Lyn Alden's "Nothing Stops This Train" (Fiscal Dominance): What Eventually Stops It & Investing Strategies

Lyn Alden was recently asked "What Eventually Stops This Train"?

Lyn Alden is a popular macro analyst of the present era. Many macro gurus are good at analyzing big picture datasets… but many times they fixate on the wrong data, weight data incorrectly relative to actual real-world importance, and/or interpret data in ways that generate weak ass returns.

If you look into most “macro gurus” personal portfolios they get absolutely murked by boring ass buy/hold strategies of ETFs like: SPY (S&P500) & QQQ — and thus introduce unnecessary noise/complexity into the ether that most would be better off ignoring

Getting whiplashed by obscure signals and becoming a “shiny object syndrome” investor is proven to be foolish. Macro Guru A says “Recession”, Macro Guru B says “Stagflation”, Macro Guru C says “Start of a Bull Market,” Macro Guru D says “Weimar Hyperinflation”, Macro Guru D says “Probably Deflation… But Anything Could Happen!” Gee thanks guys.

That said, if you listen to Lyn Alden talk about the current monetary system, you quickly get the sense that she has a good read of everything going on. Whether her perspective and takes will translate to an investment strategy that beats the S&P500 remains unclear.

Over the past year or so, Lyn has been beating the drum “NOTHING STOPS THIS TRAIN” and has caught fire, hammering home the point that she thinks the macro will be a paradigm of Fiscal Dominance (U.S. and globally ubiquitous scenario wherein countries run large fiscal deficits and finance them with financial repression).

Quick Sidebar: I’ve found myself repurposing Lyn’s catchphrase “Nothing Stops This Train” for other present-day trends (e.g. fertility decline, cord cutting, time spent on “devices”, crypto adoption, loneliness, etc.).

Recently Lyn Alden was on the podcast “Macro Voices” hosted by Erik Townsend and he asked the question everyone wanted to know the answer to: “What Will Stop This Train?”

Macro Voices #488: Lyn Alden: Run It Hot! (Lyn’s prior appearance to What Will Stop This Train?)

Forward Guidance: Deficits are Forcing the Fed Back Into Expansion — Lyn Alden (A more recent discussion)

To follow Lyn:

