Trump Captures Maduro in Venezuela: Can Regime Change Hold?

My thoughts on the (necessary) Venezuela regime change.

Regime change wars are rarely black and white; they are a spectrum of Return on Investment (ROI). Sometimes they are terrible disasters (Libya). Other times they work (Panama). And sometimes they work transiently—delivering a high immediate return by neutralizing a threat, even if the long-term outcome is messy or unsustainable.

President Trump’s targeting of Venezuela must be viewed through this lens. It is a strategic calculation to secure the “American sphere” of influence.

By dismantling a narco-terrorist socialist state, the U.S. stops the hemorrhage of drugs and migrants at the source—problems driven by a failed economy and rampant corruption that spill over into our own borders.

But the critical question is: what comes next? We must be realistic about the “substrate” we are working with.

Part I: The Evolutionary Reality of Latin America

History and behavioral patterns suggest that simply “leaving them to their own devices” or imposing a naive Western democracy will fail.

Latin America rarely sustains stable liberal democracy with disciplined markets. Instead, the region is marked by recurring cycles of:

Authoritarianism: Military or strongman rule emerges to impose order during crises.

Populism: Leaders mobilize mass support by promising redistribution and attacking “elites.”

Nationalism: Nationalist rhetoric is used to unite factions or justify intervention.

Redistributive Socialism/Communism: Leftist regimes promise and often attempt sweeping wealth transfers, frequently at the expense of long-term growth.

In practical terms, voters face two dominant options:

Social conservatism paired with fiscal populism (traditional values, patronage, and big government spending),

Hard-left redistribution and state control (socialism/communism).

The median voter in these environments consistently favors short-term rewards (redistribution) over long-term institution building, a pattern that even follows voting blocs when they migrate to high-opportunity environments like the U.S.

While technocratic, market-oriented governments occasionally emerge (e.g., 1990s Chile, Colombia, Uruguay), such regimes are often temporary and vulnerable to rapid reversal by populist or redistributive waves… or they aren’t true free market capitalism (often high corruption and top-down intervention).

“Right” parties in the region rarely pursue true small-government reform, instead blending social conservatism with state-driven economics.

The persistent reversion to populism, redistribution, or strongman rule is not an accident or simply “bad leadership.”

It’s a durable equilibrium, shaped by:

Population genetics (downstream of evolution) → shaping institutions → policies + preferences for immediate security over delayed gratification/prosperity.

The Ideal vs. The Realistic

Ideal: UAE-mode. In an ideal world, Venezuela would transform into a country analogous to the Gulf States (UAE, Qatar).

Why? In the absence of the extremely high human capital and trust found in places like Scandinavia or East Asia, a strong “CEO-style” authority is the only proven method to enforce law and order, secure resources, and allow the free market to function. It curbs the natural impulse for populist self-sabotage.

However, we must temper our idealism with realism. We may not be able to build a Dubai or a Singapore in Caracas.

Potential: Chilean Floor. But the goal should be to establish a “Chilean Floor” — a system that is stable, market-friendly, and orderly — while rigorously avoiding reverting back to the historical mean.

Anything less than a strong, market-enforcing authority will simply reset the clock for the next collapse.

Part II: Why Different Models Work for Different Populations

Understanding what institutional designs produce prosperity requires acknowledging that the same model doesn’t work everywhere. The key variables are: average human capital (cognitive capacity, time preference, trust), homogeneity/social cohesion, and the presence of external enforcement mechanisms.

Model 1: High Human Capital + Homogeneity → Nordic Model Works (For Them)

The Nordic countries (Sweden, Norway, Denmark, Finland) successfully operate high-trust welfare states with generous redistribution.

This works because:

High average cognitive capacity: National IQ estimates ~98-100, among the highest globally.

Historical homogeneity: Until recent decades, extremely ethnically uniform populations with shared cultural norms.

Low time preference: Cultural and behavioral tendencies toward delayed gratification, savings, and long-term planning.

Internal enforcement: Social pressure against free-riding is crushing; welfare fraud is stigmatized.

