U.S. Strategic Bitcoin Reserve: "Digital Gold" for Economic Resilience... But "Crypto" Reserve? Braindead.

A strategic Bitcoin (BTC) reserve in the U.S. is logical, a strategic "crypto" reserve is stupid.

Initially I thought a strategic Bitcoin (BTC) reserve would probably be suboptimal for the U.S. government, but the more thought I’ve given this, the more I’m convinced adopting a strategic Bitcoin reserve could be smart — and akin to the government holding a strategic reserve of “gold bars” at Fort Knox (assuming the bars are actually there). (If it works out, I actually think BTC is superior to physical gold for various reasons, but won’t explain that here.)

The emerging consensus: a modest yet meaningful U.S. Bitcoin Reserve may not just be viable, but could yield significant economic, strategic, and humanitarian advantages. After initial skepticism, I’m in this camp, but somewhat indifferent as to whether it happens.

U.S. Monetary Landscape (2025)

The impetus for considering an SBR is rooted in several converging factors:

High National Debt & Inflationary Pressures: Persistent deficits, quantitative easing, and expansive monetary policy have fueled concerns about potential dollar debasement. While the dollar remains strong, periodic inflation scares highlight the need for uncorrelated reserve hedges.

Geopolitical Tensions: Rival powers (like China) experiment with central bank digital currencies, seeking to chip away at dollar dominance. Adversaries can also coordinate bond sell-offs or exploit global reliance on U.S. financial infrastructure.

Pro-Crypto Policy Shift: President Donald Trump’s second term has ushered in a more openly pro-crypto stance in Washington, igniting discussions about whether Bitcoin should be formally woven into U.S. reserves.

II. Rationale for a Strategic Bitcoin Reserve

1. Bitcoin as Digital Gold

Permanent Supply Cap (21 Million Coins): Bitcoin’s algorithmic issuance schedule and maximum supply are hard-coded. No government, corporation, or miner consortium can expand Bitcoin’s supply. This immutability mimics gold’s natural scarcity, where gold’s in-ground resources are finite. Unlike gold, Bitcoin’s finite nature is perfectly transparent—audited in real-time on the blockchain.

Scarce Yet Liquid: Gold reserves can be cumbersome to transport or audit. By contrast, Bitcoin settles globally within minutes, can be subdivided (down to 1 satoshi, or 1/100,000,000th of a BTC), and is verifiable by anyone running a node. It retains gold’s scarcity advantage while adding near-instant, borderless liquidity.

Overcoming Gold’s Drawbacks: Gold’s physical limitations (security costs, difficulty in fractional division) no longer apply. This positions Bitcoin as a truly modern “digital gold”—meeting the portability and auditability demands of 21st-century finance.

2. Hedge Against Inflation & Macroeconomic Risks

Protection from Dollar Debasement: While the dollar remains relatively strong, aggressive monetary expansion or unforeseen crises (like a major geopolitical conflict) can weaken it. A small BTC reserve can offset potential losses if market sentiment turns against fiat currencies.

Historical Correlations: Bitcoin’s price has often surged in periods of market uncertainty (e.g., post-2020 liquidity injections). This suggests it reacts to fears of fiat debasement, making it a potentially valuable diversifier alongside Treasuries, gold, and foreign currencies.

Insurance Policy for Uncertain Times: Holding BTC doesn’t imply expecting dollar failure; it simply provides a Plan B if macro headwinds undermine fiat confidence. In that sense, Bitcoin is akin to digital gold bars that can be rapidly mobilized or converted if financial unrest intensifies.

3. Front-Running Global Adoption

Anticipating Central Bank FOMO: As Bitcoin matures, other central banks will likely explore or adopt BTC. Even a small 2–3% allocation by several major economies would significantly push up demand—and thus price. A U.S. reserve acquired early would reap windfall gains from such a domino effect.

Legitimacy & Signaling: A U.S. endorsement of BTC elevates it from “speculative asset” to “mainstream reserve instrument.” Institutional players worldwide often take cues from U.S. monetary policy. Thus, front-running major global inflows positions America for price appreciation and stronger bargaining power in future crypto negotiations.

