Super Bowl LX is set for today (Feb 8, 2026) at Levi’s Stadium in Santa Clara — Seattle Seahawks vs. New England Patriots.

Game-day forecast: 67°F, mostly cloudy, possible afternoon shower.

Below are prop bets I could find and verify across Polymarket, regulated sportsbooks, Nevada mega menus, offshore books, and party pools — plus an EV framework for the props where cross-platform pricing makes quantification possible.

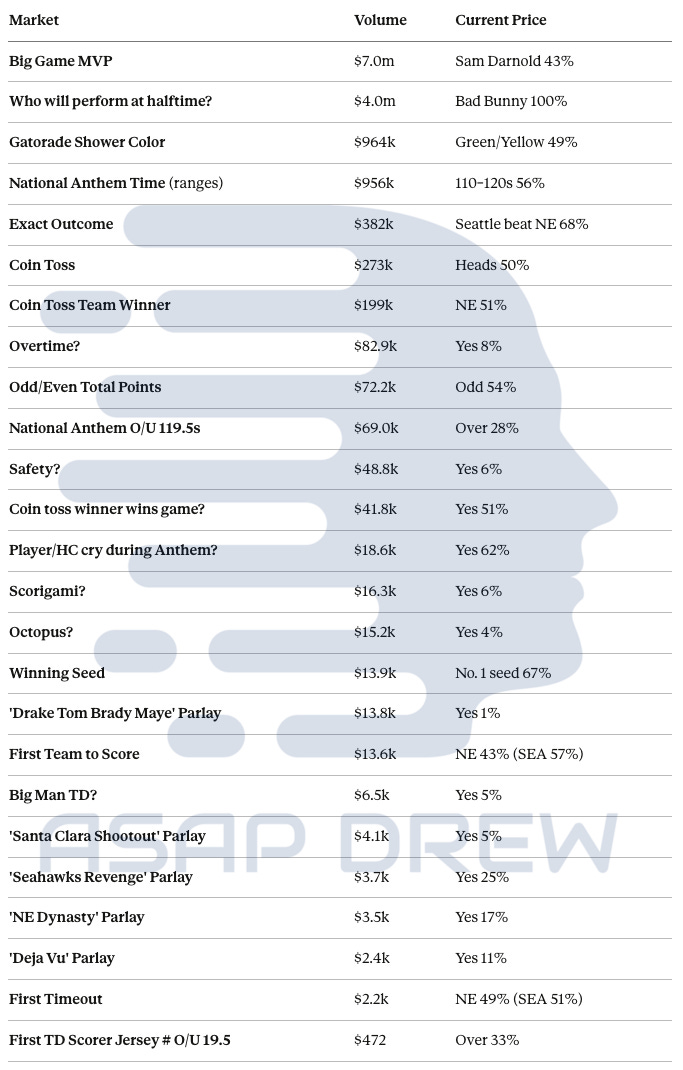

I. What’s on Polymarket Right Now

Polymarket’s Super Bowl LX hub lists 25 active game-prop markets plus additional clusters for ads, halftime, celebrity attendance, broadcast mentions, and viewership. Here’s every game-prop market, ranked by volume, with today’s odds.

All Polymarket Super Bowl LX game props (by volume)

The heavyweights (>$100k volume):

Big Game MVP — $7.0m. Sam Darnold leads at 43%. MVP markets are notoriously QB-biased; Drake Maye is the main alternative.

Who will perform at halftime? — $4.0m. Bad Bunny at 100%. Settled.

