3 Best Value Software Stocks (May 2025): IDCC, ODD, YMM

Only 3 software stocks survived an ultra-strict value screen in late April 2025

I recently screened for “value” stocks using a combination of: (1) baseline filters (e.g. market cap, avg. volume, Altman Z-score, Piotroski F-Score, 6M price change, et al.) and (2) sector-relevant metrics (in this case for software, SaaS, cloud).

I used specific caps for rev growth, FCF margins, EV/sales, gross margin, net cash/debt, SBC/revenue, shares change (YoY), etc. The result? ZERO SURVIVORS. None hit my ultra-strict criteria… perhaps this suggests there are no highway-robbery-type software stock deals.

It may also just suggest that my filters are too extreme and unrealistic. After some subtle modifications? Slim pickings, but 3 total survivors (as of late April 2025) and only 1 survivor as of May 7, 2025.

I’ll break down each of the companies below from the initial late April 2025 screening… but realize I am not endorsing any; I don’t own any.

Also understand that while some of these stocks may be decent “value” picks, this is irrelevant if you fail to account for: (1) opportunity costs (i.e. other opportunities that provide better risk-adjusted return potential); (2) macro conditions (Trump tariffs/trade deals, cycles, natural fluctuations); (3) your personal investment strategy; etc.

Just because something appears to be a good value doesn’t mean it won’t crash hard and/or turn into a horrendous investment.

DISCLAIMER: None of this is financial or investment advice. If you need assistance, consult a professional and take responsibility for your actions/decisions.

3 Software Stocks on the Radar (May 2025): IDCC, ODD, YMM

We evaluate InterDigital (IDCC), Oddity Tech (ODD), and Full Truck Alliance (YMM) on a 3–5 year horizon from a U.S. investor perspective. Each company offers distinct return profiles:

InterDigital (IDCC): A patent licensor with stable cash flows from 5G/6G and video IP.

Strengths: high-margin licensing, robust patent moat, significant net cash.

Risks: legal/regulatory (FRAND litigation), lumpy revenues tied to license renewals.

Outlook: moderate growth; lower risk, moderate IRR.

Oddity Tech (ODD): A high-growth AI-native beauty e-commerce platform (brands: IL MAKIAGE, SpoiledChild).

Strengths: direct-to-consumer model with ~72% gross margins, efficient customer acquisition (12-month repeat purchase ~80%), net-cash balance sheet.

Risks: sustaining growth via new brand launches, heavy marketing spend, inventory management.

Outlook: high growth; higher risk, high IRR potential.

Full Truck Alliance (YMM): China’s leading digital freight marketplace.

Strengths: network effects (197M fulfilled loads in 2024, +24% YoY), improving monetization (transaction revenue +71% YoY) and profitability (2024 net income ~$428M).

Risks: Chinese regulatory oversight (data/cybersecurity, fee caps), HFCAA audit compliance, macro in China.

Outlook: strong growth; high IRR potential if regulatory environment remains stable.

We rank YMM as the top allocation for aggressive growth (highest IRR potential with emerging dividends), ODD second (robust growth but execution risk), and IDCC third (steadier returns, valuable for risk mitigation).

1.) InterDigital, Inc. (IDCC): 3-5Y Investment Profile

IDCC Stock Price (May 7, 2025): ~$212.50

Business Model

A 50-year-old pure-play R&D company focusing on wireless and video compression standards.

Holds 30,000+ patents in 5G/6G cellular standards, Wi-Fi, HEVC/VVC video codecs, and emerging AI-based compression IP.

Licenses to every top-10 handset OEM (e.g., Apple, Samsung, Xiaomi) plus TV/streaming manufacturers and the Avanci auto pool.

Generates 90%+ gross-margin licensing revenues under 5- to 7-year contracts, often front-loaded with catch-up payments.

Moat & Realistic TAM Capture

Moat

Standard-Essential Patents (SEPs) in 5G/6G—licenses are mandatory for nearly all device makers.

Video codec leadership.

Recurring revenue model with strong IP-protection.

TAM and Share (2024 → 2029)

Even if smartphone units stagnate, new verticals (auto, IoT) and upgraded standards (VVC) could expand IDCC’s addressable royalty pool from $20B to $26B.