I) What “the train” is (per Lyn Alden) — definition, signs & symptoms

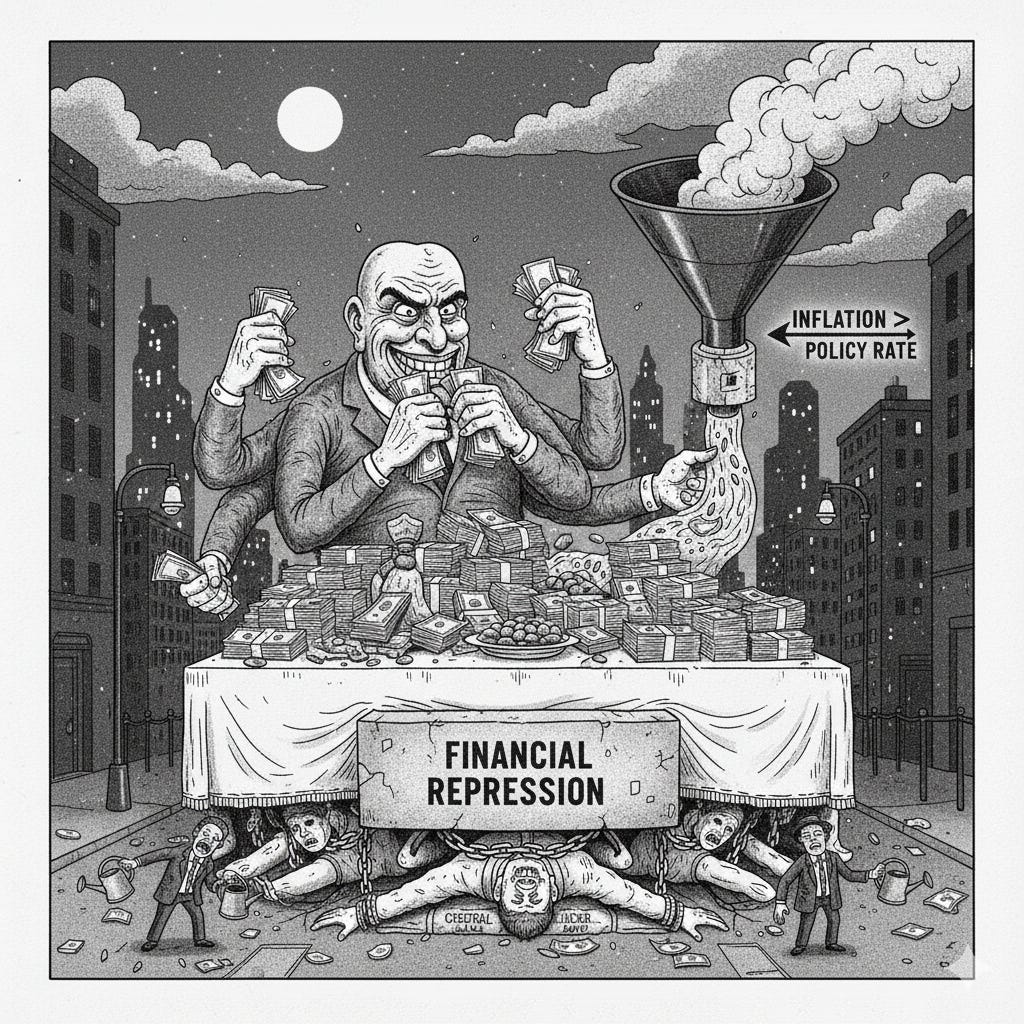

Definition: “The train” that nothing stops= a fiscally dominant regime: the U.S. runs structurally large deficits (think ~mid‑single digits % of GDP, often ~6–7%) for years, finances them with financial repression (inflation ≥ policy rate; negative real yields at times), balance‑sheet backstops, and regulatory “captive demand”—all inside a still‑dollar‑centric global system.

Why it persists:

Demographics & entitlements: Boomers moving from paying into Social Security/Medicare to drawing down → outlays are structural, not cyclical.

Institutions & politics: Polarization and reliance on “norms” vs. clean statutory fixes → ad‑hoc, backstop‑heavy solutions rather than consolidation.

Dollar network effects: Large contractual global USD demand (offshore dollar debt, invoicing, settlement) buys a long runway even as optional demand (e.g., CB reserve allocations) slowly diversifies.

The “train dashboard” — signs/symptoms to monitor:

Fiscal

Primary deficit‑to‑GDP and total deficit‑to‑GDP (staying high even in growth).

Net interest outlays vs. revenues (creeping higher share).

Entitlement cash outflows (beneficiary counts & COLA sensitivity).

Monetary/market plumbing

Persistence of negative real yields (ex‑post) over multi‑year windows.

Treasury auction metrics: bid‑to‑cover, tails, dealer absorption, SRF/ON RRP and repo facility usage.

Frequency of “mini‑crises” that are contained with facilities/backstops.

Dollar system

Official reserves: gradual diversification (more gold/other currencies), slower foreign net Treasury demand.

Cross‑border USD credit stock (slow to shrink due to contracts).

Invoicing/pricing: slow, sector‑specific diversification.

Is the train accelerating, steady, or slowing now?

Steady‑to‑gently accelerating: Deficits are entrenched; entitlements ramp; optional USD demand keeps diversifying at the margin; forward energy investment is thin (raising future inflation/repression risk). Yield‑curve signals remain blunted by fiscal dominance.

II) What Lyn thinks eventually stops the train (and tail scenarios)

Core (Lyn’s base): “Death by fire, not by ice.”

Financial repression does most of the work: long stretches where inflation ≥ policy rate; bondholders earn negative real returns.

Entitlement math resets: COLA downgrades/pauses, eligibility ages, means‑testing → real benefit cuts without nominal defaults.

Currency depreciation episodes reduce the real burden, especially for external holders.

Cited accelerants (can bring the stop forward):

Energy crunch (“broken money meets broken energy”): shale plateaus/long‑lead capex lags → inflation spike without appetite to hike → deeper repression.

Political‑legal discontinuities: capital‑flow frictions, emergency powers, selective contract changes or foreign‑holder hits.

Dollar‑pillar erosion: faster reserve/invoicing diversification; some creditor‑led re‑denomination of debt.

Extreme tail scenarios (low probability, high impact):

Temporary gates/controls on cross‑border money movement;

Selective foreign‑holder “default” (withholding, mandated conversions, punitive taxes);

Market accident (auction failure/collateral spiral) forcing yield‑management and legal emergency measures.