4. Supporting Domestic Innovation & Citizen Wealth

Boosting Americans’ BTC Holdings: Tens of millions of Americans already own Bitcoin. Government adoption and official reserve accumulation would lend the asset massive legitimacy—likely increasing Bitcoin’s global market cap and providing wealth gains to U.S. households.

Catalyzing Fintech & Job Growth: An SBR would put the U.S. stamp of approval on broader crypto technologies, incentivizing startups, exchanges, wallets, and mining operations to base themselves stateside. This deepens America’s foothold in blockchain R&D, cybersecurity, quantum-resistant cryptography, and beyond.

Implicit Check on Anti-Capitalist Policies: Notably, Bitcoin’s decentralized structure and finite supply can act as a safeguard against domestic policy extremes. When governments overspend or inflate their currency, Bitcoin tends to rally—nudging policymakers to avoid reckless moves that might pump the very hedge asset the government itself owns.

III. Reconciling Bitcoin with U.S. Dollar Dominance

1. Addressing “Undermining the Dollar” Concerns

Historical Parallel: Major economies have long held gold—even though they issue strong fiat currencies. Similarly, adopting BTC does not inherently signal distrust in the dollar; it mirrors the rationale behind owning gold: diversification and crisis insurance.

Digital Gold vs. USD: Bitcoin’s limited supply and volatility make it unsuitable for everyday commerce at scale—the dollar remains the unchallenged medium of exchange. BTC is best suited as a store of value, not the backbone of daily transactions.

Maintaining Dollar Confidence: A small BTC allocation (e.g., 1–5% of total reserves) won’t threaten the dollar’s dominant share. Public messaging can emphasize that the U.S. sees BTC as a complement—akin to how gold quietly supports existing fiat trust.

2. Complementary Roles: BTC vs. USD Stablecoins

I am a strong advocate for USD-backed stablecoins and think they need to be accelerated and integrated into the domestic and global economy as rapidly as possible.

We should be using USD stablecoins to further increase USD dominance AND save people/businesses money — while increasing transaction efficiency/transparency.

Stablecoins Pegged to USD: The U.S. already leads in stablecoin issuance (USDC, USDT). These tokens keep global crypto markets tethered to the dollar. Holding BTC in reserves alongside stablecoin dominance cements American influence in both “store-of-value” and “transactional” realms.

Two-Pillar Framework

Pillar 1: USD stablecoins for everyday digital commerce.

Pillar 2: BTC as a strategic hedge asset.

This dual approach harnesses both synergy (digital liquidity) and resilience (Bitcoin’s scarcity), reinforcing the dollar’s anchor role in global finance.

3. Optimal Allocation & Buying Strategy

Target Allocation (1–5%): Many economists propose a single-digit percentage to capture Bitcoin’s upside without overshadowing the U.S.’s enormous fiat reserves. A 3% BTC allocation in a trillion-dollar reserve system is still tens of billions in Bitcoin—substantial enough to matter, yet low-risk if BTC sees short-term dips.

Gradual Accumulation (Dollar-Cost Averaging)

DCA reduces wild price swings. Spreading purchases over months or years prevents the government from overpaying at a market peak or shocking the market with a huge buy.

Prevent Front-Running: By announcing broad intentions but not specific schedules, the Treasury can minimize front-runners trying to exploit the trades.

Public Transparency vs. Operational Secrecy

Periodic Reports: The government can disclose approximate holdings and cost basis to Congress.

Classified Details: Exact purchase times, wallet addresses, or amounts remain secret to hinder market manipulation or hacking attempts.

READ: Debunking the Myth that “Crypto” Kills the U.S. Dollar

IV. Domestic Implications (U.S.A.)

1. Public & Political Reception

Volatility Scrutiny

Critics may label Bitcoin “too speculative,” pointing to historical swings of 50% or more within a year.

A robust, long-term framing—citing gold’s historical volatility that never disqualified it—helps legitimize BTC’s role as an asset that appreciates over multi-year cycles.

Bipartisan Debate

Pro-Bitcoin Republicans may champion free-market innovation and citizen wealth gains.