But this model is not exportable. When non-Western immigration scales up, these systems face fiscal strain, integration failures, and political backlash. Denmark now offers repatriation payments; Sweden raised voluntary return benefits to ~SEK 350,000. The model works because of the population, not despite it.

Suboptimality note: Even the Nordics don’t maximize prosperity/innovation pace. They trade some growth for equality. A Hong Kong or Singapore-style system would likely produce faster progress, but the Nordic substrate sustains their preferred equilibrium.

Model 2: High Human Capital + Open Markets → Singapore/Hong Kong Model

Singapore and Hong Kong achieved first-world status within a single generation through:

High average cognitive capacity: East Asian populations with IQ estimates ~105-108.

Strict no-welfare-loops enforcement: Work permits tied to employers; no path to citizenship for low-skilled; swift deportation for non-performers.

Meritocratic governance: Low corruption, rule of law, transparent property rights.

State-guided capitalism: Not pure laissez-faire—Singapore has heavy state involvement (80% public housing, mandatory savings via CPF, sovereign wealth funds). But free market in trade/commerce.

Approximately 36-40% of Singapore’s population are non-citizens; foreigners constitute ~29% of the labor force—the highest proportion in Asia. (R) The system extracts productivity from diverse inflows by eliminating the free-riding option.

Why it works: High native human capital creates the administrative capacity and social trust to run complex meritocratic institutions. The substrate supports sophisticated optimization.

Model 3: Lower Human Capital + Authoritarian Free-Market Enforcement → Gulf Model

The UAE, Qatar, and other Gulf states achieve prosperity despite lower average human capital in the native population (~80-85 IQ estimates, heavily environmental). How?

CEO-style authoritarian governance: Strong, stable rulers enforce law, order, and property rights without democratic interference.

Extreme no-welfare-loops for migrants: Non-citizen workers account for ~90% of the UAE’s workforce. (R) Kafala sponsorship ties workers to employers; no path to citizenship; no benefits access; swift deportation.

Welfare only for citizens: The ~10-15% native population receives subsidies and benefits, but this is fiscally sustainable given oil revenues and the massive migrant workforce paying in without drawing out.

Tight social control: Low crime, strict enforcement, no tolerance for disorder.

Import human capital: High-skilled professionals from around the world run the sophisticated sectors.

Key insight: You don’t need high average native human capital if you:

Have authoritarian enforcement preventing populist capture

Import talent for complex functions

Eliminate welfare loops that would attract/create dependency

Control social order strictly

This is the closest model to what Venezuela could achieve—not Nordic welfare, not Singaporean technocracy, but Gulf-style resource extraction with strict labor controls and CEO governance.

Model 4: Latin American Substrate → Historical Failure Modes

Latin American populations exhibit trait distributions that make certain equilibria unstable:

Moderate-to-low average human capital: IQ estimates ~80-90 (heavily environmental—nutrition, education, disease burden depress scores).

Low generalized trust / high in-group preference: Colonial legacies, ethnic stratification, and weak institutions breed cynicism and clientelism.

Higher time preference: Cultural and behavioral patterns favoring immediate rewards over delayed gratification.

Inequality intolerance + redistribution demand: Extreme Gini coefficients (~0.45-0.55) create constant pressure for wealth transfers.

Result:

Democracy → median-voter demands for redistribution → populist captures → fiscal collapse → crisis → brief reform window → repeat

Even U.S. Latinos, living in the world’s highest-opportunity environment for generations, have never once voted majority Republican nationally. (R)

In 2024, Trump achieved a record ~42-48% of the Latino vote, but Democrats retained the majority. (R)

Approximately 70-75% of Latinos favor “bigger government providing more services.” (R)

The tendency doesn’t converge to host-country norms even across generations.

And the reasons Latinos/Hispanics vote right-wing (in the subset that do) are usually not conducive to long-term prosperity (social conservative, fiscal redistribution, populism).

