Gen-Z vs. Boomers: Who Had It Harder (Housing, College, Welfare, Economy, Dating Market)

Back in my day I had to walk 15 miles in the snow uphill both ways just to get to school!

Recently there has been an intense populist social media rage against the Baby Boomer generation by Millenials and Gen-Z for getting old, wanting to live in the houses that they built/raised families in, and accumulating wealth (like normal old people are supposed to do).

The Baby Boomer generation (65+ y/o) is currently ~16.8% of the total U.S. population. Working age-adults (18-64 y/o) spanning several generations (Gen-Z, Millenial, Gen X) account for ~61% of the U.S. population.

The younger gens are roasting Boomers on social media… yet it’s mostly falling on deaf ears perhaps literally and figuratively (see: Hearing Loss Research 2025). The Boomers don’t really use TikTok, IG, or even X much… they are still on Facebook sharing fake news, cringey memes, and “Liking” photos of family/friends.

A big catalyst for the Boomer hate is the mainstream media. They fuel grievances of certain groups (e.g. younger gens) by pushing one-sided polarized propaganda (anti-Boomer anger porn). Years ago it was the “gender wage gap” or “lack of diversity” (dumb shit that riles everyone up)… or Wall Street greed (pure comedy).

Most of the content shared is slanderous and does not provide proper “big picture” context. We know the “gender wage gap” is mostly driven by natural sex differences in occupational selection, having kids (women take off work), etc. We also know that “lack of racial diversity” is flat out meaningless; racial diversity is not something that is inherently good or bad.

Baby Boomers are currently ~20-25% of all active voters in the U.S. (pretty large cohort) but outnumbered by other generations (~75-80%). It is known that all groups vote for policies that benefit themselves; people are inherently self-interested (that’s the natural state of humans).

As a result, the U.S. has embraced absurdly high levels of socialism. We are far detached from the free market, low tax, small gov, low/zero safety net, low regulation “Frontier ethos” upon which the U.S. was founded. The Republicans are more aligned with OG America… but that’s not saying much of anything; Rs are about ~50% away and Dems are maybe ~60-70% detached.

Everything skews socialism. We pay a shit ton of money now for Boomers’ Social Security, Medicare/Medicaid, etc. — but we should because they paid into these policies… the government mismanaged money and blew it like retards.

We also pay out a shit ton of money to poor people, illegal immigrants, government workers (via benefits), etc. Poor people get free or heavily subsidized healthcare, housing, food, etc. — all of which drag on the fiscal system.

Some think there are insane levels of fraud across all U.S. government programs (including the military… a non-insignificant percentage of veterans are allegedly getting paid thousands per month for pseudo-disabilities).

I’m not sure I’d allege fraud, but Elon and the D.O.G.E. team think there is. At the very least there’s likely gross negligence and perverse entrenched spending feedback loops.

How do these feedback loops work? Example: Need money for “Cause A” → Government gives money to “Cause A” → People take a percentage of government money for “Cause A” and lobby hard to maintain/expand “Cause A” spending, while pocketing the rest for themselves. (“Cause A” may not even be an efficient way to improve the country.)

The main thing to know is that the U.S. essentially operates as a system I’d call a “Parasitic Democracy” wherein ~60-80% of voters are lifetime net negatives when accounting for all payments/benefits received at the federal, state, local levels and additional charity used — and they get to vote while extracting more than they contribute (zero skin in the game)!

So we have a majority of voters ~60-80% who vote for policies to enrich themselves (taking from productive people) and the only way this is sustainable is via technological innovation and hyper-productive visionaries (e.g. Elon Musk).

And once policies are enacted to “give shit away” they are impossible to roll back (just look at D.O.G.E. — it sounded great but was an utter failure that may have actually done more harm than good, despite earnest efforts by very smart people).

So these policies are massive. Then there are Democrat bills that pass to give away more free shit or expand the current free shit giveaway. And dial knobs get turned up. Just look at the tax credit added to ACA/healthcare premiums during COVID… the gov shutdown recently was to maintain that credit permanently.

The dial knob starts at a 1/10, gets turned up to a 5/10, then a 6/10… and you can almost never reverse below the current threshold.

That’s how, in 2025, we’ve ended up with U.S. gov spending accounting for ~40% of GDP. Pure government bloat and face-melting levels of fiscal inefficiency.

Whatcha gonna do about it? I can’t do anything other than propose my plan… The ASAP Protocol (2025). It involves zero-based budgeting, automatic spending caps, aggressive AI/robotics, aging reversal, full deregulation, and government subsidies to enhance IQ/health of the entire population.

It is true that Boomers will require a lot of funding for Social Security, Medicare/Medicaid, etc. (in the past these were financed by a robust younger generation)… and that a massive percentage of government spending is going to them… but remember, they paid into the system (the government spends like morons).

And due to the exponential decline in birth rates coupled with illegal immigration and other socialist policies to expand gov spending… we ended up in a monetary state of fiscal dominance (debt is serviced via financial repression… currently we are inflating some of it away).

Below is a breakdown of %s within each age bracket by generation.

1960 (Peak Boomer Youth): Under 18 (35.7%); 18–64 (55.1%); 65+ (9.2%)

1980 (Gen X Youth): Under 18 (28.0%); 18–64 (60.7%); 65+ (11.3%)

2000 (Millennial Youth): Under 18 (25.7%); 18–64 (61.9%); 65+ (12.4%)

2020 (Gen Z Youth): Under 18 (22.2%); 18–64 (61.0%); 65+ (16.8%)

2035 (Est. The Flippening): Under 18 (19.8%); 18–64 (59.0%); 65+ (21.2%)

There will be a point in the 2030s where a structural flip occurs such that the elderly (65+) become a larger percentage of the U.S. population than children under 18 for the first time in U.S. history.

It is projected that by ~2034 there will be ~77M seniors and ~76.5M children (under 18). This will shift the dependency ratio from “investing in youth” to “maintaining the elderly” (although many would argue we are already there).

Around ~28-30% of all U.S. government spending in 2025 (fed, state, local combined) is on retirees and elderly (Boomers). If analyzing strictly the Federal spending… ~39-40% goes to Boomers (SS, Medicare/Medicaid).

You could blame them… or you could blame the government (more accurate) and realize that we are in a socialist, parasitic democracy with some remnants of capitalism. Even if you cut off spending on Boomers… other groups would just vote for spending toward their preferred causes (that help themselves)… and this would never stop until you end up with the same situation: gov takes money from taxpayers → group wants money → gov spends money retardedly → gov pays money to group → becomes insolvent and owes massive interest on debt.

Before you give yourself a stroke from lashing out at Boomers, realize that (sadly) they’re going to eventually die off… and unless you had some atypical abusive relationship with them… you will miss them. Appreciate the Boomers people!

Not only did the Boomers “pay in” to the bullshit Ponzi that is Social Security, Medicare, and Medicaid… they also had plenty of kids. The government is the entity that is operating irresponsibly (kicking the can down the road to the next generation for as long as they can keep getting away with it). Yes the Boomers were part of the “vote” but it was never just them they are one generation.

The younger generation (e.g. Gen Z & Millenials) is fully convinced that if only the Boomers gave more wealth away… marriage rates and fertility rates would magically improve. Many are also convinced that Boomers had life far easier than any other generation!

This is a delusional pipe dream. This is why I wrote: In Defense of Boomers. Are the Boomers a perfect generation? No. Each generation has nuanced challenges that they deal with… but many don’t realize that, for the most part, life for the current younger generations is better than before (if they make smart choices).