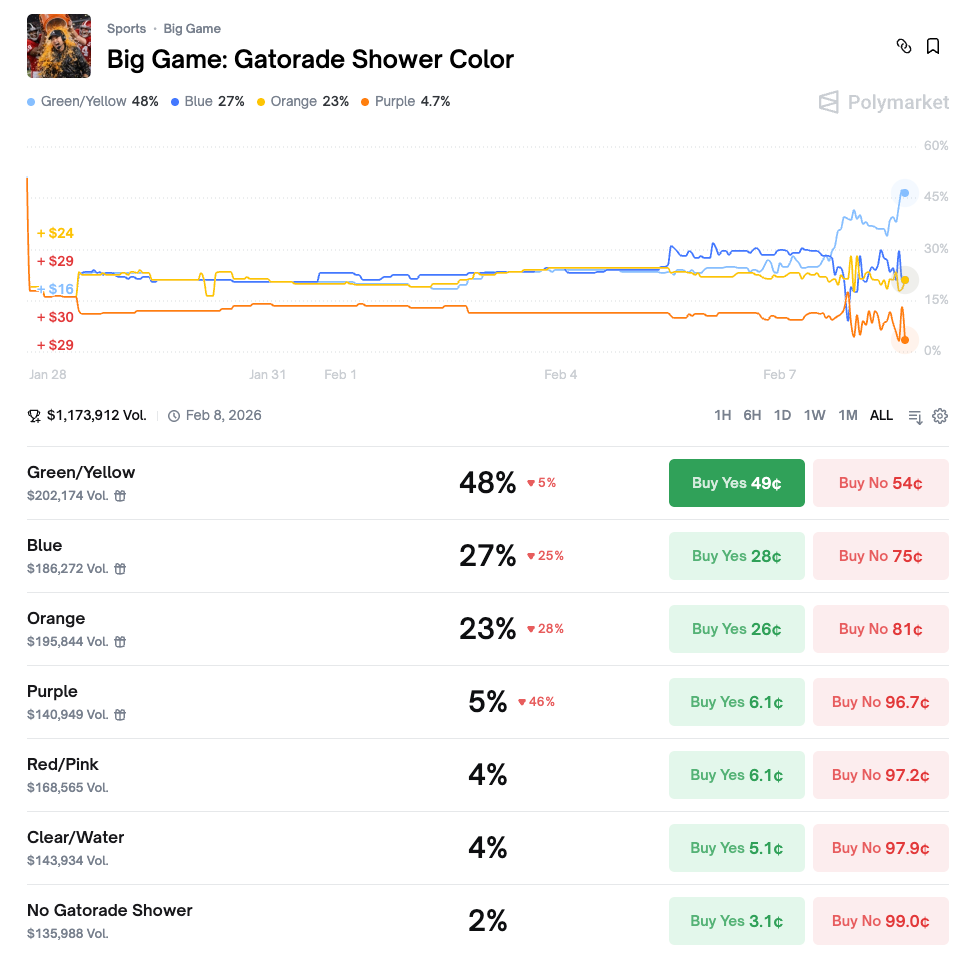

Gatorade Shower Color — $964k. Green/Yellow has surged to 49%, up from ~29% initial odds. BetMGM also moved Green/Yellow to favorite (+175) but only implies ~32% no-vig — a major Polymarket overshoot. See Section III.

National Anthem Time (ranges) — $956k. 110–120 seconds is the favorite bucket at 56%. Charlie Puth is performing.

Exact Outcome — $382k. Seattle beat NE at 68%. Essentially the moneyline as a Polymarket contract.

Coin Toss — $273k. Heads 50%, Tails 50%. A true coin flip in every sense.

Coin Toss Team Winner — $199k. NE 51%, SEA 49%. Pick’em.

Overtime? — $82.9k. Yes at 8%. Up from ~6% earlier this week. One of the stronger cross-platform EV signals — see Section III.

Mid-tier ($10k–$100k volume):

Odd/Even Total Points — $72.2k. Odd 54%, Even 46%. Even is the value side if you assume ~50/50 parity — see Section III.

National Anthem O/U 119.5 seconds — $69.0k. Over 28%, Under 72%. A separate line from the range-bucket market above.

Safety? — $48.8k. Yes at 6%. The largest cross-platform EV gap I can identify right now — see Section III.

Coin toss winner wins the Big Game? — $41.8k. Yes at 51%. Historically, coin-toss winners have lost more often than won. Market is pricing it at parity.

Player/HC cry during National Anthem? — $18.6k. Yes at 62%. No sportsbook anchor, no base rate. Pure novelty.

Scorigami? — $16.3k. Yes at 6%. A scorigami = a final score that has never occurred in NFL history.

Octopus? — $15.2k. Yes at 4%. An “octopus” = one player scoring a TD and the ensuing 2-point conversion.