What Works in Latin America: The Chilean Floor

Chile under Pinochet and the subsequent democratic governments represents the best-case Latin American outcome—not ideal, but a “floor” above which to aim:

Market reforms imposed authoritarianly (1973-1990): Privatization, deregulation, pension reform.

Democratic transition with reforms preserved (post-1990): Center-left governments retained core neoliberal framework while adding moderate social spending.

Sustained growth: Chile became Latin America’s highest GDP per capita.

Persistent inequality: Gini remained high; 2019 protests showed unresolved tensions.

Limitations: Chile is not Singapore or UAE. It didn’t eliminate welfare loops or achieve Gulf-style order. It’s a mixed system that works better than neighbors but still experiences populist pressures (recent leftward shift, new constitution debates).

For Venezuela: The goal should be to achieve at least a Chilean floor—stable, market-friendly, orderly—while using whatever leverage exists to push toward Gulf-style discipline. Anything less resets the clock.

Part III: The Current Situation—January 3, 2026

What Happened

At approximately 2:00 AM local time, U.S. forces launched what President Trump described as a “large-scale strike” involving air, land, and sea operations with over 150 aircraft. (R)

Targets included Fuerte Tiuna (Venezuela’s largest military complex), La Carlota airbase, the port of La Guaira, and other military installations. (R)

The Delta Force-led raid captured President Nicolás Maduro and his wife Cilia Flores from a fortified location. (R)

They were flown to the USS Iwo Jima and are en route to New York to face narco-terrorism charges stemming from 2020 DOJ indictments. (R)

Trump stated the lights in Caracas “were largely turned off due to a certain expertise that we had,” and referenced what he called the “Donroe Doctrine,” claiming:

“American dominance in the Western Hemisphere won’t be questioned again.” (R)

Note: Trump is embracing the “multipolar” spheres-of-influence dynamic because that’s what those in his regime are telling him is smartest. I support more U.S. intervention everywhere that’s strategic (doesn’t matter what “sphere” if it aligns with favorable long-term ROI). Stepping in and correcting Venezuela was long overdue.

The Operation Was Remarkably Low-Cost

Unlike Iraq or Afghanistan, this was a surgical decapitation strike, not an occupation:

U.S. casualties: Few injuries, no deaths claimed. (R)

Duration: A single night operation.

Venezuelan military resistance: Virtually none. The Armed Forces seemingly put up no coordinated defense, raising questions about internal betrayal of Maduro. (R)

Public support: Many Venezuelans appear to welcome the change—approximately 8 million have fled the country under Maduro; opposition commands ~70% support in polls.

Secretary of State Marco Rubio reportedly “anticipates no further action in Venezuela now that Maduro is in U.S. custody.” (R)

The Justification Framework

Primary: Narco-terrorism and drug trafficking. The DOJ charged Maduro in 2020 with narco-terrorism conspiracy, describing him as head of the “Cartel of the Suns.” (R)

Secondary:

Geopolitical: Venezuela deepened ties with Russia (strategic partnership May 2025) and Iran. (R)

Election fraud: The disputed July 2024 election, widely dismissed as fraudulent.

Oil access: Venezuela holds ~303 billion barrels of proven reserves—17% of global reserves, the largest in the world. (R)

Migration: Stopping the hemorrhage at the source.

Power Vacuum and Transition

Vice President Delcy Rodríguez demanded proof of life; Trump claims she has been sworn in as president. (R)

Interior Minister Diosdado Cabello appeared defiant but provided no resistance.

Opposition leader María Corina Machado declared “the hour of freedom has arrived.” (R)

Trump indicated he is “looking at” Machado to lead Venezuela. (R)

International Reactions

Condemnation (left-leaning, ultra-woke neighbors):

Brazil Lula: “unacceptable line” crossed, evoking “worst moments of interference.” (R)

Colombia Petro: “aggression against sovereignty”; deployed forces to border. (R)

Mexico: “clear violation” of international law. (R)

Support (right-leaning, smarter neighbors):

Argentina Milei: expressed approval. (R)

Ecuador Noboa: “time for narco-Chavista criminals to face justice.” (R)

Adversaries:

