Trump's "America First" vs. Zelenskyy's Dilemma: Ukraine-Russia War, NATO (E.U.) Free-Riding, China Ambitions

What is "America First" and what's likely to happen in the Ukraine-Russia war?

All anyone can talk about lately is the Ukraine-Russia war, indirect involvement by the U.S. and E.U., and the potential impact of China.

The left-wing (liberals, democrats, etc.) strongly favor funding Ukraine because they think: it’s the United States’ job as the global superpower to uphold democracy and stand up to autocratic bullies (e.g. Putin). They also think that the U.S. benefits significantly (even if the benefits are indirect) by supporting Ukraine and thus should uphold funding for Ukraine — especially considering that Ukraine gave up its nuclear weapons in the 1994 Budapest Memorandum (signed with the U.S., U.K., and Russia) — in exchange for security assurances.

Russia obviously violated the memorandum. The memorandum is misinterpreted by many as “U.S. protection is owed to Ukraine” but that’s not really what the agreement was.

The right-wing (republicans, conservatives, etc.) strongly favor ending the Ukraine-Russia war because they think things like: potential nuclear fallout, U.S. defense spending on Ukraine, pre-war corruption in Ukraine (e.g. money laundering), Zelenskyy supported Biden, humanitarian concerns (eternal “meat grinder”), influence of prominent figureheads (e.g. David Sacks, Elon Musk, etc.), thinking that the U.S. caused the war via NATO, thinking that the U.S. should trade with Putin, the EU isn’t doing enough, and misinformation/disinformation campaigns by Russian propagandists (high trait gullibility on the right).

From a humanitarian perspective and the deaths of Russians/Ukrainians, the best move is to end the war swiftly (fewer deaths of people who don’t want to be fighting). Most Russians have to do what Putin wants, and Ukrainians are just trying to keep their sovereignty (avoid being “puppet state” of Russia) — hence the current “meat grinder” scenario.

The recent talk/meeting between Trump and Zelenskyy at the White House was disastrous… a viral clip made Trump & Vance look like bullies, but I watched the full thing and thought Trump was fairly cordial most of the meeting.

Zelenskyy came across as lacking situational awareness and strategic thinking… it was basically “me me me” (and I don’t blame him with the fate of Ukraine on the line) — but when the fate of your country is on the line, you need to be strategic meeting with Trump (a guy with a huge ego who knows you may have wanted him to lose the 2024 U.S. Prez Election given that you were on the campaign trail with Biden in September 2024 in PA, a swing state).

There were a few lighthearted jabs thrown at Zelenskyy (e.g. “Why didn’t you wear a suit?” or whatever) but these were easy to handle. Zelenskyy mostly had it in the bag until ~45 minutes in when Trump said they’d be taking one more question… Vance spoke but Zelenskyy interjected and things took a fierce turn.

Captain obvious: The ideal play for Zelenskyy would’ve been to let Trump and/or Vance make you look like a fool, but get the damn deal done. Basically take a few punches on the chin in exchange for the minerals/security deal. Trump has a bigger ego than anyone and is trying to live up to his election slogan “promises made, promises kept.”

One of his campaign trail “promises” was that he will “end the war” that “would’ve never happened” between Ukraine and Russia if he’d been president instead of Biden (2020-2024). Trump wants credit for ending the Ukraine war and he wants to do get it done for various reasons (promises made/promises kept, ego boost, Nobel Peace Prize, etc.).

Knowing this is what Trump wants, you’ve got to throw him his win and just play the game… Zelenskyy failed here. What should Zelenskyy have done? Go with the flow, nothing controversial, and just take any deal while getting on Trump’s good side and you’re fine. Trump then gets to market his art-of-the-deal expertise as a “big win” and “highly successful deal” that nobody else could’ve done for the U.S.

But here we are. Zelenskyy choked in a key situation, but it’s not a “point of no return”… there’s still hope for him.

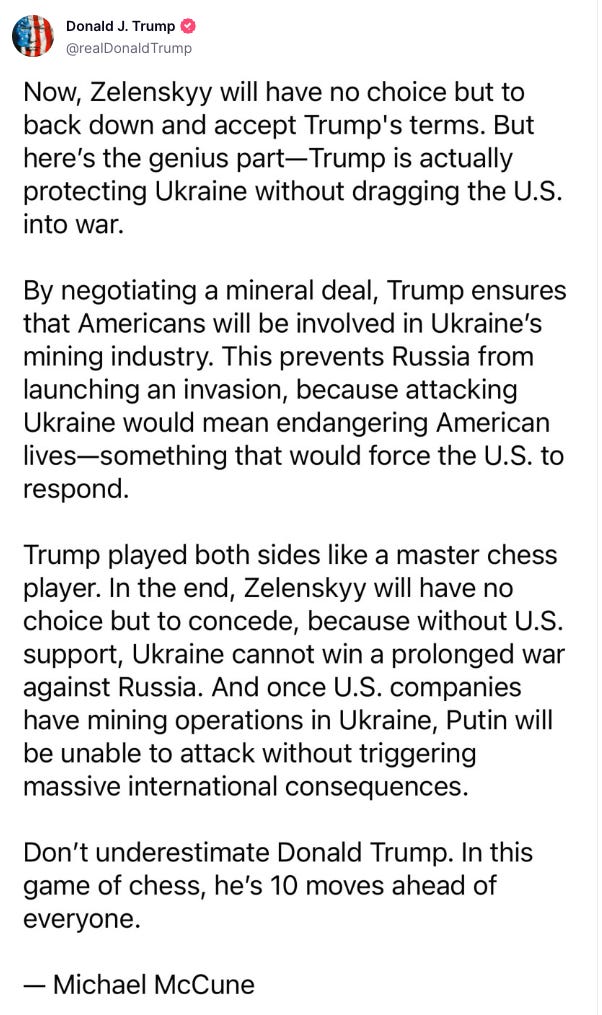

Trump posted on his “Truth Social” quoting a Tucson, AZ-based wedding DJ’s analysis that went viral on Facebook. And although it’s clearly the type of ego stroking Trump loves (keywords: “genius” + “master chess player” + “10 moves ahead of everyone”) — if Trump pulled off a deal that kept the peace (like this implies) it would be a good thing.

A few other key issues to discuss… The E.U. feels Ukraine isn’t getting enough Western support — yet they don’t want to actually increase funding themselves. Instead they’d rather freeload off of the U.S. — even when Russia is a far bigger threat to them (U.S. has greater separation).

(To be fair, thinking that someone isn’t getting enough funding and not wanting to personally give funding can still be logically consistent.)

The reason they don’t have the funds to increase Ukraine funding? I could go on an eternal rant, but the simplest factors: low native birth rates (population decline), excessive regulation, excessive socialism (anti-free market/capitalism), and unskilled/unfiltered immigration (fiscally net negative).

Another key issue to highlight is that the E.U. is funding both sides of the war (regardless of intent): Ukraine aid + Russia natural gas. In 2024, the E.U. imported a record ~16.5 million metric tons of liquid natural gas from Russia (beating the ~15.2 million in 2023).