Gen-Z has very high purchasing power and more wealth than prior generations at their age — even when accounting for inflation (they don’t comprehend how good they’ve had it so far financially).

The biggest challenge for Gen-Z is in the dating/marriage market wherein females dominate for various reasons:

Effortless attention on social media/dating apps (dating buffet, sex buffet, attention buffet, Paradox of Choice)

Stronger non-sexual social bonds (men are lonelier, women have more close friends… don’t “need” a man)

Anti-meritocratic academic/occupational market (requiring sex/gender quotas and “equitable” pay for lower median performance)

Hypergamy (women want someone who is equal or better than themselves… this is evolutionarily hardwired).

To be fair to Gen-Z, the Boomers have almost zero ability to conceptualize how savage the dating market has gotten for Gen-Z… even when young Gen-Z’ers find someone compatible… that person may not want marriage or kids (“still exploring”). And even if you recommend “just go offline” to find a spouse… this may not work as well as you’d think (many just reject others because they have an online roster and don’t want to bother with in-person randoms).

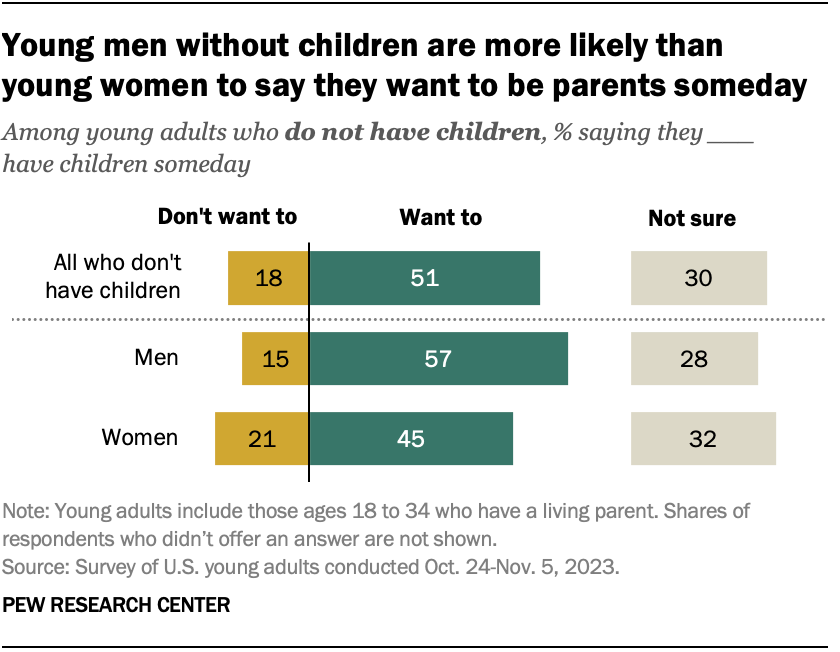

And for the first time in history, fewer childless young women want kids (~45%) than childless men (~57%). Many remain unsure (~32% for women & ~28% for men)… but ~21% of women “Don’t want to” have kids (vs. ~15% of men).

Gen-Z also has reasonable fears about AI/robotics (automation) and potentially losing white collar jobs… and somewhat of an aversion to perceived “lower status” jobs like fast food managers or the trades (even though they can pay well). (This is why there’s a growing push for UBI… but as I’ve noted, Premature UBI in Response to AI would be a colossal mistake… just more gov debt.)

Some of the aversion to “lower status” jobs is a direct byproduct of Biden era illegal immigration and fast-track to citizenship for former illegals, asylum seekers, refugees, etc.

We also have swaths of illegal immigrants working off the books (paying nothing in taxes + collecting benefits) and refugees/asylees (free gov shit)… and it demoralizes the younger American population in many ways:

Less dignity: Doing a basic blue collar job is associated with lower dignity if they are working with illegals and/or someone who lacks education.

Taking jobs: Many illegals can undercut Americans in pay because they just accept cash, work off the books, and don’t pay income taxes… many use fake IDs to collect benefits and/or partner up with a “legal” to maximize benefits. You can’t really compete with that. This displaces many would-be workers.

Disincentivization/demoralization: Coming to terms with the fact that illegals and foreigners also may get DEI bonuses (e.g. companies trying to hit X% non-white quotas) in hiring, others working off the books for tax free income, fake ID benefit schemes, etc. It disincentivizes some work and is demoralizing.

That said, Gen-Z has high purchasing power (higher than ever) and does NOT realize how good they have it in terms of health and tech relative to older generations. All they have to do is invest reasonably and they can outpace inflation.

Boomers don’t realize how lonely this young generation is in part due to cell phones/tech; this is a different era. Hyperconnected to the internet with an addiction to screens. A lot of Gen-Z is also “WFH” which can attenuate the ability to maintain a healthy, predictable social routine.

The other most substantial complaint from Gen-Z (“zoomers”) is that they want housing but can’t get it at a reasonable rate (especially in popular metros). There’s a U.S. Housing Crisis driven by NIMBY and illegals… and although it may be embellished at times, it is real.

Boomers vs. Gen Z at the Same Age (Cold Blooded Comparison)

Some Boomers think Gen-Z is soft as triple ply Quilted Northern and entitled AF, and many in Gen-Z think Boomers are straight up retarded fossils. Neither of these sentiments are accurate.

DISCLAIMER: FOR THE SAKE OF THIS PIECE, I’M REFERRING TO THE OLDER HALF OF THE GEN-Z COHORT (18-28). GEN-Z SPANS AGES 13-28 IN 2025.

I’m hoping that most Boomers AND Gen-Z’ers are sensible enough to realize that there are unique/nuanced challenges faced by each generation and that trying to compare generations generally is unproductive and stupid.

From what I’ve seen, most Boomers are sensitive to the complaints from Gen-Z and want to help. Very few take pleasure in seeing Gen-Z suffering. That said, Gen-Z needs to realize that they probably don’t have it as bad as they think.

There are entire social media echo chambers of complaints that are often completely detached from reality. If life is almost perfect but one thing is a bit “off” — people will rant about that one thing… and act like they’ve been living in an underground bunker for the past decade eating MREs trying to avoid radiation poisoning after a nuclear blast.

To set the record straight and avoid kowtowing to any specific generation… here’s what my research suggests in a head-to-head comparison. I also consider some counterfactuals.

