ACM Research (ACMR) Stock Forecast 2025: Buy or Sell? Investment Analysis

Is ACM Research Inc. a decent AI hardware stock play over the next 5 years?

Recently decided to take a closer look at the company ACM Research (ACMR).

Why? It was the lone survivor of a stock screening method I applied for HPC/hardware & semiconductor equipment sectors — so it warranted a more in-depth look.

Company-specific metrics and financial indicators make ACM Research look like a prospective “green light” for investment… but U.S.-China geopolitical tensions and trade restrictions (i.e. Trump’s trade wars) are a glaring “red light” (no go zone) — so at this precise moment I’d avoid ACMR until there’s more clarity.

In the event that Trump stops his trade-deficit tariffs — it may warrant an updated analysis.

Another potential opportune time to consider ACMR is if:

You assume it will survive trade shocks and/or bounce back no matter what (i.e. weather the trade storms) AND

It sinks to a ridiculously low floor price (creating a rare highway robbery type “buy zone”) — assuming you haven’t found any other better risk-adjusted upside equities that are undervalued (usually you can).

Note: I am NOT an investor in ACMR. Zero conflict of interest. Just learned about the company’s existence yesterday via my screening. And even if I were an investor I would NOT be hyping it up trying to convince you to invest. You can craft your own investment strategy.

Disclaimer: Nothing here is investment/financial advice. Consult a professional if you need assistance. Take responsibility for your own actions/choices.

I.) ACM Research Inc. (U.S. & China)

ACM Research, Inc. is a publicly-traded American semiconductor company that engages in the manufacture and sale of single-wafer wet cleaning equipment used to improve product yield.

Although ACM Research has a HQ in the U.S. (Freemont, California), its major operations are based in China via its subsidiary ACM Research Shanghai.

Core Focus: Wet-process tools for semiconductor front-end fabs and advanced packaging lines. These systems chemically clean, etch, or plate wafers—often at extremely defect-sensitive steps.

Flagship IP: Patented “SAPS” (Space-Alternated Phase Shift) and “TEBO” (Timely Energized Bubble Oscillation) mega-sonic cleaning technologies. They deliver uniform energy while reducing chemical consumption.

HQ: Fremont, California (U.S.) vs. Primary Operations: Shanghai, China (where most assembly and testing occur).

Revenue Mix: ~99% from Chinese fabs in 2024, but opening Oregon (U.S.) and Hwaseong (Korea) sites to diversify.

Evolution of ACMR

1998–2005: Silicon-Valley start-up → China foothold: Founded in Fremont, CA (1998). Opened Shanghai subsidiary (2005) to court China’s nascent fabs.

2011–2016: Technology breakthrough: Commercialized SAPS (2011) and TEBO (2015), enabling damage-free cleans on 1X nm patterns and TSV structures.

2017: NASDAQ IPO (ACMR) raised ~$30 m for new platforms.

2021: Dual-listing in China: 82 %-owned ACM Research (Shanghai) went public on the Shanghai STAR Market, raising RMB 3.7 bn to build a 1 000-tool Lingang “mega-fab” campus.

2023–24: Globalization & diversification: Opened an 11,000 ft² demo/R&D site in Hillsboro, Oregon (Nov 2023) and agreed to buy a larger clean-room campus nearby (close 4Q 2024). Qualified first high-temperature SPM tool in Europe and first ALD furnace at two China customers, expanding beyond cleaning.

II.) ACMR Competition (2025)

ACRM focuses mostly on: single-wafer wet clean, batch clean & bevel etch, electro-plating, and thermal ALD & furnaces — within the semiconductor industry.

Single-Wafer Wet Clean: ACMR competes against Lam Research (LRCX), Tokyo Electron (TEL), SCREEN, and NAURA. ACMR positions itself with a niche focus, leveraging specialized IP (SAPS/TEBO) and achieving lower defectivity.

Batch Clean & Bevel Etch: The main competitors are TEL, SCREEN, and Lam. ACMR competes primarily on cost-of-ownership, especially for 3D NAND applications.