Winning Seed — $13.9k. No. 1 seed at 67%. Seattle is the 1-seed, so this tracks closely with the moneyline.

‘Drake Tom Brady Maye’ Parlay — $13.8k. Yes at 1%. Multi-leg novelty. Essentially a meme bet.

First Team to Score — $13.6k. NE 43%, Seattle 57%. Tilted toward the favorite.

The tail (<$10k volume):

Big Man TD? — $6.5k. Yes at 5%. A “big man” TD = a touchdown by an offensive or defensive lineman.

‘Santa Clara Shootout’ Parlay — $4.1k. Yes at 5%.

‘Seahawks Revenge’ Parlay — $3.7k. Yes at 25%. Themed around Seattle avenging Super Bowl XLIX.

‘NE Dynasty’ Parlay — $3.5k. Yes at 17%. Themed around a New England upset + legacy narrative.

‘Deja Vu’ Parlay — $2.4k. Yes at 11%. Themed around a repeat of the XLIX outcome.

First Timeout — $2.2k. NE 49%, Seattle 51%. Flipped since earlier this week. Essentially random.

First TD Scorer Jersey # O/U 19.5 — $472. Over at 33%. Thinnest market on the board.

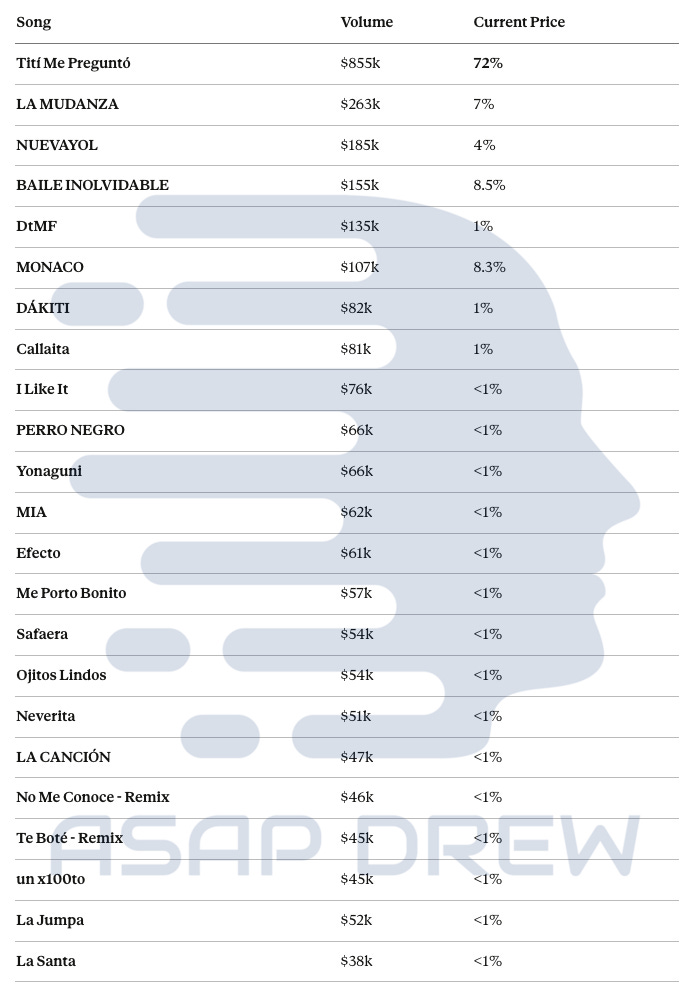

First song at halftime — $2.67m total volume

The contenders (>5%):

Tití Me Preguntó — $855k. 72%. The runaway favorite. Nearly three-quarters of the market thinks Bad Bunny opens with this.

BAILE INOLVIDABLE — $155k. 8.5%. The top alternative.

MONACO — $107k. 8.3%. Essentially tied with BAILE INOLVIDABLE.

LA MUDANZA — $263k. 7%. High volume relative to its price — lots of trading action here.

NUEVAYOL — $185k. 4%. Another high-volume, low-probability song. Meaningful money has moved through this contract.

Penny stocks (<2%):

DÁKITI — $82k. 1%.

