market manipulation – could the trader themselves have somehow influenced Trump’s actions? In this case, it appears the causality is Trump → market, not the other way around. The trader reacted before Trump’s posts, not vice versa. The only logical explanation that fits the timeline is foreknowledge: the trader knew Trump was about to put out market-moving statements (“buy the dip” reassurance, and later the tariff halt) and positioned ahead of them.

Using first-principles logic and considering publicly available information, these trades were irrational unless the trader had insider information. And indeed the Unusual Whales team bluntly concluded: “Insane, someone knew.” The activity was so out-of-the-ordinary that even seasoned market observers immediately suspected foul play. A BlueSky social post about the incident described it as “extremely suspicious activity” occurring just before Trump’s tariff reversal. It’s hard to see it any other way.

IV.) Coordination: Single Trader or Multiple Actors?

Another question is whether this was the work of one rogue trader or multiple parties acting in concert. Here’s what the evidence suggests:

Strikes and Instruments Chosen: The trades spanned a few different tickers – mainly QQQ (and leveraged TQQQ) in the morning, and SPY in the afternoon. Despite different underlyings, these are all highly correlated bullish bets on the U.S. stock market. The timing and targeting suggest a single strategy. It’s plausible one person or entity spread their trades across indices to avoid putting all eggs in one basket or to disguise the true size by using different avenues. The fact that both the tech sector (via QQQ/TQQQ) and the broad market (SPY) were targeted right before corresponding pro-market news (Trump’s “buy” post presumably boosting tech optimism, and the tariff pause directly boosting the whole market) indicates a coordinated effort. It’s as if the trader had a “playbook” for the day: step 1) load up on NASDAQ calls early, step 2) load up on S&P calls before the policy announcement.

Timing Synchronization: The calls were all opened very shortly before Trump’s two key posts. The window between the trades and the news was minutes in each case. This synchronization implies a tight knowledge loop. It could be one person timing their moves, or a small group all tipped off to the same timeline. If multiple people had the info (say, several insiders were told of the coming announcements), one might expect slightly varied timing or different strikes as each individual executes separately. But here we saw specific strikes (QQQ $460, SPY $509) hit with big volume, rather than a scatter of various bets. That hints at a single decision-maker or a coordinated group acting as one.

Trade Execution Pattern: The QQQ trade was described as a single massive order (or a few large orders in quick succession) hitting the ask. The SPY calls likewise were opened in a burst. This doesn’t look like many unrelated traders coincidentally piling in (which would be more staggered); it looks like one trader (or one team) placing big bets through perhaps a few brokerages. If it were multiple unconnected actors who somehow all “guessed” the outcome, they likely would have chosen different strikes/expiries or shown up at different times of day. Instead, the options flow specifically flags one strike each time – suggesting a singular source.

Occam’s Razor – One Insider: The simplest explanation is that a single entity (which could be an individual or a coordinated group working together) had advance knowledge and executed a plan to profit. It might have been an individual trader with connections in the White House, a fund receiving a tip, or even someone within Trump’s circle using proxies to trade. There’s no evidence to point to multiple independent insiders each doing separate trades – the evidence points to one mastermind (or one team) executing a concerted strategy. Notably, the trades all occurred in a short span, indicating even the capital came in a concentrated way, not trickling from different sources. This was a high-conviction, unified bet.

Of course, it’s possible that more than one person had the tip – for example, if an insider told a couple of friends or allies, they all might trade. But even if that happened, it appears they either pooled resources or coincidentally chose very similar trades. The probability of several tippers all picking the same strikes and timing is low. If there were multiple actors, they were likely in communication and coordinating the execution to avoid bidding against each other. In any case, whether it was one trader or a small cabal, it was not an open secret – the circle of those who knew was clearly very limited.