Electro-Plating (ECP): ACMR faces Applied Materials, TEL, Ushio, and NAURA. ACMR uses SAPS-based chemistry to gain a performance edge.

Thermal ALD & Furnaces: TEL, Lam, and ASM International dominate. ACMR targets Chinese fabs seeking "domestic-friendly" solutions, aligning with national policies.

China-centric Competition: NAURA and AMEC are strong local contenders, boosted by Beijing’s subsidies and the national "buy-Chinese" initiative.

Global Overview: Lam, TEL, and Applied Materials continue to dominate, holding 60–70% market share in single-wafer clean and plating segments worldwide.

III.) ACMR Revenue Mix & Profits (2025)

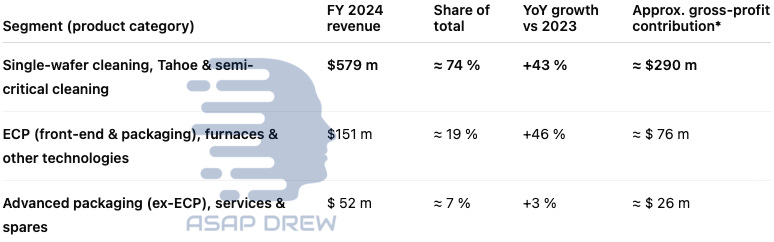

Most of ACMR’s revenue comes from: single-wafer cleaning (~74%) with 43% YoY growth in 2024; ECP (~19%) with 46% YoY growth in 2024; and advanced packaging (~7%) with 3% YoY growth in 2024.

What the numbers say

Primary engine: Single-wafer cleaning remains the work-horse, supplying three-quarters of revenue and almost 80 % of gross profit. Management highlighted 43 % growth driven by additional Ultra C “Tahoe” tool wins at Chinese logic and DRAM fabs.

Emerging growth driver: Electro-plating/furnace tools grew even faster (+46 %), lifted by first-wave production orders for copper ECP and the successful qualification of thermal & plasma-enhanced ALD furnaces.

Steady, high-margin tail: Advanced-packaging equipment and services rose only 3 % but carry service-like margins; they provide a resilient profit base and recurring spares revenue.

Profitability caveats

ACMR reports one consolidated P&L. Product-level margins can diverge materially—for example, service revenue tends to be higher-margin than new-tool hardware, while early-ramp products such as ALD furnaces typically run below the corporate average. Treat the gross-profit allocations above as rough scale rather than precise GAAP profit.

IV.) ACMR Stock Financial Metrics (Apr 2025)

As of late April 2025, its valuation is arguably better than most: $1.14B market cap with ~$223.47M quarterly revenue (Q4 2024) and 3 quarterly beats in a row with large surprises to the upside.

Market Cap: $1.16B

Enterprise Value (EV): $0.91B.

Revenue (TTM): $782M

Gross Margin: ~50% (historical range 47–50%)

P/E (TTM): ~12×

EV / Sales (TTM): ~1.16×

Beta (5y): 1.65 (high volatility vs. industry average of ~1.2)

Why Some Sources Show Different EV

ACMR holds significant “time deposits” (over $100M) not always classified as cash-equivalents.

Some websites add lease liabilities as “debt,” inflating EV.

Regardless of where you pull your valuation metrics, ACMR’s valuation is well below peer multiples.

ACMR EV/Sales Discount: ~75% below Lam/TEL, 30–40% below SCREEN (the closest wet-clean peer).

Why So Cheap? Heavy China exposure (99% of revenue), uncertain export controls, smaller cap.

V.) TAM (Total Addressable Market) & Realistic Capture (2025)

It’s generally good to estimate TAM (total addressable market) and from there determine realistic market capture (within highest-confidence TAM).

A.) Wet-Process Market Size

ACM Research’s core domain—wafer cleaning and other wet-process equipment—is a multi-billion-dollar slice of the broader semiconductor equipment industry.