I’d guess that most reasonable and “good faith” people on both sides of the aisle (Democrats & Republicans) believe some variation of the following:

Russia/Putin was the clear aggressor in this war

Siding with Putin/Russia goes against American morals & ideals

Zelenskyy is not a dictator and unlikely a criminal

There is no clear path to victory for Ukraine (I guess it depends how you define “victory” here, but odds probably low)

Continued Ukraine aid means a prolonged “meat grinder” type war (dragging out for years: more deaths, more money lost, economies tanked, etc.)

The U.S. needs to be highly-strategic in this conflict for the sake of themselves, allies, and the world

A negotiated peace deal with mechanisms in place to prevent future hostilities between Russia & Ukraine would be ideal (not sure how feasible though)

Zelenskyy lacked situational awareness (dealing with Trump/Vance) in the recent White House meeting and likely would’ve had a funding deal for Ukraine if he had just “chilled out” rather than injecting unnecessary convo with Trump/Vance

Although I don’t think Trump will be able to pull it off, perhaps the best outcome from a purely “America First” and humanitarian perspective would be: the U.S. getting minerals or rare materials from both Ukraine AND Russia simultaneously with some sort of peacekeeping arrangement (such that Americans are generating positive ROI win-wins from both countries in exchange for keeping the peace).

Another scenario might involve something like: a binding revenue-sharing agreement with Ukraine (20-30% in mineral rich zones) in exchange for continued U.S. support while simultaneously negotiating a separate agreement with Russia (e.g. raw materials & energy) that is maintained ONLY if Russia maintains current territory under strict oversight.

If you can’t work out anything with Russia and they are dead-set on continuing the war, I think the smartest “America First” play is continued U.S. aid for Ukraine with mineral payback deals — as this will weaken Russia and strengthen global security (China will likely prevent Russia from nuclear escalation).

What else could happen? The E.U. ponies up the extra funds to help Ukraine — doing some self-reflection and realizing they were freeriding off the U.S. (U.S. indirectly subsidizing their socialism via unfair trade practices, pharma IP, tech IP, defense/NATO contributions, etc.).

The ideal scenario for fixing the E.U. and getting their “GDP up” to fund Ukraine is a combination of: eliminating socialism, slashing as many regulations as possible, incentivizing skilled immigration, blocking or capping unskilled/fiscally negative immigration, and embracing AI/robotics to the maximum (zero regulation).

I should also highlight the fact that I don’t know much about Ukraine. It is true that Ukraine is more aligned with Western & European values than Russia (obviously) and are a buffer against Russian aggression/expansion, but corruption index rankings pre-war imply that Ukraine was/is extremely corrupt (nearly as bad as Russia). This means they have a lot to fix internally to gain international trust.

I. Ukraine-Russia Macro Context (2025)

A.) The Russo‐Ukrainian War (2022–2025)

Inception & Scope: Russia’s full‐scale invasion of Ukraine began in February 2022, marking one of the largest European conflicts since World War II.

Initially, Russia secured rapid gains—capturing key regions such as the Donbas, parts of Zaporizhzhia, and Kherson.

However, logistical challenges and severe manpower shortages quickly curtailed its momentum.

By early 2025, estimates suggest that Russian casualties have exceeded 700,000 (including killed, wounded, or missing), highlighting the heavy human cost and diminishing returns of its early territorial gains.

Russia is getting extremely poor ROI such that winning the war against Ukraine (if Ukraine keeps getting western funding) will be extremely taxing (years AND massive economic losses).

Western Support & Its Implications: The survival of Ukraine in the face of overwhelming odds has depended heavily on Western support.

The United States alone has contributed over $100 billion in aid—this includes advanced weaponry, critical intelligence, and extensive financial resources.

European allies have also supplied significant funds and arms, though their overall contributions remain modest relative to the U.S.

This continuous inflow of support has enabled Ukraine to resist Russian advances and maintain a credible defense, despite the cost.

However, this heavy investment is now under renewed scrutiny as domestic U.S. political currents demand tangible returns.

B.) Shifting U.S. Policy Under Trump’s “America First”

Trump’s 2024 Reelection & Promises: Donald Trump’s return to the White House in 2024 was fueled by a campaign platform that promised to end what he called “forever wars” and extricate the United States from long-term international entanglements.

Central to this platform is an “America First” doctrine that insists on extracting clear, quantifiable benefits from U.S. involvement overseas.

In the context of Ukraine, Trump’s administration now demands a direct economic “payback”—particularly in the form of concessions on critical minerals, which would serve as a tangible offset for the billions spent in aid.

Contradictions & Realpolitik Approach: Despite his campaign promise to reduce aid, the current U.S. strategy under Trump is more transactional. I actually like this approach because the U.S. has long been exploited by NATO allies… but it needs to be executed well (poor execution and it can backfire).

Instead of solely cutting spending, the administration is determined to secure economic returns—demanding, for instance, partial revenue shares (targeting 20–30%) in Ukraine’s key mineral sectors (lithium, titanium, and graphite).

This approach signals a departure from traditional alliance-based foreign policy, favoring instead a strict cost–benefit analysis where every dollar spent overseas must generate measurable returns.

In this model, conventional diplomatic ideals are secondary to realpolitik considerations, as the U.S. leverages its dominant market and military power to force allies and adversaries alike to deliver clear ROI.

C.) The Strategic Dilemma for Ukraine

Survival Imperative: For Ukraine, continued Western support is not merely a political preference—it is an existential necessity. President Zelenskyy faces the dual challenge of repelling Russian aggression and preserving national sovereignty amid a conflict that has cost the country dearly in lives and infrastructure.

Mineral Concessions as Leverage: In a bid to secure the indispensable aid from the United States, Ukraine has proposed offering partial stakes in its critical mineral resources.

By ceding 20–30% of revenues from minerals like lithium, titanium, and graphite, Zelenskyy aims to align with the U.S. demand for tangible returns.

However, much of these valuable resources are located in areas now under Russian occupation, complicating any potential deal.

The risk is that Ukraine’s concessions might not yield the promised benefits if those regions remain inaccessible.

Political Constraints & Misreading U.S. Signals: Internally, Ukraine is caught between national pride and the stark need for aid.

Zelenskyy’s reliance on moral appeals—emphasizing the humanitarian toll of the war—has clashed with Trump’s starkly transactional expectations.

This misreading of U.S. policy, compounded by Zelenskyy’s past political leanings (including indirect support for Biden in previous elections), has weakened Ukraine’s bargaining position and undermined its credibility in negotiations.

D.) Other Geopolitical Angles

China’s Rising Influence: As the war persists, China’s economic and military ties with Russia have deepened. A protracted conflict distracts the U.S. and NATO from critical Indo-Pacific issues (such as Taiwan), allowing China to leverage its growing influence. Beijing benefits from Russia’s reliance on Chinese trade and can position itself as an alternative mediator if Western unity fractures.

