How To Invest in SpaceX (2025): Best Direct vs. Indirect Investments (SPVs, Mutual Funds, ETFs)

There are many ways to invest in SpaceX in 2025... but most of them are pure garbage premium/fee machines

The global space economy is poised to skyrocket over the next 5-10 years and there’s no company better positioned to capture most of the growth than Elon Musk’s SpaceX (Space Exploration Technologies, Inc.).

However, since SpaceX is a private company, there is no place the average person can directly invest… and although some speculate that SpaceX could IPO within the next couple years, I wouldn’t hold my breath.

Elon has stated that keeping SpaceX private preserves stability better than taking it public and perception swaying based on public sentiment.

If you want to invest in SpaceX in 2025 — how can you do it? There are plenty of ways, but most of them are bad.

Questions you should ask yourself before considering a SpaceX investment include:

Why invest in SpaceX?

Are there other investments with better risk-adjusted return potential for your desired investment window? (e.g. 2025-2030, 2025-2035, etc.)

What are SpaceX shares selling for on the private market? How does this compare to approximate fair market value? (Is there a big gap?)

What are the fees/premiums added to SpaceX shares by various investment corporations? Are they fucking you over without you realizing it?

What are the risks associated with investing in SpaceX?

Let’s assume you know why you want to invest in SpaceX and are convinced it’s an excellent investment over the next 5-10-15 years.

It would be in your best interest to analyze the volatility (price fluctuations) of private shares over the past 1y, 3y, 5y… and determine how these prices stack up with your own model of FMV (fair market value); everyone disagrees on “fair” value — this is something you need to determine for yourself based on whatever metrics you value most.

From my perspective in 2025, SpaceX is trading above fair-market value (FMV), but this isn’t surprising. Anyways, it is up to you to decide whether this premium is reasonable or downright absurd… if it’s absurd you’d want to wait until things fall more in line with reality OR just avoid.

In addition to premium relative to FMV, you should consider other fees/expenses associated with direct investments (buying fees, selling fees, etc.) and potentially low liquidity or lockup requirements.

If you’re an accredited investor, the smartest way to get SpaceX exposure is via platforms like Hiive, EquityZen, ForgeGlobal, et al. If you don’t qualify, you could opt for the SoFi/Templum “Cosmos” SPV with SpaceX, but the fees are not transparent (buy-in fee up to 6% plus possible mgmt/fund fees annually which could eat at your gains).

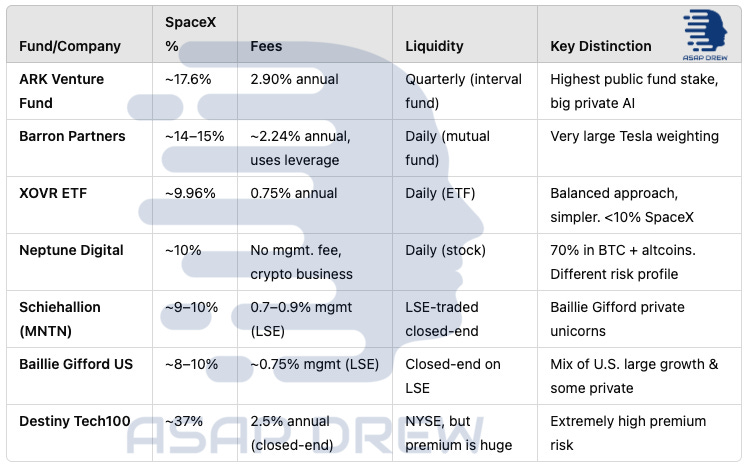

There are also actively managed funds and ETFs with SpaceX (varying %s) but many are poorly constructed (questionable co-holdings/allocations) and braindead premiums/fees (NAV, mgmt fees, fund fees, etc.) plus low liquidity.

In 2025: most funds/ETFs with SpaceX aren’t good… some are downright horrendous. I would strongly recommend against FOMO’ing into a fund/ETF just because it holds SpaceX.

For example, the DXYZ (Destiny Tech100) currently gives you a fund with SpaceX at 37% of total holdings (great) but the premium is ~800%. This is comically bad. You should run for the hills. This premium is on top of the private share price being above FMV (you’re getting taken to the cleaners).