Single-Wafer & Batch Clean: Various industry estimates project that the cleaning segment alone will exceed $15B in 2025, growing at 8–9% CAGR through 2030, in line with rising complexity at advanced nodes (more cleans per wafer).

Bevel Etch & Surface Prep: Often considered part of the “wet-process” family, these sub-steps add a few billion more in potential revenue.

Electro-Plating: Another multi-billion sub-segment (somewhere around $5–6B in 2025), expected to expand ~9% annually as advanced packaging and copper interconnect layers proliferate in 2.5D/3D architectures.

Key Growth Drivers:

3D NAND Layer Count: As 3D NAND transitions from 128 to 200+ layers, the number of cleans per wafer can double vs. planar NAND.

Gate-All-Around (GAA) & FinFET**: Each new logic node intensifies cleaning steps to minimize line-edge roughness and defectivity.

TSV/Advanced Packaging: 2.5D/3D integration (e.g., chiplet-based designs) requires plating and specialized cleans to ensure good vertical interconnect yield.

B.) ALD/Furnace & Advanced Packaging TAM

Thermal ALD/PECVD: While the entire ALD market may exceed $7–8B by 2025, the specific slice for vertical furnaces used in advanced logic and memory is closer to $1B. This vertical furnace niche, however, could outpace general WFE growth (10–12% or more) as more layers/films are deposited on advanced nodes.

Advanced Packaging Tools: Yole Group data suggests advanced packaging equipment (including plating, wafer-level packaging lines, etc.) will approach $9–10B globally by 2025. Not all of that is in ACM’s sweet spot, but the portion dealing with wafer-level plating, cleaning, and stress-free polishing is a few billion.

Served TAM vs. Total TAM

Despite the broader wafer-cleaning/deposition market being huge (> $20B if you sum up all steps), ACMR realistically addresses only the portions where it has a commercial product:

Single-Wafer & Batch Wet-Clean: The flagship SAPS/TEBO platform plus Tahoe batch systems tackle ~$15B. But ACM’s share is currently around 5–6%.

Electro-Plating & Stress-Free Polishing: Potentially $5–6B combined. ACM is new here, so current share is <1%, but it’s gaining traction in China’s packaging houses.

Thermal ALD/PECVD Furnaces: A $1B sub-market within the broader ALD sphere. ACM just qualified its first furnace tools in 2024, so near-zero current share.

Advanced-Packaging Lines: Possibly $2–3B that intersects with plating, cleaning, wafer-level packaging, etc. ACM competes with Applied, TEL, Ushio, and some local Chinese players.

Hence, the “served TAM” for ACM in 2025 might be ~$22–$25B. It could grow to $30B+ by 2030 if 3D NAND and advanced logic nodes keep scaling.

Realistic Market Share Capture (2025-2030)

Under conservative assumptions, ACM might comfortably maintain mid-teens revenue growth even if it only takes an incremental slice of the wet-process and plating TAM in China.

In a more optimistic scenario—where it lands multiple overseas design wins—ACM’s total share could approach 8–10% by 2030.

That may sound small, but in a $25–$30B served TAM, it translates to $2–$3B annual revenue potential.

Current Position (2024–25): ~5% share in single-wafer cleaning, effectively lower in batch, plating, and ALD/furnaces. Overall ~4–5% if you lump everything into a $20B+ market.

China-Led Growth: By focusing on Chinese fabs at 28 nm+ (and some advanced lines), ACM could boost its domestic share to 10–15%, especially as Western suppliers face export restrictions. That alone might double or triple ACM’s absolute sales from wet-process.

Overseas Prospects: If ACM can localize final assembly in Oregon or Korea to circumvent certain U.S. licensing issues, it could incrementally win orders in Taiwan, Korea, or even the U.S. at mature nodes. Each success outside China further expands share.

Constraints: The biggest limiting factor is U.S. export approvals for advanced node tools, plus the challenge of cracking established relationships at big global fabs.

