Bitcoin vs. M2 (Global & U.S.) Money Supply: Correlation, Causation, Macro & Price Impact (2025 Analysis)

To what extent does M2 impact the value of Bitcoin? Could it be highly predictive of peak Bitcoin price in bull cycles?

It is fairly well-known that Bitcoin (BTC) correlates fairly well with M2 Global Money Supply, as well as M2 U.S. Money Supply (in a slightly different way).

I wanted to really dig into available data (I did somewhat of a half-assed job here) to determine the strength of the M2 x BTC correlation and the degree of value M2 might provide in predicting bull cycle peaks/bear cycle starts.

Bitcoin vs. M2 (Analysis):

Historical correlation between Bitcoin & M2 (Global & U.S.): Strength of the correlation from the past to present. Is the correlation becoming more pronounced - or has it peaked? Is it staying the same? Is it stronger during bull runs than bear runs (e.g. strong in bull vs. weak in bear)?

Current estimated correlation between Bitcoin & M2 (Global & U.S.): What is the current correlation?

Latency: Does M2 lead Bitcoin? If so, by how much time, on avg.? Is this changing over time (e.g. lower latency, similar latency, etc.)?

Causality: Could M2 have a causal impact on the price of Bitcoin (even if somewhat indirectly)? What are the odds of this?

Predictivity: Can we accurately estimate the price of Bitcoin based on M2 changes (assuming M2 is a leading indicator)? For the 2025-2026 cycle can we have a reasonable idea of where Bitcoin is likely headed from M2 data? Can we likely predict “bull cycle peaks” & “bear market starts” based on M2?

What Is M2 Money Supply?

M2 is a commonly tracked measure of a nation’s money supply. It includes:

M1 Components:

Physical currency in circulation

Demand deposits (checking accounts)

Other highly liquid forms of money

Additional Components:

Savings deposits

Small-denomination time deposits (e.g., certificates of deposit under $100K)

Retail money market mutual funds

Because it encompasses both readily spendable money (M1) and slightly less liquid forms of capital (e.g., savings accounts), M2 serves as a broad gauge of total liquidity in the financial system.

Why Economists Track M2

Indicator of Broad Liquidity: Changes in M2 can signal the availability of funds for spending, saving, and investment.

Inflation Expectations: Rapid M2 growth sometimes aligns with higher inflation expectations (more money chasing the same amount of goods).

Risk-On/Risk-Off Cues: Expansions in M2 often coincide with lower interest rates or stimulative monetary policy, encouraging investors to move into equities, tech stocks, and often Bitcoin as part of a “risk-on” environment.

U.S. M2 vs. Global M2

While U.S. M2 quantifies money supply within the United States alone, Global M2 attempts to capture similar measures from other major economies (e.g., China, Eurozone, Japan, UK, Canada, Russia, Australia). Both are important for Bitcoin analysis.

A.) U.S. M2

The U.S. dollar remains the world’s primary reserve currency.

The Federal Reserve’s policy can shift global risk sentiment quickly.

Large swings in U.S. M2 often spark immediate reactions in U.S. capital markets, which can ripple into Bitcoin.

B.) Global M2

Reflects worldwide liquidity, aggregating money supply data from multiple economic blocs.

Liquidity from the Eurozone, China, Japan, etc., also flows into crypto—especially once a global bull trend is underway.

Over multi-quarter or multi-year horizons, global liquidity conditions often reinforce or amplify Bitcoin’s trajectory.

Key Consideration:

For shorter-term sentiment shifts, U.S. M2 changes can lead to swift reactions in Bitcoin.

Over longer timeframes, Global M2 expansions or contractions have a sustained influence on Bitcoin’s overarching bull or bear market phases.

Why focus on the Bitcoin-M2 relationship?

Bitcoin as a “Liquidity Barometer”

Unlike equities, Bitcoin has no earnings or dividends. It trades largely on sentiment, market liquidity, and macroeconomic factors.

When global liquidity is abundant, “risk-on” flows can push Bitcoin’s price up dramatically.

Inflation Hedge Narrative

Bitcoin’s fixed supply of 21 million coins is often positioned as a hedge against monetary debasement.