Many of these funds have a few companies paired with SpaceX that are reasonable, but there is a lot of dilution from questionable/garbage companies that will likely flop. If you really want SpaceX, my recommendation? Direct investment or nothing at all.

Even if SpaceX kicks ass, the combination of fees/premiums and questionable co-holdings could lead to low ROI.

At quick glance, a fund like XOVR seems reasonable. It holds SpaceX without a major premium, has an OK annual expense ratio <1%, and tracks the Entrepreneur Factor ER30TR large cap tech stocks for some other holdings — but mixes these with other private companies (hence it’s a “crossover ETF”).

The problem with XOVR? Weightings are far from ideal, actively managed (active management is dumb and underperformed the standard ER30TR index), and expense ratio isn’t great. XOVR could be much better if they’d drop the “active management” component.

I. SpaceX Investment Thesis (2025–2030, 2035)

In 2025, SpaceX (Space Exploration Technologies Inc.) is the clear leader of the space industry, with few competitors even in the distant horizon.

With the global space economy on track to surpass $1 trillion by 2040, SpaceX’s innovative approach, rapid launch cadence, and integrated product suite have positioned it as the best-placed company to capture explosive growth over the next 5–10 years.

This makes SpaceX a compelling potential investment.

Technological & Operational Leadership

SpaceX’s competitive edge stems from its diverse and innovative product offerings, each engineered for cost-effectiveness and scalability:

Falcon 9 Rocket: A two-stage, partially reusable vehicle that has become the workhorse of SpaceX. Its reusable first stage, capable of landing on land or drone ships, slashes launch costs significantly. In 2024, Falcon 9 completed over 50 missions, serving commercial, government, and defense clients.

Falcon Heavy Rocket: An upgraded system that employs three Falcon 9 first stages—typically reusing two—to deliver payloads up to 63,800 kg to low Earth orbit (LEO). This powerful combination of reusability and high payload capacity makes it a cost-effective choice for large-scale missions.

Dragon Spacecraft: Encompassing both Cargo Dragon and Crew Dragon variants, this family of spacecraft supports resupply missions to the International Space Station (ISS) and crew transport. Crew Dragon’s reusability—up to five flights per capsule—coupled with SpaceX’s vertical integration, reduces reliance on external suppliers and streamlines operations.

Starlink Satellite Constellation: With over 6,000 satellites already launched as of early 2025 and plans for tens of thousands more, Starlink is revolutionizing global high-speed internet. Its ability to provide broadband to remote areas, maritime and aviation sectors—and potentially direct-to-cell phone connectivity—creates a recurring revenue stream that contributed $7.7 billion in 2024.

Starship System: Designed as a fully reusable rocket and spacecraft combo, Starship targets interplanetary travel, including missions to the Moon and Mars. Although still in development with successful test flights under its belt, Starship’s promise lies in reducing launch costs to as low as $2–10 million per flight and delivering massive payloads (up to 150 tons to LEO).

Rideshare Program: By allowing multiple small satellites to share a single Falcon 9 launch, SpaceX offers an affordable entry point—around $1 million for 200 kg—for operators who would otherwise face prohibitive costs with dedicated launches.

Collectively, these innovations enable SpaceX to achieve dramatic cost reductions versus traditional expendable rockets. The company’s vertical integration—manufacturing over 70% of its components in-house—coupled with a record launch cadence (over 90 missions in 2024) drives efficiency, reliability, and market dominance.

Valuation & Growth Potential

SpaceX is currently valued at approximately $350–400 billion (late 2024), based on aggressive bidding in secondary market transactions and funding rounds.

Analysts and high-profile venture capitalists project that this valuation could soar to $500–600 billion—and potentially even reach $1 trillion by 2030. This explosive growth is predicated on several factors:

Starlink’s Expansion: With the potential to reach tens of millions of subscribers, Starlink’s recurring monthly fees could generate tens of billions in annual revenue, fueling further R&D and expansion.

Human-Rated Starship Launches: Success with Starship could unlock additional revenue streams—from satellite deployment and deep-space missions to NASA’s Artemis program and eventual commercial passenger flights.