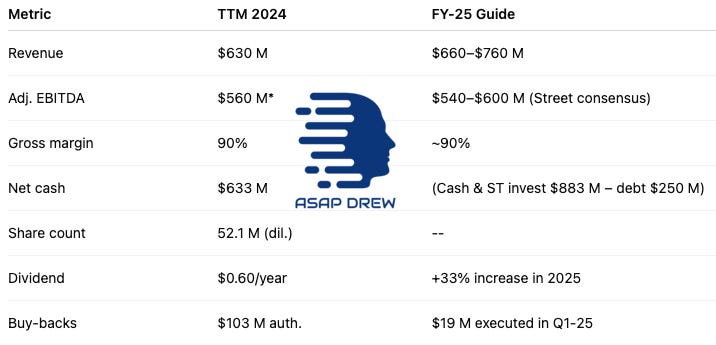

Financial Snapshot

*Excludes certain litigation one-offs.

Valuation

EV ≈ $5.0 B → EV/EBITDA ~9×, EV/S ~7.9×, P/E ~30× (GAAP).

Premium vs. some larger licensors, arguably justified by higher growth outlook and strong net-cash position.

Catalyst Map (Next 24 Months)

Scenario Valuation to YE-2029

Weighted average expected CAGR ≈ 13%.

Risks

Licensee Litigation: Typically 80%+ settle out of court. Arbitration helps reduce uncertainty.

Regulatory FRAND Rate Caps: IDCC publishes transparent rate cards and is less than 2% of total 5G SEPs.

Smartphone Demand Erosion: Offsetting factor is rising royalty per handset from 5G/6G plus IoT diversification.

Patent-Pool Dilution: Seats on major pools (e.g., VVC, Avanci) ensure they capture pro-rata share.

Risk-Adjusted Appeal vs. ETFs

Decent but likely a worse risk-adjusted investment than QQQ.

Why It’s on the Radar…

Scarce Asset: Pure IP “compounding machine” with 90% gross margins and minimal capex.

Visible Cash Flow: 70% of handset TAM under contract through 2027–29.

Optionality: Automotive, IoT, and VVC represent $300–$400 M incremental royalty runway.

Shareholder Returns: Net cash, rising dividends, ongoing buybacks.

Low Correlation: Royalty tied to device volumes, not broad market cycles—potential portfolio stabilizer.

Overall Take: Quality But Not “Highway Robbery”

Projected ~13% CAGR with modest volatility, underpinned by contractual revenues and a strong balance sheet.

For those specifically seeking a stable licensing play, IDCC may merit small consideration. Otherwise, general market ETFs can still outdo it on a pure Sharpe basis.

2.) Oddity Tech Ltd. (ODD): 3-5Y Investment Profile

ODD Stock Price (May 7, 2025): ~$67.50

Note: This company jolted in valuation right after my filtering in late April 2025… from ~$40-$42 to ~$67.50. Not sure what caused the spike, but proceed with caution after this violent upswing.

Business Model

Focus: A digital-native beauty platform with 100% DTC sales.

Brands: IL MAKIAGE (color cosmetics), SpoiledChild (skin/hair care).

Key Tech: AI-based shade matching (PowerMatch), Voyage81 hyperspectral imaging, in-house molecule R&D lab.

Economics: 75% gross margin, outsources manufacturing but owns formulas and sells direct online.

Moat & Realistic TAM Capture

Macro: Global beauty & personal care was $557B in 2024, forecast at $800B by 2029.

Online Shift: E-commerce beauty is growing from 20% to ~30–35% channel share by 2029.

ODD’s Penetration

Could feasibly hit $2B in annual sales by 2029 (~3× its 2024 revenue).

This implies just ~0.3% of the global beauty wallet—so there is a plausible runway.

Financial Metrics

April 2025 valuation ($41/share)

EV ≈ $3.5 B → EV/S ~5.4× (2024), ~4.4× (2025E).

Forward P/E ~21× (EPS $1.99–$2.04).

Moat Drivers

Data Flywheel: 2B+ labeled skin data points with ~80% repeat rate.