DtMF — $135k. 1%. Notable for high volume at a very low price.

Callaita — $81k. 1%.

I Like It — $76k. <1%.

PERRO NEGRO — $66k. <1%.

Yonaguni — $66k. <1%.

MIA — $62k. <1%.

Efecto — $61k. <1%.

Me Porto Bonito — $57k. <1%.

Safaera — $54k. <1%.

Ojitos Lindos — $54k. <1%.

Neverita — $51k. <1%.

La Jumpa — $52k. <1%.

LA CANCIÓN — $47k. <1%.

No Me Conoce - Remix — $46k. <1%.

Te Boté - Remix — $45k. <1%.

un x100to — $45k. <1%.

La Santa — $38k. <1%.

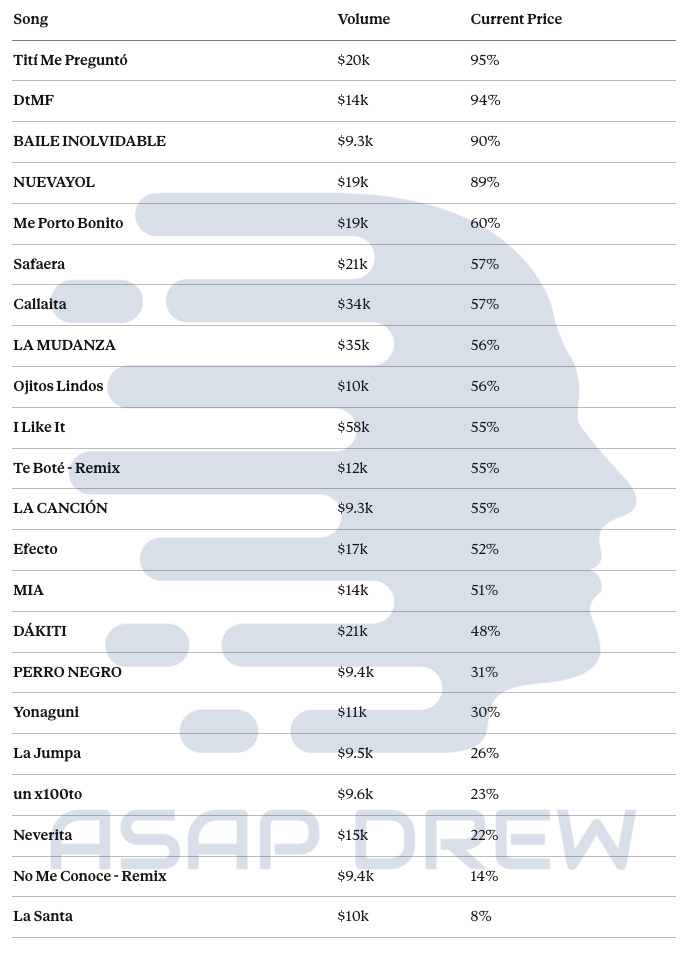

Songs that will be played (any position) — $385k total volume

The “will this song be played at all” market paints a clearer picture of the expected setlist. Four tiers emerge.

Near-locks (85%+):

Tití Me Preguntó — $20k. 95%. The only song above 90% in both markets.

DtMF — $14k. 94%.

BAILE INOLVIDABLE — $9.3k. 90%.

NUEVAYOL — $19k. 89%.

Coin-flip zone (48–60%):

Me Porto Bonito — $19k. 60%.

Safaera — $21k. 57%.

Callaita — $34k. 57%.

LA MUDANZA — $35k. 56%. Highest volume in this tier.

Ojitos Lindos — $10k. 56%.

I Like It — $58k. 55%. The highest-volume contract in the entire cluster.

Te Boté - Remix — $12k. 55%.

LA CANCIÓN — $9.3k. 55%.

Efecto — $17k. 52%.

MIA — $14k. 51%.

DÁKITI — $21k. 48%. The cutoff — below here, the market thinks it’s more likely the song doesn’t get played.

Unlikely (20–35%):

PERRO NEGRO — $9.4k. 31%.

Yonaguni — $11k. 30%.

La Jumpa — $9.5k. 26%.

un x100to — $9.6k. 23%.