VI.) 2025–2030: ACMR Outlook Under Trump 2.0

Following ACMR’s trajectory through 2025, the biggest “swing factor” is how U.S. export controls evolve under the Trump administration.

Given that ~99% of ACMR’s revenue originates from Chinese fabs, any shift in export policy can directly impact advanced-node shipments, technology licensing, and even the ability to procure certain U.S.-origin parts.

ACMR’s growth hinges on carefully navigating export licenses, localizing U.S. parts, and maintaining a leadership edge in wet cleaning within China.

With moderate carve-outs and/or exemptions, ACM could still post solid double-digit growth through 2030, potentially doubling or tripling the stock price.

Yet the downside risks are significant: severe restrictions or a massive local-competitor push could stall revenue expansion, dragging ACM toward a flat or modestly up valuation.

On balance, ACMR remains a high-beta, policy-sensitive play with a disproportionately large upside if Sino–U.S. trade tensions moderate—and a very real downside if controls expand or China’s fab spending falters.

Export-Control Headroom

Current BIS License Status by Tool Family

Single-Wafer Wet Cleaning: Controlled under ECCN 3B001.p.4 if bound for sub-14 nm logic or advanced 3D NAND (>128 layers). Licenses are “presumed denial” for leading-edge nodes, meaning ACM must redesign out U.S. components or hope for special carve-outs. Mature-node (≥28 nm) cleaning tools remain generally allowable.

ECP Plating Systems: Also restricted for advanced interconnect processes. Tools for “legacy nodes” or back-end packaging can often proceed without a license—but any sub-14 nm or sub-18 Å DRAM usage triggers a license request.

PECVD & Furnace: Squarely under recent (2022–2024) rules for advanced front-end equipment. Japanese and Dutch regulations align here, making it difficult to source or ship certain furnace/ALD parts if the end-user is a restricted Chinese fab.

Track Tools (Coater/Developer): Moderately restricted if used in lithography lines below ~16 nm, due to allied export measures in Japan.

Advanced Packaging: Generally less restricted as it focuses on wafer-level packaging, TSV, and 2.5D/3D interposers—though any U.S. parts in these systems still require compliance with Entity-List restrictions.

Entity List Ramifications

As of late 2024, ACM Shanghai was placed on the BIS Entity List, which bans direct or indirect supply of U.S.-origin technology without a license. This led to overnight shortages of certain single-sourced U.S. components (robotics, sensors, etc.).

Partial Shipments: ACM can still ship many “mature-node” or back-end packaging tools, provided it uses non-U.S. substitutes for key parts.

Timeline for Design-Around: Management estimates 12–18 months to fully localize or re-qualify non-U.S. suppliers. During this period, some advanced-node orders remain stalled or forced into design changes.

China-Only Customer Risk & Diversification

Heavy Revenue Concentration

SMIC, YMTC, and CXMT are likely the top 3 customers, collectively driving well over 50% of annual revenue. Each has faced direct or indirect U.S. restrictions that limit their procurement of next-generation tools.

Any single customer’s cutbacks or sanction hits can dent ACMR’s backlog significantly—amplified by its narrow customer base.

Potential for Global Expansion

Despite the China-heavy revenue mix, ACM has pursued overseas evaluations—e.g., small tool installations in Taiwan or Korea.

The company’s new Oregon facility (plus a planned Korea site) could allow final assembly outside China, potentially skirting “U.S.-origin” designations for certain parts. This might win new customers in Asia or even the U.S., if licensing can be navigated successfully.

Global adoption, however, remains in early innings, as most Western or advanced-node Asian fabs rely on entrenched vendors (TEL, Lam, Applied). Policy constraints complicate whether these fabs view ACM as a safe long-term partner.

Competitive Moat vs. Naura & Global Peers

SAPS/TEBO Technical Edge

ACM’s proprietary SAPS (Space-Alternated Phase Shift) and TEBO (Timely-Energized Bubble Oscillation) mega-sonic cleaning IP stands out for achieving low defectivity with minimal chemical consumption, validated at sub-20 nm DRAM and 128+ layer 3D NAND lines.

