Bitcoin's Bull & Bear Cycles (2011, 2013, 2017, 2021): A Historical Thought Experiment with Retroactive Predictions

Predicting Bitcoin cycles retroactively with AI...

With the help of AI, I conducted a historical thought experiment that analyzed all information we had up to each of Bitcoin’s market “cycles” (bull-to-bear) to predict: bull peak prices, bull peak dates, correction (%s), bear lows, bear market dates.

So for the first cycle we’d use all information post-2011 to determine when BTC would likely peak in 2013 and the peak price, then correction price… thereafter we’d attempt to predict the same things for the 2017 cycle, 2021 cycle, etc.

Essentially we are used information available only up to the prior cycle to predict what would most likely happen in the subsequent cycle (using pure logic) - and then comparing this to what actually happened in those cycles.

Related: Predicting Bitcoin’s Next 3 Cycles (2025, 2029, 2033) Using only Data up to 2022 Bear Market

Major Bitcoin Cycles: 2011, 2013, 2017, 2021

Below are the major peaks and troughs typically referenced for Bitcoin:

Peak (Jun 2011): $30

Trough (Nov 2011): $2Peak (Nov 2013): $1,150

Trough (Jan 2015): $165Peak (Dec 2017): $19,800

Trough (Dec 2018): $3,128Peak (Nov 2021): $69,000

Trough (Nov 2022): $15,600

For our “predictions,” we take the vantage point right after each trough—when we knew the last peak and the new trough but nothing about the upcoming cycle.

Vantage Point #1: Late 2011 (After the $2 Trough)

Known Data Up to Nov 2011

Bull Run (2010–2011):

Price ran from ~$0.06 (mid-2010) to $30 (Jun 2011) → ~500× gain

Time from low to peak: ~12 months

Bear Market (2011):

Peak $30 (Jun 2011) → Trough $2 (Nov 2011) → ~93% drop

Time from peak to trough: ~5 months

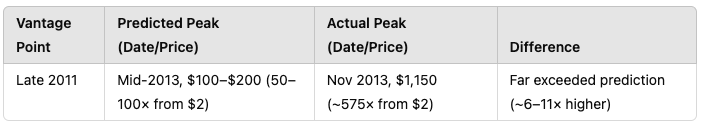

Hypothetical Prediction (as of Nov 2011)

Bull Length: Possibly 12–18 months to the next peak (mirroring the previous ~1-year run).

Price Multiple: The prior cycle saw ~500× off the very early lows. That might seem “too extreme” to repeat.

A more modest guess might be 50×–100× from $2 → $100–$200 peak.

Estimated Peak Date: ~Mid-2013 (12–18 months after Nov 2011).

Bear Correction: Maybe 70–80% afterward (common big drop in BTC’s short history).

Rationale & “Odds”

We might assume big upside still, but we’d be cautious about repeating an exact 500×.

The guess of $100–$200 would already feel extremely bullish coming out of $2.

Actual Outcome (2013)

Actual Peak: $1,150 in Nov 2013 (about 24 months after the $2 trough). That’s a 575× from $2 → $1,150, well above our hypothetical 50–100× guess.

Next Bear: Fell ~86% to $165 by Jan 2015.

Vantage Point #2: Jan 2015 (After the $165 Trough)

Known Data Up to Jan 2015

Previous Cycle (2011–2013):

Trough $2 (Nov 2011) → Peak $1,150 (Nov 2013) → ~575× gain, ~24 months

Bear Market (2013–2015):

$1,150 → $165: ~86% drop

Time from peak to trough: ~14 months