Neverita — $15k. 22%.

No Me Conoce - Remix — $9.4k. 14%.

La Santa — $10k. 8%. The market’s strongest “no” for any listed song.

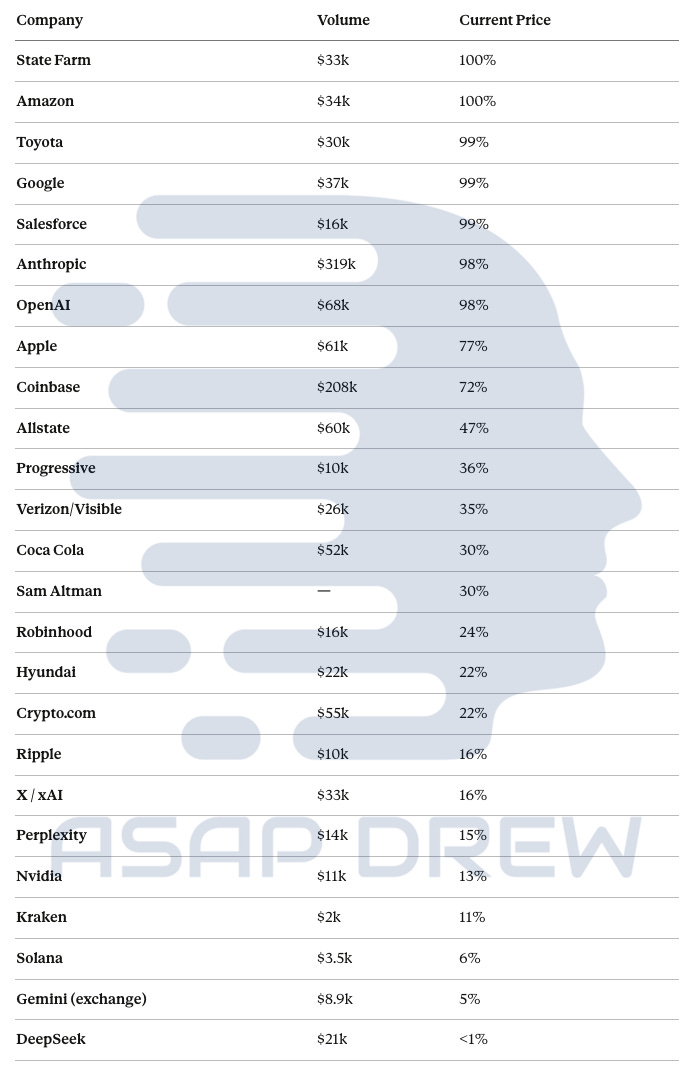

Which companies will run ads? — $1.15m total volume

The AI wars are the headline story in this cluster.

Locked in (95%+):

State Farm — $33k. 100%.

Amazon — $34k. 100%.

Toyota — $30k. 99%.

Google — $37k. 99%.

Salesforce — $16k. 99%.

Anthropic — $319k. 98%. The single highest-volume individual contract in the entire ads cluster. AI company making a Super Bowl splash.

OpenAI — $68k. 98%. The second AI lab all but confirmed.

Live action (30–77%):

Apple — $61k. 77%. Priced as likely but not certain. Note the “will Apple be said“ market is at 95% — different question.

Coinbase — $208k. 72%. Second-highest individual volume. Massive crypto bet.

Allstate — $60k. 47%. True coin flip.

Progressive — $10k. 36%.

Verizon/Visible — $26k. 35%.

Coca Cola — $52k. 30%. High volume, low conviction.

Robinhood — $16k. 24%.

Hyundai — $22k. 22%.

Crypto.com — $55k. 22%. High volume relative to low price — lots of skeptics and believers trading.

Longshots (<20%):

Ripple — $10k. 16%.

X / xAI — $33k. 16%.

Perplexity — $14k. 15%.

Nvidia — $11k. 13%.

Kraken — $2k. 11%.

Solana — $3.5k. 6%.

Gemini (exchange) — $8.9k. 5%.

DeepSeek — $21k. <1%. The board’s hardest “no.” High volume driven by people selling.