Rapid increases in M2 can raise inflation or debasement concerns, prompting some investors to rotate into Bitcoin.

Historical Trends

In recent cycles, large expansions in M2 (e.g., post-COVID stimulus) correlated with major bull runs in Bitcoin.

Conversely, when M2 growth slowed or reversed, Bitcoin’s price often faced significant headwinds.

By parsing these mechanisms, we can better understand how changes in M2 might predict or coincide with major inflection points in Bitcoin’s price—especially around cyclical peaks and troughs.

1. CORRELATION DYNAMICS (BITCOIN vs. M2)

A.) Why M2 and Bitcoin Tend to Move Together

1. Liquidity-Driven Risk Appetite

When M2 expands, there is more cash (or near-cash) in the system. Investors often rotate into higher-risk, higher-reward assets—such as equities and Bitcoin—to seek better returns.

In contrast, when M2 contracts or flattens (especially if accompanied by rate hikes), risk assets usually see sell-offs or sideways action as capital becomes more expensive or scarcer.

2. Inflation/Debasement Concerns

A rapidly growing money supply raises worries about the dilution of fiat currency value.

Bitcoin’s hard cap of 21 million coins can look increasingly attractive to those concerned about long-term monetary inflation, driving a positive correlation between BTC price and M2 growth.

3. Macro Policy Signaling

M2 expansions typically coincide with accommodative monetary policy (low interest rates, QE, etc.).

Markets interpret this as “there is a Fed put” (or central banks are likely to support assets), which increases general risk-on sentiment. Bitcoin, being a pure liquidity trade, benefits more strongly and more quickly than many traditional assets.

B.) Measuring Correlation: Methods & Caveats

1. Pearson’s Correlation Coefficient (r)

Definition: A measure from –1.0 to +1.0 indicating how two variables (e.g., monthly M2 changes and monthly BTC price changes) move in relation to each other.

Typical Findings:

High-Positive Correlation (e.g., +0.5 to +0.7) in certain bull phases, especially when both M2 is expanding and Bitcoin is rallying in tandem.

Weakened or Mixed Correlation (e.g., +0.2 to +0.3) in bear markets or times of crypto-specific turmoil, even if M2 remains elevated.

2. Time-Lag Adjustments

Often, Bitcoin does not move instantly with shifts in M2; there can be a time lag of ~3–6 months.

A direct, same-month correlation can understate the relationship if BTC is “front-running” or reacting late to M2 changes.

Advanced analyses might shift the BTC price series by 1–3 months to see if correlation rises, sometimes pushing r above +0.70 in high-liquidity eras.

3. Sample Period Bias

Measuring correlation from 2010–2016 might differ significantly from 2020–2024, because:

Bitcoin was less institutionalized in its early years; price movements were more idiosyncratic.

Post-2020, vast liquidity injections (e.g., QE) and increased institutional involvement have strengthened the correlation with macro drivers.

C.) Bull & Bear Markets (M2 & BTC)

1. High Correlation in Bull Markets

When sentiment is positive and M2 is rising, Bitcoin tends to exhibit a higher-than-normal correlation with M2.

This is partly due to the “all risk assets go up together” phenomenon—spurred by cheap capital, yield-chasing, and a willingness to bet on “high beta” plays like BTC.

Empirical Range: Correlations in the 0.60–0.70 range are not uncommon over a 6–12 month bull run.

2. Weaker or “Broken” Correlation in Bear Phases

In a crypto bear market, negative catalysts (liquidations, bankruptcies, hacks) can overwhelm whatever liquidity backdrop exists.

Even if M2 remains high or steady, fear-driven selling in crypto can cause a correlation dip to 0.20 or lower.

Example: In 2022, M2 was still near its peak (~$21T+ in the U.S.), but Bitcoin dropped from $46K to $16K primarily due to internal crypto credit contagion and global risk-off sentiment.

Hence, the correlation “fractures” when crypto faces systemic deleveraging or scandal that is independent of central bank policy.