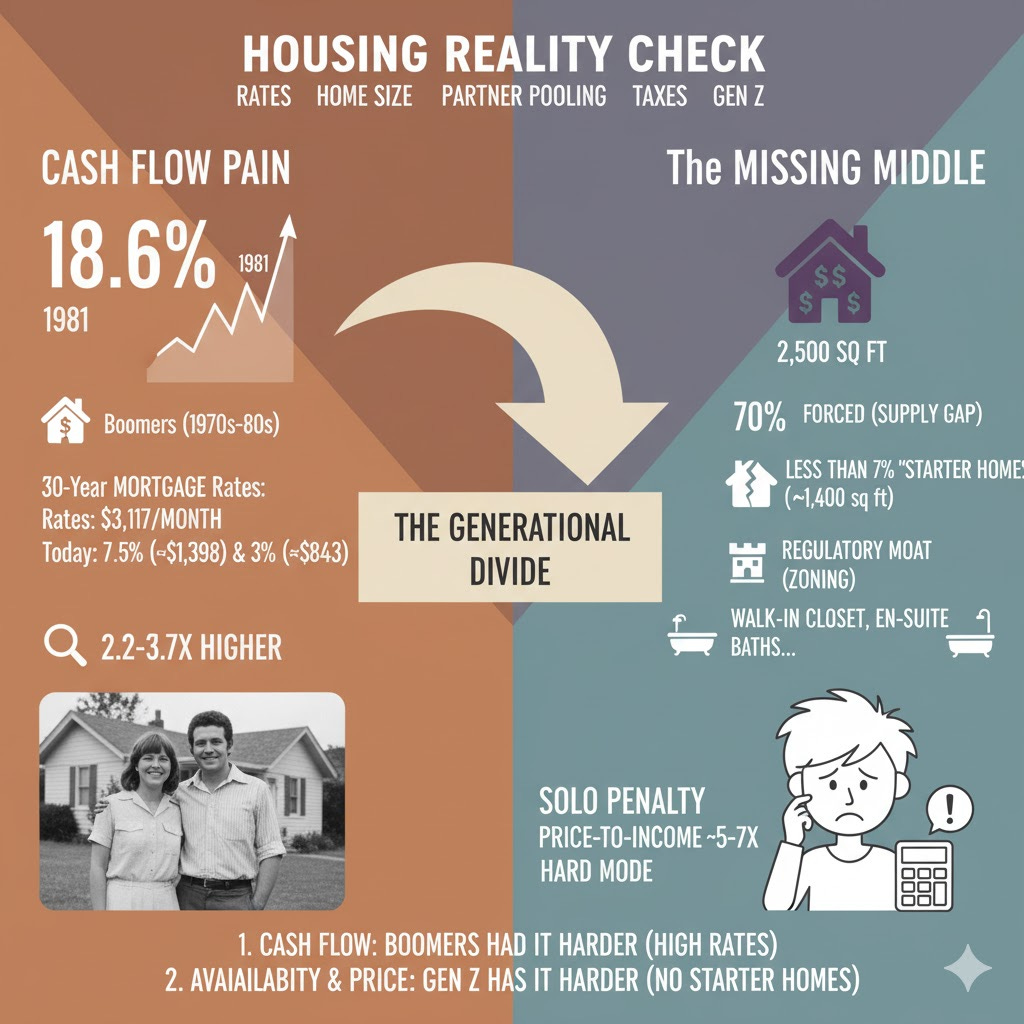

Rates vs. prices: Boomers swallowed brutal mortgage rates (30‑yr fixed peaked ~18.6% in 1981) but on much cheaper, smaller homes; Gen Z faces lower rates (even at 7–8%) but far higher price‑to‑income multiples and larger baseline house sizes. (Harvard Joint Center)

Adjusting for house size & partnership pooling: Boomers partnered earlier and effectively pooled 2 incomes into a smaller starter home; Gen Z often delays partnering, tries to “solo” larger square footage, and expects urban convenience. (Census shows household size trending down for decades; NAHB shows 2023 median new‐home size ~2,179 sq ft, down from a mid‑2010s peak but still far larger than the 1970s.) (Census.gov)

Stocks & investing tech: Older Gen Z adults experienced an extraordinary bull market (2010s S&P 500 ~13% annualized), zero‑commission trading, and 3‑bp index funds — tailwinds Boomers never had when they were 25. If you didn’t build an investment habit from 2010–2021, that was a choice. (Morningstar)

College ROI is not destiny (it’s selection): Boomers tended to attend local publics/commuter schools and paid as they went; Gen Z often self‑selects into high‑priced colleges and/or low‑ROI majors, then complains about loans. The data show huge ROI spreads by major and strong outcomes for registered apprenticeships, paths Gen Z ignored at its peril. (CEW)

Welfare state & safety nets: The U.S. has moved far from frontier minimalism: ACA enrollment is at record highs and the uninsured rate is near historic lows. Safety nets today are vastly more extensive than what young Boomers had. (CMS)

Technology & medicine: Gen Z inherited staggering life upgrades: smartphones, GPS, on‑demand services, tele‑everything, AI, plus large health gains (cancer mortality –34% since 1991; heart‑disease mortality –66% since 1970). Boomers at 25 had none of this. (ACA)

Risk environment: Violent crime rates, road‑fatality rates, and workplace deaths are dramatically lower than in the late 20th century—even if not perfectly linear post‑COVID (and even if some of this is misleading data). (FBI)

Dating markets: Online matching is cutthroat for Gen-Z males. The result is steep desirability hierarchies and asymmetric message returns… a different kind of hardship than Boomers faced (fewer institutions, more ruthless sorting). This makes it far more challenging to form relationships, get married, and have kids. (Science)

Fiscal dominance reality: Voters of all ages vote themselves benefits. The bill shows up as net interest now surpassing Defense and set to consume a growing share of revenue. “Cancel property taxes” or “forgive all loans” barely nicks the core budget arithmetic. (AAF)

1) Housing Reality Check (rates, home size, partner pooling, taxes)

The facts Boomers lived with (Cash Flow Pain). When late Boomers hit home‑buying age (late 1970s–mid‑1980s), 30‑year mortgage rates spiked into the mid‑teens—peaking around 18.6% in 1981.

On a vanilla $200,000 mortgage, principal‑and‑interest alone would run about $3,117/month at 18.6%.

Compare that to ~$1,398 at 7.5% and ~$843 at 3%. In other words, when rates were at their worst, the monthly cash flow pain was 2.2–3.7× higher than today’s environments for the same loan size.

The “Missing Middle”: Why Gen Z buys “Too Much House.” The narrative that Gen Z simply chooses to buy mansions is misleading. The reality is roughly 70% Force & ~30% Preference.

The Supply Gap (Forced): In the 1970s, builders mass-produced 1,000–1,400 sq ft “starter homes.” Today, entry-level homes (<1,400 sq ft) represent less than 7% of new construction.

The Profit Paradox: Land costs and regulatory fees have exploded. If a plot of raw land costs $150k (due to zoning scarcity), a builder loses money building a $200k starter home. They must build a $500k, 2,500 sq ft home just to make a margin.

The Regulatory Moat: Boomer-dominated local governments often utilized zoning (minimum lot sizes, setback rules) to artificially inflate property values, effectively making the construction of dense, affordable starter homes illegal in many suburbs.

The “Granite Expectation” (Preference). However, Gen Z is not entirely blameless. Surveys from the NAHB show that while young buyers scream for affordability, their “base model” expectations have inflated. Features like walk-in closets, en-suite baths, and dedicated laundry rooms—luxuries to a 1980s buyer—are now viewed as non-negotiable standards.

Result: Gen Z is paying for 40% more house than Boomers did, partly because the market won’t build smaller, and partly because Gen Z refuses to buy “ugly.”

The Income Pooling Trap (Self-Inflicted Arithmetic). The biggest mathematical handicap for Gen Z is the refusal (or inability) to pool resources.

Solo vs. Team: Boomers married earlier (median age ~22-24). They attacked the housing market with two incomes and one mortgage.

The Solo Penalty: Gen Z marries later (~30 for men, ~28 for women). Trying to buy a median-priced home on a single income in a market priced for 2 incomes (Price-to-Income ratios of ~5x to 7x) is mathematical suicide.

Nuance: Yes, finding a partner is harder in the digital age (see “Dating Markets” section), but the arithmetic remains cold: Single players play the game on Hard Mode.

Verdict: Boomers had it easier (for the most part)

Cash Flow: Boomers had it harder. 18% rates crushed monthly budgets.

Availability & Price: Gen Z has it harder. The “Starter Home” has been regulated out of existence, forcing young buyers into larger, more expensive units.