Broader Industry Trends: Financial institutions like Morgan Stanley and Bank of America expect the global space economy to exceed $1 trillion by 2040. With its integrated approach—combining launch services and broadband connectivity—SpaceX is positioned to capture a significant share of this emerging market.

Competitive Landscape & Risks

Despite its clear leadership, SpaceX faces several challenges that investors must consider:

Regulatory Delays:

Starship: Requires FAA approvals for orbital test flights, with potential environmental concerns at Boca Chica, Texas, that could delay full-scale operations.

Starlink: Must continuously secure FCC and ITU approvals for frequency rights and orbital slots, all while addressing the growing challenge of satellite debris.

Emerging Competition: Not really any serious competition in 2025.

Blue Origin: Jeff Bezos’s Blue Origin is developing the New Glenn rocket aimed at heavy-lift reusability, although its progress has lagged behind SpaceX’s timeline.

Rocket Lab: Known for its cost-effective small payload launches, Rocket Lab could expand its capabilities and capture niche segments.

Other Startups: While several new entrants are trying to carve out market niches, none currently match SpaceX’s scale—yet they could gradually erode market share in specific areas.

Market Volatility & Liquidity: As a privately held company, SpaceX’s share prices are subject to significant volatility in secondary markets. Additionally, transfer restrictions—such as the company’s right of first refusal—and the absence of a guaranteed IPO for its core rocket business add layers of uncertainty for investors.

Investment Thesis

SpaceX’s blend of groundbreaking technology, aggressive cost reduction through reusability, and robust vertical integration creates an unparalleled ecosystem in space exploration and broadband.

With current valuations reflecting its promise and future growth projections suggesting dramatic upward potential, SpaceX is poised to redefine the space economy.

However, regulatory challenges, emerging competition, and market volatility mean that investing in SpaceX—whether directly in secondary markets or indirectly via funds and ETFs—requires a careful balance of risk and reward.

For those prepared to navigate these complexities, SpaceX represents a once-in-a-generation opportunity to invest in the future of space.

II. Direct SpaceX Investments (Private Shares, Accredited Investors Only)

For investors meeting accredited investor thresholds (e.g., net worth over $1 million excluding primary residence, or annual income above $200,000 individually / $300,000 with a spouse for two+ years), direct ownership of SpaceX shares is possible… but highly illiquid. That said, a direct buy is the smartest option for exposure.

A.) Hiive

Fees: For buyers, typically no direct platform fee on standard transactions; sellers pay a transaction fee (4-5% depending on the size of the deal).

Minimum Investment: Varies based on listed shares—often around $25,000 for SpaceX but can shift.

Accreditation: Required (SEC standards).

Availability: Usually better for SpaceX than some competitors. Real-time auctions let buyers see pricing.

Lockup/Resale: No set “lockup,” but SpaceX’s Right of First Refusal (ROFR) may require the company to approve any resale.

B.) EquityZen

Fees: Typically a one-time fee at purchase (~3-5% or more) and/or at sale (~5% or more); no annual fees.

Minimum Investment: $10,000 for many deals but can be higher if demand for SpaceX is strong.

Accreditation: Required.

Availability: SpaceX shares can be rare; some data suggests limited or sporadic listings.

C.) Forge Global

Fees: Transaction fees typically ~5%, which may be charged to buyers, sellers, or both — depending on the specific transaction.

Minimum Investment: $100,000 or more, and for SpaceX specifically, sometimes $250,000.

Accreditation: Required.

Lockup/Resale: Similar constraints; shares are private, so resale requires company approval.

Takeaway: Direct secondary markets require accreditation, often have one-time transaction fees for buyers and/or sellers, with large minimum investment requirements (especially for SpaceX). There is no standard lockup, but illiquidity is high because future resales depend on finding buyers and getting SpaceX’s nod.

Cosmos Fund: A Special Purpose Vehicle (SPV) via SoFi & Templum

This is an alternative way to get direct SpaceX exposure… but you will pay a potentially larger-than-desired buyer’s fee AND you may end up paying management/fund fees (eating through your holdings)… if no management/fund fees then this could be worth considering.

Focus: Holds only SpaceX stock (pure SpaceX exposure).

Fees: Up to 6% upfront purchase fee (one-time). Unclear if additional management/fund fee as of February 2025 (not enough transparent information). Some speculate an additional 3-4% management/fund fee. If this is the case it’s a horrible deal.