European Union Dynamics: The EU, despite being geographically closer to the conflict and facing direct security threats, remains heavily dependent on U.S. support. Many EU nations contribute far less to defense spending (often below the 2% GDP target) and struggle with internal ideological divides, including a tilt toward socialist, heavily regulated policies. At the same time, some EU members continue to engage in significant trade with Russia, which undermines the collective security posture that the U.S. seeks to enforce.

Right-Wing Talking Points & Propaganda: Within the U.S., far-right narratives have flourished—claiming, for example, that “Ukraine started the war,” “we’re funding a nuclear threat,” “Democrats used Ukraine for money laundering,” “NATO is the real problem,” etc. These oversimplified arguments, often amplified by Russian disinformation, ignore the nuanced strategic benefits of U.S. engagement. They fail to account for the long-term ROI of degrading a major adversary like Russia and maintaining U.S. market dominance.

Related: Jeffrey Sachs on U.S. Foreign Policy, NATO, Ukraine-Russia

II. Key Players & Motivations (Ukraine-Russia)

A.) The U.S. (Trump Administration)

Primary Objectives

Cost Minimization:

Curtail foreign aid “handouts” that yield no direct U.S. economic returns.

Keep annual expenditures on Ukraine (~$20–$30B) at or below 3–4% of the $800B defense budget, ensuring minimal public backlash.

Concrete Payback:

Trump’s team demands a 20–30% share in Ukrainian mineral revenues (lithium, titanium, graphite) to offset the billions already spent.

Potential deals with Russia may also be considered, e.g., discounted energy or aluminum in exchange for reduced sanctions or partial relief.

Global Leverage & Alliance Restructuring:

The U.S. leverages its unmatched tech, defense, and financial power to force allies (esp. EU) to meet higher defense spending targets and adopt freer trade terms.

Traditional alliances matter less if they fail to meet the administration’s strict cost–benefit metrics.

Strategic Dilemma

Isolation vs. Containment:

While domestic political forces push for reduced entanglement, purely abandoning Ukraine could embolden Russian expansion.

Hence, a limited engagement approach—sustaining enough aid to keep Russia in check, but conditioning every dollar on resource concessions.

Technological & Economic Edge:

The administration understands that many advanced systems (Patriot missiles, advanced drones, Javelins) come from U.S. industry—giving the U.S. a near-monopoly on critical capabilities.

This supply chain leverage compels recipients to accept “repayment” deals or risk losing vital military aid.

B.) Ukraine (President Zelenskyy)

Core Objectives

National Survival: Ongoing conflict demands consistent Western (particularly U.S.) financial and military help. Without it, Russia’s superior numbers could eventually overwhelm Ukrainian defenses.

Securing Long-Term Guarantees: Hopes for NATO-like membership or a bilateral defense treaty providing a deterrent to future Russian invasions. Must preserve some sovereignty over Ukrainian resources to prevent being seen as “selling out” the country’s wealth to foreign powers.

Political Vulnerabilities

Misreading U.S. Intentions: Overreliance on moral arguments to justify aid, ignoring Trump’s core demand for a quantifiable ROI. Zelenskyy’s prior alignment with Biden administration values further complicates negotiations under Trump.

Domestic Opposition to Resource Concessions: Any large foreign stake in Ukrainian minerals (20–30% or more) risks backlash from nationalists and corruption hawks who fear commoditizing sovereignty.

Occupied Regions Limiting Actual Mineral Value: A significant portion of Ukraine’s lithium, titanium, and graphite deposits lie in contested or Russian-occupied areas, reducing immediate feasibility of extracting and selling these resources.

C.) Russia (Vladimir Putin)

Strategic Goals

Territorial Control: Having seized Donbas, parts of Zaporizhzhia, and Kherson, Russia seeks either formal annexation or international recognition of these regions.

Undermine Western Unity: By extending the conflict and exploiting cost–benefit fractures in NATO/EU, Russia aims to reduce foreign aid flows to Ukraine.

Potential Further Expansion: If Western resolve falters, Putin may attempt new offensives or infiltration, especially in the Baltics or Southeastern Europe, testing NATO’s commitments.

Tactics & Economic Leverage

Offering Direct Deals to the U.S.: Proposed resource bargains from occupied Ukrainian territories (e.g., discounted energy, aluminum exports) that could tempt a “transactional” U.S. administration.

Nuclear Brinkmanship: Frequent nuclear rhetoric to deter deeper NATO involvement, though actual use remains unlikely due to deterrence logic and China’s anti-nuclear-escalation stance.

Propaganda & Disinformation: Targeting Western domestic opinion, reinforcing narratives that Ukraine is “not worth it,” pushing policymakers to cut ties or accept “peace” on Russian terms.

D.) China (Xi)

Primary Interests

Expanding Global Influence: Takes advantage of a “distracted West,” forging deeper Sino-Russian economic ties and presenting itself as a mediator if Western unity crumbles.

Economic Partnerships: Buys discounted Russian oil/gas and invests in sectors neglected by Western sanctions.

Preventing Nuclear Chaos: A nuclear conflict would devastate global trade, harming China’s export-driven economy, so Beijing strongly discourages any nuclear escalation.

Strategic Leverage

Possible “Responsible Power” Image: If the U.S. recedes into pure transaction mode and Europe remains divided, China could step in as a “responsible peacemaker,” overshadowing American claims of global leadership.

EU Influence via Economic Deals: If U.S. demands become too onerous for the EU, China’s Belt & Road investments and large consumer market might attract European states seeking alternative funding or security hedges.

E.) The European Union (EU)

Security & Economic Challenges

NATO Underspending: Many EU countries devote <2% of GDP to defense, relying on the U.S. nuclear umbrella and advanced weaponry for credible deterrence.

Internal Ideological Divisions: Some states champion robust defense spending and free‑market policies (e.g., Poland, Baltics), while others remain more dovish, heavily regulated, or even sympathetic to Russia.

Potential Realignment

Forced Free-Market Reforms: Under a purely transactional U.S. approach, EU states may be compelled to adopt more market-friendly, anti-socialist measures to retain favorable trade status or secure U.S. defense support.

Risk of Pivot to China: If U.S. demands become too stringent, certain EU members (e.g. France) might consider a partial shift toward Chinese investments or joint ventures—challenging U.S. global dominance.

III. Before the Disastrous Oval Office Meeting (Trump & Zelenskyy)

A.) Trump’s Mineral Demands & Transactional Approach

Demand for “Payback”: During private discussions in January 2025, Trump demanded a $500B “repayment” in the form of mineral concessions from Ukraine. This figure, far exceeding the approximately $100–$113B already spent, reflected a strictly transactional mindset. For Trump’s administration, every dollar invested overseas must generate a quantifiable return.

Zelenskyy’s Response & Misreading: President Zelenskyy, under immense pressure to secure continued U.S. aid, offered partial revenue-sharing of 20–30% from critical mineral sectors (lithium, titanium, graphite). However, he failed to grasp that Trump’s approach was not based on historical goodwill or moral obligation but on raw economic calculation. Much of Ukraine’s valuable deposits lie in regions now occupied by Russia—further reducing the immediate ROI of any deal.