Skeptical Democrats might worry about aiding a “speculative asset” with taxpayer funds—yet note that a small, carefully managed BTC holding parallels gold reserves.

Outcome: Clear, transparent communication about risk mitigation is key to winning broader political acceptance.

2. Economic & Fiscal Upsides

Capital Gains & Tax Revenues

If BTC prices surge post-adoption, both private and institutional U.S. holders benefit, generating increased capital gains taxes.

Some estimates suggest even a modest BTC rally—partly triggered by official endorsement—could inject billions into federal coffers over a few years.

Multiplier Effects for Crypto Ecosystem

Endorsement would fuel the establishment and expansion of U.S.-based crypto services (wallets, exchanges, security startups).

More mining activity could shift into regulated frameworks, capturing revenue, job creation, and consistent tax payments—rather than being offshored to countries with cheaper but dirtier energy sources.

Wealth Effect Boost

American households already hold a significant share of existing BTC supply. A national reserve endorsement would likely drive the asset’s global legitimacy, increasing its market value. That in turn raises overall household wealth, fosters consumer spending, and accelerates growth.

3. Regulatory Clarity

Formalizing Crypto Guidelines

With the U.S. Treasury or Federal Reserve actually owning BTC, federal agencies have a strong incentive to finalize robust regulatory standards, from custodial requirements to tax reporting.

By extension, private entrepreneurs benefit from consistent rules, spurring mainstream adoption of crypto-based innovations.

Eliminating “Regulation by Enforcement”

Historically, the SEC and other bodies often responded to crypto developments retroactively. A strategic BTC reserve signals a proactive approach, prompting well-defined policies that avoid stifling innovation.

Catalyst for Global Rulemaking

As the global financial leader, the U.S. could shape international crypto norms—coordinating with the IMF, BIS, and allied central banks to set best practices for custody, anti-money laundering checks, and quantum-security standards.

V. Global Geostrategic Considerations

1. Promoting Free-Market Capitalism & Humanitarian Value

Opposing Authoritarian Currency Models: Bitcoin’s decentralized network contrasts sharply with authoritarian states’ financial systems, where political elites retain tight control over money—whether via capital controls, rigid central bank policies, or outright currency manipulation. By holding BTC at the sovereign level, the U.S. aligns with a free-market approach to monetary policy, demonstrating that individuals (and not just governments) should determine how and where wealth is transferred.

A Lifeline for Oppressed Citizens: In countries like Venezuela, Zimbabwe, and Iran, hyperinflation, sanctions, or currency devaluation have devastated local economies and citizens’ purchasing power. Bitcoin offers a global, censorship-resistant hedge for people trapped in such regimes. By publicly endorsing BTC, the U.S. implicitly stands for individual financial rights—providing an “opt-out” mechanism against oppressive monetary frameworks.

Capitalism & Transparency: Because Bitcoin’s ledger (the blockchain) is fully auditable, it fosters a transparent, rules-based monetary environment. This openness resonates with free-market principles of fair competition and limited gatekeeping—making it difficult for any single power to rig the system.

2. Soft Power & Diplomatic Influence

Influencing Allies: If the U.S. formally holds BTC in its reserves, allied nations—especially those already exploring crypto policies—may emulate this move. Such a chain reaction would solidify Bitcoin as a recognized global reserve-like asset, with the U.S. leading in policy frameworks and institutional adoption.

Diplomatic Leverage: When crises strike fiat markets, Bitcoin often surges in value. If the U.S. Treasury holds BTC, it gains an asset likely to appreciate during periods of high financial stress—thereby enhancing its negotiating position in international finance. In currency conflicts or sanctions standoffs, holding a stake in BTC could offer a partial cushion or alternative mechanism for cross-border operations.

Enhancing Moral Authority: A pro-Bitcoin stance supports the notion of economic liberty, showing that the U.S. backs technology empowering individuals globally. This narrative can help sway countries on the fence about Chinese- or Russian-led digital currency initiatives.

3. Countering Authoritarian Currency Models

Central Bank Digital Currencies (CBDCs): Some authoritarian governments push CBDCs that provide them total oversight and control over user transactions. By contrast, Bitcoin is an open network with no central kill-switch or censorship checkpoint.