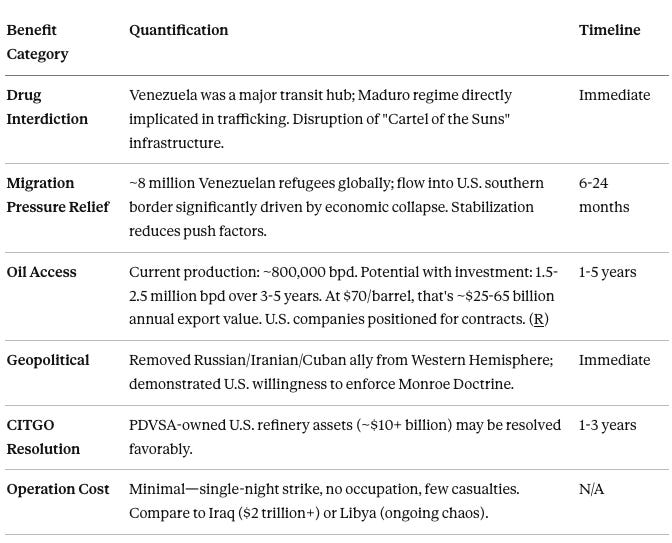

Part IV: Return on Investment—Quantifying U.S. Benefits

Immediate/Short-Term ROI (2026-2028)

The U.S. has already secured significant returns from this low-cost operation:

Drug Interdiction — Immediate

Disruption of “Cartel of the Suns.” Venezuela has served as a major transit hub with the Maduro regime directly implicated in trafficking. Intervention disrupts this infrastructure immediately.

Geopolitical — Immediate

Enforcement of Monroe Doctrine. Removes a Russian, Iranian, and Cuban ally from the Western Hemisphere and demonstrates U.S. willingness to enforce regional security.

Operation Cost — N/A

Minimal expenditure. Projected as a single-night strike with no occupation and few casualties. Contrast: Iraq ($2 trillion+) or Libya (ongoing chaos).

Migration Pressure Relief — 6–24 Months

Stabilization reduces push factors. Currently ~8 million Venezuelan refugees exist globally. The flow into the U.S. southern border is significantly driven by economic collapse; stabilization addresses the root cause.

CITGO Resolution — 1–3 Years

Asset recovery. PDVSA-owned U.S. refinery assets (valued at ~$10+ billion) may be resolved favorably.

Oil Access — 1–5 Years

Production expansion.

Current: ~800,000 bpd

Potential: 1.5–2.5 million bpd (with investment)

Value: ~$25–65 billion annual export value (at $70/barrel) U.S. companies are well-positioned for these contracts.

Net Short-Term Assessment: Extremely favorable ROI. The operation achieved regime decapitation at near-zero cost. Even if long-term outcomes are messy, the immediate strategic gains (drug/migration disruption, oil positioning, geopolitical signaling) justify the action.

Medium-Term ROI (2028-2032)

This depends heavily on:

What institutional framework is established

Whether the U.S. maintains leverage and commitment

How quickly oil production is restored

Optimistic Scenario (Chilean Floor Achieved):

Oil production reaches 1.5-2 million bpd by 2030

U.S. companies secure major contracts (Chevron, ExxonMobil)

Stable government reduces migration pressure

Drug trafficking networks disrupted

Venezuela becomes reliable U.S. energy partner

Estimated U.S. benefit: $50-100 billion in energy access, trade, reduced border costs

Base Case (Hybrid/Messy Transition):

Oil production reaches 1.2-1.5 million bpd

Partial reforms; some clientelism returns

Reduced but not eliminated migration/drug pressure

Venezuela neither hostile nor fully aligned

Estimated U.S. benefit: $20-50 billion; strategic gains partially preserved

Pessimistic Scenario (Fragmentation/Reversion):

Oil production stagnates or declines

Chaos, militia governance, humanitarian crisis

Continued migration surge

Drug networks adapt and persist

Estimated U.S. benefit: Minimal; sunk costs of ongoing intervention

Long-Term ROI (2032-2040+)

The critical constraint is U.S. domestic political sustainability.