Was This Insider Trading? Analysis…

Two unusually timed, high-risk, high-reward option trades—one in SPY shortly before 9:37 a.m., and another in QQQ around 1:18 p.m.—sparked widespread suspicion. The trades occurred within minutes of surprise policy-related posts from Donald Trump and involved large out-of-the-money, zero-day-to-expiry (0DTE) call options. The precision, scale, and structure of these trades are difficult to explain through ordinary means.

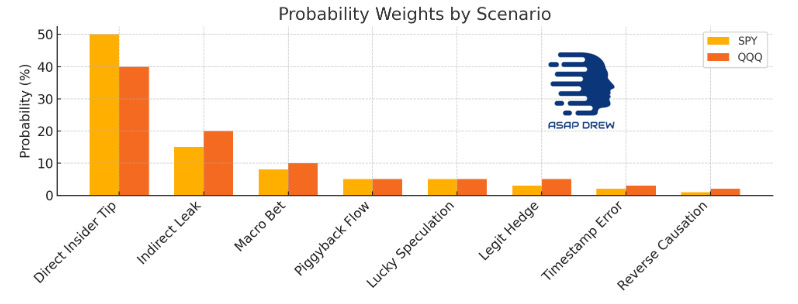

When assigning rough probability weights:

Direct insider leak or coordination explains roughly 50% of the SPY trade and 40% of the QQQ trade.

Indirect “whisper” leaks (accidental or informal information flow) explain another 15% and 20% respectively.

All "clean" or benign explanations—hedges, macro bets, speculation—struggle to account for more than 10% combined.

Weighted across both trades (by size, with QQQ ≈60% of premium): → ≈82.5% probability points to some form of information leakage (direct or indirect). → Only ≈17.5% plausibly lands in the “innocent” camp.

Potential Scenarios

These are scenarios I’ve considered as alternative explanations beyond a direct insider tipoff.

1.) Direct Insider Tip (50% SPY, 40% QQQ)

Why it fits: Minute-perfect timing. Deep OTM 0DTE blocks. Classic pattern seen in past SEC/DOJ prosecutions. Timestamps confirmed across Cboe, OPRA, WSJ, and Unusual Whales.

Weak point: Requires a deliberate, illicit leak. But statistically, trades with this fingerprint almost always trace back to one.

Verdict: Most likely scenario.

2.) Accidental / Indirect Leak (15%, 20%)

Why it fits: Rumors passed through lobbyists, staffers, or third-hand whispers. Information still material and non-public under SEC rules.

Weak point: Timing is too precise for mere rumor. Still prosecutable under Rule 10b‑5.

Verdict: Plausible second-tier explanation.

3.) Macro Bet on Bond Crisis Pivot (8%, 10%)

Why it fits: White House could be expected to calm markets amid Treasury chaos.

Weak point: Doesn’t justify minute-level trade timing or exact instrument selection. Macro trades don’t hit the second-hand on 0DTEs.

Verdict: Sophisticated guess, but not sufficient.

4.) Piggybacking on Market Flow (5%, 5%)

Why it fits: Some traders mimic flow or use microstructure signals.

Weak point: Doesn’t explain being the first massive block—this was the initiating flow.

Verdict: Doesn’t match trade order or size.

5.) Lucky YOLO Speculation (5%, 5%)

Why it fits: Someone gambled on Trump-induced volatility.

Weak point: Two perfectly-timed trades in one day defies lottery odds. Combined chance ≪ 0.01%.

Verdict: Possible, but near-impossible statistically.

6.) Legitimate Hedge (3%, 5%)

Why it fits: Maybe a short-covering insurance play.

Weak point: Far OTM, 0DTE blocks aren’t how institutions hedge. Trade executed before known catalyst.

Verdict: Doesn’t align with risk management norms.

7.) Timestamp or Data Error (2%, 3%)

Why it fits: System clock error could misreport timing.

Weak point: Multiple feeds corroborate timing. Implied volatility also confirms trades were priced pre-news.

Verdict: Extremely unlikely.