This technology gave ACM first-mover status among Chinese suppliers—outpacing domestic rival Naura in single-wafer cleans.

Cost Advantages & IP Portfolio

Shanghai-based manufacturing and local supply chains allow ~15–30% lower pricing vs. Lam or TEL.

ACM has built a patent portfolio over two decades, covering wet-clean, plating, and stress-free polishing. Some foundational patents expire post-2025, but the firm continues filing improvements to extend coverage.

Competitive Threats

Naura, AMEC: Highly subsidized by Beijing, ramping R&D. If they match SAPS/TEBO defect specs, they could undercut ACM’s growth.

Global Giants: Lam/TEL remain leaders worldwide and might rapidly re-enter the China market if export restrictions ease. For now, however, they face the same license constraints at advanced nodes—giving ACM a partial home-field advantage.

Gross Margin Durability

Historical Trajectory

Gross margins rose from ~44% in 2020 to ~50% by 2024, aided by economies of scale, local sourcing, and increasing service/spares revenue from an expanding installed base.

Product Mix & Service Contribution

Single-wafer tools, especially repeat orders, carry decent margin once engineering is amortized.

Newer products (e.g., ALD/furnace, advanced plating) can drag near-term margin while ramping. Over time, they should reach corporate-average or above.

Localization & BOM Costs

Post-Entity List, ACM must qualify non-U.S. parts, which could mean higher or lower costs depending on vendor pricing. Thus far, the margin impact has been modest, reflecting strong local supply networks and partial pass-through to customers.

Long term, after-sales service (which can carry >50% margin) should become a bigger contributor as the installed base matures, helping offset cyclical new-equipment pressures.

Cash Conversion & Future Capital Needs

Working-Capital Intensity

High inventory and A/R remain structural, as capital equipment has long lead times and milestone-based payments. Customer prepayments offset some working-capital drag.

Lingang Capex & R&D

ACM is finishing a major expansion in Shanghai’s Lingang campus, expected to sustain annual CapEx of $80–$100M through 2025.

R&D remains ~15% of revenue, critical for next-gen wet-process solutions (e.g., sub-7 nm cleaning, 3D packaging). Externally, some local government subsidies help defray costs.

Free Cash Flow Trajectory

After a burst of negative or breakeven FCF in 2022–2023, ACM turned OCF-positive in 2024. With revenue near $800M and margins hovering ~50%, the company can self-fund expansions if growth rates remain above 20%.

A deep clamp on advanced-node shipments might prompt a short-term FCF dip, but a large net-cash cushion ($200M–$400M) provides flexibility.

Scenario Analysis & Intrinsic Valuation

In this “Trump 2.0” environment — we project the following potential scenarios (and assign probabilities).

1. Bear/Clamp Scenario (30–35% probability)

Export Control: U.S. denies most new licenses for sub-28 nm tools. China memory expansions stall, and local competitors ramp up.

Revenue: Grows only at 2–5%/yr or even flat if advanced-node orders dry up. Could hover near $1B by 2030.

Margins: 40–42%, impacted by lower volumes and potential price competition.

Valuation: Stock might trade sideways or drop—implied market cap around $1.2–$1.5B in 2030 (mild upside from here or a small gain).

2. Base/Carve-Outs Scenario (50% probability)

Export Control: Mature-node tools keep flowing; partial exceptions for advanced packaging. Oregon facility re-flags some advanced equipment.

Revenue: ~15% CAGR, reaching $1.4–$1.6B by 2030.

Margins: Mid-to-high 40s% as scale improves.

Valuation: Possible 2–3× from current levels, around $3–$4B market cap if the EV/sales multiple normalizes to ~1.5×.

3. Bull/Détente Scenario (15–20% probability)

Export Control: Trade tensions ease, more licenses granted, or ACM localizes advanced lines effectively. Fabs (including some outside China) adopt SAPS/TEBO in volume.

