Will Trump Finish His Second Term? Forecast Model Odds (2025-2029)

Estimating the likelihood Trump finishes his second term...

I think Trump finishes his second term (2025-2029), but some don’t… including some very smart people.

There are many reasons why Trump may not finish his second term… the most likely being his age (Trump is old and health can deteriorate suddenly… but he has good genetics and gets excellent care).

Other possible reasons for not finishing the Trump 2.0 term include: premature handoff to J.D. Vance (I don’t see DJT doing this unless 100% necessary), global war/conflict, and full court bipartisan press from both Republicans and Democrats to oust Trump.

Surprisingly there isn’t yet a Polymarket dedicated to the question: “Will Trump finish his second term (2025-2029)?” Someone should set this up. Slacking.

I’d wager Trump will finish his term (assuming odds are reasonable). I’m skeptical of those who confidently claim he won’t finish his second term. Am doubtful most of these people would put money on it.

On the other end of the spectrum there are people who legitimately think Trump has good odds of serving a third term! Salute King Trump.

IMPORTANT: This was written May 11, 2025. Breaking news could shift odds significantly in a day, week, month, etc. (e.g. Trump reverses tariffs → markets boom).

I.) Will Trump Complete His Second Term?

Prediction (me + AI): 58% probability that Donald Trump will still be president on 20 January 2029, with a corresponding 42% chance of an early departure.

Top 3 hazards:

Age-related death or medical incapacity: 19%

Tariff-driven recession that collapses approval and prompts a voluntary or 25th-Amendment hand-off to Vice-President J.D. Vance: 9%

Backlash from a high-casualty Taiwan Strait conflict that breaks GOP Senate loyalty: 6%

All other pathways (standard House impeachment without conviction, Yemen or minor conflicts spiraling, legal shocks, black-swans) collectively account for the remaining 8%.

Why does the “finish-the-term” outcome still dominate?

Biology is on Trump’s side. A 78-year-old U.S. male enjoys a 77% four-year survival probability; after factoring in favorable lab work, genetics, and round-the-clock care that edge nudges to roughly 78%. (Social Security, AP News)

The constitutional bar is almost insurmountable. Even after a hypothetical Democratic wave in 2026, Republicans are projected to hold at least 51 seats, leaving removal 17 votes short of the 67-vote threshold. (Reuters)

Current macro and security shocks are material but not overwhelming. Goldman Sachs now assigns a 45% probability of a U.S. recession within 12 months as tariffs on roughly $600 billion in Chinese goods remain at 145%. (Reuters, Reuters) Meanwhile, the PLA’s Strait Thunder-2025A blockade rehearsal keeps a Taiwan fight a live risk but still low-frequency (~12% over the term). (Global Taiwan Institute)

Low-salience conflicts aren’t game-changers. The May 6 cease-fire paused U.S. strikes in Yemen without a single U.S. combat fatality, providing negligible pressure on presidential approval. (Reuters)

In short, the mechanics that keep most presidents in office—simple survival probabilities plus a two-thirds Senate shield—still outweigh every shock scenario we can plausibly quantify.

II.) Why People Questioning Trump Finishing His Second Term

Record-setting age and opaque health disclosures. Trump took the oath at 78, five months older than Joe Biden was at his own inauguration, making him the oldest president in U.S. history. (AP News) While April 2025 White House statements tout “excellent” vitals, the detailed results remain unpublished, reviving speculation over cognitive or cardiovascular surprises.

A bruising tariff war with global-scale downside. Since February the White House has levied an average 145% duty on Chinese imports, prompting 125% retaliation and a sustained equity sell-off; Reuters and Goldman now peg recession odds at ≈ 45% — double the pre-tariff baseline. (Reuters, Reuters) A deep slump historically shaves ≥ 12 percentage points from presidential approval, the tipping zone where co-partisan defections become imaginable.