Strategy: Gen Z is getting crushed by a “Regulatory Moat” built by older generations, but they are sealing their own fate by trying to conquer that moat as single-income soloists rather than dual-income teams.

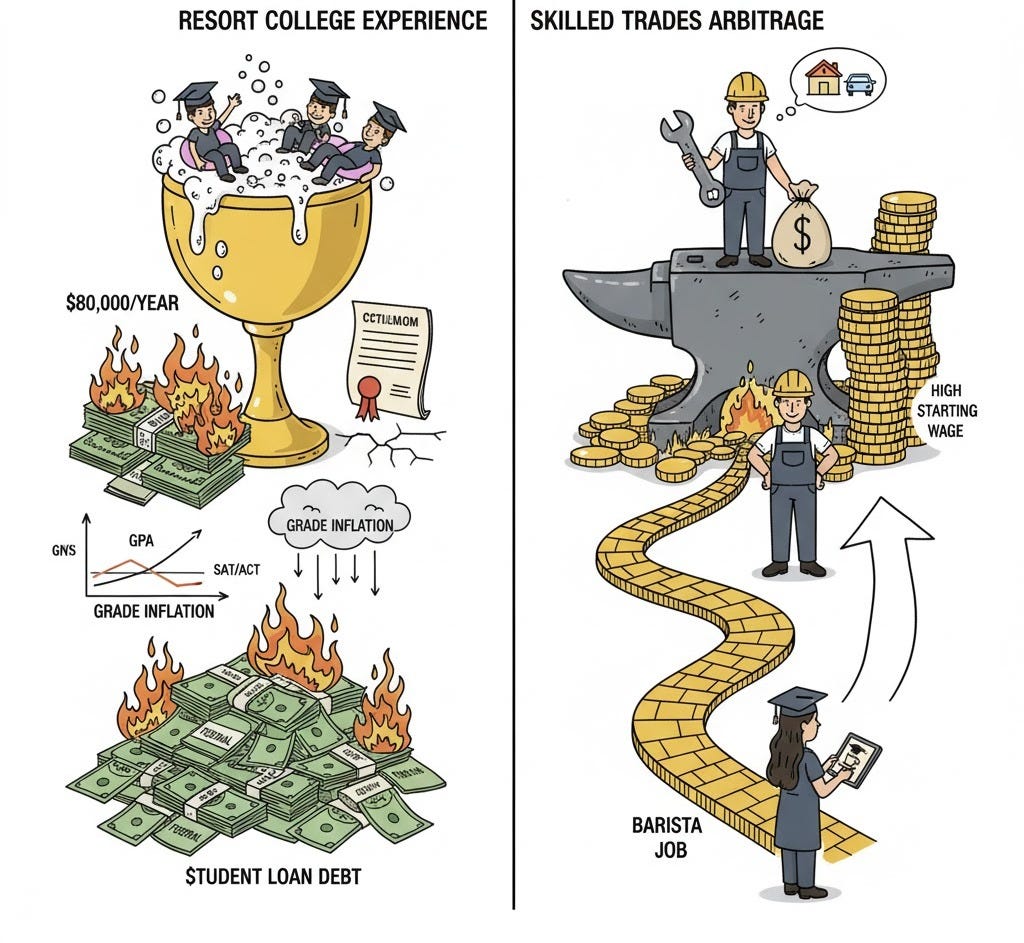

2) The Education Malinvestment: Grade Inflation, “Resort” Colleges, and Negative ROI

The narrative that “everyone needs a degree” has resulted in a massive misallocation of capital and time.

Others are partly to blame for pushing this “college-is-necessary” narrative to Gen-Z and not adapting with the times… older generations failed to properly gauge the modern utility of random college degrees and remained erroneously convinced that “just going to college” is always winning move… so that’s what they told Gen-Z to do.

Gen-Z has to take some responsibility for their own decisions though. And institutions deserve some of the blame for letting intellectually challenged people into college and then wondering why they can’t pass tests or achieve anything.

The “College Premium” is actively eroding for the bottom 50% of graduates, yet Gen Z continues to buy the product at premium prices. Unless you are high IQ and/or go into a high ROI field… you’re getting swindled by universities.

Can’t really blame the universities for cost because if they charge less, people stop going and they have to fire staff, eliminate bullshit/low ROI majors, and recalibrate costs… the students blindly paid for degrees worse than Trump University.

The Competency Crisis: Why Transcripts are Lying. Lowered admissions screens and rising GPAs do not equal capability.

Grade Inflation: High school GPAs have risen steadily since 1990, while SAT/ACT scores have remained flat or declined. An “A” average today statistically signals the same competency as a “B-” in the 1990s.

The Readiness Gap: NAEP scores in reading and math have deteriorated (especially post-2020). Telling Gen Z to “just pick STEM” without the foundation is fantasy; Calculus I failure rates of ~20%–40% at many institutions prove that grade inflation is hitting the wall of reality.

The Reversal: After a wave of “test-optional” policies, elite schools (MIT, Yale, Dartmouth, Harvard) have reinstated testing requirements. They implicitly admitted that without objective screens, students were self-immolating in majors they couldn’t handle.

The “Experience” Premium vs. The Boomer Commuter. Gen Z often views college as a consumption good (the “Experience”), while Boomers viewed it as a transaction.

Resort vs. Utility: Boomers often attended local commuter schools with minimal amenities. Gen Z pays for “The College Experience”—luxury dorms, climbing walls, and administrative bloat. This is a lifestyle purchase masquerading as an investment.

Mal-employment: According to the New York Fed, the underemployment rate for recent college grads (working jobs that do not require a degree) hovers around 33–40%. If you pay $80k for a degree to work as a barista, you haven’t invested; you’ve just delayed adulthood.

The ROI Trap & The 2010 Lending Shift. Not all degrees are assets; some are liabilities.

The “Negative ROI” Majors: Engineering, CS, and Nursing offer lifetime earnings >$3M. Conversely, Arts, Theology, and Psychology (without a PhD) often yield a negative financial return compared to a high school diploma once debt is factored in.

The Systemic Hazard: In 2010, the federal government effectively nationalized student lending, removing risk assessment. A private bank would lend $100k for Chemical Engineering but $0 for Gender Theory because the latter cannot service the debt. The government lends regardless of major, fueling the tuition spiral and trapping 18-year-olds who view loans as “monopoly money.”

The High-Agency Arbitrage: The Trades. While Gen Z fights for seats in “Email Jobs,” the physical world is offering a premium.

The Numbers: Registered Apprenticeship participation is ~680k active. These are debt-free paths with starting pay often exceeding $70k.

The Math: A 22-year-old electrician with $0 debt and 4 years of earnings is vastly ahead of a 22-year-old Sociology grad with $40k debt and an entry-level HR role. For Gen Z candidates whose cognitive profile isn’t a match for intensive calculus-driven degrees, the trades are not a “fallback”—they are the superior financial vehicle.

Verdict: Nuanced (Easier for Gen-Z if Smart Choices, Otherwise Hard Mode from Self-Inflicted Wounds)

Standards: Boomers had it harder. Grades were deflated, and admissions were tighter. Today, inflated grades trick Gen Z into expensive programs they aren’t prepared for.

The Trap: Gen Z plays on Hard Mode because the system (Gov lending + Universities) actively preys on their financial retardation, selling them low-ROI “experiences” that Boomers would have laughed at.

The Choice: Gen Z has agency. Choosing a low-ROI major at a private school is a luxury belief that the market is punishing. The “Trade School Arbitrage” is the single biggest unexploited edge in the 2025 economy.

3) Healthcare, safety nets, wars, technology

Healthcare access and risk environment are objectively superior now.