The Demographic Clock:

Non-Hispanic white population: ~57-58% and declining (minority by ~2045).

Hispanic/Latino voters: ~15% of electorate and growing; 36+ million eligible. (R)

These voters consistently favor bigger government/redistribution.

2025 off-year elections showed Latinos swinging back to Democrats (~68% in NJ). (R)

Political Sustainability:

2026–2028 U.S. Political Environment: Trump administration; maximum leverage

Window to lock in constraints. A critical period to secure oil deals and establish institutional guardrails while leverage is at its peak.

2029–2032 U.S. Political Environment: 2028 election pivotal

Divergent Paths.

Republican Win: Continued pressure on the regime.

Democratic Win: Likely softening of sanctions and diplomatic stance.

2033+ U.S. Political Environment: Demographic trends accelerate

Hardline limits. A sustained hardline approach becomes increasingly difficult to maintain due to shifting demographics, regardless of which party is in power.

Reality: The U.S. has a 2-6 year window (through Trump term, possibly one more Republican term) to lock in institutional constraints and extract maximum value. Beyond that, domestic political shifts make sustained commitment unreliable.

Long-Term ROI depends on what happens in this window:

If constraints lock in (sovereign fund, limited welfare, meritocratic governance): Long-term partnership value potentially $100+ billion

If window is squandered: Cycle likely restarts within 10-15 years; ROI diminishes to short-term gains only

Part V: Scenario Analysis and Probabilities

The Four Paths

A. Managed Hybrid (Chilean Floor) — 40% Confidence: Medium

Opposition-led government with U.S. conditions. Partial reforms are preserved; involves some clientelism but maintains general stability.

C. Fragmentation — 25% Confidence: Medium

Security forces split. Governance devolves into militia or criminal control leading to prolonged instability.

D. Reversion to Populism — 25% Confidence: Medium

Democratic transition captured. Redistributionist pressures overtake the government within 5–10 years.

B. UAE-Lite (Optimal) — 10% Confidence: Low

Strong authoritarian market-enforcer. Characterized by “no-loops” institutions and sustained external backing.

Scenario A: Managed Hybrid / Chilean Floor (40%)

What happens: Machado/González-led government with U.S. backing. Some constitutional reforms (spending limits, sovereign fund). Oil production restarts. Economic improvement from collapsed baseline. But clientelist networks partially persist; inequality remains high; populist pressures simmer.

Timeline:

2026-2028: Honeymoon period; oil restarts; infrastructure investment; returning migrants.

2028-2032: Median-voter demands increase; elections test reforms; some erosion.

2032+: Depends on U.S. political environment and whether constraints held.

U.S. ROI: Substantial—strategic gains preserved, oil access secured, migration reduced. Estimated $50-100 billion over 10 years.

Scenario B: UAE-Lite / Optimal (10%)

What happens: Strong technocratic/authoritarian government (possibly Machado in firm control, or military technocrat with opposition blessing) enforces market discipline. Oil revenues ring-fenced. Temporary foreign labor for rebuild (no citizenship path). Minimal welfare expansion. Crime/corruption harshly punished.

Why unlikely:

Requires sustained U.S. commitment (10+ years) unlikely given domestic politics.

Opposition rhetoric is democratic, not authoritarian.

No clear “Lee Kuan Yew” figure.

Regional backlash would be intense.

U.S. ROI: Maximum—Venezuela becomes reliable partner; oil production 2.5+ million bpd; migration reversed; drug networks eliminated. Estimated $150+ billion over 15 years.

Scenario C: Fragmentation (25%)

What happens: Regime remnants (Cabello, Padrino factions) resist; military splits; colectivos and criminal networks expand; multiple claimants to power; humanitarian crisis deepens; refugee surge.

Parallel: Libya post-2011—external removal of Gaddafi led to prolonged militia conflict and fractured sovereignty.

Why significant risk:

Research on foreign-imposed regime change finds it rarely produces democratization and is associated with higher civil war risk.