Competitive Differentiation: If the U.S. champions BTC, it offers an alternative template—one that respects individual freedom and privacy over top-down state surveillance.

Global Currency Warfare: Rival powers could attempt to weaponize their own digital currencies (e.g., a widely adopted digital yuan) to bypass the U.S. dollar-based system. A U.S. BTC reserve mitigates this threat because BTC, by design, sits outside national control—providing financial resilience independent of another country’s currency policies.

4. Cyber Threats & Quantum-Computing Concerns

Hacking & State-Level Adversaries: With a large national BTC reserve, the U.S. becomes a prime target for sophisticated nation-state cyberattacks (e.g., from North Korea or China). An SBR demands hardened cybersecurity, robust multi-signature protocols, and relentless “red team” exercises.

Quantum Computing: Within a decade, quantum machines might be capable of cracking current elliptic-curve cryptography. If Bitcoin’s cryptographic signatures become vulnerable, adversaries could theoretically forge transactions from addresses whose public keys have been revealed on-chain.

Quantum-Safe Upgrades: The U.S. can collaborate with Bitcoin core developers, universities, and cryptographers to prioritize post-quantum algorithms. Holding BTC thus incentivizes the government to spearhead quantum security for the broader network.

RELATED: Bitcoin vs. Quantum Computing Hack: Risk-Analysis

VI. Risk Management for U.S. Strategic Bitcoin Reserve (SBR)

1. Volatility & Market Timing

Dollar-Cost Averaging (DCA): The Treasury can purchase small tranches of BTC weekly or monthly over a set period (e.g., 12–24 months). This evens out the purchase price and minimizes the risk of making a massive buy right at a short-term market peak.

Front-Running Minimization: Classified Schedules: Specific times, amounts, and addresses remain secret to deter speculators from “front-running” Treasury buys. Political Cover: DCA also dilutes backlash—if the BTC price temporarily dips, it’s understood the government is averaging over many months, reducing accusations of mismanagement.

Moderate Hedging: While over-hedging can undermine the point of holding BTC, the government might selectively employ put options or protective collars to guard against an extreme collapse—especially during the initial accumulation phase.

2. Secure Custody & Cybersecurity

Multi-Signature Storage: 3-of-5 or 5-of-7 schemes distribute private keys across multiple federal agencies (e.g., Treasury, Federal Reserve, DoD). Each signatory manages hardware wallets in physically secure facilities. Combining them is required to move BTC, deterring both external hacking and insider collusion.

Geographic Redundancy: BTC keys (on hardware devices) are stored in separate, air-gapped vaults across various regions. This prevents any single breach or natural disaster from compromising the entire reserve.

Continuous Testing & Auditing: Annual Penetration Tests: Specialized “red teams” attempt to breach internal systems. GAO Oversight: Government Accountability Office can periodically audit security protocols, ensuring no weak links.

3. Quantum-Resistant Planning

Collaboration with Bitcoin Core Devs: Federal cryptographers can fund or co-develop post-quantum signature schemes (like lattice-based cryptography or isogeny-based protocols) within the Bitcoin community. Early implementation is crucial: once quantum computers approach a critical threshold, the network should already have a tested update ready to roll out.

Quantum Task Force: A cross-agency group (Treasury, NSA, DARPA, etc.) monitors quantum breakthroughs worldwide, ensuring the U.S. is not caught off-guard if adversaries suddenly surpass known capabilities.

4. Transparency vs. Operational Secrecy

Periodic Public Reporting: Release high-level figures: approximate BTC holdings, cost basis, overall performance. This fosters public trust and democratic oversight.

Classified Acquisition Details: Operational specifics—like daily buy amounts, wallet addresses, or multi-sig setups—remain confidential to avoid front-running and targeted attacks.

Legislative Safeguards: Congress might pass statutes limiting maximum BTC allocations or requiring supermajority approval to alter the strategic reserve policy. This ensures stability across different administrations.