Vertical Margin: No wholesale markup → 70%+ GM.

Proprietary Tech/IP: Voyage81 imaging, AI R&D lab for new molecules.

Brand Engine: SpoiledChild surpassed $100M run-rate in first year; next brand launches in 2025–2026.

Catalyst Map (Next 24 Months)

Scenario Valuation to YE-2029

Weighted average expected CAGR ~13%.

Risk-Adjusted vs. ETFs

Higher raw upside than typical consumer/beauty names but more volatility.

Likely a worse risk-adjusted investment than QQQ.

Why It’s on the Radar

Efficient Growth: Rule-of-40 = 48 (27% top-line + 21% FCF margin).

Relative “Value”: 5×–6× sales is not outrageous compared to software/consumer-tech peers.

Zero Leverage: Downside cushion from net-cash.

Brand Multiplication: Each new brand leverages the same digital platform, providing incremental TAM at low added capital.

Overall Take: Attractive But Exclusion-Sensitive

Could see 2–3× upside by 2029 if brand rollouts keep succeeding.

Still reliant on digital ad funnels and no major brand flop.

For risk-tolerant growth investors seeking a consumer-tech hybrid, ODD might warrant a small, speculative position.

3.) Full Truck Alliance Co. Ltd. (YMM): 3-5Y Investment Profile

YMM Stock Price (May 7, 2025): ~$11.50

Business Model

Core Offering: “Uber-for-freight” in China, digitally matching truckers/shippers.

Scale (2024): 197 million loads (+24% YoY), RMB 11.24 B revenue (+33% YoY).

Revenue Streams: Commissions (take-rate ~1.65%), listing fees, fuel-card fintech, insurance, small loans.

Financial Position: ~$3.8 B net cash, no debt; introduced $200M semi-annual dividend + $200M buyback for 2025.

Moat & Realistic TAM Capture

China Road-Freight Market: ~$400B GMV in 2024, possibly $550B by 2029.

YMM’s Market Share:

Could reach 4% GMV ($22B) by 2029.

Take-rate can expand from 1.65% to ~2%, well under the 5% regulatory cap.

FinTech / Insurance Upside: Currently ~5% of revenue, could reach 10%+ as adoption rises.

Competitive Moat

Network Effects: 1.9M monthly shippers, 6M truckers; new entrants would need deep subsidies.

Regulatory Licenses: Already cleared cybersecurity reviews; has the Ministry of Transport’s green light.

Ecosystem Lock-in: Fuel cards, insurance, loan programs boost driver loyalty.

Key Numbers (FY-24 / Q1-25)

Catalyst Map (Next 24 Months)

Scenario Valuation to YE-2029

Weighted average expected CAGR ~12%.

Risk & Mitigation

China Policy Shift: YMM’s current take-rate is well below the 5% cap; they’ve been proactive in compliance.

HFCAA / ADR Delisting: YMM could pivot to a Hong Kong listing, but U.S. holders risk forced conversion.

Macro Freight Slumps: Gains share from offline brokers due to digital convenience; large cash buffer.

Loan-Book Credit Risk: NPL ~1.8%, small relative to total assets, can be managed if needed.

Risk-Adjusted Comparison

High volatility, largely from China regulatory risk.

Likely a worse-risk adjusted investment than QQQ.

Why It’s on the Radar

Category Dominance: ~70% share in China’s digital trucking.

Low Valuation Multiples: PEG <1 for a 25%+ EPS growth story.

Cash Return: Initiating dividends + buybacks, ~3% combined yield for 2025.

Unique Exposure: Ties to domestic Chinese freight, less correlated to S&P macro.

Overall Take: Potential But High Volatility

If policy risk abates, YMM could rerate strongly.

Political/regulatory overhang remains real—ADR holders may be especially vulnerable.

Better suited as a small, speculative slice if one believes in a stable China policy environment.

Comparative Investment Appeal & Macro Considerations (May 2025)

InterDigital (IDCC)

Pros: U.S.-based, stable licensing, net-cash, 90% gross margin, 13% forecast CAGR, minimal direct China or tariff exposure.