Realpolitik Over Ideals: This phase marked a turning point where traditional alliance-based diplomacy was replaced by pure cost–benefit analysis. The U.S. demanded hard returns, while Zelenskyy’s moral appeals and historical narrative of Western support fell flat against Trump’s “America First” demands.

B.) The Putin-Trump Phone Call (February 12, 2025)

Discussion Points: In a 90-minute call, President Putin engaged directly with Trump. They discussed not only the Ukraine conflict but also potential resource deals—specifically, access to rare earth minerals and an aluminum supply arrangement from Russian-occupied Ukrainian territories. The call underscored that Russia was willing to bypass Ukraine entirely if the U.S. sought immediate economic benefits.

Moscow’s Strategic Gambit: Putin’s offer was designed to undercut Ukraine’s bargaining position by appealing directly to Trump’s transactional logic. If the U.S. accepted these terms, it would shift the economic “payback” directly from Ukraine to Russia—effectively sidelining Zelenskyy and weakening Ukraine’s long-term strategic leverage.

C.) Heightened Right-Wing & Domestic Pressure

Influence of Far-Right Narratives: Key conservative voices (e.g., Tucker Carlson, JD Vance, Elon Musk, alt-right influencers) amplified messages that Ukraine was overly dependent on U.S. aid, accusing it of corruption and of fueling a never-ending war. These narratives served to pressure the administration to prioritize a quick, cost-saving exit strategy—even if that meant a “mega deal” with Russia.

Internal Debate & Policy Pressures: Influential figures such as Elon Musk and David Sacks, embedded in Trump’s inner circle, argued that the war was an inefficient “meat grinder” that drained U.S. resources without yielding clear benefits. Their push for short-term peace was aimed at appeasing an isolationist base and reinforcing the “America First” agenda by reducing future expenditure.

IV. Zelenskyy’s Disaster in the White House with Trump & Vance

The meeting was basically on autopilot for the first ~45 minutes. Trump was pretty chill, Zelenskyy was going with the flow, Vance was sidelined, etc.

Trump said they would take one more question and Zelenskyy goes full-court-press on Vance. Zelenskyy botched it. Regardless of your political tilt, whether you hate or love Trump — Zelenskyy demonstrated an egregious lack of awareness.

Perhaps Zelenskyy assumed that the U.S. will give him what he wants with zero questions asked? That’s not how Trump operates. And when you imply that the U.S. will get attacked — it is triggering to patriots… the primal “reptile” part of the brain gets activated, and you start looking like an adversary.

Zelenskyy was basically like: If you don’t help me, don’t blame me when China or Russia shows up on your beautiful oceans and attacks and destroys your country. (He didn’t say this exactly, but we all know what he meant). YOU HAD ONE FUCKING JOB… and you failed.

Initially when I watched the “viral” trending clip, I thought Trump/Vance tag-team bullied Z during the meeting… but this isn’t what happened. Zelenskyy triggered them… it’s like a guy in a subordinate position starts threatening you indirectly if you don’t give him money — c’mon man.

A.) Contextual Backdrop

Meeting Details:

Date & Location: February 28, 2025, Oval Office

U.S. Delegation: President Donald Trump, Vice President JD Vance, Secretary of State Marco Rubio, advisors Richard Grenell and David Malpass

Ukrainian Delegation: President Volodymyr Zelenskyy, senior defense officials and diplomatic staff

Strategic Objectives:

U.S.: Secure access to Ukraine’s rare earth minerals in exchange for continued military and financial aid, emphasizing tangible returns for substantial support already provided.

Ukraine: Obtain firm U.S. security guarantees and continued aid without compromising sovereignty.

B.) Initial Exchanges & Rising Tension

Trump's Position: Emphasized the substantial U.S. investment in Ukraine’s defense, clearly expecting tangible reciprocity through a minerals agreement.

Zelenskyy's Response: Advocated for explicit security guarantees, arguing resource agreements without security commitments would lack value.

Vice President Vance's Reinforcement: Reinforced Trump's transactional approach, asserting explicit expectations of gratitude and cooperation from Ukraine.

C.) Escalation & Zelenskyy's Critical Mistake

Key Moment – Zelenskyy's Provocative Interjection:

Near the END OF THE MEETING, VP Vance addressed a final question reinforcing Trump’s diplomacy-based stance, highlighting America's attempt at negotiation versus military rhetoric.

Zelenskyy (for whatever reason) decided to ask vance a question “Can I ask you?” This poised diplomatic moment, directly challenging Vance.

Zelenskyy's choice of language, specifically stating the U.S. "will feel it in the future," referencing the safety granted by American geography and suggesting potential vulnerabilities, dramatically inflamed tensions.

His confrontational approach appeared disrespectful and out-of-place, violating diplomatic protocol and fueling conflict rather than collaboration.

Detailed Dialogue Context:

Zelenskyy directly questioned the effectiveness of past U.S. diplomacy, referencing failures from Obama through Biden administrations.

This discussion quickly turned heated, with Zelenskyy explicitly suggesting future threats to the U.S., provoking immediate backlash from Trump and Vance.

Trump & Vance's Strong Reactions:

Trump, visibly frustrated, bluntly accused Zelenskyy of ingratitude, highlighting Ukraine’s heavy reliance on U.S. military aid and emphasizing Zelenskyy's weakened negotiating position.

Vance intensified the criticism, accusing Zelenskyy of disrespectfully challenging the administration publicly, strongly rebuking him for escalating the situation unnecessarily.

Zelenskyy's Escalation:

Rather than diplomatically retreating, Zelenskyy maintained his confrontational stance, further agitating the situation by continuing to publicly debate U.S. strategy and military commitments.

D.) Immediate Fallout & Diplomatic Breakdown

Collapse of Negotiations:

Zelenskyy’s confrontation directly derailed the nearly finalized minerals deal, leaving the planned diplomatic engagement in disarray.

Zelenskyy exited without any formal agreement, joint statements, or assurances of continued U.S. support, seriously undermining Ukraine’s immediate diplomatic goals.

Consequences for Ukraine:

Zelenskyy’s diplomatic mismanagement significantly weakened Ukraine’s negotiating leverage, heightening immediate vulnerabilities and uncertainty around future American aid.

The incident critically damaged Ukraine's standing with influential U.S. Republicans, further risking bipartisan support.

Broader Geopolitical Impact:

NATO and European allies expressed growing concern, interpreting the incident as indicative of increasingly transactional American diplomacy, potentially weakening the collective Western alliance against Russian aggression.

E.) Strategic Analysis of Zelenskyy's Diplomatic Mismanagement

Fundamental Error:

Zelenskyy’s public challenge, particularly his implied threat regarding U.S. security, showcased poor strategic judgment and diplomatic incompetence.