Minimum Investment: $25,000.

Accreditation: Required; must join SoFi Invest and verify.

Lockup/Resale: Tied up until a liquidity event (IPO, buyback, or external buyer) — meaning indefinite hold.

Pros/Cons:

Pro: Straightforward route to 100% SpaceX if you’re accredited and want minimal complexity.

Con: 6% in fees can be steep if the stock’s growth doesn’t significantly exceed that cost. Zero liquidity until a big event.

III. SpaceX ETFs/Funds for Retail Investors (Indirect Exposure)

For non-accredited (or simply more cautious) investors seeking SpaceX exposure, several publicly accessible funds or operating companies hold SpaceX as part of their portfolios. This approach generally offers:

Lower direct exposure (often 8–18% SpaceX).

Annual expense ratios rather than big upfront fees.

Better liquidity (many trade on public exchanges daily) – though a few are interval or closed-end with unique rules.

Below are the main publicly known vehicles or companies that each hold roughly 9–10% or more of their assets in SpaceX—or at least a significant chunk.

For each, we examine SpaceX weight, fees, co-holdings, management style, liquidity, and potential for that weighting to shift.

A. ARK Venture Fund (ARKVX)

SpaceX Weight: ~17.6% (top holding, late 2024 data).

Structure & Liquidity:

Closed-end interval fund managed by ARK Invest (Cathie Wood).

Only quarterly repurchase windows for selling shares—no daily liquidity.

Fees: ~2.90% total expense ratio (2.75% mgmt + 0.15% service).

Co-Holdings:

Anthropic (AI), OpenAI (private shares), Epic Games, Tenstorrent, plus smaller public holdings like Archer Aviation.

Very heavy on “disruptive innovation”: AI, robotics, next-gen internet, blockchain.

Stability of SpaceX %: ARK is highly bullish on space. Expect SpaceX to remain a large slice unless they find new large private deals or SpaceX’s valuation outgrows others.

Pros & Cons:

Pros: Highest easily accessible SpaceX stake; exposure to cutting-edge private AI/future tech.

Cons: 2.90% annual fee is substantial; limited quarterly liquidity. Not for those who need frequent rebalancing.

B. Barron Partners Fund (BPTRX)

SpaceX Weight: ~14–15% across multiple share classes/preferred stakes.

Structure & Liquidity:

Open-end mutual fund with daily liquidity (can redeem shares any business day).

Managed by Ron & Michael Baron, known for high-conviction growth bets (e.g., Tesla).

Fees: ~2.24% expense ratio; they also use leverage, which can amplify volatility.

Co-Holdings:

Tesla (~40%), Arch Capital, CoStar Group, Charles Schwab, Hyatt, etc.

Tesla overshadow can dominate performance swings.

Stability of SpaceX %: Could rise if Tesla underperforms or if Barron invests more in SpaceX. Or shrink if Tesla soars further relative to SpaceX.

Pros & Cons:

Pros: Daily liquidity, historically strong performance, well-known manager.

Cons: Tesla weighting is huge, which might overshadow SpaceX returns; fairly high fees; leverage adds risk.

C. XOVR ETF (Entrepreneur Private-Public Crossover)

SpaceX Weight: ~10.071%.

Structure & Liquidity:

ETF traded on NASDAQ (previously “ENTR,” rebranded to XOVR in 2024).

Around 85% in ERShares’ “Entrepreneur 30” index (leading public companies with “entrepreneurial” traits), 15% in private stakes.

Fees: 0.75% total expense ratio (lower than most venture-oriented funds).

Co-Holdings:

Public: Alphabet, Meta, NVIDIA, Oracle, Salesforce, etc.

Private: SpaceX is top private holding. Possibly 1–2 other private unicorns (Klarna, etc.).

Stability of SpaceX %: Could hover near 10%. If inflows surge and XOVR can’t acquire more SpaceX shares, the weighting might dilute.

Pros & Cons:

Pros: Reasonable fees, daily liquidity (an ETF), balanced approach across big public tech + a key private stake.

Cons: ~10% in SpaceX is decent but lower than ARK’s 17% or Barron’s 14%. If you want truly maximum SpaceX, it may not be enough.