Timing (Lyn’s tone): Many years of mini‑crises rather than an imminent single break; ultimate “stop” after enough real erosion and policy formalization—unless a non‑linear shock pulls it forward.

III) Does GPT-5 Pro Agree with Lyn?

Broadly, yes. GPT-5 Pro:

I assess we are in fiscal dominance now (≈70% probability, confidence ~6/10). That means persistent, policy‑driven large fiscal deficits are the main driver of macro outcomes, and monetary/market plumbing is increasingly arranged to finance those deficits—often at the expense of holders of nominal claims (cash, deposits, long bonds). The playbook to win is: own pricing power and real assets, keep duration short, diversify custody/jurisdiction, and maintain liquidity/tail‑hedges so you can buy stress and never be a forced seller.

Current signs consistent with fiscal dominance

Structural deficits remain large outside of recessionary emergencies; entitlement outlays are rising with demographics.

Policy reaction‑function slippage: when inflation flares, rates may rise for a time, but the system gravitates back to negative or barely positive real yields over multi‑year windows (the quiet “debt tax”).

Market plumbing dependence: frequent reliance on balance‑sheet tools/facilities and regulatory “nudges” that create captive demand for government paper (liquidity ratios, collateral frameworks, balance‑sheet exemptions, etc.).

Yield‑curve signal degradation: classic recession signals (e.g., curve inversions) lose timing power because fiscal impulse props nominal growth and risk assets longer than the old playbooks expect.

Optional USD demand (e.g., foreign reserve allocations) diversifies slowly, yet contractual USD demand (offshore USD debt/invoicing) keeps the system in place—prolonging the runway.

Who is being “taken advantage of” (who pays the bill)?

Holders of nominal claims: bank deposits, CDs, money‑market cash, and long‑duration nominal bonds—they earn negative real returns in aggregate across the cycle.

Foreign official holders of local‑currency sovereign bonds (e.g., Treasuries) who absorb real losses when inflation runs hot or the currency weakens.

Pensions/insurers with long‑dated nominal assets vs. COLA‑linked liabilities.

Price‑taker households/small firms not on the receiving end of fiscal transfers.

Who benefits?

The sovereign (debt stock shrinks in real terms).

Borrowers over savers (especially with fixed‑rate debt).

Owners of scarce/real assets and businesses with pricing power (they can pass through inflation).

Sectors aligned with policy (defense, energy infrastructure, critical manufacturing).

IV) What GPT-5 Pro thinks causes the train to stop (odds, timing, rationale)

Horizon: now → mid‑2030s. Confidence (overall): ~6/10.

Slow‑melt → Fire (Base case) — 60%

Stop window: 2031–2033 (median ~2032).

Mechanism: Years of negative real returns + entitlement tweaks + one or two currency step‑downs → followed by codified framework (formalized yield‑management in stress, clearer fiscal‑monetary coordination, entitlement law changes).

Early hard stop (political/plumbing shock) — 20%

Stop window: 2027–2029.

Mechanism: Capital‑flow frictions, legal emergency powers, or Treasury‑market accident → abrupt repricing → compressed repression/restructuring cycle.

Orderly stabilization (partial fiscal repair) — 10%

Stop window: initial steps by 2026–2030.

Mechanism: Bipartisan deal; trims primary deficit; entitlement tweaks; fewer mini‑crises; slower but steadier path.

Reserve‑status fracture (disorderly) — 10%

Stop window: 2028–2032.

Mechanism: Faster reserve/invoicing shifts and creditor re‑denominations → currency step‑down + forced repression, then rebuild under a more multipolar order.

V) How we’ll know the train has stopped (diagnostic clusters)

Call it a “Stop Dashboard.” You want 2+ clusters to be true for ≥ 4 quarters:

Policy codification: Explicit/standing yield‑management tools in stress (YCC‑lite), normalized facilities; formal coordination signals. Enacted entitlement law changes (COLA formula adjustments, means‑testing, eligibility).

Macro outcomes: A completed multi‑year period with materially negative real returns on bonds (the repression “work” is done). Inflation volatility subsequently declines toward target without constant emergency backstops.

Dollar system: Official reserves stabilizing at a new lower USD share, with gold/regionals plateaued higher. Cross‑border USD credit stabilizes at a new steady level (after deleveraging/renegotiation).