Rather than employing proven diplomatic methods to appeal to Trump’s known personality traits (flattery, appeals to vanity, ego-management), Zelenskyy openly antagonized a critical ally.

Alternative Strategic Opportunity Missed:

Zelenskyy’s failure to secure the minerals deal, which had effectively aligned with Trump's personality and political motivations, represented a significant missed opportunity.

This deal could have locked Trump into a psychological investment in Ukraine's defense and provided a strategic anchor for sustained U.S. support.

Future Implications & Recommendations:

The diplomatic failure considerably damaged Zelenskyy’s credibility and effectiveness as Ukraine’s negotiator with the Trump administration and Republican Party.

To salvage future strategic relations and secure essential U.S. support, Zelenskyy needs to immediately try to work something out with Trump OR Ukraine needs new leadership capable of strategically dealing with their top backer in the war (the U.S.A. & Trump).

V. Future Potential Scenarios & Odds (Ukraine-Russia)

Included below are some potential scenarios that may occur (with estimated odds) after the botched Zelenskyy/Trump negotiations. These are not all possible scenarios. Perhaps there are some scenarios that are even more likely than those listed here… I was brainstorming.

A.) Protracted Stalemate (War of Attrition)

The conflict continues for 5–10 years without a decisive resolution. Ukraine, bolstered by limited Western (primarily U.S.) aid, holds the line, while Russia, despite retaining occupied territories, becomes embroiled in a draining stalemate.

Occasional Ukrainian offensives reclaim incremental territory, but neither side achieves a definitive breakthrough. Hybrid warfare tactics (cyberattacks, disinformation) remain constant.

Likelihood

35–40% Probability. Given the current deadlock, plus the U.S. shift toward “enforceable payback” rather than complete withdrawal, this scenario of slow attrition is substantial.

ROI for the U.S.

Approx. 5/10 Rating.

Annual Aid Costs remain around $20–$30 billion, less than 4% of the $800 billion defense budget.

Strategic Benefit: Russia stays weak and tied down militarily, meeting the containment aim.

Risk Factor: The indefinite nature of the conflict leaves space for opportunistic Chinese diplomacy and may lead to war-weariness among U.S. voters.

Winners/Losers

Winners:

USA (moderately): Achieves a relatively cheap containment of Russia, though not an outright solution.

China: Exploits Western distraction, deepening Sino-Russian ties.

Losers:

Russia: Bleeds resources for minimal additional territorial gains; sanctions remain.

Ukraine: Endures prolonged devastation, unable to secure a decisive victory or robust peace.

EU: Torn between moral obligations and war fatigue, forced to adapt but still under U.S. economic shadow.

B.) Ukrainian Counteroffensive Success

Through consistent, robust Western arms shipments and economic support, Ukraine recaptures major occupied areas (possibly securing corridors near Crimea) over 3–5 years.

Russia, overstretched and demoralized, retreats to pre-2022 borders or a greatly reduced footprint.

Likelihood

15–20% Probability. While militarily plausible if Western support remains unwavering, U.S. “America First” demands for immediate payback might complicate consistent, full-throttle aid. The EU’s underinvestment also reduces the probability of a unified Western push.

ROI for the U.S.

Approx. 8/10 Rating.

Pros: A decisive weakening of Russia yields a massive strategic advantage; the U.S. can credit a relatively modest expenditure (~$20–$30 billion/year) for toppling a major rival.

Cons: Requires high-level, sustained backing; the cost could exceed current budgets if new, sophisticated weapons must be supplied.

Potential Mineral Deals: A victorious Ukraine would be more likely to honor large U.S. stakes in critical mineral deposits, amplifying U.S. returns.

Winners/Losers

Winners:

Ukraine: Regains sovereignty, possibly fast-tracking EU/NATO membership.

USA: Strengthens global leadership, validates cost-effective approach in degrading a major adversary.

Losers:

Russia: Potential internal unrest and catastrophic reputational damage.

China: Loses advantage if Western unity is reaffirmed.

C.) “Mega Deal” – U.S. Withdraws Support, Russia Keeps Territory

Facing intense domestic pressure and preferring an “easy exit,” the U.S. negotiates a swift settlement. Russia retains occupied territory, recognized de facto if not de jure.

In exchange, America secures short-term economic wins: discounted Russian energy or partial commodity deals (potentially aluminum or strategic mineral concessions), plus reduced outlays in aid.

Likelihood

20–25% Probability. Trump’s transactional approach makes this scenario quite possible if Zelenskyy refuses large concessions or if right-wing media successfully shifts public sentiment against ongoing aid.

ROI for the U.S.

Approx. 4–5/10 Rating.

Immediate Gains: Saving $20–$30 billion/year on Ukrainian aid and acquiring discounted commodities might appear beneficial.

Long-Term Costs: Russia, having pocketed territory, likely regroups and menaces Europe again, forcing costlier future interventions. U.S. credibility—especially in Europe—diminishes.

Risk: Potentially emboldens China to replicate or accelerate expansion in the Indo-Pacific.

Winners/Losers

Winners:

Russia: Gains legitimization of conquered lands.

Trump’s Base: Applauds cost-saving “peace.”

Losers:

Ukraine: Loses critical territory; morale and sovereignty undermined.

EU: Feels betrayed, forced to consider alternative (possibly Chinese) security or energy deals.

USA (long-term): Redeems short-term savings at the cost of strategic leadership.

D.) Nuclear Brinkmanship or Limited Nuclear Escalation

Backed into a corner, Russia deploys or test-fires tactical nuclear weapons, or strongly threatens their use. The crisis ignites global market panic, forcing NATO to confront direct confrontation or high-risk negotiations.

China intervenes diplomatically, alarmed by potential global trade collapse.

Likelihood

5–10% Probability. Despite aggressive rhetoric, actual nuclear release remains unlikely due to China’s and NATO’s deterrent posture.

ROI for the U.S.

0/10 Rating.

Nuclear use is a doomsday scenario for economic stability and American interests. Even a minimal tactical use or near-miss would devastate global markets, overshadowing all potential resource deals.

The incalculable costs—humanitarian, strategic, and economic—render this option catastrophic.

Winners/Losers

Winners: None; possibly China if it mediates last-minute, yet the world order suffers irreversible damage.

Losers: Everyone, including the U.S., NATO, Russia, Ukraine, global economy.

E.) China Emerges as the Dominant Peacemaker

A fractious West fails to rally; the U.S. appears unwilling to provide unconditional aid, and the EU struggles with internal divisions. Sensing the vacuum, China orchestrates a negotiated settlement, offering financial rescue packages and partial recognition of Russian gains.

The EU, disillusioned by U.S. transactional demands, entertains or accepts Beijing’s overtures, realigning economic partnerships.

Likelihood

10–15% Probability. Feasible if U.S. rhetoric continues to alienate allies and domestic pressure curtails further aid. China’s strategic engagement could grow more attractive to conflict-weary European states.

ROI for the U.S.

Approx. 3/10 Rating.

Washington loses moral high ground and cedes a large portion of leadership in the settlement process.