Related: Predicting Bitcoin’s 2030 Price via Adoption Trends

VII. A Strategic “Crypto” Reserve with Altcoins is Braindead

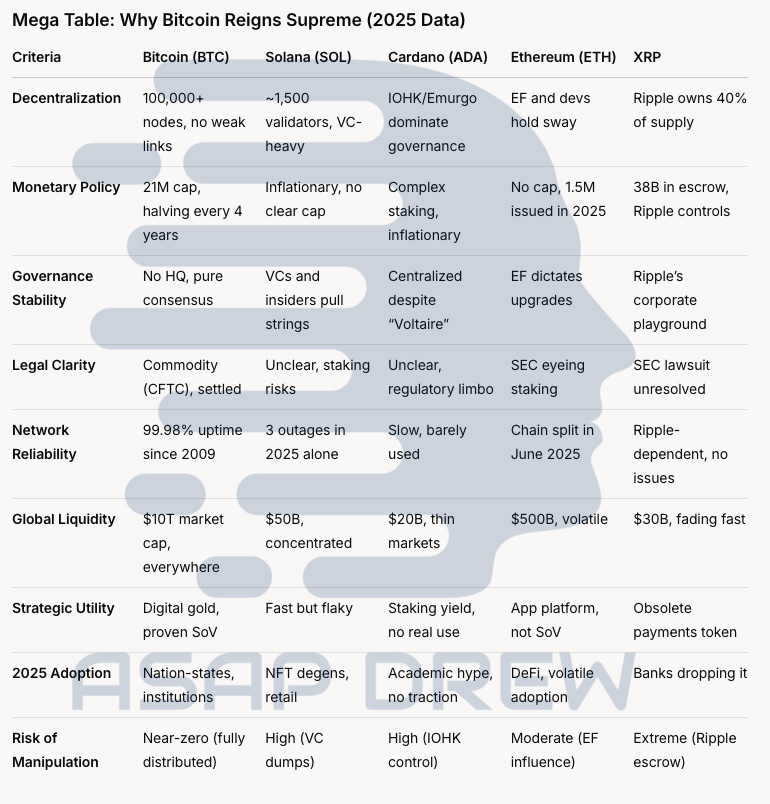

Despite a bustling crypto market filled with hype, most altcoins fail spectacularly when you apply the basic litmus test for a conservative, sovereign-grade reserve asset. Any government-backed strategic reserve demands these essentials:

Bulletproof decentralization: No central points of failure or control.

Immutable and predictable monetary policy: A fixed, transparent supply with no surprises.

Minimal governance turbulence: No drama, no central entities pulling strings.

Clear real-world utility, liquidity, and regulatory clarity: Globally accepted, legally sound, and liquid enough to move markets.

Bitcoin stands alone as the only crypto that effortlessly checks all these boxes. It’s immune to central manipulation, legally classified as a commodity, boasts a rock-solid 21 million coin cap, and enjoys unmatched global liquidity.

Related: Who is Satoshi Nakamoto?

In 2025, with nation-states like El Salvador and institutions piling in, Bitcoin’s dominance as the strategic reserve asset is unchallenged. Meanwhile, Solana, Cardano, Ethereum, and XRP collapse under scrutiny.

1. Solana (SOL): VC-Backed Crash Test Dummy

Network Instability and Frequent Outages: Solana’s “high-speed” blockchain is a house of cards. Even in 2025, outages persist—January saw a 6-hour downtime event, the third major crash in two years. Imagine the U.S. Treasury trying to liquidate reserves during a crisis, only to get a “network offline” error. Solana’s a ticking time bomb, not a reserve asset.

Extreme Centralization: With only ~1,500 validators in 2025 (versus Bitcoin’s 100,000+ nodes), Solana’s consensus is a centralized chokehold. A handful of VC-backed players could collude to halt the network or censor transactions. This isn’t decentralization—it’s a corporate sandbox.

VC-Controlled Governance & Insider Influence: Over 50% of SOL’s supply is still tied to venture capital and early insiders. In 2025, a16z dumped another 10 million tokens, crashing the price 15% overnight. A strategic reserve can’t be a punching bag for VC exit strategies.