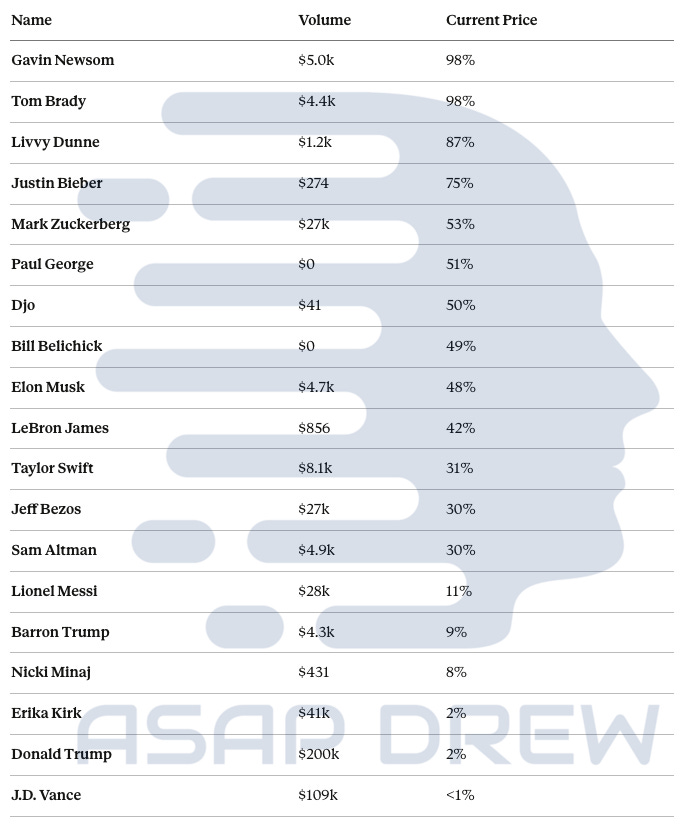

Celebrity attendance — $465k total volume

The political markets are the volume story here.

All but confirmed (75%+):

Gavin Newsom — $5.0k. 98%. California governor, home-state game. Reported by SFGATE.

Tom Brady — $4.4k. 98%. His former team in the Super Bowl.

Livvy Dunne — $1.2k. 87%.

Justin Bieber — $274. 75%.

Genuine uncertainty (30–55%):

Mark Zuckerberg — $27k. 53%. High volume, coin flip.

Paul George — $0. 51%.

Djo — $41. 50%.

Bill Belichick — $0. 49%. No volume, but the market exists. His old team playing.

Elon Musk — $4.7k. 48%. Slightly below coin-flip odds.

LeBron James — $856. 42%.

Taylor Swift — $8.1k. 31%.

Jeff Bezos — $27k. 30%. High volume, low conviction.

Sam Altman — $4.9k. 30%. Anthropic is running an ad, but Altman runs the other shop — will he show up?

Unlikely (<15%):

Lionel Messi — $28k. 11%. The wildcard — $28k in volume for an 11% contract.

Barron Trump — $4.3k. 9%.

Nicki Minaj — $431. 8%.

Erika Kirk — $41k. 2%. High volume driven by “no” sellers.

Donald Trump — $200k. 2%. The highest-volume contract in the cluster. Trump publicly said California was too far. $200k traded on a 2% outcome.

J.D. Vance — $109k. <1%. Second-highest volume. Market says definitively no.

Other clusters

“What will be said during the Super Bowl” — specific terms mentioned on broadcast (e.g., “Apple” at 95%).

Viewership — “most viewed ever?” style markets.

Halftime culture props — Bad Bunny YouTube views, etc.

II. Sportsbook Lines (Publicly Published)

Corroborated novelty-prop odds from regulated books. Useful as standalone bets and as anchors for cross-platform EV.

Gatorade color — BetMGM:

Yellow/Lime or Green +175 (was +260)

Blue +300 (was +260)

Orange +350 (was +225)

Purple +650 (was +750)

Red/Pink +900 (was +750)

Water/Clear +1100 (unchanged)

Coin toss: -102 / -102 for Heads/Tails.