Coverage & safety nets: The ACA’s under‑26 dependent coverage and subsidized marketplaces helped push the uninsured rate to modern lows; Gen Z can bridge early‑career gaps that left prior cohorts naked. Telemedicine and cheap diagnostics are mainstream. (OSHA)

Public safety: Violent crime is down dramatically versus the early 1990s; 2023 data showed declines from 2022. Workplace fatality rates and highway deaths per mile are far below 1970s levels. Day‑to‑day risk of dying young is lower for Gen Z. (JCHS)

War & conscription: The draft ended in 1973. While the U.S. fought in Iraq/Afghanistan, there’s been no conscription for Gen Z; per‑capita war deaths are a tiny fraction of Vietnam‑era losses. The risk profile for civilians is radically lower. (Army)

Life‑enhancing tech: the multipliers Boomers never had.

Work from home & flexibility: Roughly a quarter to a third of paid days are remote in the post‑2020 equilibrium. Geographic arbitrage (live cheaper, earn national pay) is a very real lever if you use it. Boomers did not have this option at scale. (ASPE)

Digital rails & investing: The 2010s delivered ~13%/yr S&P 500 total returns, one of the strongest decades on record, with fractional shares, zero‑commission trading, and auto‑indexing now default. Gen Z’s entire investing adulthood has been spent on EZ‑mode rails—if they decided to participate.

The Economic Paradox: Cheap Toys, Expensive Life (Baumol’s Cost Disease) Here lies the core frustration for Gen Z: You live in an era of Tech Deflation but Service Hyper-Inflation.

Deflation: Electronics, software, and entertainment (TVs, stocks, apps) are cheaper and better than ever.

Inflation: Services that rely on humans (Education, Healthcare, Childcare) have skyrocketed in price.

Boomers lived in the inverse: TVs were expensive, but college and doctors were cheap. Gen Z feels poor because while they can afford the “circus” (Netflix/TikTok), they cannot afford the “bread” (Housing/Health).

Caveat: comfort cuts both ways. The same screens that make everything easy also steal attention, flatten in‑person networks, and worsen pairing dynamics for some. That’s not an excuse; it’s a reminder that tools demand discipline.

Verdict: Easier for Gen-Z

On coverage, daily safety, war risk, and productivity‑boosting tech, Gen Z has it easier and… it’s not even close. If you’re not using WFH flexibility, telemedicine, and low‑fee index automation, that’s unused edge. Complaining about Boomers can’t substitute for exploiting advantages they absolutely did not have. (OSHA)

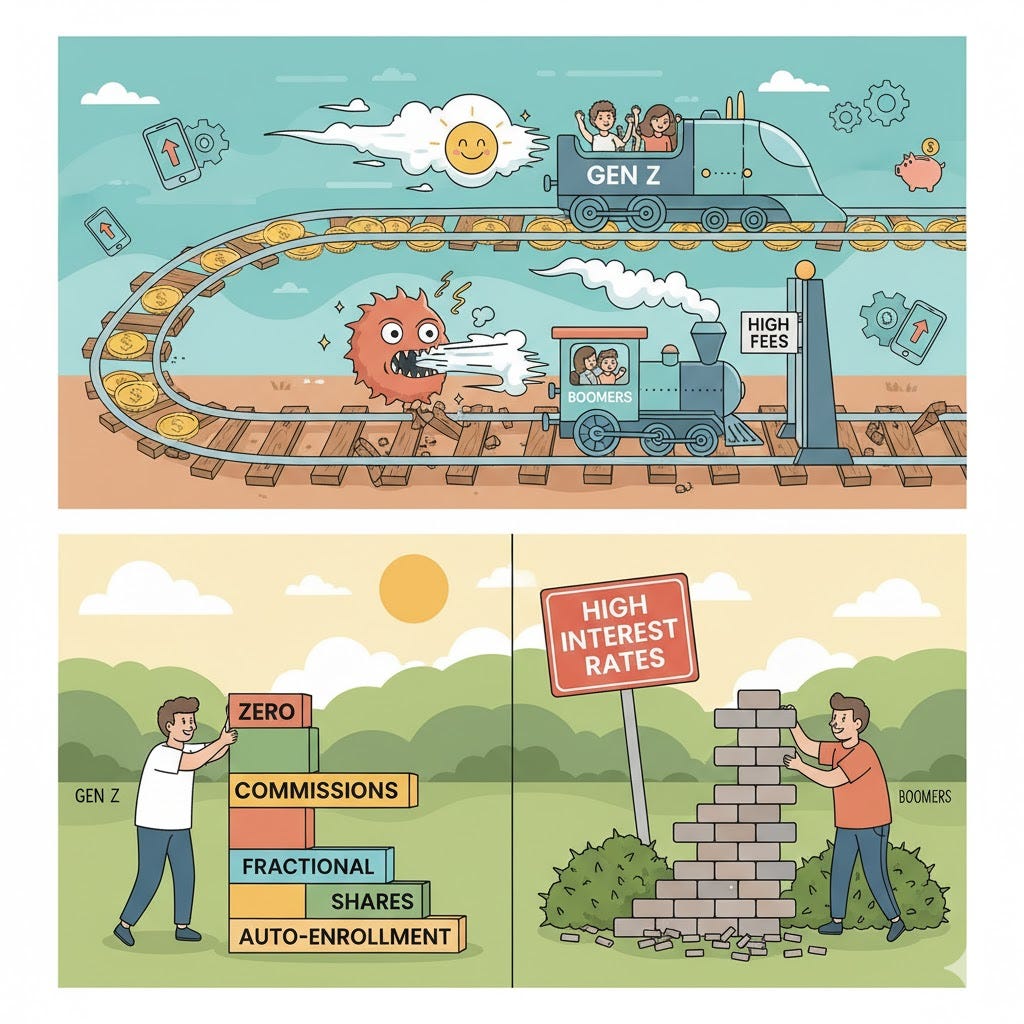

4) Wealth‑Building Rails & Interest‑Rate Cycles

The rails today are radically better than what Boomers had at 25.

Fees: The asset‑weighted average expense ratio on U.S. index equity ETFs is ~0.14%, with equity mutual funds around 0.40%, a fraction of historical costs. (ICI)

Commissions & fractional shares: Major brokers cut online equity/ETF commissions to $0 in 2019; fractional share trading rolled out widely by 2020, letting small savers buy slices and auto‑DCA. (Schwab)

Default saving plumbing: Autopilot 401(k)/403(b) designs are now standard: ~59–70% of large plans use auto‑enrollment and Vanguard’s plan‑weighted participation is ~85%; combined employee+employer total contribution rates ~12%. Those defaults didn’t exist for young Boomers. (Congress.gov)

Market backdrop when each cohort was young.

Older Gen Z’s adult investing window (2010s): One of the strongest decades in U.S. market history—S&P 500 ~13% annualized over the 2010s; the long‑run table is unambiguous. (Stern)

Late‑1970s Boomers: High inflation and punishing rates eroded real returns; retail access was costly and clunky until decades later (“May Day” deregulation was 1975, but the low‑fee index universe and zero‑commission platforms are very recent).

Translation: If older Gen Z adults didn’t build an investing habit from 2015–2021 during zero commissions, negligible fees, and a monster bull market… that was a behavioral miss.

Verdict: Gen Z’s wealth‑building environment is objectively easier

Cheaper funds, zero commissions, fractional shares, and automatic retirement plan rails layered on top of a historically strong decade for equities. Boomers had to fight frictions and inflation; Gen Z has to show discipline… and most are doing very well already!