Rates/funding: Term premium/real yields settle into a band that clears with ordinary dealer balance sheets or (dirigiste path) persistent yield management is openly part of the framework.

VI) Trump’s priorities (2025-2029)

The law (OBBB)

Signed July 4, 2025 as Public Law 119‑21 (H.R.1).

§199A (QBI) deduction: made permanent and expanded to 23% (subject to wage/phase‑outs).

Standard deduction (TY 2025): MFJ $31,500; Single $15,750; HOH $23,625.

“No tax on tips”: implemented as a deduction for qualified tips and certain overtime (IRS guidance published).

Advanced Manufacturing Investment Credit (§48D, semiconductors): 25% → 35% for property placed in service after 12/31/2025 (construction by 1/1/2027 required).

Budget effect: CBO +$3.4T to deficits over 2025–2034 (conventional score) → funding pressure persists; bias toward financial repression over time.

Trade & tariffs (2025)

Blanket IEEPA architecture announced (10% baseline; higher “reciprocal” rates for certain partners). Some collections began, but key provisions have been litigated.

Bilateral patches so far:

UK: 100,000 cars/year at 10% tariff; aircraft‑parts relief; steel/aluminum unresolved.

EU: ~15% headline compromise (vs 30% threat) + ~$600B EU commitments (energy/defense/FDI).

Japan: ~15% auto tariff framework; rules‑of‑origin for MX/CA plants still sensitive.

Incidence: Early data suggest U.S. firms/consumers are absorbing a non‑trivial share of tariff costs → mildly inflationary tilt vs 2024.

Legal status & timeline (matters for inflation mix and sector dispersion)

Federal courts blocked most “blanket” IEEPA tariffs; the Court of Appeals has affirmed. SCOTUS is expected to hear the case; think argument in winter/spring 2026, decision by ~June 2026.

Regardless of SCOTUS on IEEPA, sector‑specific tools remain and can be scaled quickly:

Section 232 (national‑security tariffs/quotas: metals, components, potentially auto‑adjacent items).

Section 301 (China: list changes, rate adjustments; previously upheld lists remain durable).

Section 201 safeguards (temporary global safeguards on injury).

AD/CVD waves (anti‑dumping/countervailing duties) across targeted SKUs.

UFLPA / sanctions / export controls / Entity List (de‑facto barriers on forced‑labor/critical tech).

De minimis tightening (small‑parcel threshold/data rules).

Buy‑America procurement and domestic‑content rules.

Interpretation: OBBB cuts effective business taxes (esp. pass‑throughs), sweetens semi capex, and keeps deficits high. Tariffs (if blanket) or workarounds (if blanket struck) create domestic price umbrellas for targeted industries and nudge inflation higher at the margin. Net: the fiscal‑dominant read persists.

Fed succession fork

Powell’s chair term ends May 2026. A successor perceived as more growth‑friendly could front‑load rate cuts in 2H‑2026.

Cuts into sticky inflation → bull‑steepener, lower real rates → gold/real assets/value cyclicals up; long nominal duration lags.

Cuts into clean disinflation → duration + quality growth up; gold/commodities lag relatively.

Global liquidity (GLI) meta‑tilt

BIS global liquidity gauges (FX‑credit) have been rising → supportive for risk assets and crypto. If GLI accelerates, lean into semis/industrials/crypto; if GLI rolls over, cut beta/crypto and lean on T‑bills/TIPS.

VII) Rank‑ordering assets under Trump priorities + current trade deals

Note: These are GPT-5 Pro’s ranks. I don’t agree with the precise ranks or allocations, but think these are still solid. Check current valuations and think critically about future flows from here. DYOR. Nothing here is investment advice of any kind.

Base assumptions: OBBB in force; blanket IEEPA tariffs blocked; workarounds active (232/301/201/AD‑CVD/UFLPA, de minimis, procurement); GLI rising; non‑trivial chance of dovish Fed front‑loading cuts in 2H‑2026.

A) Winners — Base path (IEEPA blanket blocked; workarounds active)

Defense & aerospace — procurement/geopolitics tailwind; explicit partner pledges.

Energy infrastructure (midstream) & LNG logistics — inflation pass‑through; volume resilience.

U.S. semiconductor manufacturing & equipment — §48D @ 35% reshapes fab math; toolmakers/suppliers benefit.

Gold — deficits + potential real‑rate suppression + reserve diversification.