Other corroborated lines:

Overtime: Yes +750 / No −2500

Safety: Yes +850 / No −2000

Punt Return TD: Yes +900

Kick Return TD: Yes +2000

Octopus: Yes +1500

Scorigami: Yes +2200

Largest Lead O/U 14.5 pts (+105 / −140)

Longest FG O/U 49.5 yds (−110 / −110)

Sportsbook lines from BetMGM as of Feb 8. Polymarket odds above are also live as of February 8.

III. EV Framework & Ranked Bets

Method: For a binary contract priced at p, estimated ROI ≈ (p_true − p) / p, ignoring fees and slippage. When sportsbook odds exist on the same prop, I convert both sides to implied probabilities, remove vig by normalizing, and use that no-vig probability as a rough proxy for p_true.

Caveat: Polymarket has fees and order-book spread. EV can disappear if your fill is worse than the displayed price.

Best EV: mid-priced props (≈20–60% implied)

1. Total points EVEN

Market price: ~46%

Estimated p_true: ~50%

Estimated ROI: +8.7%

Confidence: Medium

Polymarket has Odd at 54%, implying Even at ~46%.

Absent a structural reason to expect asymmetry, parity props are generally near 50/50, making Even the value side.

This is the only mid-priced prop where I can still justify an edge.

First Timeout has flipped to SEA 51% / NE 49% — no edge at parity. Coin toss team winner (NE 51%) is the same story.

Highest EV overall (includes cheap longshots)

1. Safety YES

Polymarket: 6%

BetMGM no-vig p: ~10.0%

Estimated ROI: +67%

Confidence: Low–Medium

The largest cross-platform gap on the board. Polymarket is pricing this nearly 4 points below the sportsbook’s no-vig implied probability.

2. Overtime YES

Polymarket: 8%

BetMGM no-vig p: ~10.9%

Estimated ROI: +36%

Confidence: Medium

Up from ~6% earlier this week, which has compressed the edge. Still a meaningful gap versus the book. Both carry longshot caveats: chunky vig at the sportsbook, low limits, and Polymarket fills that may be worse than the displayed price.

Gatorade: the market has moved dramatically

Gatorade: Green/Yellow looks overpriced.

BetMGM updated its Gatorade line on Feb 8.

Yellow/Lime or Green moved from +260 to +175 — a significant shift toward Green/Yellow, confirming real information is driving the move. But Polymarket has it at ~48-49%, which is far above the book.

No-vig implied probabilities from the updated BetMGM line: Yellow/Lime or Green ~31.6% (Polymarket: 49%). Blue ~21.7%. Orange ~19.3%. Purple ~11.6%. Red/Pink ~8.7%. Water/Clear ~7.2%.

Green/Yellow at 49¢ against a ~32% no-vig anchor implies roughly −35% ROI — the most overpriced contract on the board. If you can sell Green/Yellow on Polymarket (or buy NO), the implied edge is substantial. Conversely, every other color is underpriced relative to the book if you trust the BetMGM line as the better anchor.

Bottom line on quantifiable edges today

Safety YES — Polymarket 6% vs ~10% no-vig book → +67% est. ROI

Overtime YES — Polymarket 8% vs ~10.9% no-vig → +36% est. ROI

Gatorade Green/Yellow NO — Polymarket 49% vs ~32% no-vig book → +34% est. ROI

Total Points Even — Polymarket ~46% vs ~50% parity → +8.7% est. ROI

Everything else either lacks a cross-platform anchor or is information-driven (anthem time, MVP, ads, attendance).

IV. Where the Creative Props Actually Live

Here’s where the genuinely unusual stuff shows up.

1) Regulated US sportsbooks

DraftKings and BetMGM offer “fun” markets, though availability is heavily state-dependent:

Coin toss — heads/tails, winner, defer/receive, “win toss & win game”

Gatorade / liquid color on the winning coach

Any kick to hit the uprights

Flea flicker yes/no

QB sneak for a 1st down/TD

Jersey number of the first/last TD scorer; “jersey specials”

MVP meta-props — “position of MVP” and “who will MVP thank first”

Octopus (TD + 2pt by same player) and Scorigami

State restriction example: DraftKings lists anthem length and halftime first song only in Maine and Ontario.

2) Nevada mega menus (Caesars / Westgate)

The largest prop menus of anyone.