5) Dating‑Market Dynamics & Family Formation

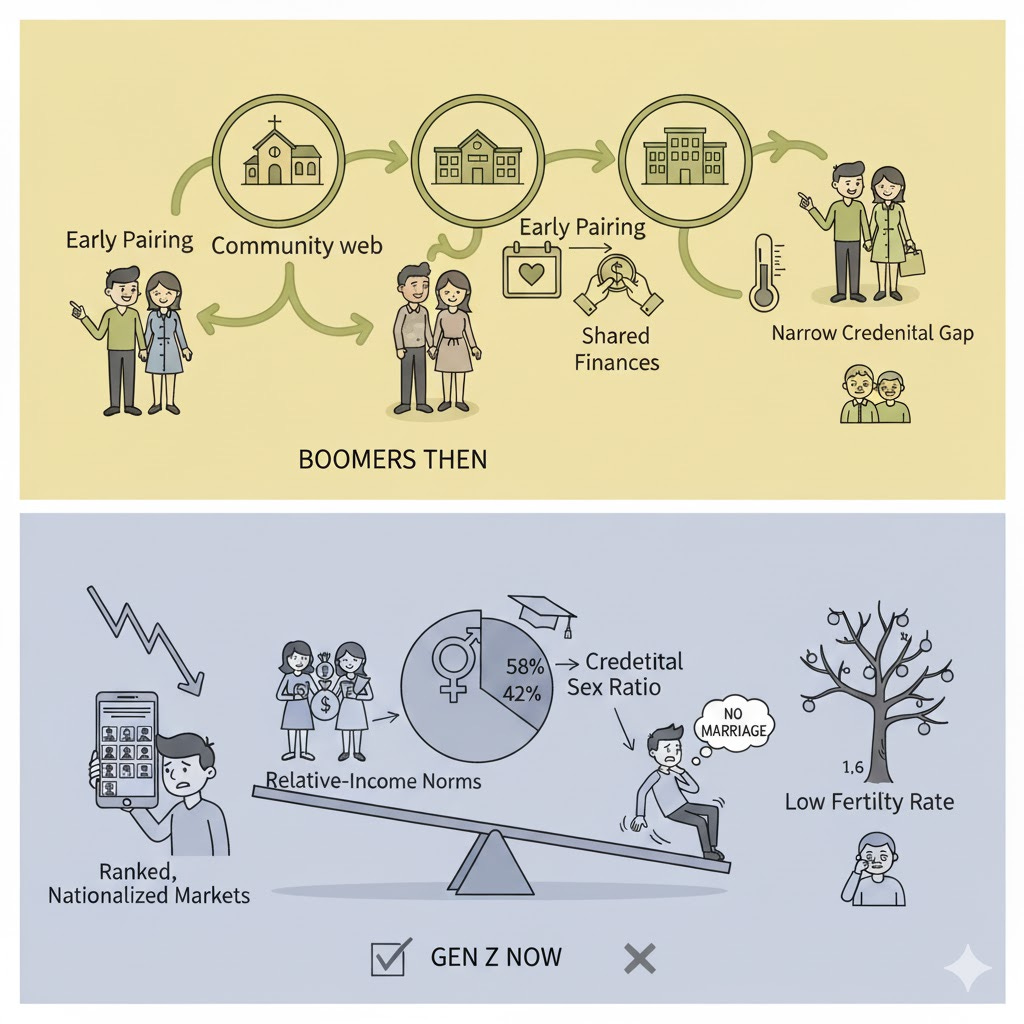

Boomers then.

Offline, local matching. Courtship ran through schools, churches, workplaces, neighborhoods… thick, repeated‑interaction networks that smooth out extremes.

Earlier pairing, narrower credential gaps. Smaller education differentials at the same age meant less assortative pressure to “match up.” The median age at first marriage was lower, and the default was two‑income pooling by late 20s.

Gen Z now.

Ranked, nationalized markets. Large dating platforms create pronounced desirability hierarchies; both men and women “reach up” (≈ 25% higher in measured desirability), and reply rates collapse with that gap—slowing matches for the median participant. (Science)

Credential sex ratio. Women are now ~58% of U.S. undergrads, shrinking the pool of similarly educated men right at prime matching ages—classic assortative‑mating friction. (NCES)

Relative‑income norms bite. At the point where wives would earn >50% of household income, marriage formation and stability both show a sharp drop—a behavioral “kink” consistent with identity norms. Affordability doesn’t erase that. (OUP)

Fertility baseline is low. Provisional CDC reads: 2023’s general fertility rate fell 3% (and broader measures put TFR ≈ 1.6). 2024 saw more births but continuing low rates. Price cuts alone don’t flip that trend. (CDC)

Verdict: Gen-Z deals with dating app savagery

Gen Z faces thinner local ties, steeper ranking, skewed sex ratios, and sticky relative‑income norms. Even with better prices, matching frictions cap marriage and birth rebounds.

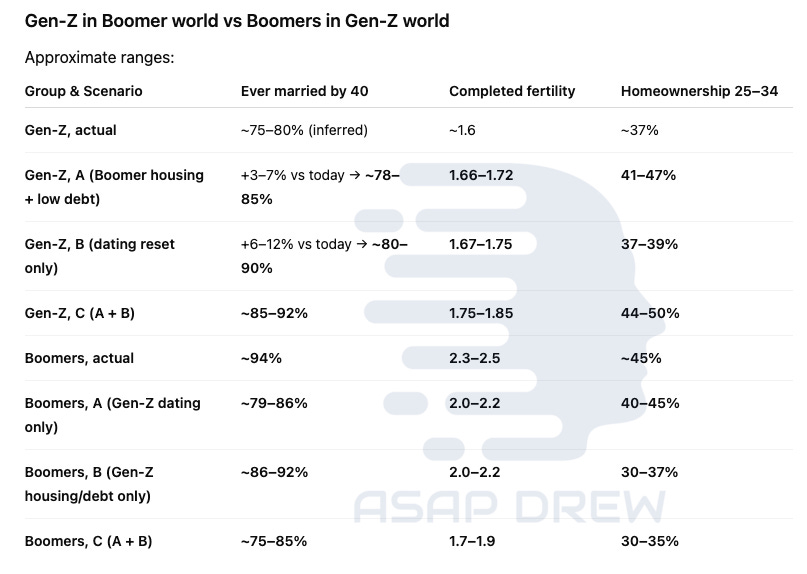

Counterfactual #1: Gen-Z with Boomer Affordability (Zero College Debt & Cheap Housing)

We start from today’s Gen‑Z conditions and then “fix” the economic and/or dating side to be like the Boomers had it.

A) Gen‑Z with Boomer housing + student debt + Boomer‑era mortgage rates

Assumptions:

Price‑to‑income: driven down from ~5.0× to about 3.0–3.2× (1990s‑like).

Student debt: in‑state public grads leave with minimal or no debt (Boomer‑like). (Urban Institute)

Mortgage rates: ~7–8% (typical for 1980s–1990s, i.e., not the ultra‑low 2010s, but similar to or slightly below today).

Dating dynamics, norms, and male earnings: stay like now.

Effects (Gen‑Z):

Homeownership (25–34):

Baseline today ≈ 37–38% (Millennial anchor).

With cheap prices + no debt → ~41–47%.

Marriage (25–34 share married):

Baseline ≈ ~39%.

With better affordability, more couples move from cohabiting/delayed to married → ~41–42%.

Fertility:

TFR today ≈ 1.6.