Copper/uranium; grid/nuclear supply chain — electrification + security.

Royalty/streaming miners — commodity upside with lower op/capex risk.

Value/quality U.S. equities with pricing power — QBI @ 23% helps pass‑through owners; tariff umbrella helps domestic producers.

TIPS (5–10y) & short T‑bills — inflation protection + dry powder; avoid long duration.

Managed futures/CTA — trend capture in commodities/rates/FX.

Bitcoin (0–5%) — liquidity + debasement optionality; mainstream access via spot ETFs.

Ethereum (0–3%) — ETF access (no staking yield in ETFs); higher tech‑beta than BTC.

B) Winners (rank‑ordered) — If SCOTUS green‑lights blanket IEEPA tariffs

Defense & aerospace

Energy infra/LNG

Gold (bigger inflation impulse)

Copper/uranium; grid/nuclear

U.S. semis mfg & equipment

Managed futures/CTA

Value/quality cyclicals

TIPS/T‑bills

Bitcoin (0–5%) / Ethereum (0–3%)

Royalty/streaming miners

C) Winners — If cuts meet clean disinflation (monetary dominance‑ish)

Intermediate/long Treasuries (initial duration rally)

Quality growth / semi designers (duration sensitive)

IG duration

U.S. semis mfg & equipment (capex still incentivized)

Energy infra/LNG (steady cash flows)

Value/quality cyclicals

TIPS/T‑bills

Managed futures (smaller role)

Gold (relative lag vs duration)

BTC/ETH (liquidity‑on but less macro urgency)

D) Laggards (rank‑ordered)

Across Base and blanket‑upheld:

Long‑duration nominal Treasuries (term premia + funding needs)

Import‑dependent, thin‑margin consumer (apparel/discount/general merch)

U.S. firms with high foreign supply‑chain reliance in exposed lanes (unless carved out)

Heavily subsidy‑dependent clean‑energy developers (policy/financing risk)

Profitless, long‑duration growth

EM exporters levered to U.S. access (country‑specific)

Exception: In the clean‑disinflation variant, long duration Treasuries move to the winners list (top‑3), and gold/commodities underperform relatively.

VIII) Avoid the communist dystopia (if possible)

High taxes are mentally braindead at all levels of gov (federal & state) and the entire country benefits more from keeping taxes as low as possible (wealth creation by high IQs → more wealth kept by high IQs → more incentive to innovate & smarter investments/innovation relative to the wasteful gov, etc.); high taxes slow innovation and worsen long-term quality of life for everyone.

The only issue is jealousy re: “wealth inequality”… humans are jealous creatures and someone like Elon racking up billions/trillions upsets many — even if they would spend it retardedly or even in ways that actively inflict damage (a la MacKenzie Scott).

Although you should be doing everything in your power to keep taxes as low as possible, if you are wealthy you should generally not let taxes dictate where you live. Live where you enjoy living (this may even include NY and/or CA).

Most ultra-rich live wherever they want and aren’t whipped around by taxes and they use every loophole possible (this is smart — as the taxes just get spent inefficiently).

If things get really bad (e.g. prez AOC, all states turn blue, every state turns Antifa mode communist → wealth taxes, confiscation of assets, exit taxes, etc.) — you’ll want to have hedges to act upon (you won’t want to live in the U.S. if it gets destroyed by the woke mind virus).

This may mean losing all your Bitcoin in a boating accident or something. Below are some options to think about… I wouldn’t act prematurely. Vote accordingly.

Design for resilience first, optimization second. No secrecy. Obey current law, but pre‑position options so you can act before rules shift.

A) Location & legal base

Home state (tax & creditor protection)

Favor no state income tax & strong homestead/creditor protection: Florida (0% income tax, no estate/inheritance tax, strong homestead) or Texas (0% income tax, strong homestead).

Avoid anchoring in state estate‑tax or capital‑gains‑surtax states unless offset by other objectives.

Trust situs (domestic)

Use South Dakota / Nevada / Delaware / Wyoming / Alaska / Tennessee for long‑duration (“dynasty”) and directed trusts, robust decanting, and strong DAPT statutes.

Build trust‑protector powers so you can change situs quickly if statutes sour.

Foreign custody rails (fully reported)

Open/live accounts with reputable custodians in Switzerland and/or Singapore (rule of law, deep custody infrastructure).

Metals storage via allocated/segregated non‑bank vaults (Zurich/Singapore).