Reality: Solana’s a turbocharged slot machine for degens and NFT flippers. It’s fast until it’s not, centralized despite the hype, and a liability no government should touch.

2. Cardano (ADA): Reddit’s Favorite Pipe Dream

Glacial Progress & Academic Vaporware: Cardano’s been “almost there” for a decade. By 2025, its DeFi TVL is a measly $500 million—Ethereum’s is 100x that. Peer-reviewed papers don’t pay the bills, and adoption is a ghost story. Bitcoin doesn’t need to promise utility—it delivers.

Centralized “Decentralization”: The Voltaire upgrade in 2025 was supposed to decentralize governance, but IOHK and the Cardano Foundation still hold the reins. A governance vote in March saw 70% of stake controlled by these entities. Bitcoin has no HQ, no puppet masters—just code.

Staking ≠ Strategic Utility: ADA’s big flex is staking for 4% APY. Great, the Treasury can earn pocket change while the token bleeds 30% in a bear market. Bitcoin’s utility is being digital gold, not a speculative yield farm.

Reality: Cardano’s a cult fueled by Reddit hype and academic buzzwords. It’s a perpetual “next year” project—useless for a national reserve.

3. Ethereum (ETH): “Foundation” Roadmap

Perpetual Protocol Instability: Ethereum’s still tweaking itself into 2025—sharding’s delayed again, and a botched upgrade in June caused a 12-hour chain split. Bitcoin’s protocol hasn’t changed in a decade because it doesn’t need to. Ethereum’s a science project, not a reserve.

Supply Uncertainty: No hard cap, just vibes. EIP-1559 burns fees, but 2025 issuance hit 1.5 million ETH—unpredictable and inflationary. Bitcoin’s 21 million limit is carved in stone, no debate needed.

Heavy Core Team Influence: The Ethereum Foundation and Vitalik’s inner circle still call the shots. A 2025 roadmap shift—pushed by EF—sparked a 20% price drop. Bitcoin has no king, no foundation, just consensus.

Regulatory Ambiguity: Staking’s a legal gray zone. The SEC’s eyeing ETH post-Merge, and a 2025 ruling could classify it as a security. Bitcoin’s a commodity—clean, clear, done.

Reality: Ethereum’s a chaotic app platform, not a stable reserve asset. The U.S. Treasury can’t bet on a network that rewrites its rules every quarter.

4. XRP: Corporate Trash Coin

Related: XRP: Future of Finance or Shitcoin?

SEC Nightmare: Ripple’s SEC lawsuit drags into 2025, with a ruling still pending. XRP’s one judge away from being a legal pariah. The Treasury holding a potential security? That’s a clown show waiting to happen.

Zero Unique Utility: XRP’s “cross-border payments” pitch is irrelevant. Stablecoins like USDT moved $2 trillion in 2025, dwarfing XRP’s $50 billion. FedNow’s faster and cheaper too. XRP’s a relic with no purpose.

Extreme Corporate Control: Ripple holds 38 billion XRP in escrow—40% of supply—dumping 1 billion monthly in 2025. That’s not a currency; it’s a corporate slush fund. Bitcoin’s fully distributed, no suits in charge.

Reality: XRP’s a centralized embarrassment—legally toxic, functionally obsolete, and tethered to Ripple’s whims. It’s the crypto equivalent of a bad penny stock.

VIII. U.S. SBR: Strategic Value vs. Potential Pitfalls

A.) Balancing Dollar Dominance & BTC Reserves

No Competition with USD: A small BTC reserve (1–5% of total holdings) doesn’t threaten the dollar’s primacy in commerce or foreign exchange. Instead, it acts as a complementary hedge, much like gold.

Preserving Dollar Confidence: By maintaining transparency around scope and rationale, policymakers can frame BTC as a modern “digital gold bar,” not a replacement for USD.

B.) Upsides

Hedge Against Macroeconomic Shocks: A non-sovereign, non-correlated asset mitigates inflationary or debt-related risks.

Boosts Domestic Wealth: Government endorsement can push BTC’s price higher, enriching U.S. citizens who already hold a significant global share of Bitcoin.