Cheaper entry into ownership and less debt gives a modest baby bump → ~1.66–1.72 (≈ +0.06–0.12).

Story: Housing and debt relief gives Gen‑Z more owners and a bit more family formation. But you don’t get anything like a baby boom; you mostly see earlier and broader first‑home ownership and a small increase in marriage and births among people who were already inclined to marry.

B) Gen‑Z with “fixed” dating dynamics; today’s housing/debt stay bad

Assumptions:

Costs: stay modern (PtI ~5×, big student debt).

Dating reset:

Education gap shrinks (men catch up to women in degrees).

Norms accept women “marrying down” in income/education. (WSJ)

Apps/digital platforms are less hierarchical / more “flat,” with more offline‑style matching.

Effects (Gen‑Z):

Homeownership (25–34):

Better matching → more stable couples, more dual incomes → ~37–39% (a small lift from more couples buying despite expensive housing).

Marriage (25–34):

Better matching + fewer “unmatchable” men/women → ~41–44% married in this age band (vs ~39% baseline).

Fertility:

More stable couples → more 1st and 2nd births even with high costs.

TFR moves from ~1.6 to roughly 1.67–1.75 (+0.07–0.15).

Story: Fixing the matching process and norms, even with ugly housing, raises marriage more than the pure affordability fix. But high housing/childcare costs still cap family size; you get slightly more couples and slightly more kids, not a return to 2.1.

C) Gen‑Z with both Boomer economics and a dating reset

Combine:

Boomer‑style affordability + minimal student debt

Dating market parity (education), softer relative‑income norms, fewer ranking frictions

Effects (Gen‑Z):

Homeownership (25–34):

A and B reinforce each other → about 44–50% (very Boomer‑like for young adults).

Marriage (25–34):

More viable couples + affordable housing → ~45–50% married (vs ~39% today).

Over the life course, share of adults ever married climbs materially; you’d see something more like late‑1990s marriage prevalence than today’s.

Fertility:

TFR rises to roughly 1.75–1.85 (+0.15–0.25 vs today).

That’s a real bump, but still below replacement (2.1).

Gen‑Z counterfactual:

Even when you give Gen‑Z Boomey housing and a friendlier dating market, you land at something like 1.8 kids per woman and near‑Boomer young‑adult homeownership, not a 1950s‑style baby boom.

Big constraints that remain:

Childcare and time costs

Different work norms

Long‑run shift in preferences around marriage and family size

Counterfactual #2: Boomers with Gen Z’s dating market, college debt, housing market

Now flip it: we start from Boomer reality and impose Gen‑Z‑style constraints.

A) Boomers with Gen‑Z dating dynamics, but Boomer housing/debt

Assumptions:

Housing/debt: stays cheap and light (PtI ~3.2×, little student debt).

Dating: shift to modern pattern:

Strong female advantage in higher ed,

weaker norms around marrying at all,

cohab widely accepted,

app‑driven, more hierarchical, more individualistic.

Effects (Boomers):

Ever married by 40: From ~94% down to about 79–86% (i.e., 14–21% never married, instead of 6%).

Completed fertility:

From ~2.3–2.5 → roughly 2.0–2.2.

More delay + more permanent singlehood and child‑free choices.

Homeownership (25–34): Cheap housing still wins: maybe ~40–45% (only slightly under the actual ~45% benchmark).

Story: Modern dating norms by themselves are strong enough to push Boomers down toward bare‑replacement fertility and non‑universal marriage, even though buying a house is still easy.

B) Boomers with Gen‑Z housing/college debt, but Boomer dating norms

Assumptions:

Housing/debt: Gen‑Z style:

PtI ≈ 5× (national), not ~3.2×.

Big student loans.

Dating/norms: Boomer‑era:

Strong expectation to marry, offline matching, weaker acceptance of lifelong singleness.

Effects (Boomers):

Homeownership (25–34):

Using the observed ~8‑point gap Millennials vs Boomers at the same age as a guide, you plausibly get ~30–37% (vs 45% in reality).

Ever married by 40:

Norms still push toward marriage; housing just delays it.

Likely ~86–92% ever married (only slightly lower than 94%).

Completed fertility:

Housing + debt costs shave off some 2nd and 3rd kids → ~2.0–2.2 (similar size hit as 3A but via finances, not matching).

Story: Expensive housing and big student debt radically change how Boomers live (more renting, later buying) but only moderately dent the likelihood they marry at all; norms and strong male earnings are doing a lot of work here.

C) Boomers with both Gen‑Z dating + Gen‑Z housing/debt

Now we stack the full modern constraint set on Boomers:

App‑driven, weaker marriage norms, higher female education, more cohab/singleness

Plus high housing prices and student debt

Effects (Boomers):

Homeownership (25–34):

Housing/debt constraints still dominate → ~30–35% (similar to B, maybe slightly lower if more people stay single and renting).

Ever married by 40:

Combine the matching hit and the affordability hit; you get something remarkably like today’s pattern.

~75–85% ever married, i.e., 15–25% never married (vs 6% in actual Boomer history), very close to the 25% never married at 40 we see in 2021 data.

Completed fertility:

Economic + matching constraints both pulling down.

From 2.3–2.5 → roughly 1.7–1.9, very close to today’s low fertility regime.

Story: Put Boomers inside a Gen‑Z‑style economic and dating environment and they look much more like today’s cohorts: more long‑term singles, fewer kids, fewer young homeowners — even though they still have the more stable late‑20th‑century labor market.

Gen-Z Expectation Distortion: The $588,000 Delusion

If you want to understand why Gen Z feels “poor” despite objectively high purchasing power, look at their benchmark for success.

The Data: The “Magic Number” Gap. A 2024 Empower survey revealed a staggering disconnect in what each generation believes they need to earn annually to achieve “financial success”:

Baby Boomers: ~$99,000

Gen X: ~$212,000

Millennials: ~$181,000

Gen Z: ~$588,000

The Anchoring Problem. Gen Z has anchored their “survival” number to a salary that puts them in the Top 1% of earners in 32 out of 50 states.

Net Worth Fantasy: Gen Z believes they need a net worth of $9.47 million to be successful. (For context, the actual top 1% net worth threshold in the U.S. is roughly $5.8 million).

The Happiness Equation: Happiness = Reality minus Expectations.

When Boomers hit $100k (inflation-adjusted), they felt they “made it.”

When Gen Z hits $100k, they feel like failures because they are $488k short of their imaginary benchmark.

Why is this happening? (The Algorithmic Warp). Gen Z isn’t stupid; they are hallucinating due to social media poisoning coupled with an overreaction to inflation, jealousy of older generations, and being a byproduct of “Good Times” (creating a mentally warped — in some cases spoiled — generation).

Algorithm-Induced Dysmorphia: Boomers compared themselves to their neighbors (who drove Fords). Gen Z compares themselves to the curated “Top 0.01%” on TikTok/Instagram (who fly private). The “average” life is invisible on social media, making “extreme wealth” look like the baseline.

Baumol’s Nightmare: Because housing and childcare have tripled in cost, Gen Z intuitively feels they need “rich person money” just to buy a “standard Boomer life” (house + 2 kids). They aren’t wrong that it costs more—but they are overshooting the mark by 600%. They also don’t realize that many goods have deflated significantly.

The “Good Times” Curse (Jealousy & Fragility): Gen Z is a byproduct of the adage: “Hard times create strong men, good times create weak men.” Growing up in an era of relative safety, no draft, and instant digital gratification has created a mentally warped (and in some cases spoiled) generation. This lack of resilience fuels a vicious jealousy of older generations; they view Boomer wealth not as the result of 40 years of compounding, but as an injustice, simply because they cannot handle the friction their ancestors tolerated.