D.) Historical Strength of the Correlation (BTC & M2)

Key Observation: The correlation can swing meaningfully based on whether macro or crypto-specific factors dominate. Overall, though, the big picture (2020 onward) shows a positive relationship—especially in expansionary liquidity phases.

E.) Global vs. U.S. M2 Correlation with Bitcoin

U.S. M2:

Often leads changes in Bitcoin price by a shorter window (1–3 months).

The Federal Reserve’s policies are typically the first to move global markets, so a shift in U.S. M2 growth can trigger immediate risk-on/off moves.

Global M2:

May take longer to manifest—3 to 6 months—because data from other central banks (ECB, PBoC, BoJ) filters into the market more gradually.

Once a bull run starts (sparked by U.S. liquidity), global expansions amplify and prolong the trend, reinforcing the positive correlation.

Practical Implication:

Traders closely watch U.S. Fed announcements for the initial sign of a liquidity shift.

Global liquidity (e.g., China’s or the Eurozone’s expansions) can sustain or supercharge a bull phase once it’s underway.

F.) Key Takeaways on Correlation Dynamics

Correlation Is Generally Positive, but Volatile

It strengthens significantly in bull cycles where M2 is rising and risk appetite soars.

It weakens in bear markets if crypto-specific panic overrides macro liquidity signals.

M2 Leads Bitcoin by ~1–6 Months

The lag is shorter (~1–3 months) when focusing on U.S. M2, longer (~3–6 months) with Global M2.

Front-running can occur if market participants anticipate future policy pivots (e.g., expecting QE restart).

Bull vs. Bear Discrepancies

Bull runs see correlation upwards of 0.60–0.70.

Bear markets may see correlation drop to 0.20–0.30 or lower, as deleveraging events can dominate.

Evolution Over Time

Early Bitcoin cycles (pre-2017) showed lower correlation due to lower institutional involvement.

Post-2020 correlation has been higher and more consistent, reflecting Bitcoin’s integration into macro portfolios and liquidity-driven markets.

The correlation between Bitcoin and M2 is a dynamic phenomenon that hinges on overall market psychology and crypto’s internal health.

During times of easy money and euphoria, Bitcoin tracks liquidity very closely.

In darker times, the correlation can temporarily “break” as crypto undergoes idiosyncratic shocks, though the longer-term uptrend of M2 and Bitcoin price typically reasserts their underlying positive linkage.

2. HISTORICAL OVERVIEW (2020–2024+)

A.) Early to Mid-2020: COVID Crash & Rapid Recovery

COVID Panic (March 2020)

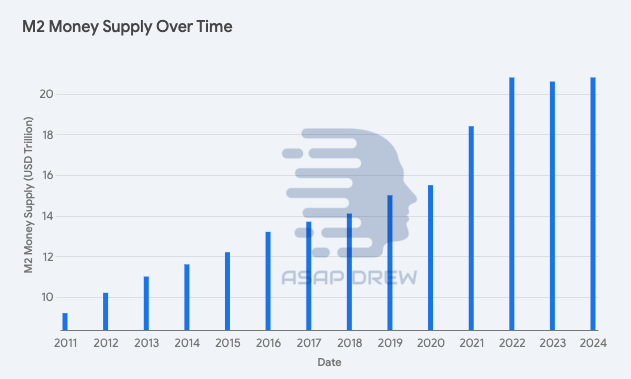

U.S. M2: Around $15–$16 trillion pre-pandemic. Suddenly, the Federal Reserve launched massive emergency measures (rate cuts to near-zero, QE, stimulus checks).

M2 Growth: Within months, M2 jumped from $15–$16T to $18T+ (an unprecedented surge).

Bitcoin Price: Collapsed from ~$9K to ~$4K in the March “Black Thursday” crash, then rebounded above $10K by late summer.

Interpretation

Rapid M2 expansion + risk-on sentiment returning after initial pandemic fear led to one of the fastest BTC recoveries ever.

Correlation: If you compare monthly percentage changes, you see a moderate-to-strong correlation (~+0.50–0.60) during the immediate bounce phase.

Latency: The policy shift (Fed QE) practically coincided with BTC’s revival, although the big jump in M2 data showed up more clearly by late Q2 while BTC truly took off in Q3–Q4.