Expect and plan for full FATCA/FBAR/8938 compliance; transparency by design.

Mobility

Add an OECD second residency (ideally work‑eligible) in a high rule‑of‑law jurisdiction (e.g., UAE, Switzerland, Singapore, Netherlands, Nordics, New Zealand). Maintain small funded accounts so rails are live.

B) Structures, tax location & concentration management

Asset location: place tax‑inefficient strategies (credit/alternatives/high‑turnover) inside qualified plans or insurance wrappers where appropriate; keep equity indexers/munis in taxable.

Concentration without big sales: collars, exchange funds, prepaid variable forwards to diversify/finance with deferral.

Charitable tools: DAF for bunching; CLAT/CRT to diversify low‑basis assets while meeting giving goals.

Estate: fund dynasty trusts now; plan for possible step‑up curtailment in what‑ifs.

C) Liquidity & credit (don’t be a forced seller)

Hold 12–24 months expenses + interest in T‑bills across two institutions.

Set 2 credit lines when you don’t need them:

One term, non‑callable (preferably low‑LTV, non‑recourse).

One SBLOC‑type facility kept unused for contingencies.

If you use “buy‑borrow‑die,” keep LTV ≤ 25–30%, pre‑fund interest, and model failure modes (rates up, step‑up curtailed, deductibility tightened).

D) Crypto governance (defense‑first)

Multisig cold storage, keys split across jurisdictions/agents; documented estate SOP.

Maintain cost‑basis/wallet logs; reconcile any broker reports; don’t rely on “they can’t prove access.” You are on self‑assessment; stay clean.

E) Tripwires → pre‑agreed actions (so you move on time)

Create a one‑page “If X then Y” and pre‑sign the instructions. Review quarterly.

Legislative tripwires

A federal bill advancing that:

introduces capital‑flow frictions,

imposes wealth‑tax + exit‑tax escalation, or

broadens confiscatory emergency powers → within 72 hours, raise offshore (reported) liquidity to 50–60% of liquid NW; pause new long‑duration domestic commitments; verify second‑residency logistics.

Administrative tripwires:

Formal expansion of reporting/withholding regimes or regularized emergency freezes for non‑criminal behavior → increase jurisdictional diversification; shorten asset duration; elevate tail‑hedge notional.

Market‑plumbing tripwires

Repeated auction stress, persistent reliance on standing facilities, or incipient yield‑management → cut duration further; raise real‑asset tilt; ready liquidity for volatility dislocations.

Annual 72-hour drill: test wires/limits, foreign settlement, vault withdrawal, BTC signature ceremony, CPA filing readiness.

If not fiscal dominance, where?

If not fiscal dominance, plausible alternatives:

Horizon for all scenarios: 2026–2032 (the “unstable window”).

Meta‑overlays:

Fed balance sheet: QT likely ending soon, with a shift to flat → mild balance‑sheet growth via T‑bill ↔ reserve operations (not duration QE). Liquidity‑positive but sized, which extends the repression feel without implying “QE∞”.

SCOTUS on blanket IEEPA tariffs: decision likely by mid‑2026; affects the inflation mix and sector dispersion, not the deficit math.

Fed succession (Powell’s chair ends May‑2026): a dovish successor cutting into sticky inflation reinforces repression; cuts into clean disinflation enable monetary dominance.

Global Liquidity (GLI): accelerating FX‑credit/liquidity boosts semis/industrials/crypto; a rollover argues for duration/cash and less beta.

Scenario 2 — Monetary dominance returns

Odds: 12% | Confidence: ~4/10 | Earliest start: 2027–2029

Pre‑conditions (what would flip us here):

SCOTUS curtails blanket tariffs and the administration restrains sectoral workarounds (less inflation impulse).

New Fed chair signals positive real rates for longer; QT persists; balance‑sheet backstops used sparingly.

Deficit math stabilizes at least modestly (primary deficit/GDP narrows) or markets impose discipline (term‑premium reprices and then settles).

Mechanics: New chair keeps real rates durably positive; balance‑sheet support recedes. Early on, term premia can rise (supply overhang), but as inflation is crushed, duration rallies.

Ranked winners (refined):

Intermediate Treasuries first (5–10y), then long Treasuries once term premium peaks.

Quality growth/mega‑cap tech (lower discount rates; clean disinflation).

IG duration (after the initial term‑premium repricing).