Taiwan Strait flash-point on a 2027 clock. Beijing’s Strait Thunder drills have morphed from signaling to monthly blockade rehearsals, explicitly tied to Xi Jinping’s vow to “resolve the Taiwan question” before 2027 ends. (Global Taiwan Institute) CSIS and RAND war-games model thousands of U.S. casualties in a worst-case defense—numbers that historically drag approval 10-20 points once the early “rally-round-the-flag” bump fades.

Mid-term re-shuffle meets a stiff constitutional ceiling. Republicans currently command a 53-47 Senate. Even a 2026 Democratic mini-wave would leave the GOP with a protective floor of ~51 seats, forcing any removal effort to flip sixteen or more Republicans—unprecedented outside Nixon-era collapse. (Reuters)

Legal clouds vs. practical immunity. The Supreme Court’s 2024 ruling granted presumptive immunity for official acts; state prosecutions are frozen while he remains in office. Legal risk therefore lurks but lacks the immediacy that forced Richard Nixon out in 1974.

Yemen and other low-casualty theaters. The May 6th deal that halted U.S. airstrikes against Houthis underscored a pattern: low-risk drone or air campaigns rarely move domestic polling. Yemen is, in probability terms, a rounding error. (Reuters)

These converging factors—an unusually elderly president, tariff-induced macro peril, a live Taiwan fuse, and an opposition that can impeach but probably not convict—make the “Will Trump make it?” question more than cocktail-party chatter. It is a genuine scenario-planning imperative for investors, allies, adversaries and political strategists alike.

III.) How We Think About Odds Trump Finishes Second Term

We start with hard, measurable constraints — biology and the Constitution — then add every shock that could plausibly shift the baseline.

1. Biology

Source: 2021 Social Security life table.

Input: A 78-year-old male has a 77% chance of living four more years.

Application: This serves as the baseline survival/competence figure for the “finishes term” branch and is subject to adjustments as detailed in Section IV.

2. Constitution

Source: U.S. Constitution.

Input: There are only four constitutionally defined paths for a president to leave office prematurely: death, resignation, 25th Amendment transfer of power, or impeachment by the House followed by a conviction vote by at least 67 Senators.

Application: This framework necessitates that any scenario involving political removal must address the "67-vote puzzle" in the Senate.

3. Political Arithmetic

Source: Cook Political Report (May 2025 map).

Input: The projected 2025 Senate composition is 53 Republicans, 45 Democrats, and 2 Independents. Cook’s May 2025 map indicates a Republican floor of approximately 51 seats, even in the event of a significant Democratic ("blue wave") electoral success in 2026.

Application: Consequently, the probability of an "impeach-and-remove" branch cannot realistically exceed single digits unless a minimum of 17 Republican Senators were to defect.

4. Macro-economy

Source: Reuters, citing Goldman Sachs.

Input: Goldman Sachs has increased the 12-month U.S. recession odds to 45%, following the imposition of 145% tariffs on approximately $600 billion worth of Chinese goods.

Application: Historically, a deep recession (defined as GDP ≤–2%) has led to a decrease in presidential approval ratings by ≥12 percentage points. This level is considered a trigger zone for potential Republican desertions, feeding into a 9% probability for a "tariff-recession exit" path.

5. Security Shocks

Source: CSIS Taiwan war-game simulations.

Input: The Center for Strategic and International Studies (CSIS) Taiwan war-game indicates that the U.S. could lose "tens of thousands" of troops in many simulated scenarios.

Application: A 12% chance is assigned to a sustained conflict involving Taiwan (defined as ≥1,000 troops deployed and ≥50 U.S. Killed in Action per year). Half of these scenarios are projected to push presidential approval below 30%, resulting in a 6% risk for a "Taiwan backlash exit."

6. Legal Headwinds

Source: Supreme Court.

Input: A Supreme Court ruling from July 2024 confers presumptive immunity for official acts undertaken while in office.

Application: This ruling is expected to cause state-level cases to stall, limiting the "legal-shock" branch probability to 3%.

7. Low-Level Conflicts

Source: Current conflict status.

Input: The air war in Yemen is currently paused under a cease-fire agreement effective May 6 (year not specified, assumed recent relative to context). There have been zero U.S. Killed in Action.