B.) 2021: Stimulus Peak & Bitcoin Bull Market

U.S. M2 Continues to Climb

Ended 2020 near $19T, then pushed toward $20–$21T by late 2021.

Stimulus checks, extended unemployment benefits, and Fed asset purchases all contributed to historic yoy M2 growth (20–25% at some intervals).

Bitcoin’s Price Action

January 2021: BTC around $29K at the start.

April 2021: Peaked near $64K, then dipped to ~$30K in mid-year.

November 2021: New all-time high near $69K.

Correlation Note

Mid-2020 to Late 2021: One of the strongest alignment periods—the “everything rally,” when equities, tech, and crypto soared in tandem.

Some Pearson’s r estimates on monthly changes range +0.60 to +0.70 (or even higher with short-lag adjustments).

Key Factors

M2 soared under near-zero rates and stimulus.

Bitcoin benefited from an institutional adoption wave (e.g., MicroStrategy, Tesla).

Inflation hedge narrative grew as M2 expansion fueled concerns over monetary debasement.

C.) 2022: Flattening M2 & Crypto-Specific Contagion

Monetary Policy Shifts

The Fed signaled rate hikes, began tapering QE, and M2 growth slowed drastically.

U.S. M2 hovered around $21.7T in early 2022 but plateaued—dipping slightly toward $21.3–$21.4T by year-end.

Bitcoin’s Crash

Start of 2022: BTC near $46K.

End of 2022: BTC fell to $16–$17K.

Catalysts:

Terra/Luna collapse (May 2022)

Crypto lending/hedge fund crises (Celsius, 3AC, Voyager)

FTX implosion (November 2022)

Broader risk-off environment amid Fed rate hikes.

Correlation Dynamics

Even though M2 remained historically high, the growth rate had stalled, and crypto deleveraging dominated headlines.

On a month-to-month basis, correlation fell to 0.20–0.30 or sometimes negligible, as idiosyncratic crypto events overshadowed macro.

Insights

Demonstrates how internal crypto shocks can temporarily “break” the BTC–M2 correlation.

The pace of liquidity change (slowing or reversing) is often more critical than the absolute M2 level.

D.) 2023: Bottoming Out & Start of a New Bullish Phase

M2 Trends

Began 2023 around $20.7–$20.8T, then inched up to $20.9–$21.1T by year-end.

The Fed’s rate hikes slowed; markets priced in a potential pivot or at least a pause in tightening.

Bitcoin’s Rebound

BTC bottomed near $16K in late 2022.

By mid-2023, it rallied to $30K+.

Ended 2023 around $34–$42K—a strong recovery from the prior lows.

Correlation

Began to improve again once the worst of the crypto credit contagion passed and modest M2 growth returned.

Estimates might hover around +0.50 to +0.65, indicating partial realignment with macro liquidity conditions.

E.) 2024: Halving Year & Documented M2 Growth

U.S. M2

By November 2024, U.S. M2 stands at $21.45T (per public data).

This represents a moderate increase from late 2023 ($20.7–$20.8T).

Bitcoin’s Performance

The halving (April 2024) historically exerts a bullish influence within 6–9 months after the event.

BTC sees a strong uptrend: from ~$42K at the start of 2024 to over $100K by early 2025.

Correlation Aspect

With no massive negative events unfolding in crypto and M2 on the rise, the BTC–M2 correlation remains high (estimates in the +0.60–0.70 range).

The combination of halving momentum and moderately expansionary M2 fosters a textbook bull run scenario.

F.) Recap: 2020–2024 Correlation

Key Lessons:

High Correlation in bullish liquidity + positive crypto sentiment phases (e.g., 2021, 2024).

Weaker Correlation if crypto deleveraging or contagion events dominate (e.g., 2022).

The growth rate (acceleration vs. plateau) of M2 matters more than the absolute level.

The halving cycle can magnify a bullish macro backdrop, as seen in 2024.

3. CURRENT STATE OF M2 & BITCOIN (2025)

Having reviewed the historical record of how Bitcoin (BTC) and M2 money supply moved from 2020 through 2024, we now turn to where things stand in 2025.