Revenue: 20%+ CAGR, potentially $2.0–$2.5B by 2030.

Margins: ~47–50%, boosted by global service revenue.

Valuation: EV/sales could rise above 1.8×, driving a 4–5× return if big overseas orders materialize.

Potential 3× Upside vs. Bearish Downside

Roadmap to Triple

ACMR would need to:

Secure continuous licensing for at least mature-node shipments in China,

Expand share in plating/ALD tools, and

Land non-China customers from Oregon or Korea lines by ~2027.

This scenario implies a $2B+ revenue in 2030, with a modest re-rating in valuation multiples (e.g., from ~1× EV/sales to ~1.8×).

How It Could Fall Short

A harsh clamp on any sub-28 nm tech shipments might cap revenue near $1B, leaving the stock range-bound or only modestly up if mature-node demand offsets advanced-node losses.

Intensifying competition from domestic Chinese peers (Naura, AMEC) could erode ACM’s advantage if they replicate SAPS-style cleaning or secure deeper state subsidies.

Top 10 Risks & Sell Triggers

Any of these events could shift the multi-year outlook drastically, prompting a “flip-to-sell” if the investment thesis of steady China-fueled growth no longer holds.

Broader Export Ban: If U.S. extends controls to 28 nm or all wafer-processing tools, ACM’s advanced-node shipments collapse.

China Fab Capex Slowdown: Overcapacity or new government policy cuts spending on logic/memory expansions.

Major Customer Defection: SMIC or YMTC switching to a rival local supplier or losing BFS/Tolling privileges under sanctions.

Technology Gap: SAPS/TEBO failing at 7 nm or 3 nm-level features, undermining yield.

Patent Erosion: Key IP expires or is challenged, allowing knock-offs.

Entity List Expansion: If additional ACM subsidiaries are targeted, design-around time extends.

Quality/Service Issues: Potential wave of RMA/warranty claims damaging margins or reputation.

Geopolitical Events: E.g., Taiwan crisis pushing the U.S. to fully block Chinese semiconductor progress.

Liquidity Squeeze: Unexpected working capital spike or interest-rate shock forcing equity raises, although net cash is currently healthy.

Easing of U.S. Rules: Ironically, if Lam/TEL regain full access to China, ACM’s home market advantage fades.

VII.) Buy Scenarios, Timing, Risk-Reward (2025)

Why the ACMR Discount Exists

China Reliance: Nearly all revenue stems from Chinese fabs, which fall under volatile U.S. export controls. Investors fear a clamp-down could choke off advanced-node demand and derail growth.

Size & Visibility: At ~$1.16B market cap, ACMR is a small-cap in a market dominated by $50–$100B+ equipment giants. High share-price volatility (beta ~1.65) deters more conservative, large-scale institutional money.

Geopolitical Headwinds: Each new U.S. administration or BIS rule can swiftly alter the company’s licensing status. That “binary risk” yields a persistent valuation gap (1× EV/sales vs. 4–5× for Lam/TEL).

Despite these discounts, fundamentals remain solid (cash-positive, ~50% gross margins, strong local brand).

This sets up a situation where the market heavily penalizes policy uncertainty—even if the actual clamp might never fully materialize.

Odds of Survival Under a Hard Clamp

Even if a Trump-era government bans advanced-node tools (14 nm or below), ACMR could still:

Serve mature nodes (28 nm, 40 nm, etc.), which represent a major portion of China’s continued fab expansions.

Pivot to advanced packaging (TSV plating, wafer-level packaging), less restricted than front-end processes.

Tap local Chinese financing and R&D subsidies, given its strategic importance to China’s semi ecosystem.

Rely on net cash (~$200–$400M) to sustain 1–2 years of lower revenue; the company is unlikely to go bankrupt.

In a worst-case clamp scenario, ACMR probably survives—but its growth stalls. The stock might languish near “deep-value” levels for a while, at or slightly above net cash. Eventually, even partial carve-outs or mature-node expansions could revive revenue, leading to a rebound.