Application: This is assessed to have a negligible effect on presidential approval, translating to a 1% removal risk from this factor.

8. Black Swans

Source: General risk assessment.

Input: This category encompasses unforeseen events such as terror attacks, assassination attempts, or a constitutional crisis.

Application: A residual 2% tail risk is assigned to these low-probability, high-impact events.

The decision tree multiplies these conditional slices, then normalizes to 100%. That yields the headline 58% finish-term / 42% early-exit split presented earlier.

IV. Factoring in Trump-Specific Modifiers

We add Trump-specific modifiers (family history, current labs, behavior, and presidential-level medical care) to arrive at a refined survival/competency estimate.

The following factors contribute to this adjustment:

Parental longevity: His father, Fred Trump, died at 93, and his mother, Mary Anne, at 88. This contributes a +2 percentage point (Δ) versus a generic male.

First-degree dementia: His father had Alzheimer’s (diagnosed in 1991), which introduces a –3 percentage point cognitive-decline hazard.

Weight trend: He is reported to be down 20 lbs since 2020, now at 224 lbs (BMI ≈28), adding +1 percentage point.

Cholesterol & BP: With an LDL of 70 mg/dL, total cholesterol of 140, and BP of 128/74 mmHg, this accounts for another +1 percentage point.

Non-smoker / light alcohol: Lifelong abstention from cigarettes adds +1 percentage point.

Occupational stress: Executive stress studies, which show a +10–15% increase in cardiac events, result in a –2 percentage point adjustment (Framingham / CEO-stress literature).

24/7 presidential care: Continuous cardiology and neuro screening, standard White House protocol, provide a +2 percentage point benefit.

Net health adjustment: +2 pp−3 pp+1 pp+1 pp+1 pp−2 pp+2 pp=+1 pp

So the raw 77% four-year survival/cognitive-integrity figure nudges to roughly 78%. That flows directly into the political tree:

Health death/incapacity branch becomes ≈19% (23% actuarial mortality –4 pp VIP care +1 pp labs).

The 25th-Amendment dementia branch is baked into that 19%, adding only ~3 percentage points of the total.

Key Insight: None of the personalized health inputs moves the finish-term probability by more than a couple of points; the decisive swing variables remain political (Senate arithmetic), economic (tariffs), and strategic (Taiwan).

V. Constitutional & Political Mechanics

The 67-vote wall. The U.S. Constitution allows removal only if the House impeaches and the Senate convicts by a two-thirds super-majority. The current Senate is 53 R vs. 45 D vs. 2 I. Even in the interactive consensus map’s worst plausible 2026 “blue wave,” Republicans are still projected to hold ≈ 51 seats (270toWin.com). That means Democrats would still need 16-17 GOP defections — a feat achieved only once in U.S. history (the 1974 GOP stampede that forced Nixon to resign before a vote).

House-flip ≠ removal. Generic-ballot models give Democrats roughly a 65% chance of retaking the House in 2026, so impeachment articles are likely. But unless Trump’s job approval drops below ~30%—the Nixon threshold—those articles will die in the Senate. All “impeach-but-no-convict” outcomes therefore live in a low-single-digit branch of our tree.

25th-Amendment pathways. Sections 3 and 4 of the 25th allow the Vice-President and Cabinet to declare the President “unable.” Trump’s Cabinet is stacked with loyalists, and VP J.D. Vance owes his national profile to Trump; the political cost of revolt is enormous unless a medical crisis is obvious. We therefore embed §3/§4 risk almost entirely inside the 19% “death or incapacity” branch.

Intra-party guard rails. Historical defection data show GOP senators tolerate approval down to the mid-30s without bolting. The trigger for mass desertion is typically a compound shock—Watergate’s criminality or a Vietnam-scale casualty toll. Absent recession or Taiwan war casualties, institutional GOP cohesion keeps conviction odds pinned below 5%.

VI. Macro-Economic Shocks

We estimate the impact of macro-economic factors on presidential approval and the likelihood of an early exit. The metrics are based on the status as of May 2025.