Cons: Fully valued at ~9× EV/EBITDA; can underperform if handset volumes shrink faster or if FRAND rates get cut.

Overall: Arguably the most balanced risk–reward among these three for a conservative investor, though not an “insanely cheap” opportunity.

Oddity Tech (ODD)

Pros: Rule-of-40 outlier (~27% growth + 21% FCF margin), net-cash, brand-launch momentum. Potential for 2–3× by 2029.

Cons: Execution risk on new brands, dependence on digital ad funnels, and valuation near 5–6× forward sales. Volatile if growth wobbles.

Overall: A high-beta, higher-upside consumer-tech bet. Consider only as a small “venture-like” allocation if you strongly believe in its brand-building prowess.

Full Truck Alliance (YMM)

Pros: Dominant in China’s digital freight, strong growth (20%+), net-cash, cheap multiples (PEG <1).

Cons: China ADR political/regulatory risk, possible delisting, cyclical freight volumes, high share-price volatility.

Overall: Potentially big upside but overshadowed by macro/policy uncertainty. Many U.S. investors might choose to skip unless they have a specific edge on China’s regulatory path.

Impact of Macro & Geopolitics

Tariffs / Trade War (e.g., “Trump 2.0” scenario)

IDCC: Minimal effect (licensing intangible IP, global exposure).

ODD: Minor effect (~2–3 pp possible COGS bump on imported components), but not existential.

YMM: Unlikely direct tariff impacts (domestic Chinese freight), but broader Sino-U.S. tensions may clamp ADR investor sentiment.

China Crackdown on U.S.-Listed Stocks

IDCC & ODD: Irrelevant (IDCC is U.S.-based; ODD is Israeli FPI, PCAOB-inspected).

YMM: Directly at risk of forced delisting or HFCAA constraints.

Odds of Going to Zero? All three maintain net-cash, positive free cash flow, and intangible assets that keep them far from insolvency risk. The bigger risk is persistent valuation compression or delisting, not actual bankruptcy.

Are There Better Opportunities?

Sectors like U.S. defense primes, energy MLPs, or AI/data-center suppliers may have more favorable risk/reward for certain investors.

Large index ETFs (SPY, QQQ) still likely offer a better overall Sharpe ratio, especially if you prefer lower portfolio management complexity.

Thoughts on Whether to Invest or Pass

IDCC: Could be considered if you want a low-vol, IP-royalty play. Not a “screaming buy,” but stable and decently positioned for mid-teens returns.

ODD: Potentially rewarding but carries significant execution risk. Size accordingly — if at all.

YMM: High volatility with China-specific overhangs. Unless you have specialized insight or accept the heightened geopolitics, it may be prudent to wait or allocate only a very small fraction of capital.

For most U.S.-based investors lacking a specific thesis or appetite for higher tail risks, sticking with broad ETFs (e.g., SPY, QQQ) or carefully selected sector funds might offer superior risk-adjusted returns.

None of these 3 names appears to be a once-in-a-lifetime bargain at today’s valuations; each has its merits, but also uncertainties that may or may not be worth the extra portfolio complexity.

What do I think of IDCC, ODD, YMM (2025)?

Well 3 software stocks that I’ve never heard of made it through my preliminary screening filter… yet none seem enticing enough to warrant a buy in May 2025.

Perhaps I’ll do my screening once a month (or once in a while) and only write about filter survivors if there’s *seemingly* strong value.

Would rather have plenty of cash in short-term T-bills and cash sweeps ready to pounce on major opportunities that surface during Trump’s unpredictability… and would rather stick with ETFs or satellite plays that have stronger logic (e.g. SOXX for semi growth with U.S. tilt, possibly ITA, possibly URNM, etc. depending on spending bills/tariffs, etc.).

I think there are far better opportunities (risk-adjusted ROI potential) than IDCC, ODD, YMM right now (May ‘25)… but you may like these… who knows.

Recommendation: 8 Big Cap Tech Stocks in a 6-Month Selloff. This piece covers tech stocks that likely offer better risk-adjusted opportunities. These aren’t my top picks currently… but there are some potentially highly-compelling opportunities for certain types of investors.