Over time, Chinese-led reconstruction frameworks might tie both Ukraine and segments of Europe closer to Beijing, weakening American trade and diplomatic influence.

Winners/Losers

Winners:

China: Solidifies global leadership credentials, capturing crucial reconstruction and investment deals.

Russia: Gains partial acceptance of territorial acquisitions, with Beijing’s backing.

Losers:

USA: Marginalized, significantly reduced leverage in Europe.

Ukraine: Finds peace but sacrifices territory/influence to Sino-Russian arrangement.

EU: Becomes more reliant on Chinese capital, drifting from traditional U.S. ties.

F.) U.S. Dual Resource Deal Variant (with Observers)

In this nuanced scenario, the U.S. uses its leverage to enforce an immediate ceasefire, acknowledging current Russian occupation but extracting concessions from both Russia and Ukraine.

From Ukraine: A 20–30% revenue share of critical minerals (in uncontested zones) plus possible facilitation of additional mining operations.

From Russia: Discounted commodity exports (oil, gas, aluminum) and a partial stand-down arrangement, combined with a binding anti-expansion clause enforced by a U.S.-led observer mission.

Enforcement & Odds

Russian Compliance: ~50% chance. Kremlin might see it as a “freeze” to regroup, then potentially violate later if enforcement is weak.

Ukrainian Acceptance: ~60–70% chance. Zelenskyy’s government may reluctantly accept if it secures partial territory retentions and ensures continuing American aid.

Effective Observer Force: ~50–60% success probability. Adequate U.S./international monitors are crucial to deter low-level sabotage.

ROI Analysis

Short-Term: Potentially high (~8/10) if the U.S. saves on indefinite aid while scoring direct resource streams from Ukraine and discounted Russian commodities.

Long-Term: More moderate (~5–6/10) given the risk that Russia could eventually violate terms, or that Ukraine might oppose indefinite revenue concessions if it re-establishes control over resource sites.

Winners/Losers

Winners:

USA (short-term): Gains immediate economic relief and resource deals.

Russia: Achieves partial recognition of its gains without returning territory, obtains partial sanction relief.

Losers:

Ukraine: Forced to accept a “frozen conflict,” losing some sovereignty over occupied areas.

EU: Side-lined if the U.S. negotiates directly with Moscow and Kyiv for its own gain, undermining transatlantic unity.

VI. Optimal Long-Term “America First” Strategy

In the aftermath of the Oval Office breakdown, the U.S. faces critical choices on how to maximize its interests strictly through a transactional lens. The following approach outlines a cutthroat, America First policy focused on:

Minimizing U.S. spending relative to perceived benefits.

Forcing allies (E.U.) and adversaries (Russia) alike to provide tangible payoffs for American support.

Using the massive leverage of the U.S. market and military dominance to reshape global alliances on strictly economic terms.

A.) Core Objectives & Strategic Imperatives

1. Extract Tangible Returns from Ukraine

Insist on a 20–30% revenue share in any feasible mineral extraction, covering lithium, titanium, graphite, or other high-value deposits in uncontested territories.

Condition further U.S. military/financial aid on Ukraine’s explicit acceptance of these terms, with oversight to ensure promised revenues flow to U.S. stakeholders.

If Kyiv resists beyond a set deadline, threaten to reduce or suspend future aid, thereby placing the onus on Zelenskyy to decide between partial resource concessions or losing U.S. support altogether.

2. Leverage Potential Russian Deals

Maintain open communication with Moscow about discounted commodity exports (e.g., aluminum, oil, gas) that could offset American expenditures.

If Ukraine fails to agree to the demanded resource stake, pivot to exploring partial or even comprehensive “mega deals” with Russia, acknowledging limited Russian territorial gains in exchange for immediate payback to U.S. industries.

This dual-track approach heightens competition between Ukraine and Russia for U.S. favor, ensuring better terms for American interests.

3. Force EU Allies Toward Higher Defense Contributions & Free-Market Reforms

Use the threat of partial NATO withdrawal or trade/tariff penalties to compel European nations to meet or exceed the 2% GDP defense spending mark.

Insist that allied nations adopt freer market structures, scaling back socialist-driven policies that hamper competitiveness, thereby opening their markets more extensively to U.S. exports and investment.

Offer preferential deals (such as advanced weapons systems or technology transfers) only to those allies meeting clearly defined financial and policy benchmarks.

B.) Specific Strategic Steps

1. Negotiate a Conditional “Dual Resource” Peace Deal

Outline a provisional arrangement involving both Ukraine and Russia:

Ukraine grants the 20–30% mineral stake to the U.S., Russia offers discounted energy/commodities to the U.S. or partial sanction relief.

Deploy a U.S.-led observer force to monitor both Russian compliance and Ukraine’s resource exploitation progress.

Emphasize that if either party fails to comply, the U.S. can pivot quickly, withholding aid or re-imposing sanctions.

2. Use U.S. Market Dominance to Reconfigure Allies

Threaten the EU with selective tariff increases unless they adjust to more market-based policies and ramp defense spending.

Structure a new transatlantic agreement linking defense burden-sharing and free-market reforms to U.S. trade access.

Offer carrot-and-stick incentives: deeper trade partnerships for compliant allies versus potential isolation or tariff hikes for those resisting.

3. Minimize Direct U.S. Outlays

Cap Ukrainian aid at $20–$30 billion annually, ensuring no escalation in costs.

Publicize that each billion spent must produce at least a corresponding billion in future mineral or commodity valuations—reinforcing the “taxpayers paid, now we recoup” message domestically.

4. Maintain Robust Deterrence Without Overextension

Keep advanced arms flowing to Ukraine (if it honors resource deals) to continuously degrade Russian forces at limited cost.

Preserve nuclear deterrence posture. If Russia hints at escalation, signal readiness for severe economic retaliation while highlighting that any nuclear action would sever all negotiation prospects and invite catastrophic sanctions.

C.) Quantifying the Likely Return on Investment

Short-Term Gains

Reduced Aid Costs: Cutting or limiting new financial inflows underlines the White House’s promise of “not another blank check.”

Immediate Resource Concessions: If the U.S. secures a 20–30% stake in Ukrainian minerals—valued in the tens (or even hundreds) of billions of dollars over decades—the long-term net present value can be significant.

Improved Trade Terms with EU: Forcing EU allies to reform or pay more for defense can yield billions in annual trade improvements, plus open markets for U.S. defense manufacturers.

Long-Term Outcomes

Possible Gains from a Russian Commodity Deal: If Ukraine refuses to cede enough stake, a direct arrangement with Moscow might yield heavily discounted oil, gas, or aluminum, saving American industries billions over a decade.

Restructuring Alliances in U.S. Favor: Over 5–10 years, forcing Europe to adopt freer market principles could align them more closely with U.S. capitalism, fostering deeper trade reliance on American goods.

Risks & Drawbacks

Emboldened Russia if Deals Go Awry: Should the U.S. finalize a partial settlement that effectively recognizes Russian-occupied territories, future expansions might become more likely.