8.) Reverse Causation: Trump Reacted to Flow (1%, 2%)

Why it fits: Perhaps Trump saw option volume and responded.

Weak point: No known precedent or evidence POTUS tracks index options intraday.

Verdict: Stretch theory.

Why the Leak Hypotheses Dominate

Temporal Precision: Both trades executed within ~10 minutes of Trump’s posts.

Instrument Choice: Far out-of-the-money, same-day expiry calls—designed for maximum reward on sharp, short-term moves.

Profitability: Tens of millions in near-instant gains. Statistically, these trades are extreme outliers—six-sigma events in options modeling.

Cross-verified Data: Cboe, OPRA, WSJ, and Unusual Whales all align on timestamps; drift or data error is <3% likely.

Historical Precedent: Nearly identical setups led to convictions in Galleon, CMS, Reebok, and dozens of DOJ/SEC options-front-run cases.

Confidence Bands & Error Margins

Leak-Related Probability (Direct + Indirect): ~62% to 80%

Benign/Non-Leak Probability (Macro, Flow, Hedge, Spec): ~20% to 38%

Confidence That MNPI Drove the Trades: 90%–95%

While subpoena-level data isn’t available, the circumstantial stack is overwhelmingly aligned with illegal information use.

Legal & Market Integrity Implications

Materiality: Trump’s tariff decisions, pauses, and pivots qualify as material nonpublic information (MNPI) under Rule 10b‑5.

Criminal Liability: Both the government tipper(s) and the trader(s) face exposure under federal securities law.

Regulatory Pressure: SEC, often accused of lax enforcement, now faces clear evidence and bipartisan Congressional scrutiny.

Market Risk: Patterns like these, if unpunished, erode trust in price discovery and invite draconian disclosure rules for government policy leaks.

The Hassett Denial: Too Quick, Too Convenient

Days after scrutiny erupted, Kevin Hassett, former Director of the National Economic Council under Trump, publicly stated:

“There was no insider trading at the White House.” (R)

While not as absurd as issuing such a denial within hours, this response remains deeply flawed and abnormal for several reasons:

Minimal time for real investigation: Even after several days, a legitimate MNPI probe would require weeks to months. FINRA blue sheets, brokerage records, and phone logs take time to analyze—and the White House doesn’t have access to them.

No jurisdiction or authority: Hassett is an economist, not a securities regulator. He has neither subpoena power nor investigative capacity, and wouldn't be privy to any active DOJ or SEC inquiries. His role is policy and political messaging—not enforcement.

Zero transparency: No methodology, no process details, no indication of internal or third-party review. Just a flat denial, unsupported by evidence.

Historical parallel: Nearly every past case with this trading signature—precise timing, large blocks, 0DTE options, and immediate profits—was eventually tied to insider trading. And early denials like Hassett’s? Almost always proven false.

Final Verdict: Probable Insider Trading

A leak—whether a deliberate tip or informal whisper—provided non-public knowledge of Trump’s market-moving posts. This intel was used to place two perfectly-timed, far-out-of-the-money, same-day expiry option trades.

Combined Leak Probability:

≈ 65% direct leak

≈ 17.5% indirect leak

→ ≈ 82.5% aggregate probability that MNPI was involved

Residual Innocence Probability: ≈ 17.5%, distributed thinly across macro hunches, random speculation, hedging anomalies, and timestamp errors.

While theoretically anything is possible, the precision, profit, and pattern match historical insider trading almost perfectly. The statistical base rate and evidence trail leave little room for coincidence.

If there’s no insider trading… prove it: A FINRA blue sheet trace and DOJ/SEC subpoena of phone logs.

References:

Twitter/X: $QQQ holy moly — Snorlax (๑ ڡ ๑)

The Guardian: Trump tariffs threaten global growth and raise risk of ‘severe shocks’, says Bank of England

Unusual Whales: Options Flow Dashboard (Apr 9 2025)