Promotes Free Markets & Human Rights: Champions an open, censorship-resistant monetary system—empowering citizens under oppressive financial controls.

Incentivizes Fiscal Responsibility: If federal mismanagement of the dollar leads to higher BTC valuations, it indirectly pressures lawmakers to avoid reckless monetary policy.

Geopolitical First-Mover Advantage: Early accumulation outpaces other nations, yielding potential windfall gains when they inevitably adopt BTC.

C.) Risks

Volatility: Short-term drops can spark political backlash or PR nightmares about “taxpayer losses.”

Operational Complexity: Requires advanced cybersecurity, multi-signature protocols, quantum readiness, and stealth accumulation strategies.

Messaging & Public Perception: If not framed properly, critics might argue it signals “dollar weakness” or panders to crypto-lobby interests.

Potential Regulatory Clashes: While BTC is generally seen as a commodity, broader crypto regulations could shift rapidly—though Bitcoin is far less exposed than altcoins.

Net Strategic Value

A well-executed strategic Bitcoin reserve—small but meaningful in scale—can reinforce the United States’ financial resilience, align with free-market capitalism, support oppressed populations globally, and keep domestic policy more accountable.

The synergy with existing dollar dominance (especially through stablecoins) remains intact, ensuring that BTC complements rather than competes with the greenback.

IX. Path Forward for U.S. SBR (2025)

The U.S. Strategic Bitcoin Reserve concept has moved from fringe to feasible. Over a decade, Bitcoin has grown from a niche experiment to a global, multi-trillion-dollar asset with a track record of surviving regulation scares, market crashes, and internal debates—none of which undermined its core scarcity and decentralization.

A measured allocation in BTC is analogous to holding a modern, digital version of gold.

Policy Recommendations

Legislative Framework: Authorize the Treasury (or Federal Reserve) to allocate 1–5% of total reserves to BTC. Introduce oversight mechanisms ensuring purchases remain gradual and transparent at a high level.

Gradual Accumulation: Implement dollar-cost averaging over 12–24 months to mitigate market shocks and political blowback. Keep exact daily/weekly purchase details classified, but provide Congress with aggregated updates.

Robust Custody & Quantum Preparedness: Mandate multi-signature storage across agencies, with offline, geographically distributed vaults. Fund collaborative efforts with Bitcoin devs to accelerate post-quantum cryptography readiness.

Clear Messaging: Emphasize that BTC is a complement—akin to gold—rather than a challenge to the dollar. Highlight humanitarian and free-market benefits, as well as domestic wealth gains.

Looking Ahead…

With strategic BTC holdings, the U.S. secures financial resilience, amplifies dollar-based stablecoin networks, and champions global economic liberty.

By staking a first-mover claim, the nation reaps both near-term capital appreciation and long-term credibility as the premier advocate for open-market, decentralized innovation.

In a future where digital assets loom ever larger, America’s proactive adoption of Bitcoin could be remembered as a watershed policy—one that bolstered national strength, fostered new economic freedoms worldwide, and safeguarded democratic capitalism in an era of profound monetary transformation.

Closing thoughts: A SBR isn’t necessary for the U.S. government in 2025, but wouldn’t be a bad move… it’s a game theory move. You start buying BTC as a “store of value” reserve asset, U.S. citizens hold more BTC than other countries, and it triggers a domino-effect wherein other countries feel as though they need to follow suit (giving the U.S. a front-runner advantage and adding legitimacy to BTC as a hedge asset).

I think Bitcoin (BTC) is a far better reserve asset than physical gold even if it hasn’t behaved that way currently/historically. Gold’s real-world necessity is minimal and diminishing rapidly, it’s difficult to transport, and there’s a big % of “gold investors” that don’t realize their shares aren’t actually backed by gold (double-counted).

Bitcoin is a superior asset to gold… but whether it inevitably becomes a hedge against inflation is all related to psychology. Like gold, you need enough people to perceive it as such and “buy in.” Once a critical mass of HODL’ers is achieved, BTC finally achieves “hedge asset” status… and with the adoption rate/uptake in the younger generation… it’s probably a matter of time.

A strategic “crypto” reserve though? BRAINDEAD.