Loss of Soft Power: The U.S. might face moral criticisms, potentially driving neutral actors (some in the EU, or in Asia) closer to China as a counterbalance.

Enforcement Challenges: Ensuring compliance from both Ukraine (on mineral revenues) and Russia (on territorial expansions) requires robust observer missions, which themselves carry costs and potential for mission creep.

D.) A Strictly Transactional “America First” Path

From a pure realpolitik standpoint, the United States, under the Trump administration, can exploit its dominant market, technology, and defense position to achieve:

Dual Resource Concessions: Forcing both Ukraine and Russia to compete in providing tangible economic offsets (minerals, discounted commodities) in exchange for American military aid or sanction relief.

EU Realignment: Pushing European nations to sharply increase defense budgets and adopt more market-oriented reforms, reducing the financial burden on the U.S.

Strategic Cost Management: Capping or reducing Ukraine war expenditures, ensuring every aid dollar is matched by quantifiable gains for U.S. interests.

While this approach is unapologetically transactional and may alienate traditional allies, it presents the highest projected ROI by ensuring that every foreign engagement yields direct returns, preserving the U.S. taxpayer’s advantage.

The success, however, will hinge on rigorous enforcement of any negotiated pacts, strong deterrence mechanisms to prevent adversarial backsliding, and the administration’s ability to handle domestic political and international diplomatic fallout.

Related: America First is Probably Ukraine Aid with Minerals Deal

VII. “America First” Path & Takeaways

A.) Recap of Key Developments

Origins of the War & Shifting U.S. Stance

Russia’s 2022 full-scale invasion initially led to rapid advances but spiraled into a high-casualty quagmire.

The U.S. invested over $100 billion in Ukrainian support, but under Trump’s renewed “America First” directive, that spending must now be matched by quantifiable returns.

The Oval Office Breakdown

The disastrous meeting between President Trump and President Zelenskyy showcased the stark disconnect: Washington insisted on tangible payback (e.g., 20–30% mineral stakes), while Zelenskyy leaned on moral appeals and security guarantees before a minerals deal — and botched the end of the meeting. (YOU HAD ONE JOB!)

This meltdown underscored a new diplomatic reality: humanitarian arguments with a narcissistic (“me me me”) ungrateful tone will no longer suffice when dealing with Trump/Vance — especially if you’re insulting their country (implying U.S. will get invaded) and have nothing to offer in return.

Potential Realignments

Russia, having sustained steep casualties, still wields enough leverage to dangle resource deals before the U.S., tempting a partial settlement or “mega deal.”

The EU’s reliance on U.S. defense and tech remains high, but it could also consider alternative alignments if American demands become too punitive.

Meanwhile, China stands poised to exploit any fissures, potentially emerging as a mediator or a source of reconstruction funding in Europe.

B.) Evaluating the Scenarios from an “America First” Lens

Protracted Stalemate

Likelihood: ~35–40%

ROI for the U.S.: Moderate (≈5/10). The slow bleed of Russian capabilities is cost-effective but allows for prolonged instability and possible Chinese exploitation.

Ukrainian Counteroffensive Victory

Likelihood: ~15–20%

ROI for the U.S.: High (≈8/10). Achieving a decisive setback for Russia would validate U.S. expenditures, strengthen global leadership, and potentially secure mineral deals from a grateful Kyiv. The downside is the high cost and sustained commitment required.

“Mega Deal” with Russia

Likelihood: ~20–25%

ROI for the U.S.: Mixed (≈4–5/10). Quick savings on aid plus some resource concessions from Russia, but it undercuts U.S. credibility, emboldens future expansion, and fractures alliances long-term.

Nuclear Brinkmanship

Likelihood: ~5–10%

ROI for the U.S.: 0/10. Even limited nuclear use leads to catastrophic global fallout, negating any strategic or economic gains.

China as Dominant Peacemaker

Likelihood: ~10–15%

ROI for the U.S.: Low (≈3/10). Washington loses significant leadership, as Beijing orchestrates a settlement that cements its global influence.

Dual Resource Deal Variant (with Observers)

Likelihood: ~40–50% (combined factors)

ROI for the U.S.: High short-term (≈8/10) but moderate long-term (≈5–6/10). It secures immediate resource dividends from both Ukraine and Russia if well-enforced, yet enforcement remains a challenge. (This would be the best scenario — and best way to end the war).

C.) Key Takeaways

Leverage Over Allies and Adversaries: The U.S. holds enormous sway via its defense industrial base and vast consumer market, giving it leverage to demand “fair share” defense spending from EU states and to negotiate resource deals with Russia or Ukraine.

Transaction Over Tradition: Moral leadership, once a cornerstone of U.S. foreign policy, has been set aside in favor of direct economic returns. While this approach may alienate some allies and undermine the notion of a U.S.-led liberal order, it ensures that American investments are tied to measurable ROI—a key requirement of the “America First” base.

Risks of Purely Transactional Deals: If poorly monitored, deals with Russia might legitimize territorial conquests, letting Moscow regroup for future aggression. Similarly, if Ukraine finds itself under-liberated territory but forced into permanent revenue concessions, domestic backlash and potential instability could undermine long-term compliance.

China’s Opportunistic Window: In every scenario, if the U.S. fails to maintain consistent, enforceable policies, China might capitalize by forging alternative diplomatic solutions or reconstructive investments, eroding American influence in both Eastern Europe and beyond.

VIII. Recommendations for “America First” (Ukraine-Russia War)

A.) Actionable Steps & Tactics

1. Enforcing Conditional Peace or Aid Deals

Structured Resource Agreements:

Require Ukraine to sign an irrevocable revenue-sharing contract giving the U.S. 20–30% stakes in key mineral extractions once territories are secure.

If Russia is cooperative, consider partial commodity deals from occupied Ukrainian areas, albeit with tight verifiability.

Observer Missions & Sanctions Triggers:

Station a U.S.-led observer force to monitor compliance (both Russian troop movements and Ukraine’s resource exploitation).

Mandate automatic sanctions or the reinstatement of U.S. aid cuts if either party reneges.

2. Pressuring the EU & Restructuring Global Alliances

Defense Spending Mandates: Threaten partial withdrawal from NATO or the imposition of tariffs unless EU members quickly raise defense budgets to meet or exceed 2% of GDP, with a target of 3% for certain large economies. Tie advanced weapons sales or technology transfers to compliance.

Trade & Economic Incentives: Offer preferential U.S. market access for EU exporters who adopt more free-market reforms (reducing socialist subsidies, streamlining regulations). Penalize those that maintain protectionist or heavily regulated sectors, ensuring America’s own industries don’t suffer unfair competition.

3. Maintaining Deterrence at Minimal Cost

Annual Aid Cap: Publicize a strict $20–$30 billion/year ceiling for Ukraine assistance, reinforcing “fiscal discipline” to U.S. taxpayers. Justify any additional outlays only if they produce matching or higher resource valuations in signed agreements.