Pathological optimism? Remarkably, 71% of Gen Z believe they will achieve this financial success (vs. only 45% of Boomers). This creates a dangerous setup: A generation convinced they deserve and will get top 1% outcomes. When the market (reality) only delivers median outcomes (~$60k), the result could be both disappointment and subsequent radicalization. They don’t blame their expectations; they blame “Capitalism” (and rallying against capitalism will further erode their wealth).

Gen-Z’s mental calibration error

Gen Z is suffering from a massive calibration error. They have conflated “Financial Freedom” with “Elite Status.” Until they recalibrate their definition of “Enough” closer to reality ($100k–$150k), they will remain miserable, regardless of how well the economy performs.

High‑Agency Playbook for Gen-Z’ers

If I had advice for Gen-Z thinking about career paths, what would I recommend?

Female: Nursing-maxxing if you can handle it and run up the racks… try to avoid shift work if possible. Max your advancement if you are motivated (e.g. upgrade to “Nurse Practitioner” or whatever). If not just roll with general nursing. Dental Hygienist, Ultrasound Tech, etc. aren’t bad either. Be cautious of invites to Dubai.

Male: Electrician. Plumber, HVAC Tech. Ultrasound Tech. Nursing (if you can stomach being in a female-dominated field… it’s very lucrative). Air Traffic Controller, Elevator Technician, or start your own biz. Construction isn’t a bad option either (but you will be competing with illegals in some places… then again you can hire them off-the-books if running your own biz).

You can do pretty much anything… invest smartly and try not to full-port YOLO on some quantum computing stocks while they’re in a hype bubble… or memecoins. If you want to gamble, limit yourself to a small % of your income.

Do the standard investing shit (I’m not giving financial advice). Basic shit: Keep most money in a high-yield savings account and/or SGOV (for dip buying and spending)… DCA into SPY/QQQ (or whatever is easiest), Hard Assets & Commodities (e.g. Gold, Bitcoin, Copper, Uranium, Oil/Energy)… and consider other niche ETFs that align with gov spending (e.g. ITA/PPA) and maybe select international markets.

A) Education & skills (ability‑aware, debt‑aware)

Gate first, borrow later. Use a proctored placement (SAT/ACT + math placement). If you can’t pass Calc I without remediation, route to applied tech / IS / supply chain / allied health / registered apprenticeship instead of lighting money on fire. (Apprenticeship scale: ~680k active in FY 2024; DOL cites ~$80k average starting pay for completers; ~90% retention.)

Debt rule: Total undergrad borrowing ≤ your expected first‑year salary.

The “Blue Collar” Arbitrage: Stop viewing the trades as a fallback; view them as a superior financial vehicle. This is pure math.

The Scenario: An electrician starts earning at 19, carries $0 debt, and invests the difference (compound interest). A white-collar grad starts earning at 23, carries $40k debt, and spends 5 years catching up.

The Result: By age 30, the net worth of the tradesman often exceeds the white-collar grad who is just finishing paying off loans. In an AI-saturated world, “people who fix physical things” have a wider moat than “people who send emails.”

B) Housing (buy the payment, not the brand)

Target ≤ 30% of gross for PITI; start with 1,200–1,600 sq ft or a duplex/condo; house‑hack or partner to pool DTI sooner.

Move toward elastic‑supply metros; don’t fight 5× price‑to‑income markets if remote‑eligible.

C) Work & earnings (use the rails Boomers lacked)

Remote is structural: Americans still work about 28% of paid days from home… time and geography arbitrage Boomers didn’t have. Re‑deploy saved commute hours to sales/ops/AI‑tooling or a license (e.g., electrician, rad‑tech). (AEA)

AI: be the complement, not the substitute. Translate tools into throughput (fewer hours per deliverable) and scope (more complex deliverables). The exposure is real, but the upside goes to adopters.

D) Money (automation > opinions)

15–20% gross to retirement + taxable index funds by default; auto‑increase 1–2 %/year. You have near‑zero fees and $0 commissions—a structural surplus Boomers didn’t enjoy at 25.

E) Family on purpose (acknowledge the market you’re in)

Treat partnership like a project: cap swiping time, maximize offline repeated‑interaction settings if possible (clubs, sports, faith, service), and move if your local sex‑ratio/age mix is hostile to your goals.

Relative‑income norms exist: Raise earnings/credibility or date across education lines if children are priority. (There is MASSIVE DROP-OFF in marriage when the female earns 50%+ of the income!) (OUP)

F) Mindset (Recalibrate Reality)

Kill the $588k Anchor: The market will not pay you $588k just because TikTok convinced you that is the baseline for survival. That number is a statistical hallucination (Top 1%). It’s fine to work towards that… but expecting it may lead to disappointment/defeat.

Reject the Jealousy: Many in Gen-Z grew up in safety and instant gratification; do not let that make you fragile. Stop viewing Boomer wealth as an injustice; view it as the result of 40 years of compounding that you haven’t done yet. If you cannot handle the friction your ancestors tolerated, you are the problem, not capitalism.

Fix Your Happiness Equation: Happiness = Reality minus Expectations. Currently, your expectations are 600% over reality. Stop letting the algorithm distort your perception of “average.” Delete the feeds that make you feel like a failure for not flying private at 25. The goal is Financial Freedom (time autonomy) with potential but not guaranteed upside.

Final verdict: Gen-Z vs. Boomers

The head to head comparison was fun and I learned quite a bit about the current older generation (Boomers) and the young adults (Gen-Z). Each generation has good people.

The challenges for each generation are highly nuanced. And even if — from a meta lens — Gen-Z is mentally entitled/spoiled or whatever… this itself is a disadvantage.

From an overall happiness and “balanced life” perspective, I’d say Boomers had it way easier (social life, family formation, stable work routines, housing, etc. — all matter more than the economy and money).

Gen-Z had their lives uprooted by COVID and was pushed to go to college by parents to get degrees (for the sake of degrees)… many weren’t good fits for the actual labor market.

Colleges accepted nearly everyone (despite many being intellectually unqualified)… and as a result these people graduate with an inability to effectively utilize their specific degrees/skills. The degrees were devalued in the process.

There will always be generational tensions over government spending.

The current biggest issue is expansion of the U.S. government and inefficient spending of taxpayer dollars with zero accountability… while allowing lifetime net negative taxpayers vote for policies that extract more money… leaving them feeling shortchanged (as though they are owed even more for nothing)!

It’s very easy to spend other people’s money. Government reform or a reckoning with the debt and interest on debt may be coming eventually, but I don’t think it’s coming anytime soon.

I suspect the spending train doesn’t stop… and fiscal dominance is the result (cue Lyn Alden: Nothing Stops this Train!)… live and invest accordingly. Perhaps AI/robotics and automation will surprise to the upside. You should be supporting rapid AI acceleration if you want to save the country… it’s currently the only shot.

On daily living conditions, market/investing access, and tools — Gen Z has it easier than Boomers did at the same age.

On dating dynamics and norms, Gen Z has it harder — and those frictions won’t yield to mortgage or tuition tweaks alone.

The most durable gains come from discipline and routing: right‑sized housing, early cost‑pooling, ability‑aware education, relentless investing (to outpace inflation), and using the time/tech rails Boomers never had.

Blame is free but sterile. Outcomes in the next decade will be set less by inter‑generational shouting and more by whether Gen Z acts like owners of their budgets, careers, cities, and timelines.