Venezuela has armed colectivos, ELN presence, criminal organizations.

Oil infrastructure sabotage would prolong chaos.

U.S. ROI: Negative in medium-term; short-term gains (Maduro removal, signaling) offset by ongoing instability, refugee flows, potential proxy conflict.

Scenario D: Reversion to Populism (25%)

What happens: Democratic transition proceeds; elections held. Populist elements gain traction exploiting inequality and unfulfilled expectations. Oil revenues fund expanded spending. “Socialism lite” emerges. Cycle restarts.

Why likely: This is the historical pattern. Without rigid external enforcement, the substrate reasserts. Median-voter demands reliably push leftward in high-inequality Latin contexts.

U.S. ROI: Moderate short-term (5-10 years of improved relations, oil access); diminishing long-term as cycle restarts. Estimated $20-40 billion before reversion.

10-Year Outcome Distribution

Hybrid / Stable (Chilean+) — 35% Imperfect but functional market democracy.

The most likely scenario. Represents a shift toward a functioning market economy and democratic governance, though likely retaining some structural imperfections.

New Authoritarian (Chavista or Right-Wing) — 20% New boss, similar dynamics.

A transition of power that results in a different figurehead or faction taking control, but maintaining the existing authoritarian structures and dynamics.

Chronic Instability — 20% Fractured governance, militia control in regions.

A breakdown of central authority leading to prolonged chaos, where regional governance fractures and non-state actors (militias) gain significant control.

Democratic but Fragile — 15% Competitive elections, weak institutions.

A return to democratic processes with competitive elections, but hampered by institutional weakness that threatens long-term stability.

Chavista Restoration — 10% Revanchist politics after chaos.

The least likely scenario. A full return to previous Chavista policies and leadership styles, driven by a backlash or “revanchist” politics following a period of chaos.

Part VI: Strategic Recommendations

For the Trump Administration (2026-2028)

This is the window. Use it to lock in maximum constraints. The clock is ticking.

Condition all aid/investment on structural reforms

Sovereign wealth fund for oil revenues with external oversight

Constitutional spending limits

Independent judiciary with initial international monitors

Selective migration framework (favor skilled/temporary)

Secure oil contracts immediately

Chevron, ExxonMobil, others positioned

Terms that survive political transitions

Revenue-sharing that funds reconstruction without populist capture

Maintain credible deterrence

Make clear that backsliding has consequences

Sustain sanctions infrastructure (can be reimposed)

Security cooperation with new government

Support opposition leadership that understands the stakes

Machado appears market-oriented; back her faction

Technical advisors for institutional design

No naive “democratization” without guardrails

For Venezuela’s Transition Government

Learn from Chile, not from Sweden

Market reforms must be imposed before democratic pressures overwhelm them

Social spending should be targeted/conditional, not universal

Inequality will remain; growth must be the priority

Learn from UAE, even if you can’t replicate it

Oil revenues must be insulated from populist capture

Labor market should favor productivity over patronage

Law and order must be prioritized

Avoid the Argentina trap

Don’t promise what can’t be sustained

Don’t print money to fund redistribution

Don’t antagonize the U.S. for nationalist points

Conclusion: Realistic Expectations

The U.S. just achieved a remarkably cost-effective regime change. Maduro is captured; the narco-state is decapitated; oil access is secured; geopolitical signaling is complete. The short-term ROI is already locked in.

The long-term outcome depends on factors largely outside U.S. control:

The population’s underlying behavioral tendencies will push toward familiar equilibria.

Without rigid, enforced institutional constraints, reversion is the base case.

The U.S. itself faces demographic and political shifts that limit long-term commitment.

The realistic goal is not to build a Singapore or a Dubai in Caracas. It’s to establish a Chilean floor—stable, market-friendly, orderly—and use every lever to prevent reversion below it.

Anything less than a strong, market-enforcing authority will simply reset the clock for the next collapse.

The patterns don’t lie. But patterns can be resisted temporarily with the right institutions and sustained pressure. The question is whether the window is used wisely.