Targeted Military Deployments: Avoid large U.S. troop commitments. Instead, supply high-impact advanced weaponry and intelligence to degrade Russian capacity, sustaining an asymmetric advantage at lower cost. Keep nuclear deterrence posture robust, warning that any Russian nuclear action invalidates all resource deals and triggers maximum sanctions.

4. Avoiding the ‘Mega Deal’ Trap Without Enforcement

Short-Term Gains vs. Long-Term Risk: A direct pact with Moscow that cedes Ukrainian territory for cheap commodities may bring immediate financial relief but sets a dangerous precedent of rewarding aggression. Should such a deal be unavoidable, it must include strict observer oversight and significant direct benefits to American interests to offset future reputational risks.

Leaning on the Dual Resource Model: If Zelenskyy’s refusal to meet big demands persists, keep the door open for a “dual resource arrangement,” acknowledging territory lines short-term while forcibly extracting American mineral shares and discounted Russian exports. This approach ensures the U.S. benefits financially no matter which party (Ukraine or Russia) ultimately controls valuable deposits.

B.) Balancing Potential Outcomes

Economic Metrics of Success

Cost–Benefit Tracking: For each $1 of aid, require an estimated $1 or more in potential resource profits or equivalent trade enhancements.

ROI Benchmarks: Evaluate every quarter whether resource extraction is on schedule, whether Russia continues to comply with discount commodity rates, and whether EU allies meet increased defense budgets.

Mitigating Reputational Damage

Domestic Narrative Management: Emphasize how every dollar is returning “direct value” to U.S. taxpayers, framing moral considerations as secondary to a strict “balance sheet” success. Cater to conservative media by showcasing data on how resource deals or lowered EU socialist policies benefit the U.S. economy.

International Diplomacy: Acknowledge the moral complexities without letting them override the transactional approach. Maintain lines of communication with moderate EU states to avoid total schism, assuring them that adopting freer markets and fairer defense spending can preserve their link to the U.S.

Long-Term Vision

Preserving Dominance: Whether through a “stalemate,” a dual resource deal, or limited alliances, the U.S. must keep its technology lead and ensure key adversaries (Russia, China) remain containable at modest cost.

Incentivizing EU Reforms: If the EU meets new benchmarks for defense and market liberalization, the U.S. could gradually relax trade or tariff measures, thereby consolidating a more American-friendly global economic system.

The “America First” Approach to Foreign Policy

In a purely cutthroat approach, moral or alliance-based “obligations” become negotiable commodities. The U.S. can, and should—under this philosophy—extract tangible payoffs from every major foreign engagement.

Although it risks accelerated fracturing of the established post-WWII order, the short- to mid-term economic and strategic returns could be substantial, especially if enforced with unwavering discipline and robust verification.

The dual resource deal variant stands out as the most practical immediate path for maximizing ROI, provided there is a stringent observer component and each concession is locked into enforceable contracts.

While a Ukrainian counteroffensive success offers the highest theoretical benefit, it remains less likely and demands consistent outlays—factors that clash with the administration’s drive for immediate revenue.

Ultimately, this “America First” approach ensures that even in the absence of conventional alliances, the sheer gravitational pull of the U.S. economy and defense industry compels partners and adversaries alike to accede to Washington’s transactional terms.

Should any party resist, America’s ability to pivot to other resource deals or impose crippling trade restrictions sustains the U.S. edge—making short-term diplomatic strains an acceptable cost for long-term strategic and economic dominance.

My final thoughts?

Zelenskyy royally F’d up: Was clearly unintentional, but demonstrated zero situational awareness (Trump/Vance, U.S. giving more aid than any country, coming across as being unwilling to sign a peace deal, implying the U.S. will be attacked, etc.).

E.U. needs to stop free-riding: What’s the point of an alliance if you don’t pull your weight? Why would the U.S. continue the relationship? Either step up or you’re out. It’s all relative to GDP. The E.U. is funding the degradation of itself instead of things that would fix it. Ideally they’d stop the socialism and start paying what they agreed upon for NATO (this aligns more with American ideals). Russia is a far bigger threat to the E.U. than the U.S. based on proximity, so they should at least contribute a fair amount. They also need to stop funding both sides of the war if they want anyone to take them seriously.

U.S. realpolitik: The U.S. should be open to any deal that benefits the U.S. directly or indirectly. The options are: minerals deal with Ukraine for continued funding/weaponry, dual deals with both Russia/Ukraine in exchange for peace, or continue funding Ukraine to weaken Russia if no deal can be done with Russia and the E.U. won’t step up.

Although many right-wingers/conservatives love to parrot “war is bad” and ask retarded questions like: “Why don’t you go fight in Ukraine if you support them?” This is so braindead it’s not worth responding to… but in short you can support Ukraine indirectly with funding/weaponry to potentially save money long-term WITHOUT joining the front-lines.

If a team is planning a space mission to Mars and needs money for rocket ship upgrades, you can “support the Mars mission” with donations. Nobody reasonable is asking: “If you support going to Mars — why aren’t you on the rocket ship too?!” (Obviously we can provide indirect support without putting our lives on the line.)

Most people supporting Ukraine are not “warmongers” — they just think Putin cannot be trusted to keep the peace (based on past behavior — this isn’t a random hypothesis… there’s logic to substantiate it).

So the optimal scenario for the U.S.? Dual deals with high ROI from both Russia/Ukraine in exchange for peacekeeping. If this isn’t an option? E.U. needs to step up more (possibly via cutting social benefits & shifting to free market capitalism).

If the E.U. steps up, it would be in the U.S./Trump’s best interest to get a minerals deal done with Zelenskyy (overlooking his perceived ingratitude/rudeness). What about nuke threat? I think nuclear escalation is unlikely given that China will likely tell Putin it’s not an option.

The U.S. should probably continue funding Ukraine if Russia won’t do any deal… it should theoretically save money in the long-term by weakening Russia/preventing future Russia expansion. Thinking just “Why are we sending money to Ukraine?” often fails to consider long-term implications/odds of certain moves by Russia.

But Russia will win right? Maybe but it won’t be easy or quick. The war ROI for Russia in the past 2 years has been abysmal. The cumulative financial & human life toll has been insane for very little gain. It’s like a Vietnam-type quagmire for them (money/resources pit)… and Ukraine is defending its territory well.

Putin likely realizes he made a huge mistake with this war, but can’t backtrack because it makes him look weak as a strong-arm/autocratic leader… so the meat grinder continues. Many claim Ukraine could end the war, but clearly so could Russia. And if you’ve ever been in any kind of physical fight — you know it’s much tougher to stop fighting once you’ve started… often need a mediator.

I’m not sure what Trump or his staffers are thinking here… but I know guys on Trump’s staff buy into a “Multipolar Era” perspective wherein U.S. controls one sphere, China another, and Russia the third… so maybe they’ve convinced Trump that he should shift to this for foreign policy? Unclear. Trump is more of an isolationist, but we’ll see how this plays out.