Regarding specific metrics:

Tariff Level: Currently, there is an average 145% duty on approximately $600 billion of Chinese imports, with China retaliating with duties up to 125%. Historically, each 1 percentage point hit to GDP translates to an approximate –4 percentage point change in presidential approval, according to the Blom-Rudebusch elasticity. This factor feeds the 9% “tariff-recession resignation/§3” branch in our tree.

Recession Odds: Goldman Sachs now places a 45% probability on a U.S. recession occurring within 12 months, following a partial tariff walk-back. A deep slump, defined as GDP ≤–2%, has historically pushed presidential approval below 30%. If such a recession coincides with a House flip, it's conceivable that GOP donors could broker a hand-off to Vice President Vance.

Market Stress: The S&P 500 is off 18% year-to-date, and the CAPE ratio has returned to 2022 lows. Bear markets typically amplify economic blame, further reducing presidential approval by an additional 2-3 percentage points. This stress is already baked into the same 9% "tariff-recession resignation/§3" branch.

Offsetting Positives: The May 10 Geneva “total reset” talks signal a potential de-escalation channel. Such a development could claw back 2–3 percentage points in approval, thereby lowering the recession exit odds by approximately 1 percentage point. This is handled via sensitivity analysis in Section IX.

Even at 45% recession odds, the jump from economic pain to constitutional ouster must pass through the Senate defectors’ gate. Unless the downturn is both deep and prolonged, the macro channel stops at pressure for a voluntary resignation — or fails altogether.

VII.) Security-Shocks: Taiwan as a Wildcard

We evaluate the potential for security shocks to impact the presidency, with a particular focus on the Taiwan Strait as the most significant potential disruptor.

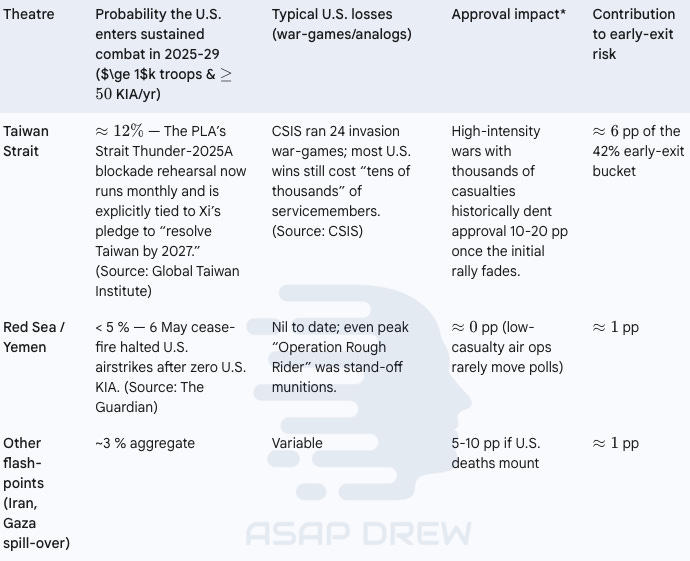

Taiwan Strait: There is an estimated ≈12% probability that the U.S. enters sustained combat in the Taiwan Strait between 2025-2029, defined as involving ≥1,000 troops and ≥50 U.S. Killed in Action per year. The PLA’s Strait Thunder-2025A, a blockade rehearsal, now runs monthly and is explicitly tied to Xi Jinping’s pledge to “resolve Taiwan by 2027” (Source: Global Taiwan Institute). War-games conducted by CSIS (24 invasion scenarios) indicated that most U.S. victories would still incur "tens of thousands" of service-member losses. Historically, high-intensity wars with thousands of casualties tend to dent presidential approval by 10-20 percentage points once any initial rally-around-the-flag effect fades. This scenario contributes approximately 6 percentage points to the 42% early-exit bucket.

Red Sea & Yemen: The probability of sustained combat here is less than 5%, particularly as a May 6 cease-fire halted U.S. airstrikes after zero U.S. KIA were reported (Source: The Guardian). To date, U.S. losses have been nil; even at the peak of “Operation Rough Rider,” operations involved stand-off munitions. Consequently, the approval impact is approximately 0 percentage points, as low-casualty air operations rarely move polls significantly. This theatre contributes about 1 percentage point to the early-exit risk.