D. Neptune Digital Assets (TSXV: NDA / OTCQB: NPPTF)

SpaceX Weight: ~10-15% of total assets (recent disclosure, late 2024).

Structure:

Actually an operating crypto-mining and DeFi business, not a typical fund/ETF. You buy stock in the company.

Large exposure to Bitcoin (~60–70% of holdings), plus altcoins (Solana, ATOM, etc.).

Fees: None in the sense of a management fee—but you face typical corporate overhead. The share price can deviate from net asset value.

Stability of SpaceX %: Could fluctuate if crypto prices skyrocket (diluting SpaceX’s portion) or if Neptune changes strategy.

Pros & Cons:

Pros: If BTC soars and SpaceX also appreciates, synergy could be huge. No explicit mgmt fee.

Cons: Highly volatile due to crypto. Not purely a SpaceX bet—crypto’s performance can overshadow everything.

E. Schiehallion Fund (LSE: MNTN)

SpaceX Weight: ~9–10%.

Structure & Fees:

Closed-end investment company on the London Stock Exchange.

0.7–0.9% management fee, no performance fee.

Co-Holdings:

Focuses on late-stage private unicorns (ByteDance, Stripe, Epic Games, Databricks).

Managed by Baillie Gifford’s private companies team.

Liquidity & Premium/Discount: Trades on LSE, volume can be low, price can diverge from NAV.

Pros & Cons:

Pros: Relatively moderate fee, high-quality private growth portfolio.

Cons: Less convenient for many U.S. investors. Subject to closed-end discount/premium swings.

F. Baillie Gifford US Growth Trust (LSE: USA)

SpaceX Weight: ~8–10%.

Structure:

Closed-end trust, invests in U.S. public growth + some private stakes (SpaceX, Zipline, etc.).

~0.75% annual fee.

Co-Holdings: Tesla, Amazon, Shopify, The Trade Desk, etc.

Stability of SpaceX %: Modest. If big public holdings surge, SpaceX’s share is diluted.

Pros & Cons:

Pros: Balanced approach, known Baillie Gifford approach to growth investing, moderate fees.

Cons: LSE listing, <10% SpaceX. Harder for retail U.S. accounts unless your broker supports LSE.

G. Destiny Tech100 (NYSE: DXYZ)

SpaceX Weight: ~36.9% at last disclosure (Q3 2024).

Structure & Fees:

Closed-end fund on NYSE under ticker DXYZ.

2.5% annual management fee. No publicly stated performance fee in the core documents.

NAV Premium:

Historically soared above 100%. Reports suggested a premium as high as 800% earlier in 2024.

This means you could pay many times the underlying net asset value. Highly speculative.

Co-Holdings:

~22 private companies so far (e.g., Revolut, OpenAI, Epic Games), aiming for 100 eventually.

“SpaceX is top holding” at ~37%.

Pros & Cons:

Pros: Enormous SpaceX weighting, daily market trading, invests in other star private names like OpenAI, Stripe, Instacart, etc.

Cons: That massive premium is the biggest red flag. If the premium collapses, you can lose a lot, even if SpaceX thrives.

IV. Comparisons & Rankings of Indirect Funds/ETFs with SpaceX

I should note that I’m not really a fan of any of these funds/ETFs. If I could 100% verify Neptune Digital’s holdings AND I liked the BTC/crypto angle… this might be reasonable.

XOVR is decent, but the weightings are fairly atrocious. Top weights should be capped around 20%. Holdings overall good. Active management is dumb.

Most funds with SpaceX have terrible co-holdings, fees, etc. and zero SpaceX allocation guarantees. Many lure investors in by marketing private companies with SpaceX, but a lot seem like bad companies to me.

You’d honestly be better off just making a MAG7 ETF with SpaceX at ~10-20% instead… these are pathetic and traps for retail investors to get burned and heavily screwed over in fees. Would rather own the S&P than all of these.

The question you should be asking is — do I really think this fund will outperform QQQ or SPY or the MAG7 or even a basic ass global index. My guess is most of these roundabout SpaceX investments will not perform popular ETFs.

Note: This is mostly a subjective ranking if I had to come up with something. All of these funds have pretty significant drawbacks.