Secular software/AI leaders (if earnings deliver and capex ROI stays high).

USD (stronger USD is typical—benefits U.S. importers; hurts EM carry).

Caution: heavy Treasury supply can delay the long‑duration leg even as inflation falls.

Laggards (clarified):

Gold and broad commodities (relative underperformance vs. duration).

Energy beta (E&P cyclicals) and royalty/streaming (relative).

EM commodity exporters; high‑leverage cyclicals.

Tripwires (quantified):

Core PCE 3‑mo annualized ≤ ~2.2% and trimmed‑mean easing.

Unit labor cost growth trending down toward ~2–2.5%.

Fed nominee/hearings: rhetoric on r* materially above market; QT path firm.

Primary deficit/GDP narrowing; Treasury auctions less tail; bid‑to‑cover improving.

Scenario 3 — Productivity/disinflation boom (AI/automation supply shock)

Odds: 15% | Confidence: ~4/10 | Window: 2026–2031 ramp

Pre‑conditions:

Rapid, diffuse TFP gains (automation, software, onshored fabs) → unit‑cost disinflation outpaces demand.

Capex boom without overheating prices; supply chains de‑bottleneck.

Mechanics: Disinflation from the supply side; real incomes rise; margins stay healthy.

Ranked winners (richer dispersion):

Growth equities (AI platforms, leading‑edge semi designers/EDA, automation).

Longer Treasuries (disinflation + credible nominal anchor).

High‑ROIC compounders across sectors (pricing power + cost deflation).

Select industrial metals (esp. copper) and grid/nuclear equipment (electrification demand)—not a broad commodity boom, but targeted strength.

USD modestly firm; developed markets with strong IP bases win.

Laggards (relative):

Broad commodities and gold (relative lag vs. duration/growth).

Legacy energy beta (relative)—but midstream/regulated utilities can still do fine on allowed‑ROE models.

Tripwires (quantified):

Nonfarm business productivity > 1.5–2.0% y/y sustained.

Margins expanding while CPI/PPI cool.

Capex/IT spend growth high without accelerating core goods/services inflation.

Scenario 4 — Balance‑sheet recession/deflation

Odds: 10% | Confidence: ~3/10 | Window: shock risk 2026–2028

Pre‑conditions:

Funding/market accident (auction failure risk, collateral spiral) or banking stress that tightens credit abruptly; policy error in tightening/liquidity.

Synchronized credit contraction across banks/markets.

Mechanics: Negative money/credit impulse; the Fed eases but balance‑sheet repair dominates for a period; USD squeezes initially.

Ranked winners (two‑phase view):

Acute phase:

Long Treasuries (flight to safety; convex rally).

Cash/T‑bills (optionality).

Tail hedges (index puts/long vol).

USD (long bias) (typical squeeze)

Policy‑response phase (QE/YCC/reflation attempt): Gold and quality duration continue to work; select staples/regulated utilities recover; BTC can rebound with liquidity—but after the acute drawdown.

Laggards:

Cyclicals, HY/levered loans, commodities, small caps.

BTC/ETH typically sell off hard in the acute phase (liquidity/risk‑off), then recover if liquidity is re‑introduced.

Tripwires (quantified):

Persistent SRF take‑up alongside GC‑SOFR spreads widening; repeated Treasury auction tails/coverage slippage; facility usage surges.

Bank funding spreads widening; SLOOS tightening; PMIs < 48; defaults up with new orders down.

Why the base case still isn’t these: OBBB’s fiscal stance (+$3.4T/10yr), the protection mosaic (even if blanket IEEPA is struck), and the odds of a dovish post‑Powell chair tilt the system back toward repression‑lite, i.e., fiscal dominance—unless the pre‑conditions above materialize. Given OBBB + tariffs + CBO math, the fiscal‑dominant read remains stronger. (CBO)

Bottom line: Choo choo!

The train is fiscal dominance with structural deficits and repression; it’s still running.

It most likely stops after years of real erosion and formalized policy resets (base ~2031–2033), but a political/market accident could pull that into 2027–2029.

Winning anyway means: own pricing power & real assets. Keep duration short.

Maintain dual custody/jurisdictions, set tripwires and a 72‑hour drill, and operate a clean, fully lawful structure that can pivot before rules change—no matter who’s in power.

DISCLAIMER: NOTHING HERE IS FINANCIAL OR INVESTMENT ADVICE.