Other flash-points (Iran, Gaza spill-over): There's an aggregate probability of around 3% for sustained combat arising from other flash-points. Typical U.S. losses are variable, but if U.S. deaths mount, the approval impact could be between 5-10 percentage points. These flash-points contribute approximately 1 percentage point to early-exit risk.

A Taiwan fight is the only security scenario big enough to crack GOP Senate loyalty; Yemen barely registers.

VIII.) Integrated Scenario Tree & Branch Odds

Completes full term: This scenario has a probability of 58% with a meta-confidence of 65%. The expected timing if an exit occurs is not applicable.

Death / medical incapacity → President J.D. Vance: This outcome has a 19% probability and 50% meta-confidence, with a median expected timing of July 2027 if an exit occurs.

Tariff-recession resignation or 25th-A § 3 transfer: There is a 9% probability for this scenario, with 40% meta-confidence. If an exit occurs, the expected timing is late 2027 to mid-2028.

Taiwan war backlash forces exit: This has a 6% probability and 35% meta-confidence. The expected timing, should an exit occur, is 2027–28, depending on the conflict's onset.

Impeached by Democratic House 2027, not removed: This scenario is assigned a 3% probability with 30% meta-confidence, and an expected timing of Q1 2027 if an exit occurs (though this specific scenario does not result in removal).

Impeach and remove after 2026 super-wave: This has a 4% probability and 25% meta-confidence. If this exit occurs, the earliest expected timing is Q2 2027.

Yemen / minor-war escalation: A 1% probability is assigned here, with 25% meta-confidence. An exit could occur anytime between 2025-2029.

Misc. black-swans: These unpredictable events have a 2% probability and 30% meta-confidence. The timing of such an exit is unpredictable.

Totals: 100%. The 3 dominant hazards (health, recession, Taiwan) produce 34 percentage points of the 42 percentage points early-exit risk; everything else sums to 8 percentage points.

IX. Sensitivity Analysis

If there is no Taiwan clash and tariffs are rolled back to ≤40% after Geneva talks, the new “finish-term” probability increases to ≈71%. This is because it removes 6 percentage points of war risk and 7 percentage points of recession risk.

If a deep recession occurs (-2% GDP for two quarters) and Taiwan casualties exceed 5,000, the new “finish-term” probability drops to ≈43%. Such a scenario would likely cut approval below 25% and add 15 percentage points to the impeachment/defection branches.

If Democrats achieve a shock result in the Senate map, reaching 60 seats (an outcome Cook Political Report currently calls reliant on “few opportunities”), the new “finish-term” probability becomes ≈52%. In this case, removal would still necessitate seven GOP defectors, but the barrier would be more surmountable if presidential approval were already significantly diminished.

X.) Implications

Markets: A 42% early-exit tail, concentrated in recession and war, justifies higher risk pricing of long-dated U.S. assets. Watch Beijing’s posture and monthly ISM data.

Foreign allies: Europe and Indo-Pacific states must contingency-plan for a Vance presidency by mid-2027 even if base case is continuity.

Domestic politics: GOP donors’ calculus: stick with Trump unless his approval < 30%; hedge with Vance infrastructure. Democrats will frame 2026 mid-terms as the referendum that could unlock impeachment.

Final Take: Trump ~58% Odds to Finish Second Term

A brutal tariff regime, a live Taiwan fuse and the oldest chief executive in U.S. history combine to give Donald Trump one of the highest early-exit risks of any modern president — yet the structural odds still favor him finishing the term (≈ 58%).

Biology is surprisingly benign (≈ 78% four-year survival once labs and VIP care are factored in), while the constitutional 67-vote wall makes partisan removal a moon-shot.

Unless a deep recession or a high-casualty Taiwan war collapses his approval and fractures Senate GOP unity, the most likely outcome remains Donald J. Trump taking the oath’s last clause — “…preserve, protect and defend” — all the way to 2029.