Caesars publicly released its full prop menu — described as its largest ever.

Westgate SuperBook dropped ~500 bets in a 53-page packet.

Specials from Caesars: “Any onside kick successfully recovered” (+2200), quarter-by-quarter scoring specials (”1+ passing TD in each quarter”). Book-priced, but the menu breadth is the draw.

3) Offshore / international books

Objectively where the most creative props exist.

Halftime show total number of songs (O/U 11.5)

Halftime show outfit changes (multiple alternate lines)

Sunglasses during first song (Yes heavy favorite)

Drone show / laser show / hologram appearance props

Huge list of “first song” candidates for Bad Bunny

Puppy Bowl XXI props (winner, MVP gender, etc.)

Variable legality and consumer protections. Factual catalog, not an endorsement.

4) Halftime show in mainstream ecosystems

Covers’ halftime page shows “first song” pricing and guest-appearance lists.

Notes halftime betting isn’t generally available on regulated US sportsbooks but is available in Canada and at Kalshi.

5) Commercials / brand advertiser props

Polymarket and Kalshi (”national broadcast only,” excludes local ads).

6) Cross-sport props

Some books offer cross-sport props pitting Super Bowl stats against other events like “First half total points vs USA/Canada combined gold medals.”

7) Party pools

Super Bowl squares — printable grids, random number generators.

Prop sheets / bingo — Covers and similar sites offer printable sheets.

V. “Epstein List” Markets

I did not find a Super Bowl prop on Polymarket or Kalshi framed as “will any players be on the Epstein list.”

What does exist: a separate Epstein-files prediction market cluster — e.g., “Who will be named in newly released Epstein files by February 28?” with public figures as outcomes, plus other disclosure/release markets.

The Epstein angle is bleeding into Super Bowl week — the NFL is investigating messages involving Giants co-owner Steve Tisch — but these markets are structurally separate from Super Bowl props.

Mainstream sportsbooks don’t list them; they’re a prediction-market phenomenon.

VI. Why Most of the Slate Isn’t Ranked as +EV

Gatorade color — Green/Yellow at 49% on Polymarket vs ~32% no-vig at BetMGM is the clearest fade on the board. But the YES side of other individual colors is hard to trade because Polymarket doesn't offer a single "not Green/Yellow" contract.

National anthem time — 110–120s is the favorite at 56%. Information-driven; edge requires knowing Charlie Puth’s rehearsal pace.

MVP — Darnold at 43% on $7m volume. QB-biased, information-asymmetric. Needs a game model.

Themed parlays — “Drake Tom Brady Maye” (1%), “Santa Clara Shootout” (5%), “Seahawks Revenge” (25%), “NE Dynasty” (17%), “Deja Vu” (11%). Multi-leg bundles where each leg compounds vig. Entertainment only.

Player/HC crying during anthem (62%) — No anchor, no base rate.

Halftime first song — Tití Me Preguntó at 72% is the heavy favorite. Unless you have setlist intel, no edge.

Ads — The locks (State Farm, Amazon, Google, etc.) pay nothing. The mid-tier (Apple 77%, Coinbase 72%, Allstate 47%) is information-driven — you need to know who bought ad time.

Celebrity attendance — Same story. Newsom (98%) and Brady (98%) are settled. Zuckerberg (53%), Musk (48%), Swift (31%), Bezos (30%) are genuine uncertainty but unanchorable.

Songs that will be played — The near-locks (Tití 95%, DtMF 94%, BAILE INOLVIDABLE 90%, NUEVAYOL 89%) pay pennies. The 50–60% cluster is where the action is, but edge requires setlist knowledge.

First team to score / first timeout / jersey-number props — Noisy at low volume. Play if you have a model, not because a 2–3% paper edge appears.

One More Constraint

Even when props exist “somewhere,” you may not be able to bet them legally in your state. Missouri regulators barred most novelty props — coin toss, Gatorade color, etc. — leaving mostly on-field props + MVP + squares.

The true menu depends on where you are and which platform you’re using.

Most compiled Feb 8, 2026 (game day). Odds and market prices are snapshots and will move. Nothing here is financial or legal advice.